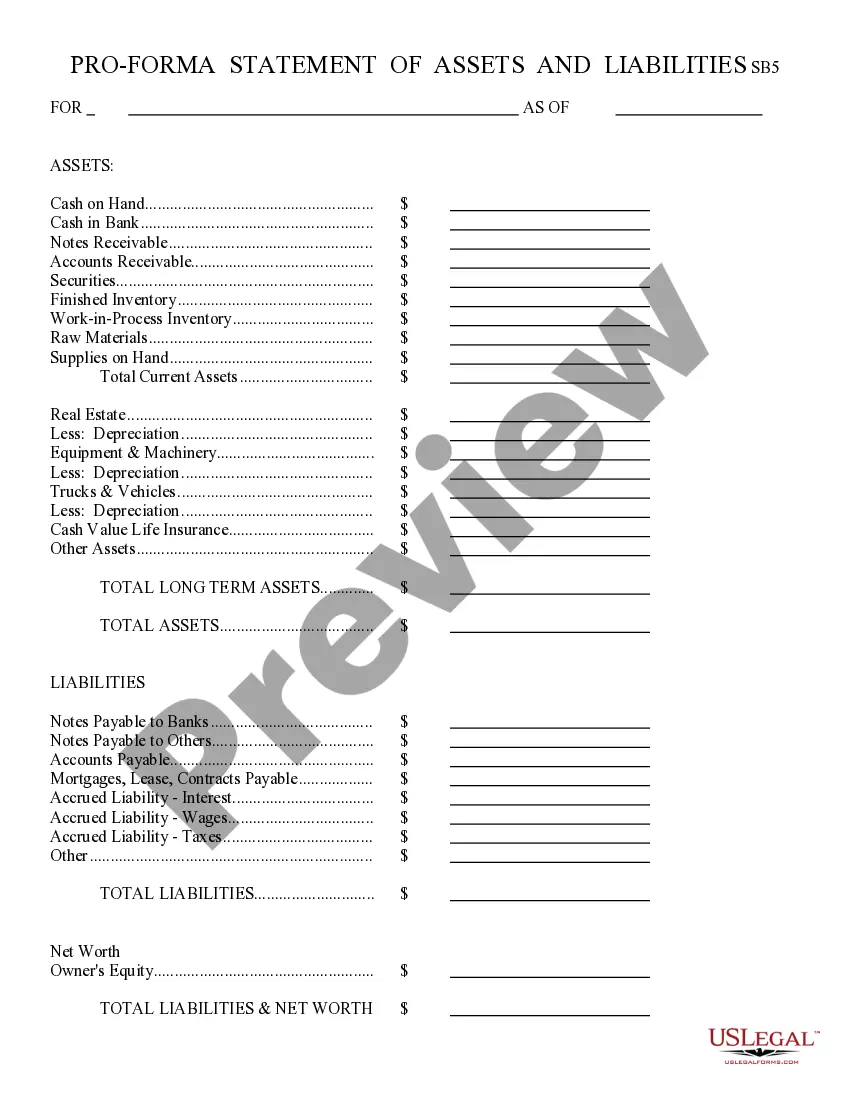

Statement of Assets; Liabilities: This is a general Statement of Assets and Liabilities for a company. It lists in detail, all assets, including real property and machinery, as well as all liabilities, or expendentures, such as rent. This form can be used by any type of company, whether a corporation or a sole proprietor. This form is available in both Word and Rich Text formats.

Arizona Statement of Assets and Liabilities - Asset Purchase

Description

How to fill out Arizona Statement Of Assets And Liabilities - Asset Purchase?

If you're looking to discover suitable Arizona Statement of Assets and Liabilities - Asset Acquisition web forms, US Legal Forms is what you require; find documents crafted and validated by state-authorized legal professionals.

Using US Legal Forms not only spares you from complications related to legal paperwork; you also conserve effort and time, as well as finances! Downloading, printing, and completing a professional template is significantly more cost-effective than hiring an attorney to handle it for you.

And that's it. In just a few simple steps, you possess an editable Arizona Statement of Assets and Liabilities - Asset Acquisition. After creating your account, all future transactions will be processed even more effortlessly. Once you have a US Legal Forms subscription, simply Log In/">Log In to your account and click the Download button you see on the form's page. Then, whenever you need to use this blank again, you'll always be able to find it in the My documents section. Don't waste your time sifting through numerous forms across different web sources. Purchase accurate copies from a single reliable platform!

- Start by completing your registration process by providing your email and creating a password.

- Follow the instructions below to set up your account and locate the Arizona Statement of Assets and Liabilities - Asset Acquisition template to address your needs.

- Utilize the Preview option or review the document details (if available) to ensure that the form is exactly what you need.

- Check its relevance in your state.

- Click Buy Now to place your order.

- Choose a preferred pricing plan.

- Set up your account and make a payment with your credit card or PayPal.

Form popularity

FAQ

Every resident and non-resident with income sourced from Arizona is required to file an Arizona state tax return. This also applies to businesses involved in asset purchases, ensuring that all necessary financial aspects, including the statement of assets and liabilities, are reported. Staying informed about filing requirements helps you avoid issues down the road.

If your business generates revenue in Arizona, then yes, you will need to file an Arizona corporate tax return. This includes accurately reporting your Arizona Statement of Assets and Liabilities related to asset purchases. Filing on time helps ensure compliance with state laws and avoids unnecessary penalties.

Certain individuals and organizations, like non-profits and certain governmental entities, may be exempt from Arizona state income tax. Additionally, depending on your income level and other factors, you might qualify for some deductions. Ensure you understand your situation or consult with a tax adviser to clarify your eligibility.

Yes, non-residents may need to file an Arizona tax return if they earn income from Arizona sources. This includes entities involved in asset purchases that are subject to Arizona tax laws. Understanding your filing obligations is crucial, and platforms like US Legal Forms can help streamline the process.

You can file Arizona Form 120 directly with the Arizona Department of Revenue. This submission ensures that your Arizona Statement of Assets and Liabilities for asset purchases is accurately recorded. For convenience, electronic filing may also be available, making the process smoother and faster.

Typically, any corporation or partnership that has incurred a tax liability in Arizona must file Arizona Form 165. This form is essential for reporting the Arizona Statement of Assets and Liabilities related to asset purchases. If you are not sure whether your situation applies, consider consulting a tax professional for guidance.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

No goodwillGoodwill is not recognized in an asset acquisition. Even if there is economic goodwill in the transaction, this amount is allocated to the assets acquired based on their relative fair values. This results in a higher asset basis that must then be amortized or depreciated.

In a merger, two separate legal entities become one surviving entity. All of the assets and liabilities of each are owned by the new surviving legal entity by operation of state law.

Once an asset purchase is complete, the assets and liabilities that have been purchased are moved to the new entity and the old entity (and any assets or liabilities it still owns) must be wound down. In a stock purchase, the buyer purchases the entire company, including all assets and liabilities.