The Arizona Waiver of Special Meeting of Stockholders — Corporate Resolutions is a legal document that allows stockholders of a corporation in the state of Arizona to waive the requirement for a special meeting of stockholders to be held for certain corporate resolutions. This waiver provides an efficient and streamlined process for the corporation to make important decisions without the need for a physical meeting. This document is commonly used when there is a need to save time and resources by avoiding the logistical challenges associated with convening a special meeting. It allows stockholders to give their consent in writing, eliminating the need for them to physically attend a meeting. The waiver can be used for a variety of corporate resolutions, such as approving a merger or acquisition, amending the bylaws, or authorizing a significant transaction. The Arizona Waiver of Special Meeting of Stockholders — Corporate Resolutions typically includes key details like the name of the corporation, the date of the resolution, and the specific resolution being addressed. It also contains a section where the stockholders can provide their consent and signature, indicating their agreement to waive the requirement of a special meeting. This consent is usually obtained through a voting process, where the stockholders cast their votes in favor or against the resolution. It is important to note that there may be different types of Arizona Waiver of Special Meeting of Stockholders — Corporate Resolutions, depending on the specific purpose or type of resolution being addressed. For example, there may be separate waivers for different types of transactions, such as a waiver specific to mergers and acquisitions, or a waiver specific to amendments of the bylaws. Overall, the Arizona Waiver of Special Meeting of Stockholders — Corporate Resolutions provides a flexible and efficient mechanism for corporations to obtain stockholder consent without the need for a physical meeting. It streamlines the decision-making process and allows corporations to save time and resources while still ensuring stockholder participation in major corporate decisions.

Arizona Waiver of Special Meeting of Stockholders - Corporate Resolutions

Description

How to fill out Arizona Waiver Of Special Meeting Of Stockholders - Corporate Resolutions?

Are you currently in the situation where you need documents for either business or personal use every day.

There are numerous legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers a vast selection of document templates, such as the Arizona Waiver of Special Meeting of Stockholders - Corporate Resolutions, that are designed to comply with federal and state regulations.

Once you find the correct document, click Get now.

Choose your desired pricing plan, enter the required information to create your account, and purchase your order using PayPal or a credit card.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arizona Waiver of Special Meeting of Stockholders - Corporate Resolutions template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for your correct city/state.

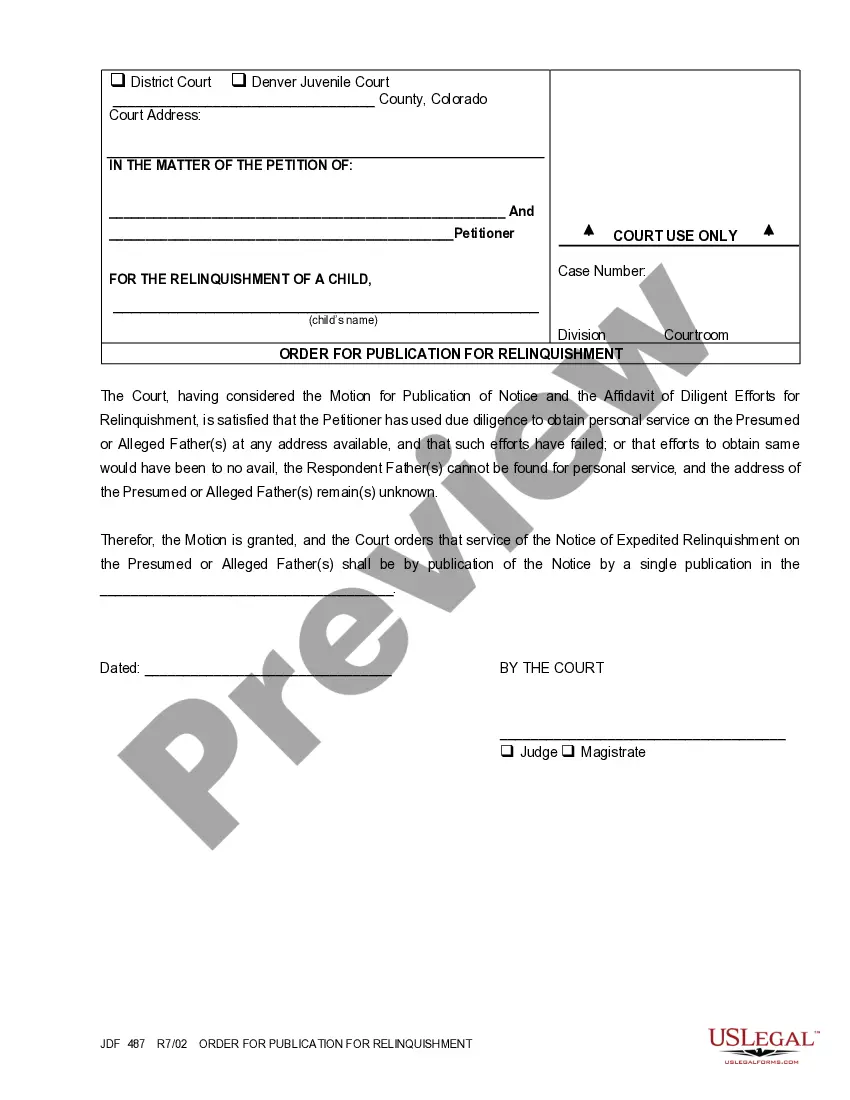

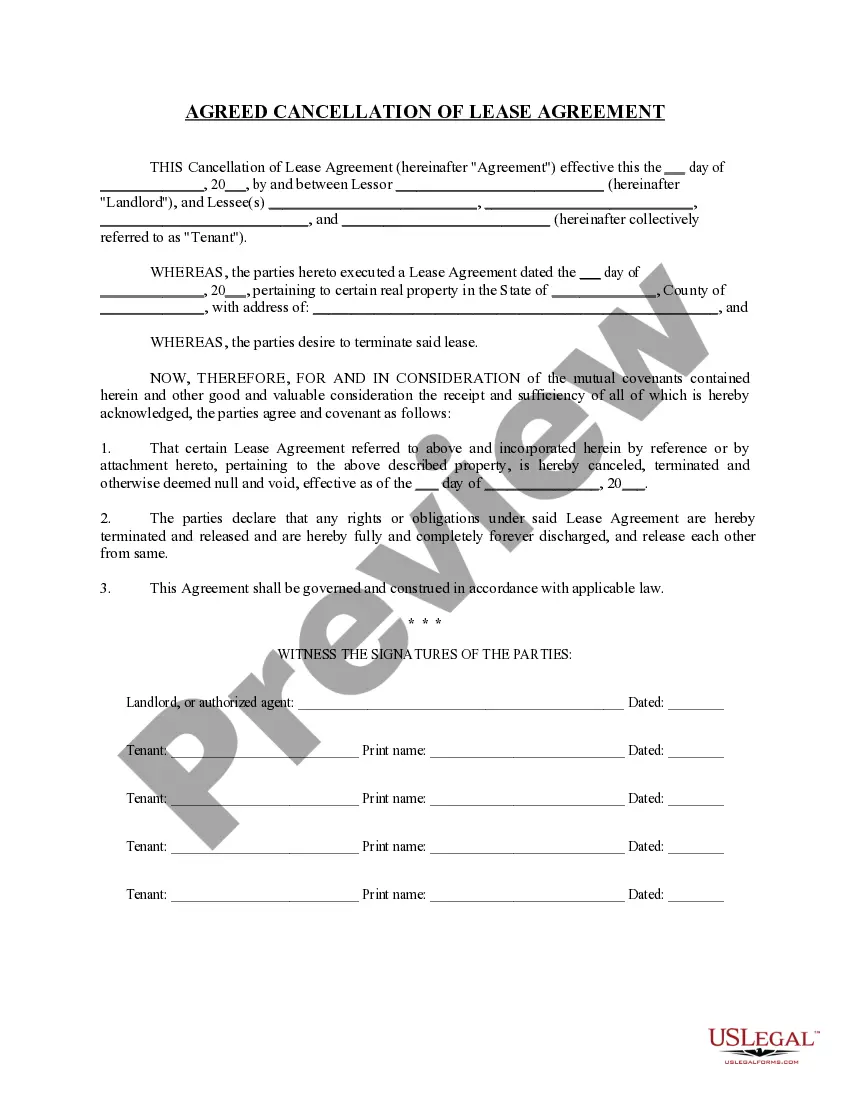

- Use the Preview option to review the document.

- Check the description to make sure you have selected the appropriate document.

- If the document is not what you're searching for, utilize the Search area to find the document that meets your needs and requirements.

Form popularity

FAQ

A shareholder meeting will often be called when shareholder input is needed in a major decision, such as a change in directors. Investors are also able to call special shareholder meetings, subject to a specific set of rules.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation

Typically either the president or a majority vote of the board (or both) can call a special meeting. You need to give proper notice to members and, of course, you need a quorum to do business. The procedure should be spelled out in your bylaws.

Special meetings of directors or members shall be held at any time deemed necessary or as provided in the bylaws: Provided, however, That at least one (1) week written notice shall be sent to all stockholders or members, unless a different period is provided in the bylaws, law or regulation.

A waiver of notice is a common document used for board of directors special meetings. Special meetings are called when there's a pressing issue that can't wait for the next scheduled meeting. If there's not enough time for a formal meeting notice, directors can opt to sign a waiver and hold the meeting without notice.

A waiver of notice is a legal document that states a board member agrees to waive the formal notice, and it must be signed by the board member. Organizations will have different rules based on the type of meeting, such as the first meeting, special meetings, emergency meetings, and executive sessions.

A waiver of notice is a legal document that states a board member agrees to waive the formal notice, and it must be signed by the board member. Organizations will have different rules based on the type of meeting, such as the first meeting, special meetings, emergency meetings, and executive sessions.

Why would I need a waiver of notice for the first shareholder meeting? A waiver of notice documents that all shareholders are okay with having a meeting without being formally notified ahead of time.

Notice to Shareholders Most states require notice of any shareholder meeting be mailed to all shareholders at least 10 days prior to the meeting. The notice should contain the date, time and location of the meeting as well as an agenda or explanation of the topics to be discussed.

The directors' must call the meeting within 21 days after the request is given to the Company and the meeting must be held no later than two months after the request (Section 249D(5)). The obligation to call the meeting is imposed on the directors, whereas the obligation to hold the meeting is imposed on the company.

More info

A corporation which operates solely by virtue of its ownership of stock in other corporations shall not be required as a condition of operation to register for federal income tax purposes unless it has filed federal income tax returns and such returns have been approved for filing by the Internal Revenue Service. (N. J. S. A. §13-1102.) If an Arizona member corporation that does not operate solely by virtue of its ownership of stock in other corporations has more than one class of its business or engaged in business for profit in Arizona and at least one of which is a trade or business of supplying a service to persons in Arizona, then section 9-102.