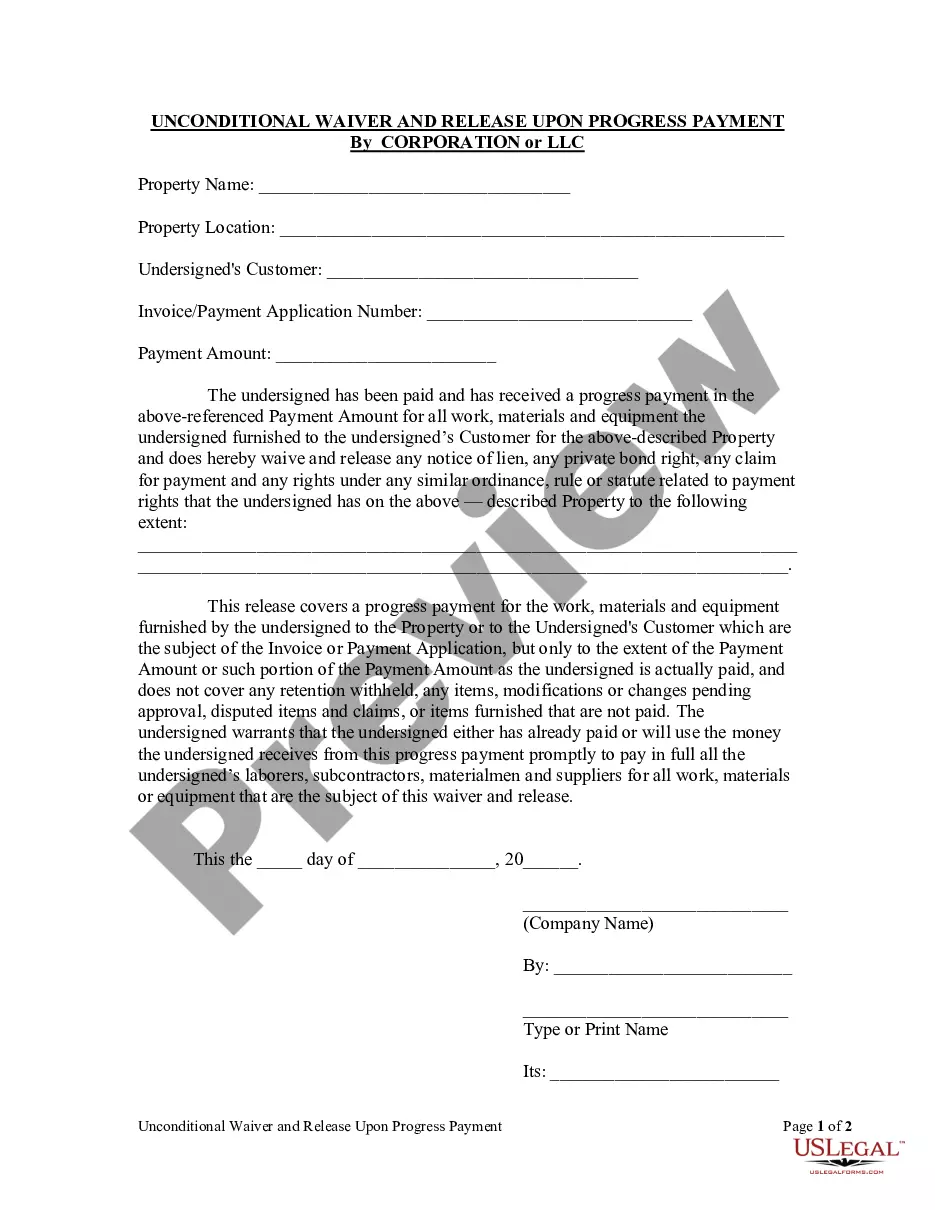

Renouncement of Inheritance - Arizona: This is a form, which allows for the renouncing, or relinquishing, of an inheritance. The intended heir, may willingly give up his/her rights to any property, or money, which would have been given to them otherwise. This form is to be signed in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Arizona Renouncement of Inheritance

Description Arizona Inheritance Estate

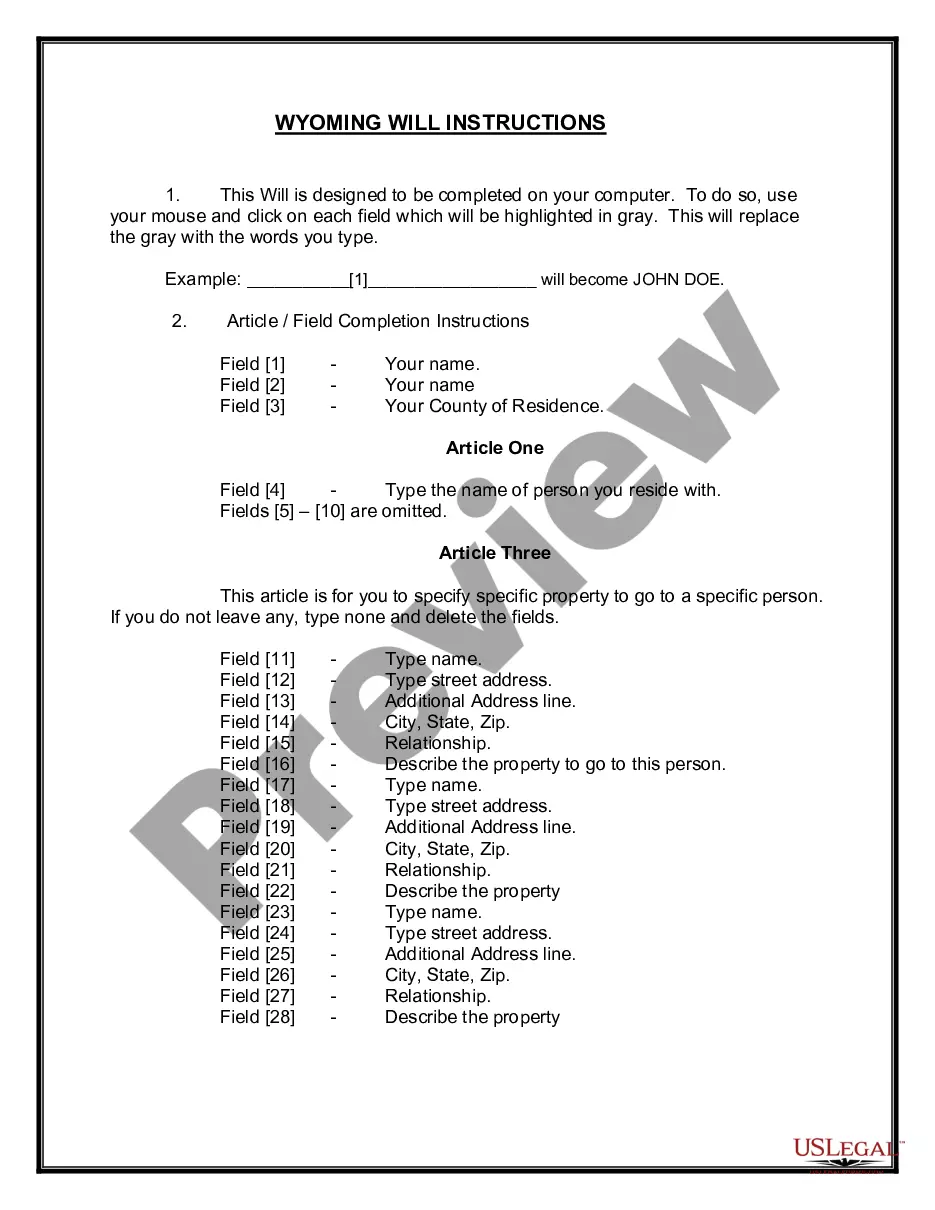

How to fill out Az Inheritance Application?

If you're looking for accurate Arizona Renunciation of Inheritance templates, US Legal Forms is exactly what you require; find documents crafted and reviewed by state-licensed attorneys.

Utilizing US Legal Forms not only protects you from worries related to legal documents; it also saves you time, effort, and money! Downloading, printing, and completing a professional form is considerably less expensive than seeking legal guidance to handle it for you.

And that’s it. In just a few simple steps, you acquire an editable Arizona Renunciation of Inheritance. After creating your account, all future requests will be even simpler. Once you have a US Legal Forms subscription, just Log In/">Log In to your account and click the Download button visible on the form’s page. Then, whenever you need to use this template again, you'll always be able to find it in the My documents section. Don’t waste your time and effort browsing endless forms across various online sources. Obtain professional templates from a single trusted provider!

- To begin, finish your registration by entering your email and creating a password.

- Follow the steps below to set up an account and obtain the Arizona Renunciation of Inheritance template to address your issue.

- Utilize the Preview option or review the document description (if available) to confirm it’s the template you need.

- Verify its relevance in your area.

- Click on Buy Now to place your order.

- Select a preferred pricing plan.

- Register and complete payment using your credit card or PayPal.

- Choose a convenient format and save the document.

Arizona Inheritance File Form popularity

Az Inheritance File Other Form Names

Renouncement Inheritance Application FAQ

Inheritance law in Arizona is a combination of statutory provisions and common law that details how assets are distributed upon death. Arizona is a community property state, meaning assets acquired during marriage belong to both spouses. Understanding the nuances of the Arizona Renouncement of Inheritance ensures that you are well-equipped to address your legal rights and responsibilities during the distribution process.

In certain situations, you may be able to sell your deceased parents' house without going through probate in Arizona. If the property was held in a living trust or if it meets the requirements for a small estate, you could avoid a lengthy probate process. Consulting with experts about the Arizona Renouncement of Inheritance can provide clarity and options for managing inherited property smoothly.

The order of inheritance in Arizona begins with the surviving spouse and children, followed by parents, siblings, and then more distant relatives as necessary. If there are no immediate family members, the estate could ultimately go to the state. Familiarizing yourself with the Arizona Renouncement of Inheritance can guide you in understanding how your estate will be divided and could influence key decisions.

As of now, Arizona does not impose a state inheritance tax, which means you can inherit assets without any state tax obligations. However, federal estate tax laws might still apply based on the total value of the deceased's estate. Staying informed about your options through the Arizona Renouncement of Inheritance can help you navigate potential tax implications effectively.

When there is no will in Arizona, the state's intestacy laws dictate how the estate is divided. Generally, the spouse and children have the first rights to inherit, followed by parents, siblings, and more distant relatives as necessary. This emphasizes the importance of planning ahead and possibly consulting about the Arizona Renouncement of Inheritance if you wish to make specific arrangements regarding your estate.

In Arizona, a spouse does not automatically inherit everything if there are surviving children from the decedent's previous relationships. However, under community property law, the spouse is entitled to half of the community property accumulated during the marriage. Understanding your rights under the Arizona Renouncement of Inheritance can help clarify how assets will be distributed among heirs, including the spouse.

The renunciation of inheritance is the legal process by which an individual formally declines their right to receive inheritance or benefits from an estate. In Arizona, this procedure allows heirs to refuse their share, which may affect the distribution of assets. If you are considering this option, it is essential to understand the implications of the Arizona Renouncement of Inheritance, as it can impact both your financial situation and family dynamics.

In Arizona, an inheritance typically remains separate property, not marital property. However, if the inherited assets get commingled with marital assets, this can change their status. The Arizona Renouncement of Inheritance allows individuals to give up their rights to an inheritance, potentially simplifying matters related to marital property. Exploring this option can provide clarity and assist you in retaining greater control over your assets.

In Arizona, you have the option to turn down the entire inheritance, but not just a part of it. If you wish to customize the distribution, you might need to communicate with other beneficiaries or pursue alternative legal options. Full renouncement ensures that you do not inherit any assets or liabilities associated with the estate.

Yes, you can renounce your inheritance in Arizona, provided you follow the proper legal procedures. It is essential to file the renouncement in a timely manner, typically within a specified period after the individual's death. Leveraging the US Legal Forms platform can help ensure that you complete the necessary steps correctly and efficiently.