Arizona Statement Of Bankruptcy And Or Receivership is a document used by the state of Arizona to declare a business bankrupt or to appoint a receiver to manage its assets. The statement serves as an official notice of a business’s inability to pay its debts and creditors. It also helps to protect creditors’ rights and interests. There are two types of Arizona Statement Of Bankruptcy And Or Receivership: voluntary and involuntary. Voluntary statements are filed by a business that has reached an agreement with its creditors to restructure its debts. Involuntary statements are filed by creditors who have obtained a court order to declare a business bankrupt. In both cases, the statement outlines the business’s liabilities, assets, and creditors, and provides information about the business’s legal standing. Once the statement is filed, the courts will review the case and make a determination regarding the status of the business.

Arizona Statement Of Bankruptcy And Or Receivorship

Description

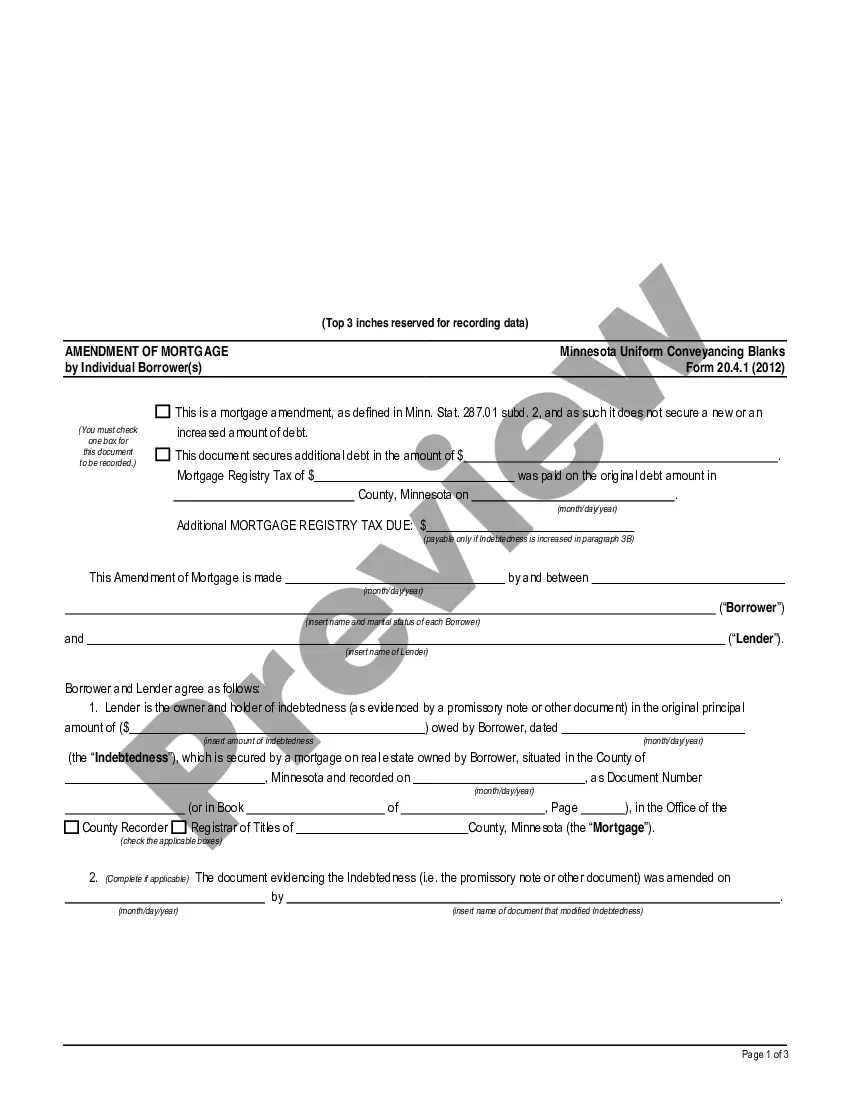

How to fill out Arizona Statement Of Bankruptcy And Or Receivorship?

How many hours and resources do you usually allocate for drafting official documents.

There’s a more efficient alternative to obtaining such forms than engaging legal professionals or spending countless hours searching online for an appropriate template.

Another advantage of our library is that you can access previously acquired documents securely stored in your profile in the My documents tab. Retrieve them anytime and re-complete your forms as often as needed.

Save time and energy managing official documentation with US Legal Forms, one of the most reliable online services. Register with us today!

- Review the form content to ensure it complies with your state regulations. To do this, consult the form description or use the Preview option.

- If your legal template does not satisfy your requirements, search for another one using the search bar at the top of the page.

- If you are already a member of our service, Log In and download the Arizona Statement Of Bankruptcy And Or Receivorship. If not, continue with the next steps.

- Once you have located the correct document, click Buy now. Select the subscription plan that best fits your needs to access our library’s complete resources.

- Create an account and process your subscription payment. You can pay via credit card or through PayPal—our service is completely secure for this purpose.

- Download your Arizona Statement Of Bankruptcy And Or Receivorship onto your device and fill it out on a printed copy or electronically.

Form popularity

FAQ

To obtain an Arizona certificate of good standing, you should contact the Arizona Secretary of State's office. You can request this certificate online, by mail, or in person. Ensure that your business is compliant with state regulations, as this certificate confirms your legal status. Uslegalforms can guide you through the steps necessary to maintain compliance related to the Arizona Statement Of Bankruptcy And Or Receivorship, ensuring you have the proper documentation.

Finding your bankruptcy records in Arizona is straightforward. You can access your records through the Arizona court system's online portal or by visiting the local court where your case was filed. Additionally, you can request your bankruptcy records from the Clerk of the Court. For assistance, uslegalforms offers resources to help you navigate the Arizona Statement Of Bankruptcy And Or Receivorship process.

To reinstate a corporation in Arizona, you need to file the necessary reinstatement documents with the Arizona Corporation Commission, along with paying any owed fees. It's important to ensure that all reports and taxes are current. Understanding the role of the Arizona Statement Of Bankruptcy And Or Receivorship during this process can help you make informed decisions. Use platforms like USLegalForms to facilitate the reinstatement successfully.

Yes, Arizona permits corporations to restate their articles of incorporation. This process typically involves submitting a Restated Articles of Incorporation form to the Arizona Corporation Commission. If you are concerned about any implications related to the Arizona Statement Of Bankruptcy And Or Receivorship, it may be helpful to consult resources such as USLegalForms for legal clarity.

To reactivate your company in Arizona, you typically need to address any outstanding issues such as unpaid taxes or fees. After resolving these matters, submit a reinstatement application to the ACC. If you're unsure how the Arizona Statement Of Bankruptcy And Or Receivorship plays a role in this reactivation, seeking assistance from USLegalForms can be a great choice.

Reinstating a suspended license in Arizona requires you to fulfill specific obligations. These may include paying any fines, completing court-ordered classes, and providing proof of insurance. It's essential to confirm how the Arizona Statement Of Bankruptcy And Or Receivorship may impact your license status. USLegalForms can guide you through the reinstatement steps and help ensure compliance.

To reinstate your LLC in Arizona, you need to file the appropriate paperwork with the Arizona Corporation Commission (ACC). This includes submitting the Application for Restoration with the necessary fees. Additionally, it is wise to check whether your Arizona Statement Of Bankruptcy And Or Receivorship affects your LLC status, as it may influence the reinstatement process. You can use platforms like USLegalForms to navigate this process efficiently.

You may use a PO box for business communications, but it cannot serve as your LLC's official address in Arizona. Having a physical address is vital for compliance with state regulations. This distinction is crucial if your business is involved in situations relating to the Arizona Statement Of Bankruptcy And Or Receivorship. For guidance on managing your business address, check out the resources provided by US Legal Forms.

Yes, Arizona law requires you to publish a notice of your LLC formation in a newspaper for three consecutive weeks. This requirement helps to inform the public of your business's existence and is part of formalizing your LLC. Publishing is especially important if your LLC might be associated with an Arizona Statement Of Bankruptcy And Or Receivorship in the future. You can find easy-to-follow tools and templates on the US Legal Forms platform to comply with this requirement.

Yes, you can use a virtual address for your LLC in Arizona, but it must meet specific requirements. While a virtual address can handle your mail, you still need to provide a physical address for your LLC registration. This is crucial for maintaining compliance with laws relating to the Arizona Statement Of Bankruptcy And Or Receivorship. US Legal Forms can guide you in selecting the right virtual address service to meet your needs.