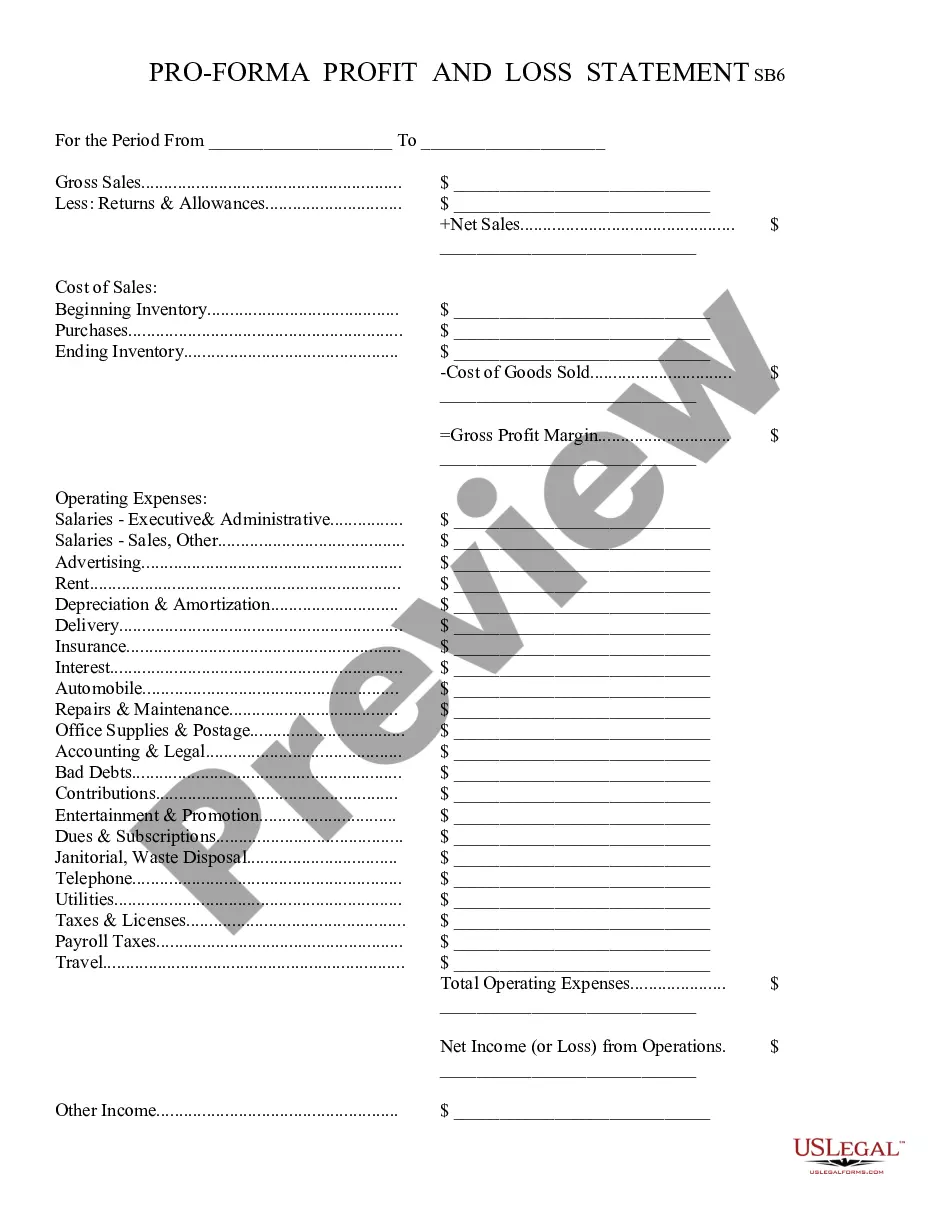

Profit and Loss Statement: This is a general Statement of Profits and Losses for a company. It lists in detail, all profits, or gains, as well as all losses the business may have suffered. This form can be used by any type of company, whether a corporation or a sole proprietor. This form is available in both Word and Rich Text formats.

Arizona Profit and Loss Statement

Description

How to fill out Arizona Profit And Loss Statement?

If you're looking for suitable Arizona Profit and Loss Statement samples, US Legal Forms is what you require; discover documents created and reviewed by state-authorized legal professionals.

Utilizing US Legal Forms not only protects you from issues related to legal paperwork; you also conserve time, energy, and finances! Downloading, printing, and completing a professional form is significantly less expensive than hiring a lawyer to do it for you.

And that's it. With a few simple steps, you receive an editable Arizona Profit and Loss Statement. After creating your account, all future orders will be processed even more easily. With a US Legal Forms subscription, just Log In to your account and click the Download option available on the form's page. Then, whenever you need to access this template again, you can always find it in the My documents section. Don't waste your time sifting through countless forms on different platforms. Acquire precise copies from a single secure source!

- First, finish your registration process by providing your email and creating a password.

- Follow the instructions below to set up your account and find the Arizona Profit and Loss Statement template for your needs.

- Utilize the Preview feature or check the document description (if available) to ensure that the form is the one you desire.

- Verify its validity in your location.

- Click on Buy Now to place an order.

- Select a preferred pricing option.

- Create your account and pay using your credit card or PayPal.

- Choose a convenient file format and save the document.

Form popularity

FAQ

Form 301 is used to determine Arizona's distribution of income at the state level. It is primarily for those who need to report gain or loss resulting from transactions reported on Form 140. Using the information from your Arizona Profit and Loss Statement will aid in filling out Form 301 accurately, leading to a smoother tax filing process.

Form 140 is the Arizona Individual Income Tax Return form that residents must file to report their taxable income. This form includes information about your income, deductions, and credits. Accurately completing this form is essential, especially when you incorporate your Arizona Profit and Loss Statement data to ensure all income is reported correctly.

The long-term capital gain exclusion in Arizona allows for specific gains to be excluded from taxable income. Typically, this applies to gains from the sale of qualified investments, real estate, or businesses held for more than a year. You should ensure that your Arizona Profit and Loss Statement reflects these exclusions properly to benefit from potential tax savings.

Filling out a profit and loss statement involves collecting information about your income and expenses for a specific period. Start by listing your total revenue, followed by categorizing your expenses, such as operating costs and taxes. Using tools like those available on the uslegalforms platform can simplify this process, making it easier to generate an accurate Arizona Profit and Loss Statement.

For non-resident individuals, long-term capital gains are typically subject to US taxes only if the gains come from U.S. sources. The rates may differ, and it’s essential to consult with a tax professional. Filling out an Arizona Profit and Loss Statement accurately will help you report these gains correctly and fulfill your tax obligations.

In Arizona, the exemption limit for long-term capital gains is critical for taxpayers. Generally, gains from the sale of certain assets held for more than a year may qualify for this exemption. However, it is essential to refer to the IRS guidelines and state regulations to maximize your benefit when you compile your Arizona Profit and Loss Statement.

The Arizona tax rate on capital gains aligns with the standard income tax rates in the state. This means that both short-term and long-term gains are taxed as ordinary income. Depending on your income bracket, the rates can vary from 2.59% to 4.5%. Keeping accurate records helps you prepare an Arizona Profit and Loss Statement to assess your capital gains efficiently.

You should mail your Arizona state tax forms to the address specified in the instructions for each form. This information can be found on the Arizona Department of Revenue's website as well. Ensure that you double-check the address for the specific form to avoid delays. Keeping your Arizona Profit and Loss Statement organized will ensure you submit all necessary documents accurately.

Arizona Form 165 should be sent to the address provided in the form's instructions, which typically depends on whether you are filing electronically or by mail. If you file electronically, follow the procedures outlined in the Arizona Department of Revenue's online portal. Accurate filing of your Arizona Profit and Loss Statement is essential for this submission.

Filing a profit and loss statement typically involves including it as part of your overall tax documents, whether submitted online or mailed. You may need to attach this statement to tax forms like Form 1040 or Form 165, depending on your business type. Accuracy is key, and uslegalforms can assist you in preparing your statement properly for submission.