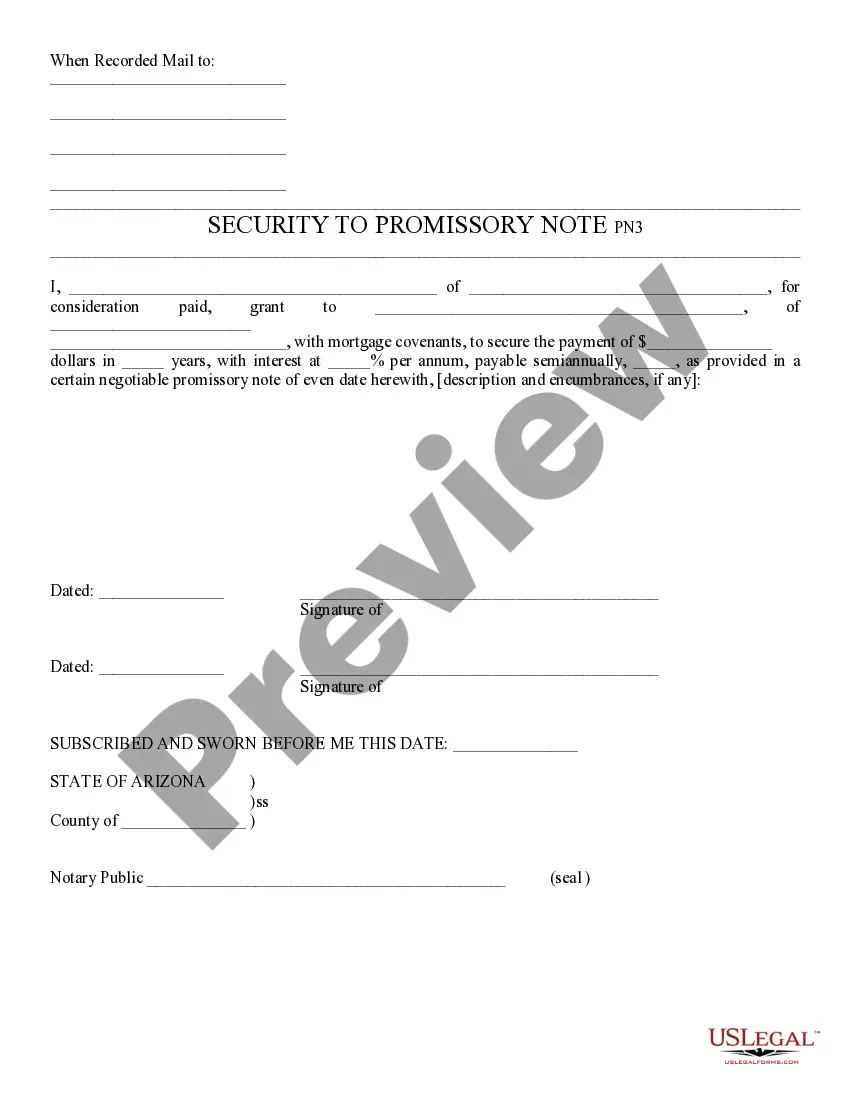

Security to Promissory Note - Arizona: This is a form which gives a type of security, or collateral, in exchange for the signing of a promissory note. It is to be signed by both parties, in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Arizona Security to Promissory Note

Description Legally Binding Promissory Note Template

How to fill out Arizona Security To Promissory Note?

If you're seeking appropriate Arizona Security to Promissory Note samples, US Legal Forms is precisely what you require; obtain documents crafted and validated by state-certified lawyers.

Utilizing US Legal Forms not only shields you from concerns regarding legal documents; you also save effort, time, and funds! Downloading, printing, and filling out a professional template is significantly more economical than hiring an attorney to do it for you.

And there you go. With just a few simple steps, you possess an editable Arizona Security to Promissory Note. After creating an account, all subsequent orders will be managed even more easily. If you have a US Legal Forms subscription, simply Log In to your account and click the Download button available on the form's page. Then, when you need to access this template again, you'll always be able to find it in the My documents section. Don't waste your time and effort comparing numerous forms on various web platforms. Purchase accurate copies from a single secure service!

- To start, complete your registration process by entering your email and creating a secure password.

- Follow the steps outlined below to set up your account and locate the Arizona Security to Promissory Note template to address your needs.

- Take advantage of the Preview feature or review the document description (if available) to ensure that the form is what you need.

- Verify its validity in your state.

- Click Buy Now to place an order.

- Select a suggested pricing plan.

- Create an account and make a payment with a credit card or PayPal.

- Choose an appropriate file format and download the document.

Form popularity

FAQ

While promissory notes offer numerous benefits, they do come with some disadvantages, such as potential difficulties in enforcing payment. Without proper documentation or a clear payment schedule, misunderstandings may arise. Additionally, if the note is not secured, the lender faces greater risk. It's prudent to utilize platforms like USLegalForms to draft effective Arizona Security to Promissory Note agreements that mitigate these challenges.

Yes, you can secure a promissory note by backing it with collateral or guarantees from the borrower. Securing a note helps reduce the risk for the lender, as it provides an avenue for recovery should the borrower default. Utilizing Arizona Security to Promissory Note strategies can enhance the agreement's effectiveness and foster trust between both parties.

In Arizona, the statute of limitations for enforcing a promissory note is typically six years from the time the payment was due. This means that if you do not take legal action within that timeframe, you may lose the ability to collect on the note. Understanding the implications of the statute of limitations is essential when dealing with Arizona Security to Promissory Note agreements.

You can easily obtain your promissory note by visiting the US Legal Forms website. After navigating to the Arizona Security to Promissory Note section, you can select the relevant document you need. Once you complete the form with your information, you can download it instantly. This streamlined process ensures that you have your promissory note ready for use without unnecessary delays.

A promissory note can be cancelled if both parties agree to terminate the contract. This process should be documented in writing to avoid misunderstandings later. If the note is secured, ensure that any collateral is also released as per the cancellation terms. For further assistance, consider using services like uslegalforms to draft a cancellation agreement related to your Arizona Security to Promissory Note.

To turn a promissory note into a security, you generally need to can convert it into a marketable financial instrument by bundling it with other similar notes. This includes assessing the risk, creating a prospectus, and adhering to regulatory requirements to attract investors. Make sure to understand the legal implications of this process, especially related to Arizona Security to Promissory Note. Consult professionals for guidance throughout this conversion.

In Arizona, a promissory note does not require notarization to be legally binding; however, having it notarized can enhance its credibility and acceptance. Notarization provides a layer of proof that the document was signed willingly, which can be valuable in legal disputes. While it is not mandatory, it is often a good practice to protect both parties involved. Utilizing platforms like uslegalforms can help you create a properly formatted promissory note.

To securitize a promissory note, you can bundle it with other similar loans and sell the resulting security to investors. This process involves converting the asset into a financial product that is attractive to buyers. Make sure to consult a financial advisor to understand the implications and legality of the securitization process, especially regarding Arizona Security to Promissory Note. It’s crucial to follow proper legal channels for effective securitization.

A promissory note is secured by collateral, which provides the lender a legal claim to certain assets if the borrower defaults. Common forms of collateral include real estate, vehicles, or other valuable property. This security gives lenders peace of mind, knowing they have a way to recover their funds if necessary. When dealing with Arizona Security to Promissory Note, ensure that the collateral is clearly defined in the agreement.

To account for a promissory note, first, identify the terms of the note, such as the principal amount, interest rate, and payment schedule. Record the note as an asset on the balance sheet, reflecting the amount due from the borrower. When payments are received, recognize interest income and reduce the principal balance accordingly. This process is essential for maintaining clarity in your financial statements, especially when utilizing Arizona Security to Promissory Note.