Arizona Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

How to fill out Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

If you want to accumulate, acquire, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Utilize the site’s simple and convenient search to locate the documents you require. Various templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to find the Arizona Acknowledgment by Charitable or Educational Institution of Receipt of Gift with just a few clicks.

Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the purchase.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Arizona Acknowledgment by Charitable or Educational Institution of Receipt of Gift. Every legal document template you purchase belongs to you permanently. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again. Compete and acquire, and print the Arizona Acknowledgment by Charitable or Educational Institution of Receipt of Gift with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the Arizona Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, refer to the guidelines below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

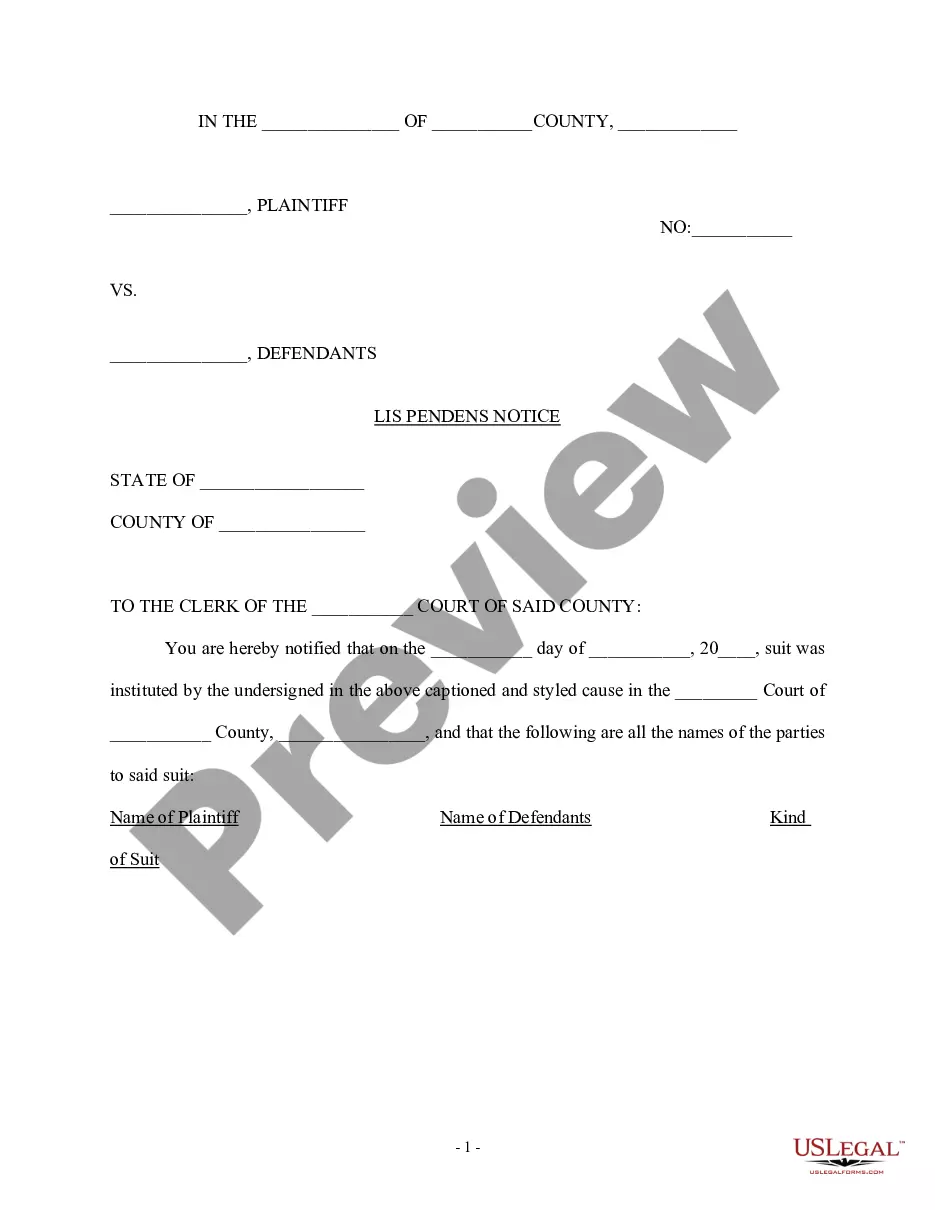

- Step 2. Use the Preview option to review the form’s details. Don't forget to read the information.

- Step 3. If you are dissatisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

Form popularity

FAQ

To issue a receipt for a charitable donation, your organization must create a document that details the donor's information, the donation amount, and the purpose of the gift. It's crucial to state that no goods or services were exchanged for the donation, reinforcing its tax-deductible status. By following the 'Arizona Acknowledgment by Charitable or Educational Institution of Receipt of Gift' guidelines, you can simplify the process and ensure that your receipts meet all necessary legal standards.

To acknowledge receipt of a donation, a charitable or educational institution should provide a formal letter or receipt to the donor. This document should include the name of the organization, the donor's name, the date of the donation, and the amount given. Additionally, mentioning that the donation is tax-deductible can be beneficial. Utilizing the 'Arizona Acknowledgment by Charitable or Educational Institution of Receipt of Gift' ensures compliance with state requirements and fosters trust with your donors.

A gift acknowledgement is a formal document that recognizes a donor's contribution to a charitable organization. It typically includes essential details such as the donor's name, the amount of the gift, and a statement confirming the receipt of the contribution. Issuing a gift acknowledgement is vital as it functions as an Arizona Acknowledgment by Charitable or Educational Institution of Receipt of Gift, helping donors with their tax records and reinforcing their relationship with the organization.

The Arizona gift clause refers to specific regulations that govern the acceptance of gifts by charitable organizations in Arizona. This clause ensures that gifts made to these institutions are appropriately acknowledged and documented, promoting accountability and proper use of donated funds. Understanding this clause is crucial for organizations to maintain compliance and to issue an Arizona Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

To acknowledge a gift from a donor-advised fund, you should issue a written acknowledgment that specifies the name of the fund, the donor, and the date of the contribution. It is important to clarify that the donor is not eligible for a tax deduction due to the nature of the fund. This acknowledgment is part of the Arizona Acknowledgment by Charitable or Educational Institution of Receipt of Gift, fostering transparency and trust with your donor community.

An effective written acknowledgment for a charitable contribution should clearly state the name of the charitable organization, the date of the contribution, and the amount donated. It should also include a statement that no goods or services were provided in exchange for the gift. This document serves as an essential Arizona Acknowledgment by Charitable or Educational Institution of Receipt of Gift, ensuring compliance with tax regulations and providing donors peace of mind.

Gifts of $20 or less per occasion, not to exceed $50 in a year from one source; Opportunities and benefits that are offered to members of a group unrelated to government employment; Awards and honorary degrees (but these require prior approval of the component head).

Gift giving policies generally focus on the value of a gift and the position of the recipient in an organization. For example, many companies do not allow any employee to receive a gift worth more than $25. This number may have to do with tax laws around professional gifts. It could also be a matter of company culture.

This provision does not prohibit acceptance by an employee of food, refreshments, or unsolicited advertising or promotional material of nominal value. Although Arizona law allows gifts of under $10.00 in value, even such nominal gifts are forbidden if they are designed to influence a state employee's conduct.