An Arizona Corporate Resolution for Bank Account is a legal document that authorizes the opening, closing, and management of a bank account on behalf of a corporation or business entity registered in the state of Arizona. It serves as an official record of approval by the corporation's board of directors or members, granting specific individuals or authorized signers the power to conduct banking activities on behalf of the company. The resolution outlines important information such as the corporation's legal name, registered address, and federal tax identification number (EIN). It also specifies the purpose of the bank account, whether it is for general operations, payroll, investments, or any other designated purpose. Moreover, the resolution names the individuals who are authorized to manage the account, which usually includes corporate officers such as the President, Vice President, Treasurer, and Secretary. This ensures that only authorized personnel can handle the corporation's funds and make financial decisions on its behalf. The resolution also defines the scope of authority granted to the authorized individuals and may require multiple signatures for certain types of transactions or a specific quorum of board members' approval for major financial actions. In addition to the general Arizona Corporate Resolution for Bank Account, there can be various specific types that cater to different scenarios or requirements. These may include: 1. General Operations Resolution: Authorizes the opening and management of a bank account for day-to-day operational expenses of the corporation. This type of resolution covers routine transactions such as deposits, payments, and transfers. 2. Payroll Resolution: Specifically addresses the establishment and management of a bank account dedicated solely to payroll activities. It ensures the timely and accurate payment of employees and related taxes. 3. Investment Resolution: Allows the corporation to establish a bank account for investment purposes, such as holding funds for specific projects or ventures. This resolution may include provisions regarding investment strategies, authorized investment instruments, and limitations on risk exposure. 4. Special Projects Resolution: Pertains to the creation of a bank account dedicated to a specific project or campaign. It outlines the source of funds, anticipated expenses, and specific individuals authorized to manage these funds. 5. Closure Resolution: This resolution is used when the corporation decides to close a bank account. It mandates the authorized individuals to complete the necessary procedures, such as transferring remaining funds, notifying relevant parties, and returning any associated debit cards or checks. Overall, the Arizona Corporate Resolution for Bank Account is a crucial legal document that ensures proper authorization and control over a corporation's bank account activities. By clearly delineating the individuals empowered to handle financial matters, it helps protect the corporation from unauthorized transactions and facilitates smooth banking operations.

Arizona Corporate Resolution for Bank Account

Description

How to fill out Arizona Corporate Resolution For Bank Account?

If you wish to total, obtain, or printing lawful record themes, use US Legal Forms, the greatest selection of lawful types, that can be found on-line. Use the site`s basic and practical lookup to discover the files you will need. A variety of themes for organization and specific functions are categorized by groups and says, or keywords. Use US Legal Forms to discover the Arizona Corporate Resolution for Bank Account in a number of click throughs.

If you are presently a US Legal Forms consumer, log in to your accounts and click the Acquire switch to obtain the Arizona Corporate Resolution for Bank Account. Also you can accessibility types you formerly acquired in the My Forms tab of the accounts.

If you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the form for the correct town/country.

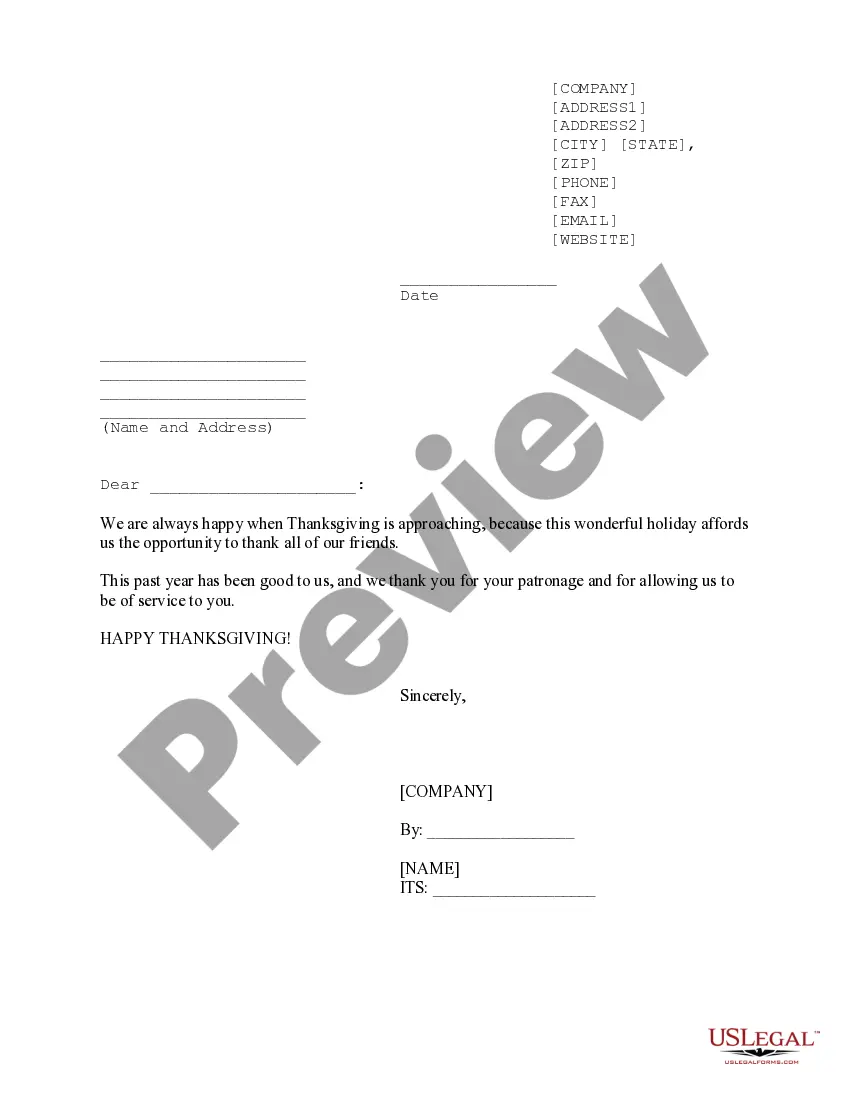

- Step 2. Make use of the Preview solution to look through the form`s content. Do not forget about to read the outline.

- Step 3. If you are unsatisfied together with the develop, make use of the Research industry on top of the display screen to discover other versions of your lawful develop web template.

- Step 4. Once you have identified the form you will need, click the Purchase now switch. Opt for the costs strategy you favor and add your references to register to have an accounts.

- Step 5. Procedure the transaction. You can utilize your bank card or PayPal accounts to complete the transaction.

- Step 6. Choose the structure of your lawful develop and obtain it on the device.

- Step 7. Total, modify and printing or indication the Arizona Corporate Resolution for Bank Account.

Each and every lawful record web template you get is the one you have for a long time. You might have acces to every single develop you acquired inside your acccount. Select the My Forms portion and select a develop to printing or obtain once again.

Compete and obtain, and printing the Arizona Corporate Resolution for Bank Account with US Legal Forms. There are many expert and status-specific types you may use for your personal organization or specific needs.