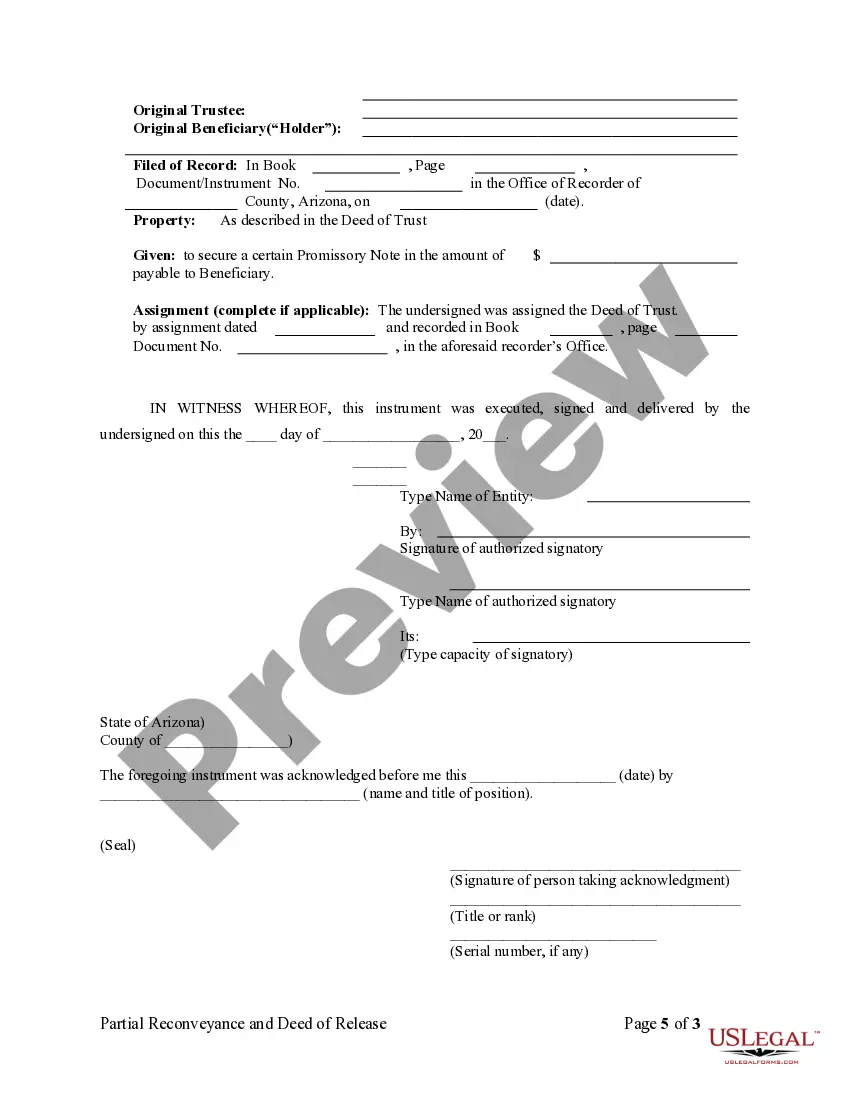

Partial Release of Property From Deed of Trust for Corporation

Assignments Generally: Lenders,

or holders of mortgages or deeds of trust, often assign mortgages or deeds

of trust to other lenders, or third parties. When this is done the

assignee (person who received the assignment) steps into the place of the

original lender or assignor. To effectuate an assignment, the general

rules is that the assignment must be in proper written format and recorded

to provide notice of the assignment.

Satisfactions Generally: Once a mortgage

or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Arizona Law

Execution of Assignment or Satisfaction: Assignment

must be signed by mortgagee. Satisfaction must be signed by mortgagee or

trustee.

Assignment: An assignment of a mortgage

may be recorded in like manner as a mortgage, and the record is notice

to all persons subsequently deriving title to the mortgage from the assignor.

Demand to Satisfy: If the lender has failed

to record the satisfaction of the deed of trust within 30 days of full

payment, he becomes liable to the borrower for damages caused by the failure.

If the borrower then sends a written request to record satisfaction by

certified mail to the lender, and the lender fails to do so within 30 days

of receipt thereof, then lender becomes liable for $1000 plus damages.

(See below, sec. 33-712.)

Recording Satisfaction: If

a mortgagee, trustee or person entitled to payment receives full satisfaction

of a mortgage or deed of trust, he shall acknowledge satisfaction of the

mortgage or deed of trust by delivering to the person making satisfaction

or by recording a sufficient release or satisfaction of mortgage or deed

of release and reconveyance of the deed of trust, which release, satisfaction

of mortgage or deed of release and reconveyance shall contain the docket

and page number or recording number of the mortgage or deed of trust.

Marginal Satisfaction: Marginal satisfaction

is still recognized.

Penalty: See above entry for Demand

to Satisfy.

Acknowledgment: An assignment or satisfaction

must contain a proper Arizona acknowledgment, or other acknowledgment approved

by Statute.

Arizona Statutes

33-706. Assignment of mortgage; recording as notice

An assignment of a mortgage may be recorded in like manner as

a mortgage, and the record is notice to all persons subsequently deriving

title to the mortgage from the assignor.

33-707. Acknowledgment of satisfaction; recording

A. If a mortgagee, trustee or person entitled to payment receives

full satisfaction of a mortgage or deed of trust, he shall acknowledge

satisfaction of the mortgage or deed of trust by delivering to the person

making satisfaction or by recording a sufficient release or satisfaction

of mortgage or deed of release and reconveyance of the deed of trust,

which release, satisfaction of mortgage or deed of release and reconveyance

shall contain the docket and page number or recording number of the mortgage

or deed of trust. It shall not be necessary for the trustee to join in

the acknowledgment or satisfaction, or in the release, satisfaction of

mortgage or deed of release and reconveyance. The recorded release or satisfaction

of mortgage or deed of release and reconveyance constitutes conclusive

evidence of full or partial satisfaction and release of the mortgage or

deed of trust in favor of purchasers and encumbrancers for value and without

actual notice.

B. When a mortgage or deed of trust is satisfied by a release or

satisfaction of mortgage or deed of release and reconveyance, except where

the record of such deed of trust or mortgage has been destroyed or reduced

to microfilm, the recorder shall record the release or satisfaction

of the deed of trust or mortgage showing the book and page or recording

number where the deed of trust or mortgage is recorded.

C. If the record of such mortgage or deed of trust has been destroyed

and the record thereof reduced to microfilm, it shall be sufficient evidence

of satisfaction of any such mortgage or deed of trust for the release or

satisfaction of mortgage or deed of release and reconveyance to be recorded

and indexed as such. The instrument shall sufficiently identify the mortgage

or deed of trust by parties and by book and page or recording number of

the official records. Such instrument shall be treated as a release or

satisfaction of mortgage or deed of release and reconveyance and recorded.

D. If the note secured by a mortgage or deed of trust has been lost

or destroyed, the assignee, mortgagee or beneficiary shall, before acknowledging

satisfaction, make an affidavit that he is the lawful owner of the note

and that it has been paid, but cannot be produced for the reason that it

has been lost or destroyed, and the affidavit shall be recorded. If the

record of such mortgage or deed of trust has been destroyed and the record

thereof reduced to microfilm, such affidavit shall be recorded and indexed

as releases, satisfactions of mortgage and deeds of release and reconveyance

are recorded and indexed and shall have the same force and effect as a

release or satisfaction of a mortgage or deed of release and reconveyance

as provided in subsection A of this section.

E. If a full or partial release or satisfaction of mortgage or deed

of release and reconveyance of deed of trust, which according to its terms

recites that it secures an obligation having a stated indebtedness not

greater than five hundred thousand dollars exclusive of interest, has not

been executed and recorded pursuant to subsection A or C of this section

within sixty days of full or partial satisfaction of the obligation secured

by such mortgage or deed of trust, then a title insurer as defined in section

20-1562 may prepare, execute and record a full or partial release or satisfaction

of mortgage or deed of full or partial release and reconveyance of deed

of trust. At least thirty days prior to the issuance and recording of any

such release or satisfaction of mortgage or deed of release and reconveyance

pursuant to this subsection, the title insurer shall mail by certified

mail with postage prepaid, return receipt requested, to the mortgagee of

record or to the trustee and beneficiary of record and their respective

successors in interest of record at their last known address shown of record

and to any persons who according to the records of the title insurer received

payment of the obligation at the address shown in such records, a notice

of its intention to release the mortgage or deed of trust accompanied by

a copy of the release or satisfaction of mortgage or deed of release and

reconveyance to be recorded which shall set forth:

1. The name of the beneficiary or mortgagee or any successors in

interest of record of such mortgagee or beneficiary and, if known, the

name of any servicing agent.

2. The name of the original mortgagor or trustor.

3. The name of the current record owner of the property and if the

release or satisfaction of mortgage or deed of release and reconveyance

is a partial release, the name of the current record owner of the parcel

described in the partial release or satisfaction of mortgage or deed of

partial release and reconveyance of deed of trust.

4. The recording reference to the deed of trust or mortgage.

5. The date and amount of payment, if known.

6. A statement that the title insurer has actual knowledge that

the obligation secured by the mortgage or deed of trust has been paid in

full, or if the release or satisfaction of mortgage or deed of release

and reconveyance of deed of trust is a partial release, a statement that

the title insurer has actual knowledge that the partial payment required

for the release of the parcel described in the partial release or satisfaction

has been paid.

F. The release or satisfaction of mortgage or release and reconveyance

of deed of trust may be executed by a duly appointed attorney-in-fact of

the title insurer, but such delegation shall not relieve the title insurer

from any liability pursuant to this section.

G. A full or partial release or satisfaction of mortgage or deed

of full or partial release and reconveyance of deed of trust issued pursuant

to subsection E of this section shall be entitled to recordation and, when

recorded, shall constitute a full or partial release or satisfaction of

mortgage or deed of release and reconveyance of deed of trust issued pursuant

to subsection A or C of this section.

H. Where an obligation secured by a deed of trust or mortgage was

paid in full prior to September 21, 1991, and no release or satisfaction

of mortgage or deed of release and reconveyance of deed of trust has been

issued and recorded within sixty days of September 21, 1991, a release

or satisfaction of mortgage or deed of release and reconveyance of deed

of trust as provided for in subsection E of this section may be prepared

and recorded without the notice prescribed by subsection E of thissection.

I. A release or satisfaction of mortgage or a release and reconveyance

of deed of trust by a title insurer under the provisions of subsection

E of this section shall not constitute a defense nor release any person

from compliance with subsections A through D of this section or from liability

under section 33-712.

J. In addition to any other remedy provided by law, a title insurer

preparing or recording the release and satisfaction of mortgage or the

release and reconveyance of deed of trust pursuant to subsection E of this

section shall be liable to any party for actual damage, including attorneys'

fees, which any person may sustain by reason of the issuance and recording

of the release and satisfaction of mortgage or release and reconveyance

of deed of trust.

K. The title insurer shall not record a release and satisfaction

of mortgage or release and reconveyance of deed of trust if, prior to the

expiration of the thirty day period specified in subsection E of this section,

the title insurer receives a notice from the mortgagee, trustee, beneficiary,

holder or servicing agent which states that the mortgage or deed of trust

continues to secure an obligation, or in the case of a partial release

or satisfaction of mortgage or deed of partial release and reconveyance

of deed of trust, a notice that states that the partial payment required

to release the parcel described in the partial release or satisfaction

has not been paid.

L. The title insurer may charge a reasonable fee to the owner of

the land or other person requesting a release and satisfaction of mortgage

or release and reconveyance of deed of trust, including but not limited

to search of title, document preparation and mailing services rendered

and may in addition collect official fees.

33-708. Release by attorney in fact

An attorney in fact to whom the money due on a mortgage or deed

of trust is paid may execute the release provided for in this article.

Such acknowledgment of satisfaction or deed of release, duly acknowledged

and recorded, showing the docket and page or recording number, releases

the mortgage or deed of trust and revests in the mortgagor or person who

executed the deed of trust, or his legal representatives, all title to

the property affected by the mortgage or deed of trust.

33-709. Acknowledgment of satisfaction by personal representative

of mortgagee to whom indebtedness was paid before death

The executor or administrator of a mortgagee or of the holder or

owner of an indebtedness secured by a mortgage or deed of trust shall,

if the indebtedness was paid to the decedent in his lifetime, acknowledge

satisfaction thereof by delivering to such person a sufficient release,

satisfaction of mortgage or deed of release of the mortgage or deed of

trust or acknowledge satisfaction as provided in subsection C of section

33-707. If the executor or administrator, upon proof to him of the payment

of the indebtedness to his decedent, does not, within thirty days, acknowledge

satisfaction by delivering to the person owning the property a sufficient

release, satisfaction of mortgage or deed of release, or acknowledge satisfaction

as provided in subsection C of section 33-707, he shall personally forfeit

to the party aggrieved one hundred dollars and be personally liable for

the damages thereby sustained. The executor or administrator shall not

be liable to the estate of which he is executor or administrator for any

indebtedness by mortgage or deed of trust released by him in accordance

with this section.

33-712. Liability for failure to acknowledge satisfaction

A. If any person receiving satisfaction of a mortgage or deed of

trust shall, within thirty days, fail to record or cause to be recorded,

with the recorder of the county in which the mortgage or deed of trust

was recorded, a sufficient release, satisfaction of mortgage or deed of

release or acknowledge satisfaction as provided in section 33-707, subsection

C, he shall be liable to the mortgagor, trustor or current property owner

for actual damages occasioned by the neglect or refusal.

B. If, after the expiration of the time provided in subsection A

of this section, the person fails to record or cause to be recorded a sufficient

release and continues to do so for more than thirty days after receiving

a written request which identifies a certain mortgage or deed of

trust by certified mail from the mortgagor, trustor, current property

owner or his agent, he shall be liable to the mortgagor, trustor or current

property owner for one thousand dollars, in addition to any actual damage

occasioned

by the neglect or refusal.

C. Any action to enforce the provisions of this section, including

any action to recover amounts due under this section, shall be brought

and maintained in the individual names of, and shall be prosecuted by,

persons entitled to recover under the terms thereof, and not in a representative

capacity or otherwise. This subsection shall apply to all actions under

this section, whether brought before or after July 13, 1988.