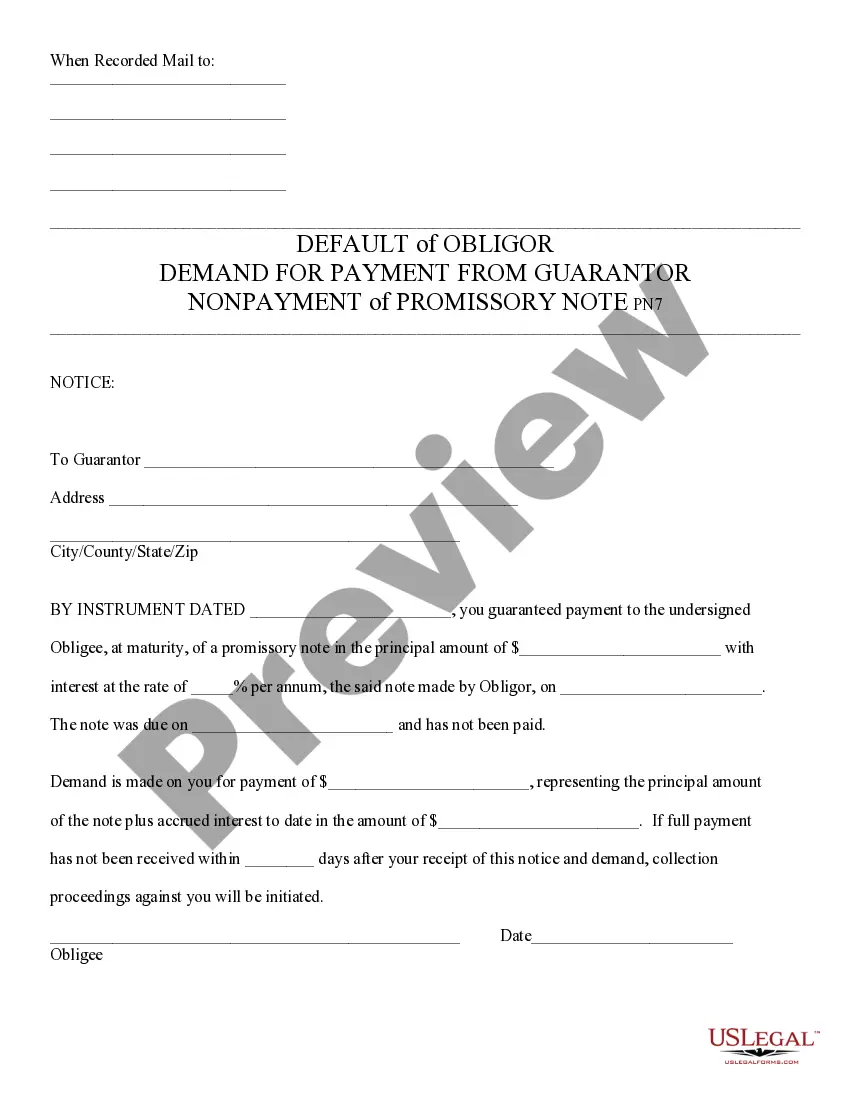

Default of Promissory Note and Demand for Payment - Arizona: This is a Notice to the Guarantor of a promissory note. It states that the note is in default, and therefore, the entire amount is now due of the Guarantor. It is available for download in both Word and Rich Text formats.

Arizona Default of Promissory Note and Demand for Payment

Description Promissory Note Payment

How to fill out Arizona Promissory Statement?

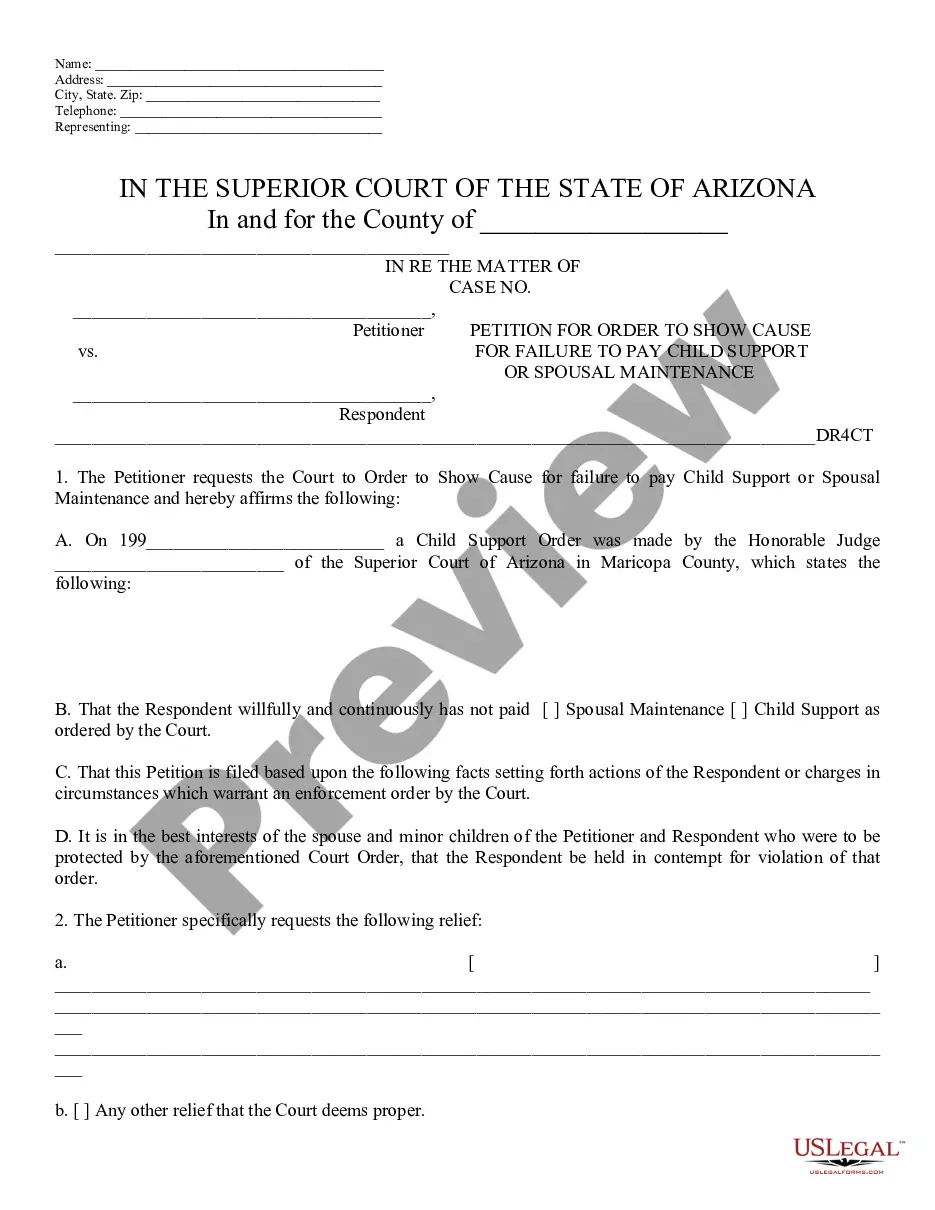

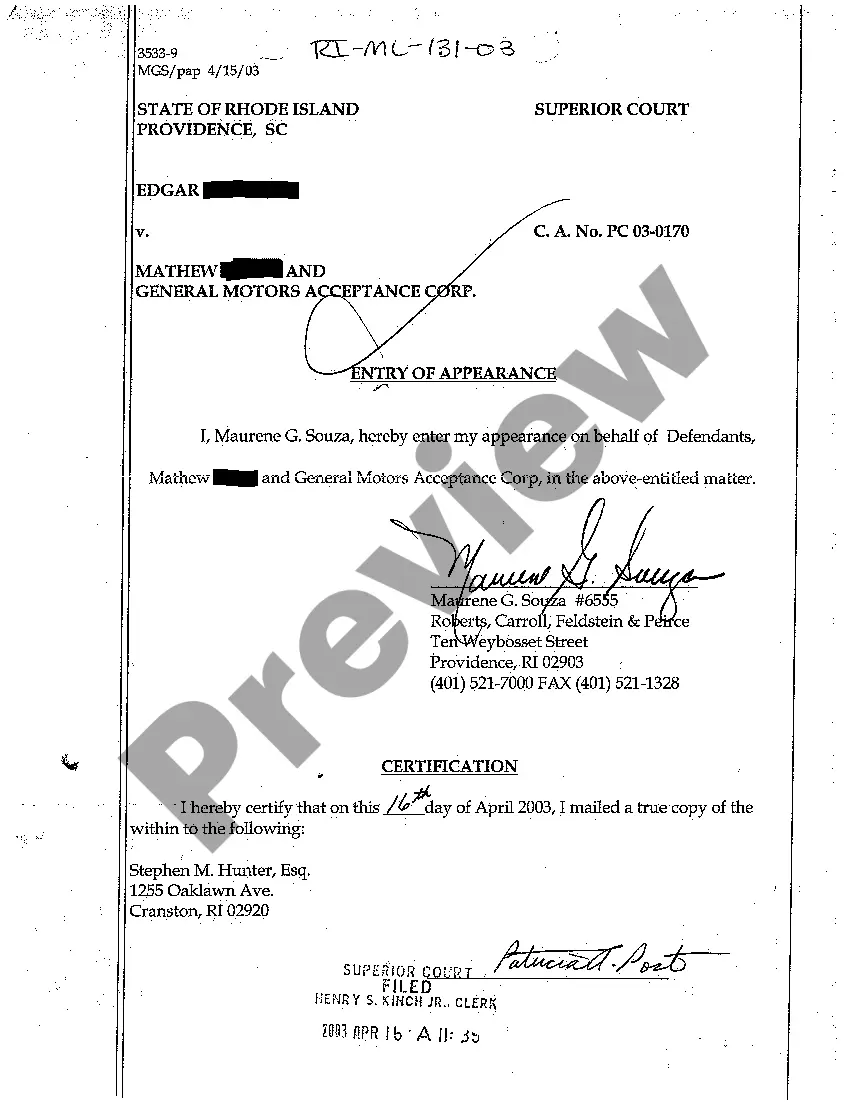

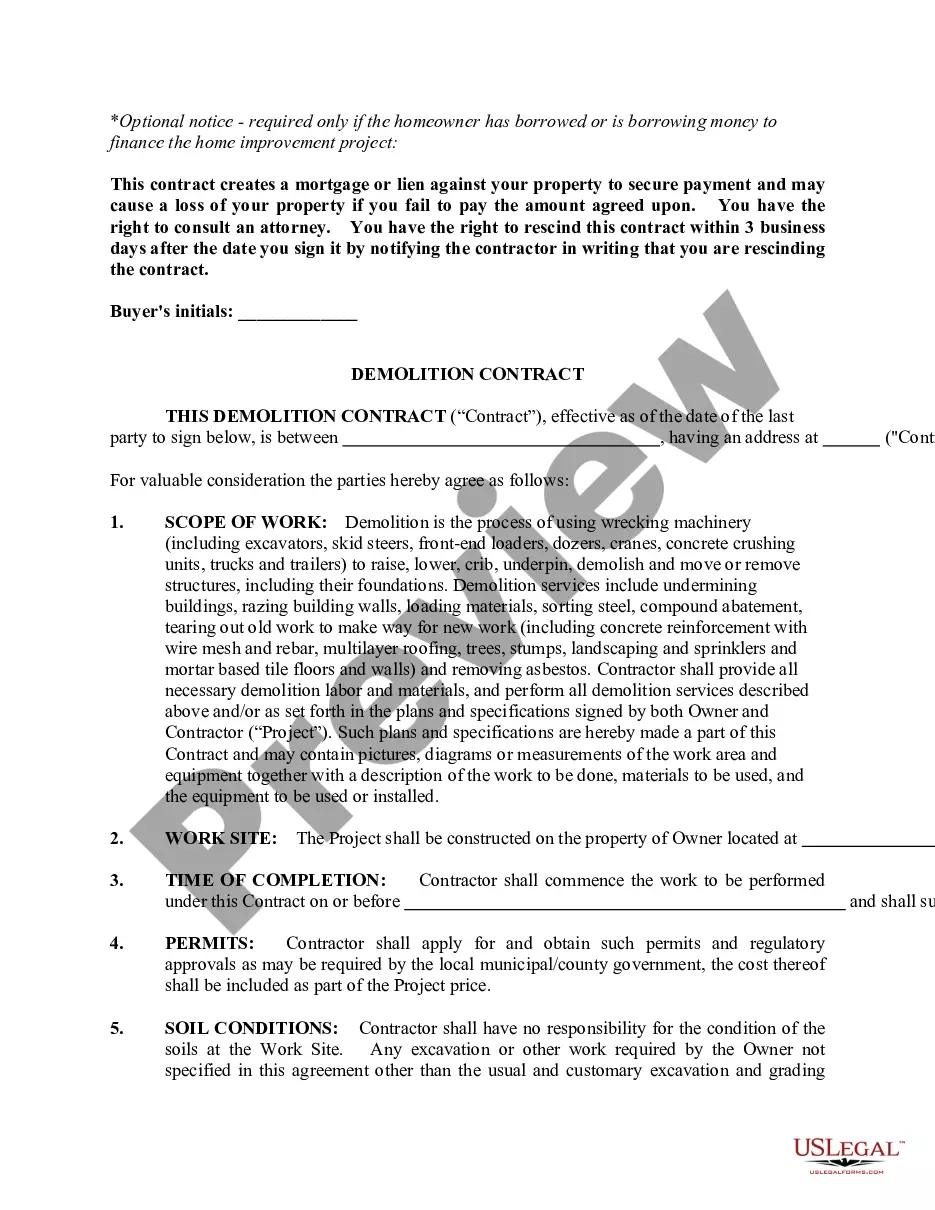

If you are seeking precise Arizona Default of Promissory Note and Demand for Payment forms, US Legal Forms is exactly what you require; discover documents created and validated by state-certified legal professionals.

Utilizing US Legal Forms not only spares you from concerns regarding legal documents; it also saves you time, effort, and money! Downloading, printing, and submitting a professional form is far more affordable than hiring an attorney to draft it for you.

And that’s it. In just a few simple clicks, you will have an editable Arizona Default of Promissory Note and Demand for Payment. Once you create your account, all future orders will be processed even more easily. If you have a US Legal Forms subscription, simply Log In/">Log In to your account and click the Download option visible on the form’s page. Then, when you need to use this template again, you will always be able to find it in the My documents menu. Don’t waste your time searching multiple forms on different platforms. Order accurate copies from one trusted service!

- To begin, complete your registration process by providing your email and creating a secure password.

- Follow the instructions below to set up your account and obtain the Arizona Default of Promissory Note and Demand for Payment form to address your issue.

- Use the Preview option or review the document details (if available) to confirm that the template is the one you need.

- Verify its legality in your jurisdiction.

- Click on Buy Now to place an order.

- Choose a preferred pricing plan.

- Set up your account and pay using your credit card or PayPal.

- Select an appropriate file format and save the document.

Promissory Payment Form popularity

Promissory Note Demand Other Form Names

Promissory Payment Form FAQ

In Arizona, the statute of limitations for collecting most debts is six years. This means creditors can legally pursue payment for this duration after the debt becomes due. However, it's important to note that specific types of debts might have different timelines. If you face an Arizona Default of Promissory Note and Demand for Payment, knowing this timeline can help you navigate your options effectively.

In a promissory note, the person who signs the document is primarily liable for repaying the debt. This means that if the borrower defaults, the lender can pursue that individual for repayment. The terms outlined in the promissory note, including interest rates and payment schedules, clarify the obligation. Understanding your liability is crucial, especially in relation to an Arizona Default of Promissory Note and Demand for Payment.

The default rate on a promissory note can vary based on the terms set by the lender, but it typically reflects a higher interest rate after a default occurs. In the context of an Arizona Default of Promissory Note and Demand for Payment, this rate serves to compensate the lender for the added risk and delay in receiving payment. Understanding these terms before signing a promissory note can help you make informed decisions. If you find yourself in default, consider resources from uslegalforms to navigate your options.

If you default on a promissory note, the lender may initiate a process to recover the owed amount. This often involves sending a Demand for Payment to formally request the outstanding balance. As a result of an Arizona Default of Promissory Note, the lender could also seek legal action to enforce repayment, which may lead to wage garnishment or property liens. It's essential to address the situation promptly to avoid further complications.

The default clause of a promissory note outlines the circumstances under which the borrower is considered in default, typically including failure to make timely payments. This clause is essential as it informs the borrower of their obligations and the consequences of non-compliance. Being aware of the default clause can provide clarity on handling an Arizona Default of Promissory Note and Demand for Payment.

A promissory note does not need to be witnessed in Arizona, but having witnesses can strengthen the document, especially in the case of disputes. While notarization is not mandatory, it serves to validate the signatures and can safeguard against claims of fraud. Properly executed notes are crucial for addressing an Arizona Default of Promissory Note and Demand for Payment effectively.

If you default on a promissory note, the lender has the right to initiate legal proceedings to recover the owed amount. This can lead to the lender seeking a judgment against you, which may include garnishing wages or placing liens on your property. Understanding the ramifications of an Arizona Default of Promissory Note and Demand for Payment can help you avoid these serious consequences.

In Arizona, notarizing a promissory note is not strictly required, but it is highly recommended for added legal protection. A notarized document can provide a level of credibility and ease any potential disputes. When dealing with an Arizona Default of Promissory Note and Demand for Payment, having a notarized document can help clarify intentions and obligations.

In Arizona, the statute of limitations for written contracts, which includes promissory notes, is six years. After this period, you cannot be legally compelled to fulfill the terms of the contract, thus protecting those who face financial difficulties. Understanding these time limits is essential for anyone involved in an Arizona Default of Promissory Note and Demand for Payment situation.

The statute of limitations on a promissory note in Arizona is six years, similar to that of other written contracts. This means that a lender has six years to take legal action to enforce the note if payments are missed. Being aware of this timeframe can significantly influence how you handle payments and any disputes regarding the Arizona Default of Promissory Note.