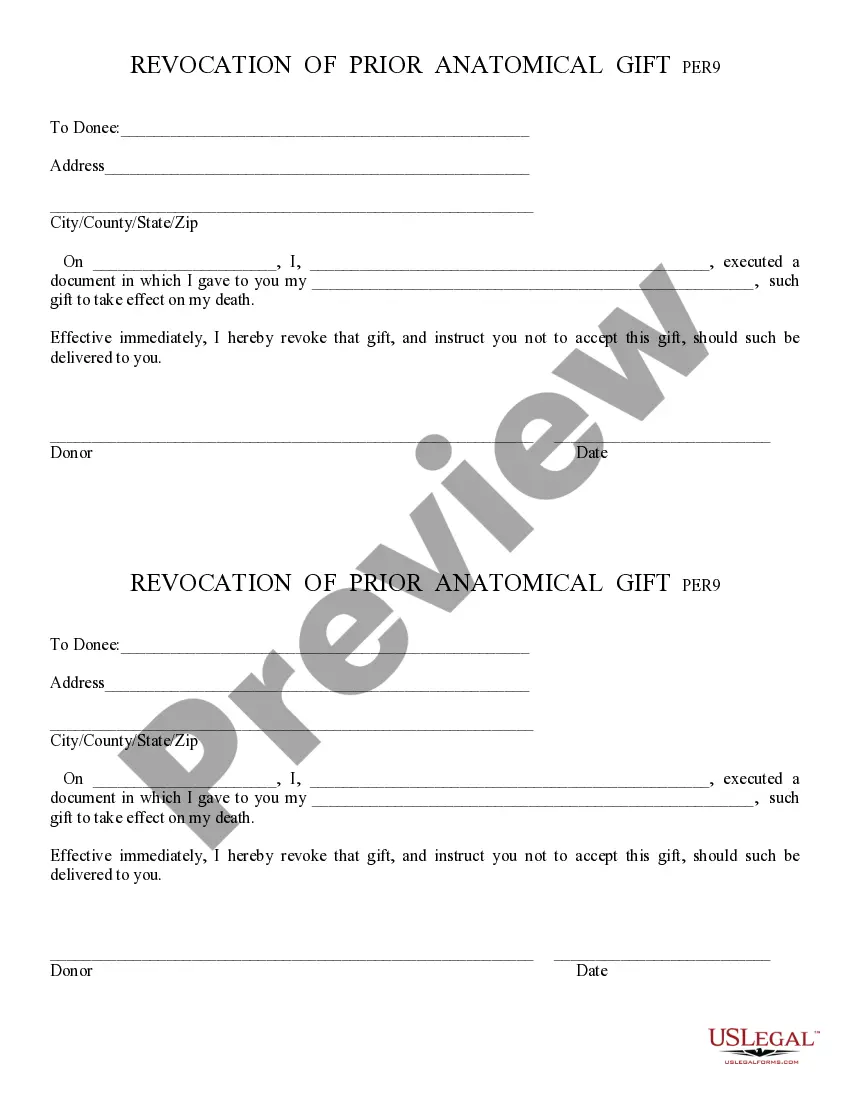

Revocation of Prior Gift - Arizona: This form revokes a prior anatomical gift, which the signing party had at one time decided to give. This is to be signed in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Arizona Revocation of Prior Gift

Description

How to fill out Arizona Revocation Of Prior Gift?

If you are seeking accurate copies of the Arizona Revocation of Prior Gift, US Legal Forms is precisely what you require; discover documents offered and reviewed by state-approved attorneys.

Utilizing US Legal Forms not only alleviates stress regarding legal documents; moreover, it saves you time, effort, and money! Downloading, printing, and filling out a competent template is significantly cheaper than hiring a lawyer to do it for you.

And that's all it takes. In just a few straightforward steps, you will have an editable Arizona Revocation of Prior Gift. Once your account is established, all future requests will be processed even more effortlessly. If you hold a US Legal Forms subscription, simply Log In and click the Download option available on the document's page. Later, when you need to use this template again, you will consistently find it in the My documents section. Don't waste your time and effort comparing numerous forms across various platforms. Acquire accurate documents from a single trustworthy service!

- Initiate the process by signing up with your email and creating a password.

- Follow the instructions below to establish an account and obtain the Arizona Revocation of Prior Gift template to address your needs.

- Utilize the Preview tool or review the description of the document (if available) to confirm that it is what you require.

- Verify its relevance in your state.

- Click Buy Now to place your order.

- Select a desired pricing plan.

- Create an account and make payment via credit card or PayPal.

- Choose a suitable format and save the document.

Form popularity

FAQ

Gift law in Arizona includes various statutes that regulate how and when gifts can be given or revoked. It emphasizes the importance of intent, competency, and proper documentation. Understanding Arizona Revocation of Prior Gift laws is essential for anyone considering making significant gifts or changes to their estate plan. Utilizing resources like US Legal Forms can help guide you through the legal requirements, ensuring your gifts are valid and your intentions are honored.

In Arizona, there is no state gift tax, but federal gift tax rules do apply. As of now, the federal gift tax limit allows individuals to give up to $15,000 per person each year without incurring tax. It's important to keep the Arizona Revocation of Prior Gift in mind when planning large gifts, as understanding the limits can influence how you choose to give. Ensuring you stay within these limits can help you effectively manage your estate.

Statute 14 3108 in Arizona addresses the rules governing the validity of wills and testaments. This statute ensures that any changes or revocations made to a will are properly documented and valid. When navigating the Arizona Revocation of Prior Gift, it is essential to consider how this statute complements your overall estate planning. Having a clear understanding of both statutes can help you avoid misunderstandings regarding your wishes.

Statute 14 5501 in Arizona pertains to the revocation of prior gifts. This law allows an individual to withdraw or cancel a gift they have previously made under specific conditions. The Arizona Revocation of Prior Gift statute provides clarity on how and when a gift can be canceled, ensuring that individuals can manage their assets effectively. Understanding this statute is crucial for those considering their estate planning options.

The Arizona gift clause refers to a provision in Arizona law that allows individuals to revoke or modify gifts made during their lifetime. This is particularly important when considering the Arizona Revocation of Prior Gift, as it ensures that your intentions regarding property and assets are respected. If circumstances change, such as a change in relationships or financial situations, you can take advantage of this clause. Understanding the Arizona gift clause helps you protect your interests and ensures your estate plan aligns with your current wishes.

The gift statute in Arizona outlines the legal parameters for gifting and revoking gifts. This statute details the rights of both the donor and the recipient under Arizona law. Understanding these statutes helps individuals know their rights and obligations regarding the Arizona Revocation of Prior Gift.

The revocation of a gift refers to a legal process by which a donor can cancel their previous gift. In Arizona, specific laws apply, entailing that the donor must take clear steps to communicate their intent, such as writing a formal letter. This process can be crucial for ensuring that the gift is returned or nullified.

If you want to return a gift, communicate openly with the giver about your feelings. You can express your gratitude and explain why you prefer not to keep it. Depending on the situation, they might appreciate the honesty and even encourage the return.

Gifts are generally not reversible once given. However, under specific circumstances, you may invoke the Arizona Revocation of Prior Gift statute if you can prove that the gift should be undone. Understanding legal grounds for gift revocation is crucial, and seeking guidance can clarify your options.

Revoking a gift involves providing clear, written communication to the person who received the gift. In Arizona, it's essential to include specific details about the gift, and you may also want to consult legal resources for assistance, such as US Legal Forms, to ensure that your revocation follows proper legal standards.