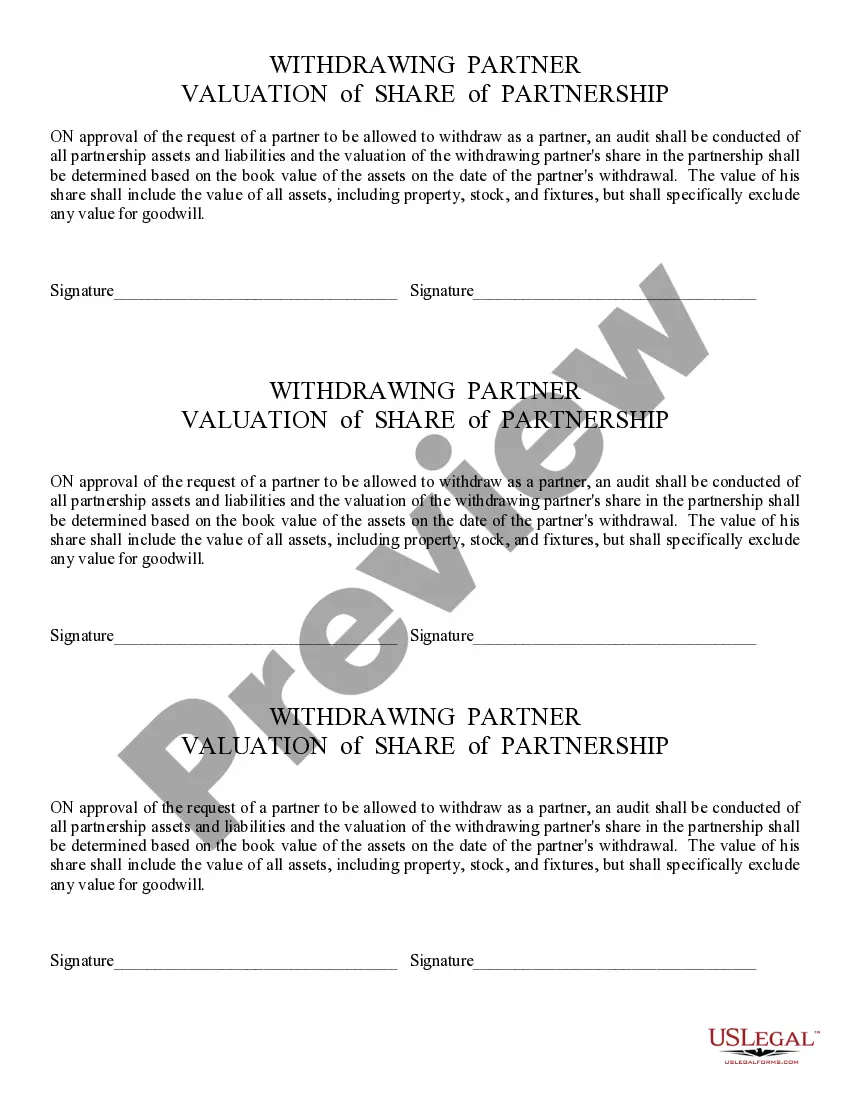

This form states that on approval of the request of a partner to be allowed to withdraw as a partner, an audit shall be conducted of all partnership assets and liabilities and the valuation of the withdrawing partner's share in the partnership shall be determined based on the book value of the assets on the date of the partner's withdrawal. The value of his share shall include the value of all assets, including property, stock, and fixtures, but shall specifically exclude any value for goodwill.

Arizona Valuation of Share of Partner

Description

How to fill out Arizona Valuation Of Share Of Partner?

If you are looking for suitable Arizona Valuation of Share of Partner templates, US Legal Forms is precisely what you require; obtain documents crafted and verified by state-authorized legal professionals.

Using US Legal Forms not only alleviates concerns about legal documents but also saves you time, effort, and money! Acquiring, printing, and completing a professional document is significantly cheaper than hiring an attorney to do it for you.

And that’s it. In just a few simple steps, you have an editable Arizona Valuation of Share of Partner. Once you establish an account, all future transactions will be even more straightforward. If you have a US Legal Forms subscription, just Log In and click the Download button available on the form’s page. Then, when you need to use this template again, you can always find it in the My documents section. Don’t waste your time sorting through numerous forms across various web resources. Acquire professional templates from a single reliable platform!

- To begin, complete your registration process by providing your email and creating a secure password.

- Follow the steps below to set up an account and locate the Arizona Valuation of Share of Partner template to address your needs.

- Utilize the Preview option or review the document details (if available) to ensure that the template is suitable for you.

- Check its relevance to your location.

- Click Buy Now to place an order.

- Select a preferred pricing plan.

- Create an account and pay using your credit card or PayPal.

- Choose a convenient format and download the document.

Form popularity

FAQ

The Ptet rate in Arizona refers to the Partnership Tax Electric Template, which varies based on the partnership's income levels. Understanding this rate is crucial for partners to ensure they comply with state tax laws while accurately reflecting their individual shares. When focusing on the Arizona Valuation of Share of Partner, knowing the Ptet rate enables better financial planning and compliance.

Calculating the amount left after taxes on $100,000 in Arizona depends on the current tax rates for the income bracket. After factoring in state and potential federal taxes, partners may find their take-home amount significantly reduced. Utilizing tools or platforms like uslegalforms can provide clarity and assist in evaluating the Arizona Valuation of Share of Partner with accurate figures.

An LLC in Arizona is taxed on a pass-through basis, meaning profits are reported on the owners' personal tax returns. The income tax rates vary depending on the amount earned, similar to the individual tax rates. When considering the Arizona Valuation of Share of Partner, it is essential to account for these income tax rates to assess the overall financial impact on the partners.

The 2.5 tax rate in Arizona specifically refers to the corporate income tax rate applied to certain entities. This rate may influence how various business structures calculate their taxes, impacting partnership distributions and the Arizona Valuation of Share of Partner. Understanding your tax obligations can help you make informed financial decisions.

AZ Form 165 must be filed by partnerships operating in Arizona that generate income. This form reports the income, deductions, and other important information regarding the partnership. When determining the Arizona Valuation of Share of Partner, filing AZ Form 165 ensures that each partner's share is accurately represented for tax and financial purposes.

The Arizona Partnership Tax Entity (AZ Pte) allows partnerships to file taxes collectively. This process simplifies the tax obligations for partners by assessing tax at the entity level rather than for individual partners. Understanding this mechanism is crucial when dealing with the Arizona Valuation of Share of Partner, as it ensures compliance and optimal tax management.

The Arizona partnership return form is known as AZ Form 165. This form is specifically designed for partnerships and is essential for reporting income, deductions, and tax liabilities. Accurately calculating the Arizona Valuation of Share of Partner through this form is important to ensure compliance with Arizona tax laws.

Non-residents who earn income from Arizona sources must file an Arizona tax return. This applies if you are a partner in a partnership generating income in Arizona. Understanding the implications of the Arizona Valuation of Share of Partner will help you determine your tax responsibilities as a non-resident.

AZ Form 165 is required for partnerships operating in Arizona, where partners need to report their income, credits, and deductions. It helps to determine the appropriate Arizona Valuation of Share of Partner, ensuring that all partners comply with state tax laws. Filing this form accurately is essential for avoiding potential penalties.

Arizona's corporate tax return must be filed by all corporations doing business in the state. This includes profit corporations, nonprofit corporations, and foreign corporations that operate in Arizona. Understanding how the Arizona Valuation of Share of Partner applies to your situation can help streamline your filing process.