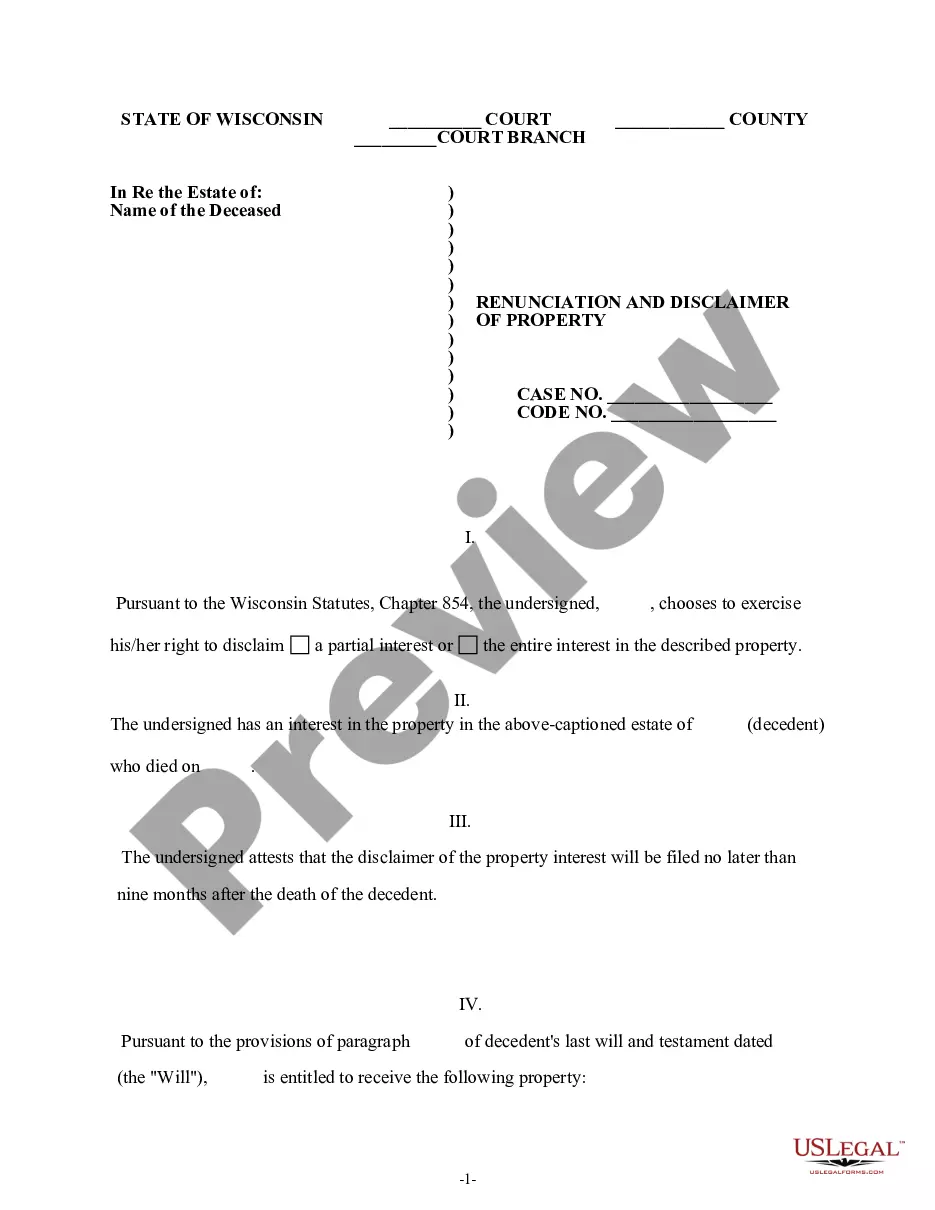

Inventory and Appraisement of Estate Property - Arizona: This form is used when an administrator of an estate is called upon to list all the estate property, as well as the property's value. It lists in detail, every item contained in the estate, and then that property's estimated worth. It is available for download in both Word and Rich Text formats.

Arizona Inventory and Appraisement of Estate Property

Description

How to fill out Arizona Inventory And Appraisement Of Estate Property?

If you're looking for accurate Arizona Inventory and Appraisement of Estate Property examples, US Legal Forms is your solution; obtain documents crafted and reviewed by state-certified lawyers.

Utilizing US Legal Forms not only protects you from issues related to legal documents; you also save effort, time, and money!

And there you have it! In just a few simple clicks, you obtain an editable Arizona Inventory and Appraisement of Estate Property. After creating an account, all future requests will be processed more effortlessly. Once you have a subscription with US Legal Forms, simply Log In and click the Download button visible on the form's page. Then, whenever you wish to utilize this template again, you will always be able to locate it in the My documents section. Don't waste your time sifting through numerous forms on different platforms. Acquire accurate copies from one secure source!

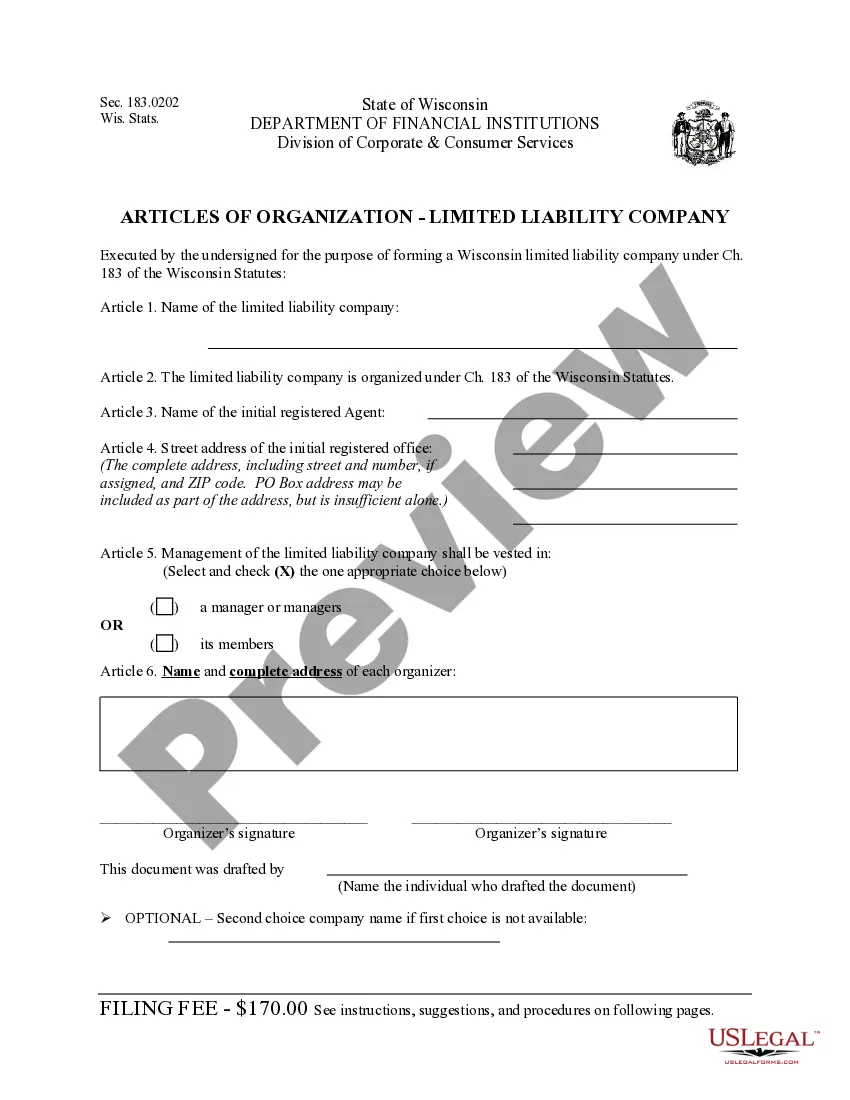

- Initiate by completing your registration by providing your email address and creating a secure password.

- Follow the guidelines below to set up an account and acquire the Arizona Inventory and Appraisement of Estate Property template to address your needs.

- Utilize the Preview option or examine the document description (if available) to confirm the form is what you require.

- Verify its validity in your state.

- Click Buy Now to place your order.

- Choose a preferred pricing plan.

- Establish an account and complete the payment with your credit card or PayPal.

- Select a convenient file format and save the document.

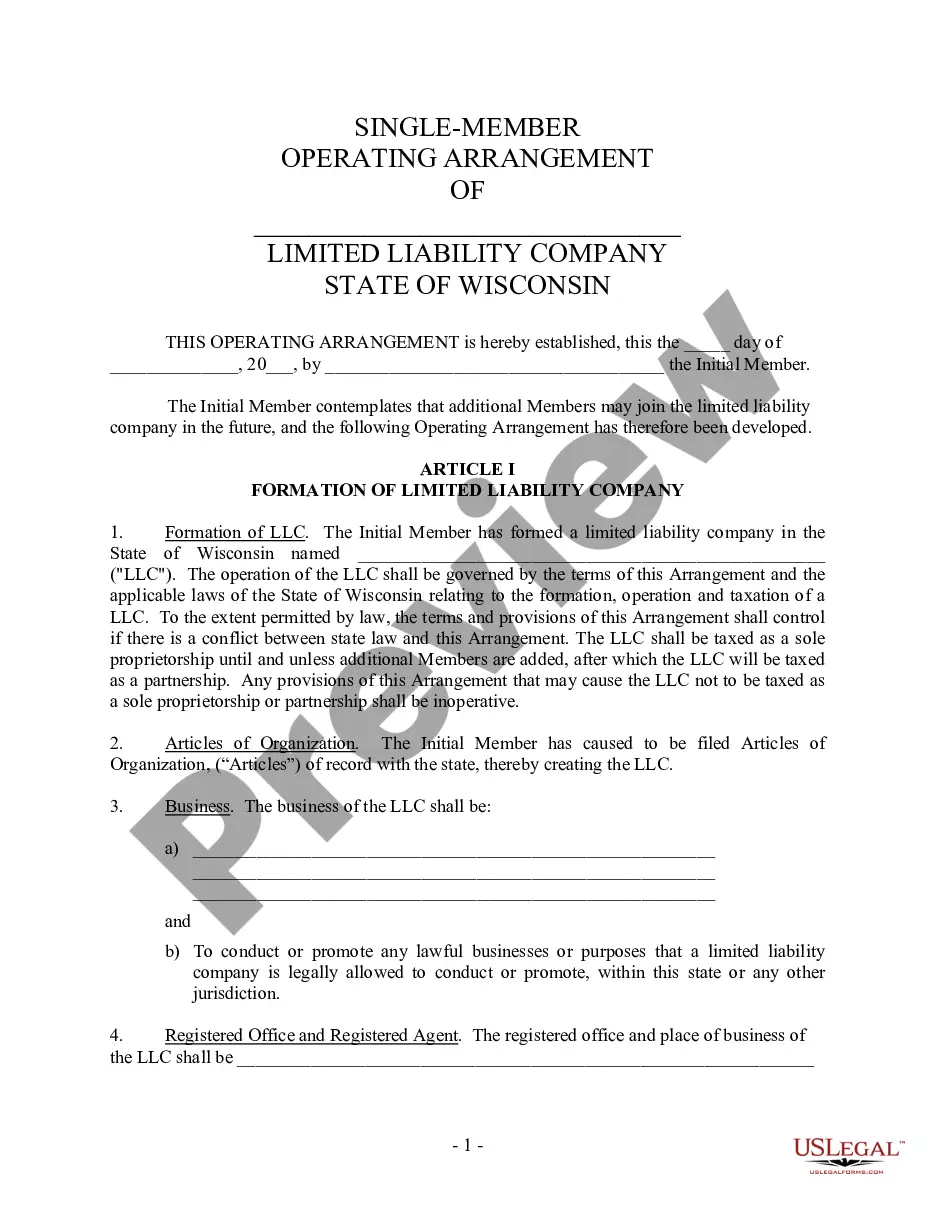

Form popularity

FAQ

In Arizona, the threshold for an estate to require probate is generally $75,000 in personal property or $100,000 in real property. This means if the total worth of the estate falls below these amounts, a simplified process may apply. Understanding these limits helps families navigate the Arizona Inventory and Appraisement of Estate Property process more effectively. Working with professionals can clarify this for specific cases.

Valuing the assets in an estate involves assessing the worth of physical and non-physical items held by the deceased. Common methods include hiring appraisers for real estate and personal items, as well as researching market values for financial assets. This process is integral to the Arizona Inventory and Appraisement of Estate Property to ensure that everything is accounted for during probate. You can also consider using platforms like uslegalforms to guide you through this process.

The inventory value in an estate represents the total worth of all assets included within the estate's inventory. This valuation plays a key role in the probate process and informs tax obligations. Accurately determining this value is essential for the Arizona Inventory and Appraisement of Estate Property procedure, ensuring all heirs receive their fair share. Utilizing professional appraisers can assist in achieving a precise valuation.

The 3-year rule for a deceased estate refers to the timeframe in which estate assets may be subject to state taxes and reporting requirements. In Arizona, this rule emphasizes that certain filings should occur within three years to avoid penalties. Understanding this rule is vital for those involved in Arizona Inventory and Appraisement of Estate Property, as it influences financial planning and compliance. Acting promptly can safeguard against those potential issues.

The inventory of a deceased estate consists of all assets owned by the deceased at the time of their passing. This includes real estate, bank accounts, personal belongings, and other valuable items. Conducting a thorough inventory is crucial for completing the Arizona Inventory and Appraisement of Estate Property process accurately. A clear inventory ensures proper distribution of assets according to the decedent's wishes.

In Arizona, bank accounts can go through probate depending on how the account is set up. If the account has a designated beneficiary or is a joint account with right of survivorship, it may avoid probate. However, if the accounts are solely in the deceased's name, they will likely be part of the Arizona Inventory and Appraisement of Estate Property process. Understanding these nuances can help streamline estate management.

The value of inventory in an estate is multifaceted, as it represents the total worth of all included assets. This valuation is crucial for estate settlement, tax preparation, and determining distributions to heirs. By understanding the implications of the Arizona Inventory and Appraisement of Estate Property, you can ensure that the assets are managed and distributed according to the described values.

Inventory, in an estate context, refers to a detailed list of all physical and financial assets owned by a deceased person. While the term 'inventory' is often associated with current assets in business, within estate planning, it represents a broad range of property. Accurately defining your assets within the Arizona Inventory and Appraisement of Estate Property will support effective estate management and distribution.

Creating an inventory list for probate begins with gathering all relevant documents and information regarding the deceased's assets. You should categorize items into real property, personal property, and financial accounts while noting their current value. Using the Arizona Inventory and Appraisement of Estate Property guidelines can help ensure your list is comprehensive and meets all legal requirements.

In Arizona, certain assets are exempt from the probate process, which streamlines the distribution for heirs. These include property held in joint tenancy, life insurance policies with designated beneficiaries, and assets in a trust. Understanding these exemptions can simplify the Arizona Inventory and Appraisement of Estate Property, making it easier for you and your family.