Title: Arizona Sample Letter to State Tax Commission regarding Decedent's Estate: A Detailed Description Introduction: In Arizona, managing the tax responsibilities of a decedent's estate is a vital part of the probate process. This article provides a detailed description of an Arizona Sample Letter to State Tax Commission concerning a decedent's estate. By utilizing relevant keywords and addressing various types of estates, this content aims to assist individuals in effectively communicating with the State Tax Commission. Keywords: — Arizona State TaCommissionio— - Decedent's estate — Probate proc—ss - Tax responsibilities — Letter templat— - Legal obligations - Inheritance tax — Estate ta— - Final tax return - Personal representative — Estate asset— - Tax compliance Types of Arizona Sample Letters to State Tax Commission Concerning Decedent's Estate: 1. Letter Regarding Estate Tax: If the estate is subject to estate tax, this sample letter provides a comprehensive template for addressing the State Tax Commission. It guides the personal representative in notifying the commission about the decedent's estate and fulfilling the necessary tax obligations. 2. Letter Addressing Inheritance Tax: When an estate is subject to inheritance tax in Arizona, this sample letter assists in communicating with the State Tax Commission on behalf of the estate. It outlines the applicable tax rates, the value of inherited assets, and guides the personal representative in complying with inheritance tax regulations. 3. Letter for Final Tax Return: In the case of a decedent's final individual tax return, this sample letter template acts as a guide for the personal representative to inform the State Tax Commission about the completion of the fiduciary duties. It clarifies the final tax obligations, details the assets sold or distributed, and provides comprehensive taxpayer identification information. 4. Letter Requesting Tax Clearance: When the personal representative seeks tax clearance from the State Tax Commission, this sample letter helps in requesting the confirmation that all taxes related to the decedent's estate have been fully satisfied. It provides a clear and concise format for formal communication, ensuring compliance with tax regulations. Conclusion: Understanding and fulfilling tax obligations is crucial when managing a decedent's estate in Arizona. This detailed description highlights various types of Arizona Sample Letters to State Tax Commission concerning decedent's estates and provides a suitable template for each scenario. By utilizing these templates, personal representatives can effectively navigate the tax responsibilities associated with probate and ensure compliance with the law.

Arizona Sample Letter to State Tax Commission concerning Decedent's Estate

Description

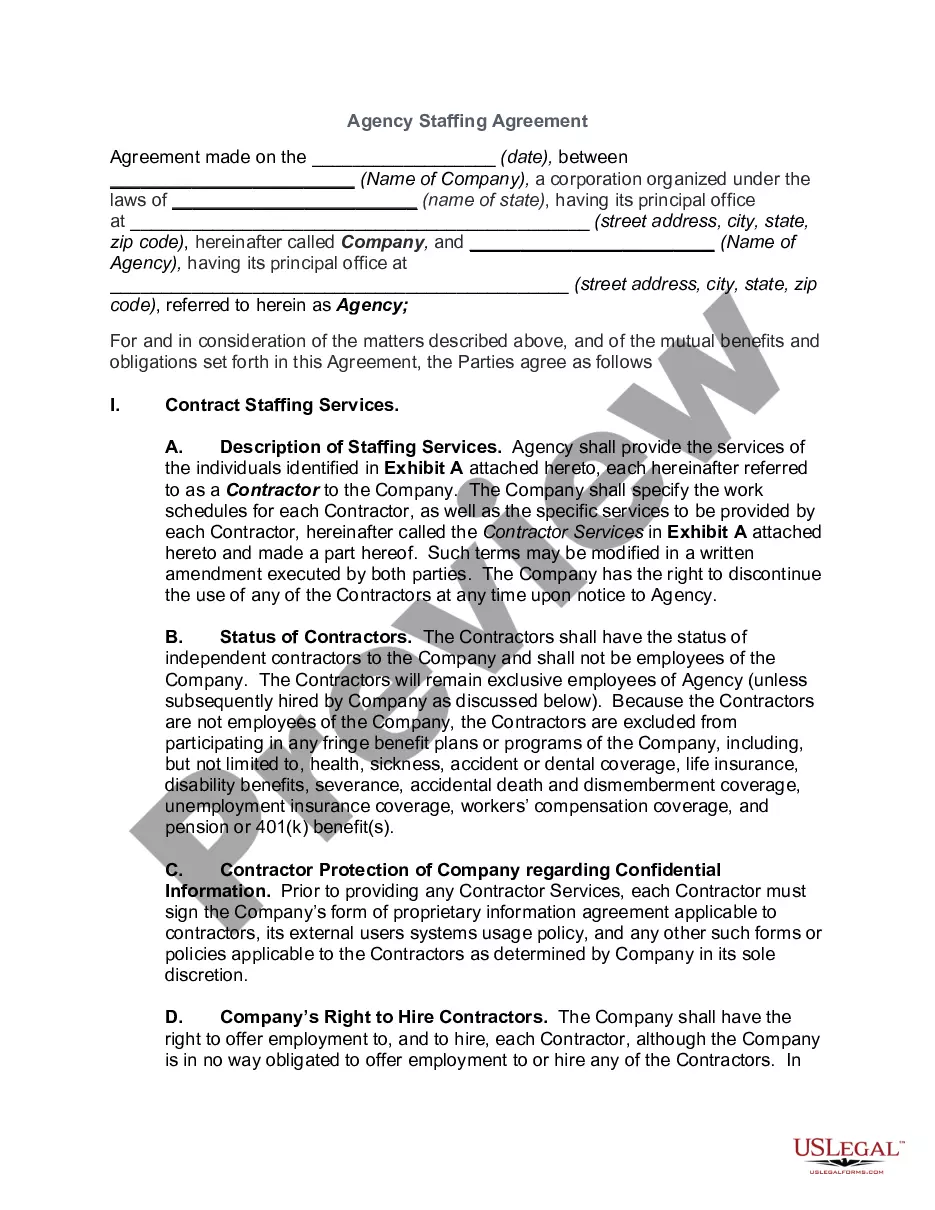

How to fill out Arizona Sample Letter To State Tax Commission Concerning Decedent's Estate?

If you need to complete, obtain, or print legal record themes, use US Legal Forms, the biggest variety of legal kinds, that can be found on the Internet. Use the site`s simple and convenient lookup to obtain the files you want. A variety of themes for business and individual purposes are sorted by groups and states, or keywords and phrases. Use US Legal Forms to obtain the Arizona Sample Letter to State Tax Commission concerning Decedent's Estate in a couple of clicks.

If you are presently a US Legal Forms consumer, log in for your bank account and click the Acquire button to get the Arizona Sample Letter to State Tax Commission concerning Decedent's Estate. You may also access kinds you previously downloaded within the My Forms tab of your bank account.

If you work with US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have selected the shape for that correct metropolis/nation.

- Step 2. Make use of the Review choice to look over the form`s content material. Do not overlook to see the outline.

- Step 3. If you are unhappy using the develop, use the Lookup area at the top of the screen to discover other types of your legal develop format.

- Step 4. Once you have identified the shape you want, select the Acquire now button. Select the pricing plan you like and add your qualifications to register for an bank account.

- Step 5. Method the purchase. You may use your credit card or PayPal bank account to accomplish the purchase.

- Step 6. Select the structure of your legal develop and obtain it in your device.

- Step 7. Comprehensive, change and print or indicator the Arizona Sample Letter to State Tax Commission concerning Decedent's Estate.

Each legal record format you purchase is your own forever. You possess acces to each develop you downloaded with your acccount. Click the My Forms section and choose a develop to print or obtain once more.

Compete and obtain, and print the Arizona Sample Letter to State Tax Commission concerning Decedent's Estate with US Legal Forms. There are many expert and condition-particular kinds you can use for your business or individual demands.