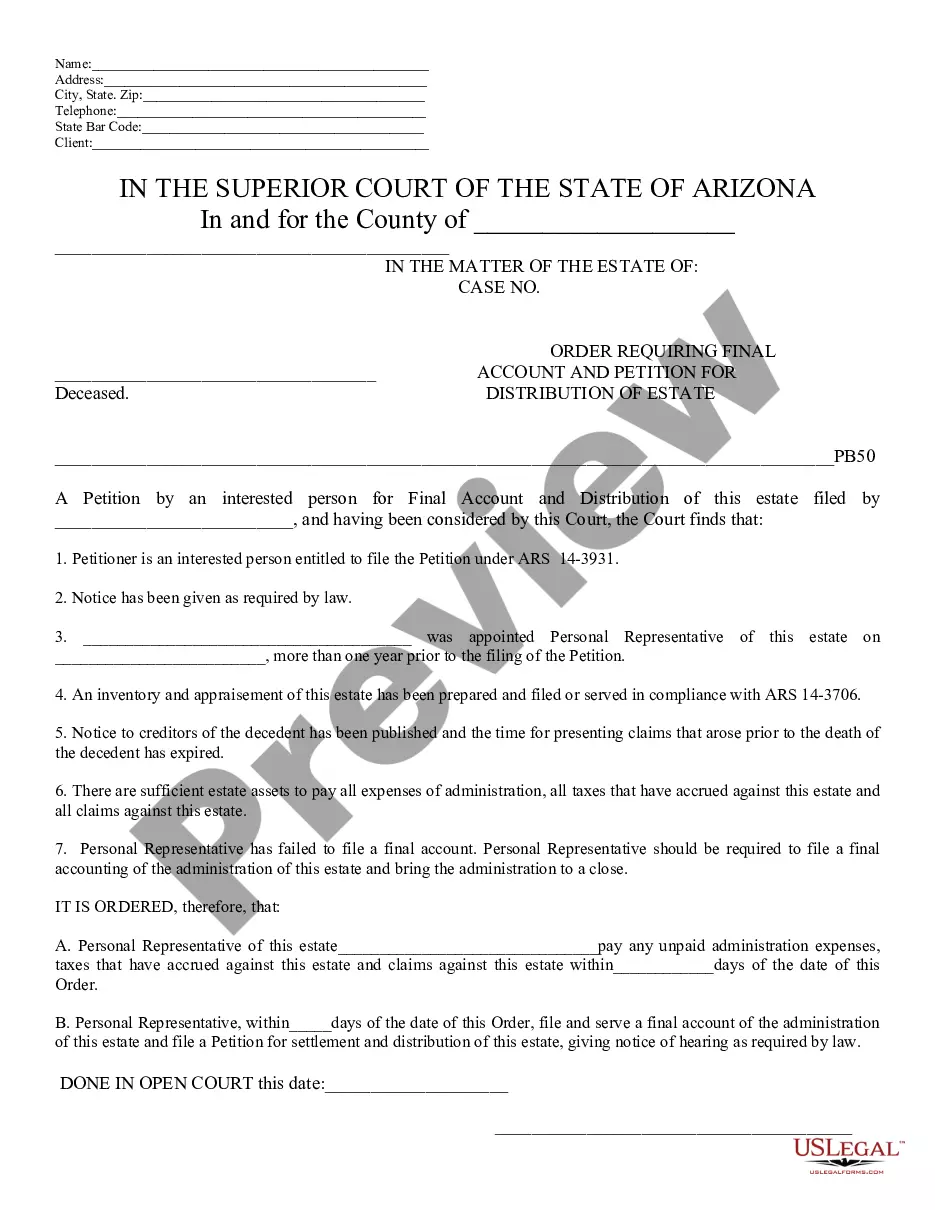

An Order is an official written statement from the court commanding a certain action, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order Requiring Final Accounting and Petition for Distribution of Estate - Arizona, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

Arizona Order Requiring Final Accounting and Petition for Distribution of Estate

Description Final Distribution Estate

How to fill out Arizona Order Final?

If you are looking for accurate Arizona Order Requiring Final Accounting and Petition for Distribution of Estate copies, US Legal Forms is precisely what you need; obtain documents prepared and reviewed by state-certified legal professionals.

Utilizing US Legal Forms not only relieves you from issues regarding legal documents; moreover, you save time, effort, and money! Downloading, printing, and completing a professional template is considerably more cost-effective than hiring an attorney to do it for you.

And that's it. With just a few simple steps, you obtain an editable Arizona Order Requiring Final Accounting and Petition for Distribution of Estate. Once you establish an account, all future transactions will be processed even more effortlessly. After acquiring a US Legal Forms subscription, simply Log In to your profile and select the Download option available on the form's page. Then, whenever you wish to access this template again, you will consistently find it in the My documents section. Don’t waste your time comparing countless forms across various online sources. Get professional templates from a single reliable service!

- To start, complete your registration process by entering your email and creating a secure password.

- Follow the steps below to establish your account and acquire the Arizona Order Requiring Final Accounting and Petition for Distribution of Estate template to address your needs.

- Utilize the Preview option or review the file description (if available) to ensure that the form is the one you require.

- Verify its validity in your residing state.

- Click Buy Now to place your order.

- Select an appropriate pricing plan.

- Set up your account and pay using a credit card or PayPal.

- Choose a suitable format and download the form.

Estate Accounting Example Form popularity

Az Final Petition Other Form Names

Petition Administration Order FAQ

In Arizona, executors generally have about 18 months to two years to settle an estate, but this timeframe can vary based on the estate's complexity. Prompt action is vital, as delays can lead to complications or court issues. Executors should aim to complete necessary filings, including the Arizona Order Requiring Final Accounting and Petition for Distribution of Estate, as efficiently as possible. Keeping beneficiaries informed can also help maintain trust throughout the process.

When an estate closes, it signifies that all debts, taxes, and expenses have been settled, and remaining assets have been distributed to beneficiaries. This process includes completing the Arizona Order Requiring Final Accounting and Petition for Distribution of Estate. Closing an estate finalizes the executor's responsibilities and releases them from legal obligations. This is an important milestone that offers peace of mind to everyone involved.

While it is not strictly required to have an attorney to close on a house in Arizona, having legal guidance can simplify the process. An attorney ensures that all necessary documents, including the Arizona Order Requiring Final Accounting and Petition for Distribution of Estate, are completed correctly. Additionally, they help navigate any legal complexities that may arise. This can be especially beneficial during estate closures.

An estate in Arizona generally must be worth more than $75,000 in order for probate to be necessary. This value includes real property but excludes certain exempt assets. If an estate's value falls below this threshold, you may have alternative options available. Consulting resources that explain the Arizona Order Requiring Final Accounting and Petition for Distribution of Estate can provide clarity on your situation.

In Arizona, an estate typically should be settled within 18 months to two years after death, depending on its complexity. The executor must manage the estate efficiently, addressing any challenges that may arise. Timely completion of necessary legal documents, such as the Arizona Order Requiring Final Accounting and Petition for Distribution of Estate, will facilitate this process. Staying proactive helps ensure you meet court expectations.

Closing an estate in Arizona involves several steps, primarily completing the Arizona Order Requiring Final Accounting and Petition for Distribution of Estate. Executors must settle debts, distribute remaining assets to beneficiaries, and file necessary documents with the probate court. Ensuring all legal obligations are met is essential for a smooth closure. Utilizing platforms like uslegalforms can provide templates and guidance to simplify this process.

Not all estates must go through probate in Arizona. Certain smaller estates may qualify for a simplified process or may be administered without probate. It is important to assess the specific circumstances of the estate, including its value and assets, before proceeding. If you seek guidance, resources like the Arizona Order Requiring Final Accounting and Petition for Distribution of Estate can assist you.

In Arizona, creditors typically have four months from the date of the first publication of the notice to creditors to make their claims against an estate. This timeline is crucial for personal representatives to understand when handling an Arizona Order Requiring Final Accounting and Petition for Distribution of Estate. If creditors fail to file their claims within this period, they may lose the right to collect debts from the estate. It's important to manage this process carefully to ensure compliance with state laws.

Rule 53 outlines the requirements for filing an Arizona Order Requiring Final Accounting and Petition for Distribution of Estate. It mandates that personal representatives must provide a comprehensive accounting of the estate's finances to the court. This ensures that all assets and debts are transparent and properly managed before the final distribution occurs. Understanding this rule is essential for those navigating the probate process in Arizona.

You can avoid probate in Arizona through various means, such as establishing trusts, holding property in joint tenancy, or naming beneficiaries on accounts. These strategies allow for the direct transfer of assets to heirs, bypassing the probate process. Utilizing the Arizona Order Requiring Final Accounting and Petition for Distribution of Estate can streamline your planning efforts.