Arizona Deferred Compensation Agreement - Short Form

Description

How to fill out Deferred Compensation Agreement - Short Form?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By using the site, you can access thousands of forms for business and personal purposes, classified by categories, states, or keywords.

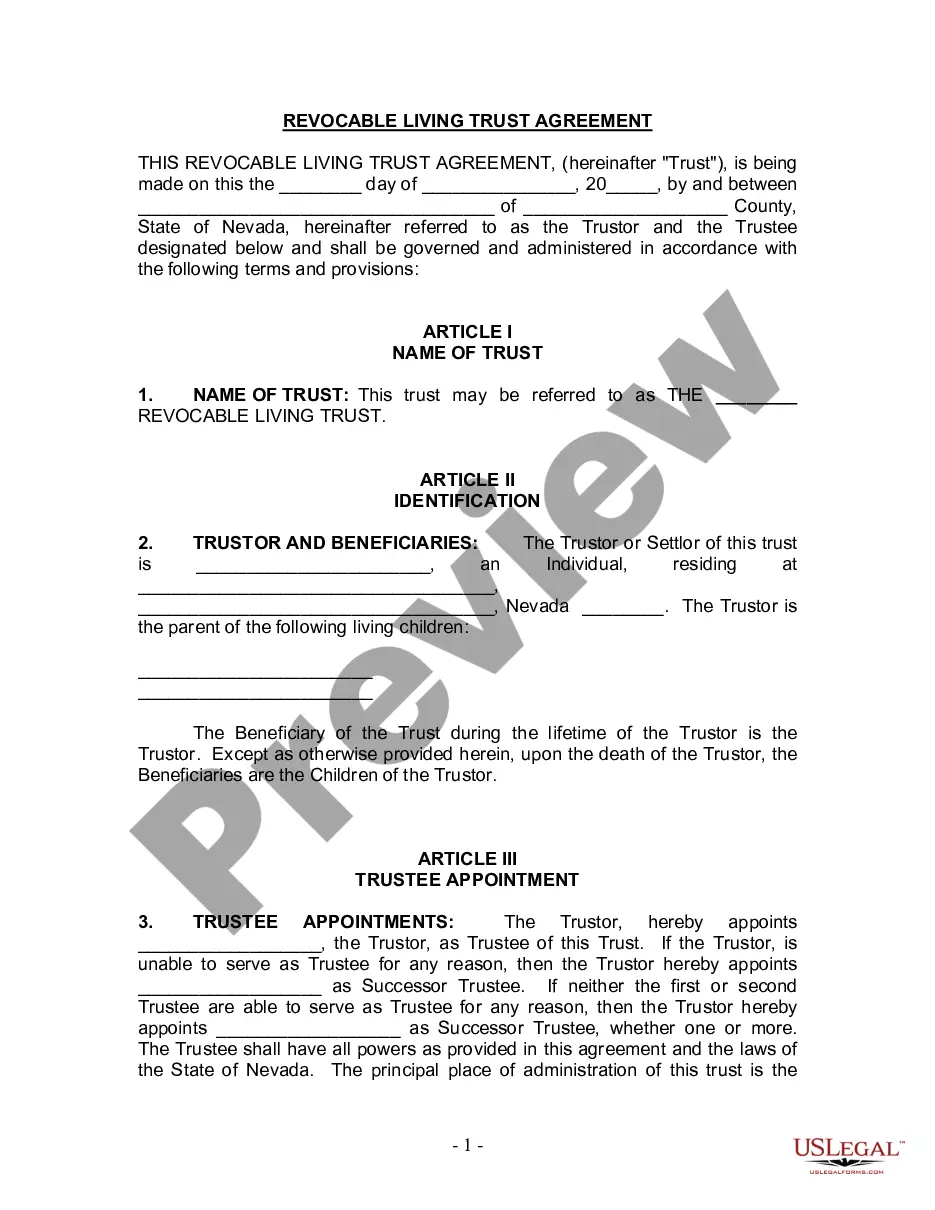

You can obtain the latest versions of documents like the Arizona Deferred Compensation Agreement - Short Form in just minutes.

Review the form details to confirm that you have chosen the right document.

If the form doesn't meet your requirements, use the Search field at the top of the page to find one that does.

- If you already have an account, Log In and download the Arizona Deferred Compensation Agreement - Short Form from the US Legal Forms library.

- The Download button will be available on every document you view.

- You can find all previously downloaded forms in the My documents section of your account.

- To start using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for the city/state.

- Click on the Preview button to review the form's details.

Form popularity

FAQ

457 plans are IRS-sanctioned, tax-advantaged employee retirement plans. They are offered by state, local government, and some nonprofit employers. Participants are allowed to contribute up to 100% of their salary, provided it does not exceed the applicable dollar limit for the year.

PEBSCO is the largest, most experienced administrator of deferred compensation plans in the United States, serving over 2,500 government bodies with over 320,000 participants. In the State of Illinois PEBSCO administers plans for 65 jurisdictions.

There are two different types of 457 plansthe 457(b), which is offered to state and local government employees, and the 457(f) is for top executives in nonprofits. A 403(b) plan is typically offered to employees of private nonprofits and government workers, including public school employees.

Established in 1990, OBRA is an acronym for Omnibus Budget Reconciliation Act. The primary purpose of this 457 deferred compensation plan is to provide a retirement alternative to Social Security for all non-benefited part-time, seasonal and temporary employees.

A 457(b) plan is an employer-sponsored, tax-favored retirement savings account. With this type of plan, you contribute pre-tax dollars from your paycheck, and that money won't be taxed until you withdraw the money, usually for retirement.

DEFINITION. A 457(b) plan is an employer-sponsored, tax-favored retirement savings account. With this type of plan, you can contribute pre-tax dollars from your paycheck, and that money won't be taxed until you withdraw the money, usually for retirement.

401(k) plans are offered by for-profit companies to eligible employees who contribute pre or post-tax money through payroll deduction. 403(b) plans are offered to employees of non-profit organizations and government. 403(b) plans are exempt from nondiscrimination testing, whereas 401(k) plans are not.

A deferred compensation plan is another name for a 457(b) retirement plan, or 457 plan for short. Deferred compensation plans are designed for state and municipal workers, as well as employees of some tax-exempt organizations.

The program deducts 7.5 percent of your pretax wages and deposits it in a PST Program account for you, allowing you to build retirement savings. It's set up as a 457 Plan, a type of retirement savings plan governed by IRS rules.

457s are savings plans primarily offered to government employees, including state and local government officials, public school teachers, county and city employees, and first responders. By contrast, 401(k) retirement plans are usually offered by private enterprises.