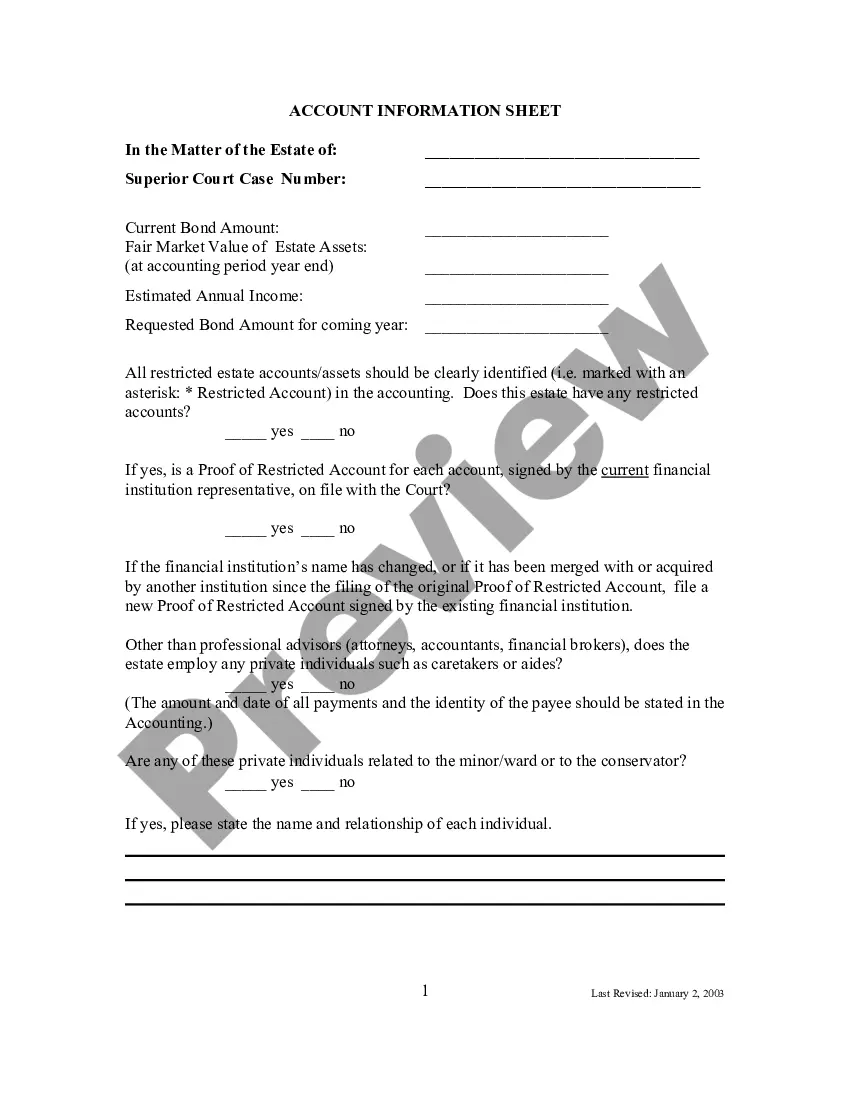

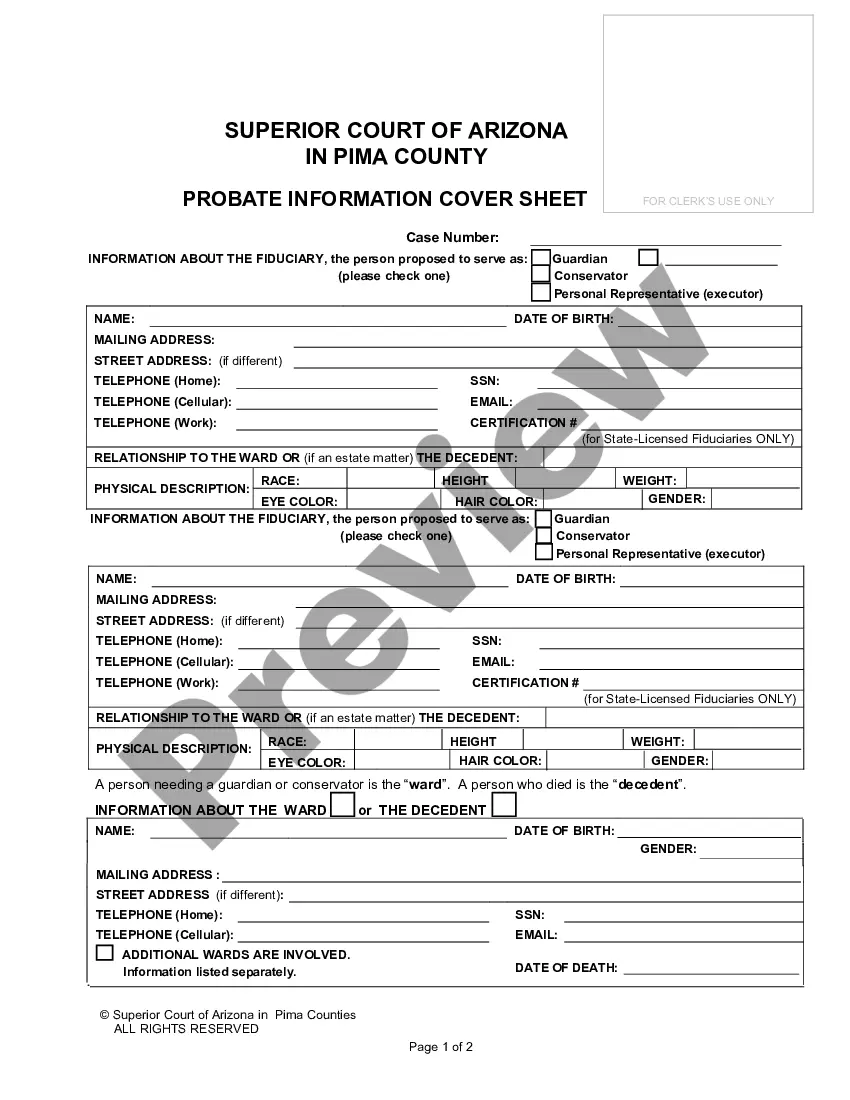

The Arizona Account Information Sheet is a document used by the Arizona Department of Revenue to collect tax information from businesses operating in the state. It is a mandatory form for all Arizona business entities that file state taxes. The form is used to gather important information such as the legal name of the business, the state and federal employer identification numbers, and the address where the business is located. It also requests the type of business entity as well as the type of taxes the business must pay. The Arizona Account Information Sheet also serves as a reference for the Arizona Department of Revenue to ensure that the taxes are filed correctly and on time. There are two types of Arizona Account Information Sheets: the general form and the Limited Liability Company (LLC) form. The general form is used for all business types except for LCS, while the LLC form is specifically designed for LCS. Both forms must be filed with the Arizona Department of Revenue and kept on file for at least three years.

Arizona Account Information Sheet

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Account Information Sheet?

How much duration and resources do you frequently devote to creating official documents.

There’s a more efficient choice to obtain such forms than employing legal professionals or wasting hours searching the internet for an appropriate template. US Legal Forms is the leading online repository that offers expertly crafted and verified state-specific legal documents for any purpose, such as the Arizona Account Information Sheet.

Another benefit of our service is that you can retrieve previously downloaded documents that you securely keep in your profile in the My documents tab. Retrieve them at any time and redo your paperwork as often as you require.

Conserve time and energy preparing legal documents with US Legal Forms, one of the most reliable online services. Join us today!

- Review the form details to confirm it satisfies your state criteria. To do this, peruse the form description or utilize the Preview option.

- If your legal template does not fulfill your requirements, locate another one using the search feature at the top of the page.

- If you already possess an account with us, Log In and download the Arizona Account Information Sheet. If not, proceed to the following steps.

- Click Buy now once you identify the right document. Choose the subscription plan that fits you best to gain access to our library’s complete offerings.

- Register for an account and remit payment for your subscription. You can process your payment using your credit card or via PayPal - our service is completely dependable for that.

- Download your Arizona Account Information Sheet onto your device and fill it out on a printed copy or digitally.

Form popularity

FAQ

You can obtain your 1099-G online by visiting the Arizona Department of Economic Security’s website. This allows you to access your tax document conveniently. For enhanced efficiency, ensure you have your Arizona Account Information Sheet on hand, as it contains essential details that may speed up the retrieval process.

To secure your W-2 from Arizona, reach out to your employer or access your payroll system if available. Employers are required to provide W-2 forms by January 31st. If you are having trouble, consult your Arizona Account Information Sheet; it can help you gather the necessary details to prompt your employer effectively.

Finding your Arizona Department of Economic Security (DES) account number can be done through the DES website or by contacting their office. This number is crucial for managing your benefits and services. Reference your Arizona Account Information Sheet as it may hold information to assist in locating your DES number.

Arizona tax forms can be downloaded directly from the Arizona Department of Revenue website. Make sure you select the forms needed for your specific situation to avoid any delays. Your Arizona Account Information Sheet contains the necessary data to ensure you are using the right forms for your tax filings.

To find your Arizona unemployment account number, visit the Arizona Department of Economic Security’s website or contact them directly. The Arizona Account Information Sheet may assist you as it contains information that may verify your employment status. This verification can simplify your inquiry process.

Arizona income tax forms are readily available on the Arizona Department of Revenue’s official website. Ensure you download the correct forms corresponding to your tax situation. Using your Arizona Account Information Sheet can help streamline the process by providing you with specific details needed to complete the forms.

To obtain your 1099G from Arizona, visit the Arizona Department of Economic Security website. There, you can find resources to access your tax documents. You may also need to utilize your Arizona Account Information Sheet to verify your identity and retrieve your records effectively.

Yes, if you earned income from Arizona sources, you need to file a tax return as a non-resident. The Arizona Account Information Sheet will provide the necessary insight into what income needs to be reported. It’s essential to adhere to these requirements to avoid penalties.

Certain individuals may be exempt from Arizona state income tax, including specific low-income earners and certain pensioners. Referencing the Arizona Account Information Sheet will aid in confirming whether you qualify for any exemptions. Staying informed about exemptions can reduce your tax burden.

The filing requirement for Arizona varies based on your filing status and income. Typically, if your gross income meets certain thresholds, you must file a return. The Arizona Account Information Sheet helps clarify these requirements, providing insights to make your filing process smoother.