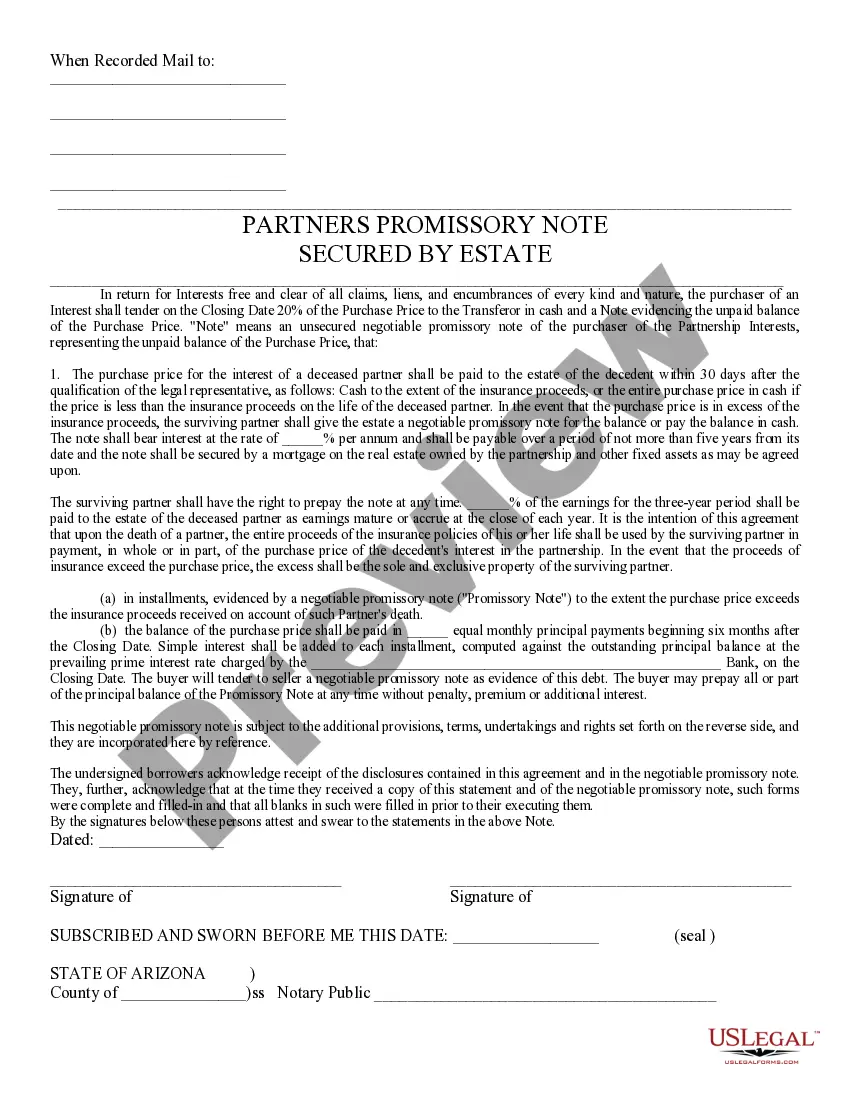

In return for interests free and clear of all claims, liens, and encumbrances of every kind and nature, the purchaser of an interest shall tender on the closing date a certain percentage of the purchase price to the transferor in cash and a note evidencing the unpaid balance of the purchase price.

Arizona Partners Note Secured by Estate

Description

How to fill out Arizona Partners Note Secured By Estate?

If you're in search of accurate Arizona Partners Note Secured by Estate templates, US Legal Forms is precisely what you require; access documents crafted and reviewed by licensed attorneys in your state.

Utilizing US Legal Forms not only shields you from issues related to legal paperwork; furthermore, you save time, effort, and money! Acquiring, printing, and submitting a professional template is far less expensive than hiring an attorney to accomplish it on your behalf.

And that’s all. With just a few simple clicks, you have an editable Arizona Partners Note Secured by Estate. After creating your account, all future requests will be processed even more efficiently. Once you have a US Legal Forms subscription, simply Log In to your profile and click the Download button visible on the form’s page. Then, whenever you need this template again, you'll always be able to find it in the My documents section. Don’t waste your time and effort comparing numerous documents on different platforms. Obtain precise forms from one secure source!

- Begin by finalizing your registration by entering your email and creating a password.

- Follow the steps below to set up an account and locate the Arizona Partners Note Secured by Estate template to resolve your situation.

- Utilize the Preview option or review the document description (if accessible) to ensure that the template is the one you require.

- Verify its legitimacy in your jurisdiction.

- Click on Buy Now to place an order.

- Select a preferred pricing plan.

- Establish your account and make payment using your credit card or PayPal.

Form popularity

FAQ

The penalty for filing a tax return late can vary based on the jurisdiction. In Arizona, the penalties can add up quickly if you do not file on time. This can impact financial decisions, particularly concerning an Arizona Partners Note Secured by Estate. To minimize risks and handle your filing properly, resources like USLegalForms can be invaluable.

Filing Arizona state taxes late can incur penalties, which are typically based on the amount of tax due. The late filing penalty is often a percentage of the unpaid tax, and interests can also accumulate over time. If your situation involves an Arizona Partners Note Secured by Estate, timely filing is essential to avoid such penalties. USLegalForms can help streamline the filing process to stay compliant.

Arizona Form 165 must be filed by certain partnerships operating in Arizona. If your partnership has income, you are required to report it, even if there is no tax due. This applies to partnerships involving the Arizona Partners Note Secured by Estate. For assistance in navigating this form, consider USLegalForms for user-friendly options and resources.

In Arizona, a promissory note does not need to be notarized to be legally binding. However, notarization can add an extra layer of security and credibility to your document. When dealing with an Arizona Partners Note Secured by Estate, it's wise to ensure all documentation is well-prepared and properly managed to prevent disputes. Utilize USLegalForms for templates and guidance.

Yes, Arizona allows passive loss carryover, and this can be beneficial for taxpayers. If your passive activities result in a loss, you can carry this over to offset future income from passive activities. Understanding how this interacts with your Arizona Partners Note Secured by Estate could enhance your financial strategy. Consult resources or platforms like USLegalForms for detailed guidance.

The maximum penalty for filing a late return in Arizona can be significant. Generally, it is 25% of the unpaid tax amount, which can accumulate quickly. In the context of an Arizona Partners Note Secured by Estate, it's crucial to stay ahead of filing deadlines to avoid these penalties. Always consider using platforms like USLegalForms to manage your returns efficiently.

Yes, Arizona Form 165 does accept federal extensions. If you receive a federal extension, it typically extends the deadline for your Arizona state tax return as well. This means you can have additional time to file while ensuring your Arizona Partners Note Secured by Estate remains compliant with state regulations. Be sure to check specific deadlines to avoid penalties.

If you generate income within Arizona as a nonresident, you typically must file a nonresident tax return. This includes income sources such as business earnings or property investments, especially if managed through a vehicle like Arizona Partners Note Secured by Estate. Reviewing your specific situation can clarify your filing obligations.

You should send AZ Form 165 to the Arizona Department of Revenue, using the address specified in the form’s instructions. Sending it to the correct location ensures your submission is processed quickly. Using platforms such as USLegalForms can streamline this filing and ensure accuracy.

Filing Arizona Form 165 late results in penalties, typically a percentage of the tax owed for each month the filing is delayed. This could significantly affect your financial standing, especially when dealing with instruments like Arizona Partners Note Secured by Estate. It's essential to file on time to avoid unnecessary financial strain.