The Arizona Corporation — Transfer of Stock refers to the legal process of transferring ownership of stock or shares from one entity to another within a corporation registered in the state of Arizona. This transaction is usually subject to specific procedures and regulations outlined by the Arizona Revised Statutes governing corporations and securities. The transfer of stock allows individuals or organizations to buy, sell, or gift their ownership interest in a corporation. This can involve transferring partial or complete shares of stock, impacting the voting rights, dividends, and other associated benefits for the new stockholder. There are various types of transfers of stock that can occur within an Arizona corporation, including: 1. Purchase or Sale Transfer: This is the most common type of transfer, where an existing shareholder sells their stock to another party. The buyer pays an agreed-upon price, and the corporation updates its records to reflect the change in ownership. 2. Gift Transfer: Shareholders may choose to gift their stock to other individuals or entities. In this case, no monetary exchange occurs, and the ownership transfer is considered a gift. 3. Inheritance Transfer: When a shareholder passes away, their stock may be transferred to their heirs or beneficiaries according to their will or intestate laws. The process typically involves probate court or the execution of a formal transfer document such as an affidavit of warship. 4. Interfamily Transfer: This type of transfer occurs when stock ownership is moved between family members, often for estate planning or tax purposes. The transfer may involve considerations such as gift tax, capital gains tax, or the creation of trusts. Regardless of the type of transfer, certain steps need to be followed to ensure compliance with Arizona corporation laws. The transferring parties generally complete a stock transfer form, which includes details such as the names of the transferor (seller) and transferee (buyer), the amount and type of stock being transferred, the purchase price, and any applicable signatures. An authorized officer of the corporation typically reviews and approves the transfer before updating the stock ownership records and issuing new stock certificates. It is important to consult legal counsel or a qualified professional when engaging in a transfer of stock within an Arizona corporation to ensure compliance with state laws and regulations. This will help protect the interests of both the transferring parties and the corporation itself.

Arizona Corporation - Transfer of Stock

Description

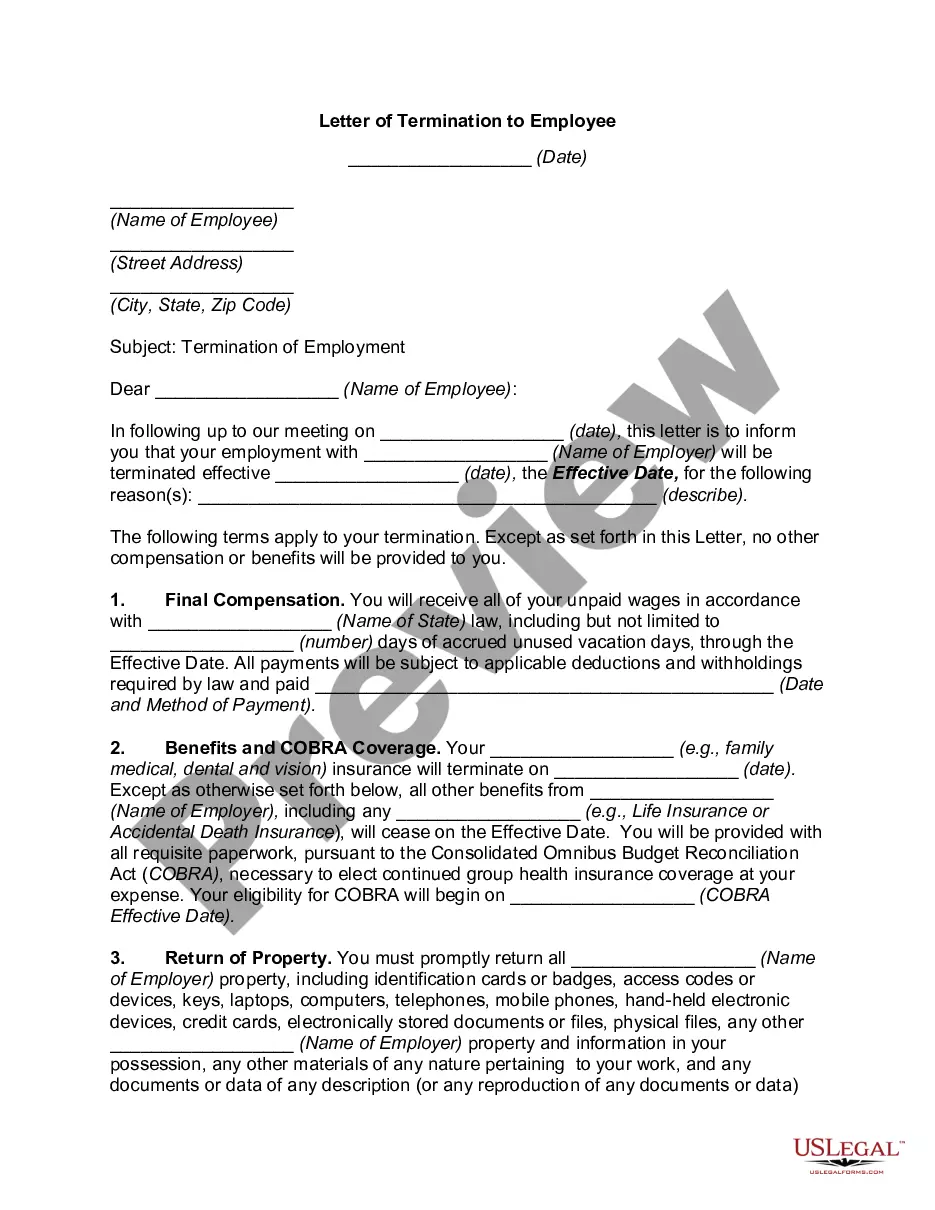

How to fill out Corporation - Transfer Of Stock?

You can spend hours online trying to discover the official form template that fulfills both state and federal requirements.

US Legal Forms offers a wide variety of official templates that have been vetted by experts.

It is easy to obtain or print the Arizona Corporation - Transfer of Stock from our service.

If available, utilize the Preview option to view the form template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain option.

- Afterward, you can fill out, edit, print, or sign the Arizona Corporation - Transfer of Stock.

- Each official form template you receive is yours to keep indefinitely.

- To get another copy of any purchased form, navigate to the My documents tab and click the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple steps below.

- First, make sure that you have selected the correct form template for your desired region/city.

- Review the form description to ensure that you have chosen the correct version.

Form popularity

FAQ

Yes, filing an Arizona corporate tax return is mandatory for corporations operating within the state. This applies regardless of whether your corporation generated income or not. Ensure that your Arizona Corporation - Transfer of Stock is compliant with all filing requirements to avoid penalties.

Any corporation doing business in Arizona must file an Arizona corporate tax return. This requirement applies even to corporations that have no income. Compliance with tax regulations is a vital part of maintaining your Arizona Corporation - Transfer of Stock and its good standing.

If your business is an Arizona corporation or an LLC, you are generally required to file an Arizona state tax return. This applies even if your business had no income during the year. Understanding your tax responsibilities helps you manage your Arizona Corporation - Transfer of Stock effectively.

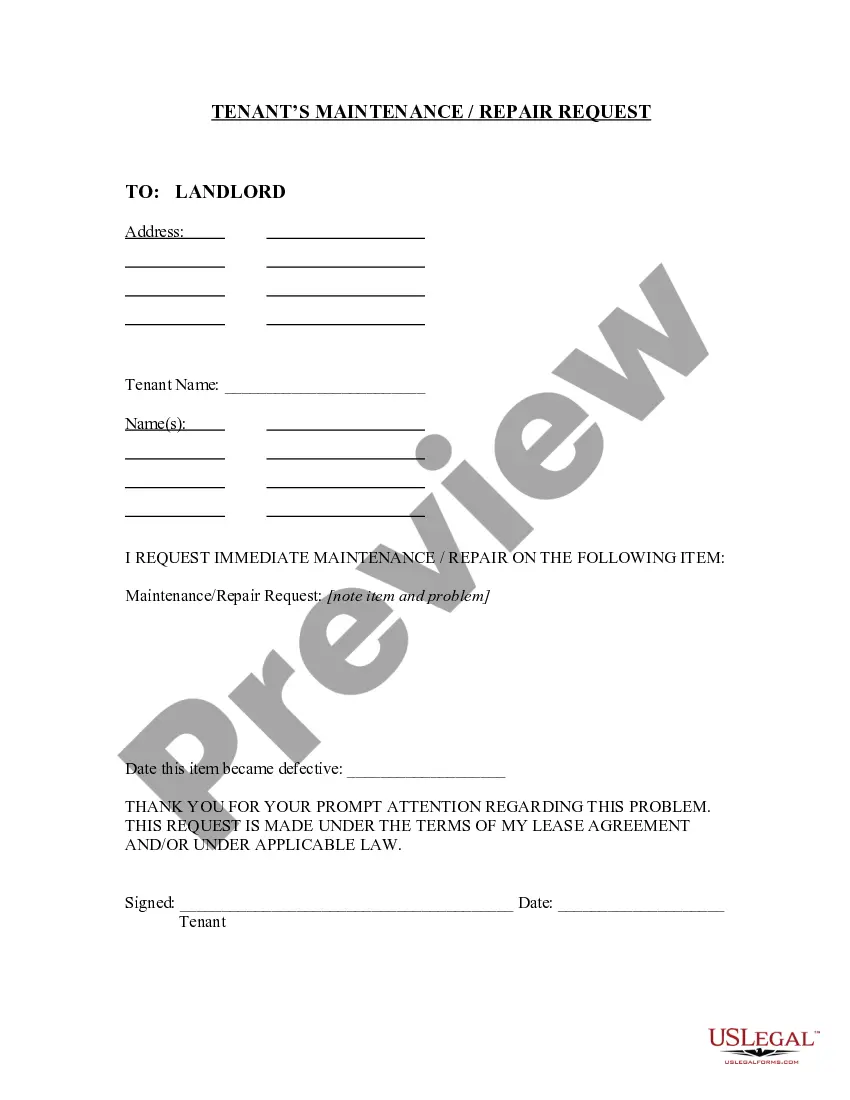

Transferring ownership of an LLC in Arizona involves updating the operating agreement to reflect the new ownership. You also need to notify the Arizona Corporation Commission by filing the appropriate forms. Use care in these transactions to maintain the integrity of your Arizona Corporation - Transfer of Stock.

Yes, corporations in Arizona must file a tax return annually, regardless of whether they have taxable income. This requirement ensures that the state has accurate financial information about every authorized corporation. Managing your Arizona Corporation - Transfer of Stock includes fulfilling tax obligations, which is crucial for legal compliance.

In Arizona, corporations must file an annual report with the Arizona Corporation Commission. This report includes key details about your corporation, such as updated addresses and officers. Failing to submit this report can result in penalties, so it’s essential to keep your Arizona Corporation - Transfer of Stock compliant and up-to-date.

To update officers in the Arizona Corporation Commission, you need to file the appropriate forms with the Commission. This usually involves submitting a Statement of Change form along with any required fees. Keeping your records current ensures compliance and proper governance within your Arizona Corporation - Transfer of Stock.

Updating officers with the Arizona Corporation Commission involves submitting a form to change the information in your business records. Specifically, you should use the Notification of Change of Officer form, ensuring you include any relevant details regarding the Arizona Corporation - Transfer of Stock. You can complete this process online or via mail. For a smoother experience, platforms like US Legal Forms can provide you with templates and guidance throughout the update process.

To file with the Arizona Corporation Commission, you need to submit the appropriate documents, including your Articles of Incorporation or Articles of Organization. Ensure you provide any necessary information regarding the Arizona Corporation - Transfer of Stock, as this may affect your filing. It's essential to use the online portal for efficiency, or you can mail your forms. If you encounter any difficulties, consider using the US Legal Forms platform to access guided resources and templates.

Transferring ownership of stock in a corporation typically involves executing a stock transfer agreement, signing the necessary documents, and updating the corporation's stock ledger. It's crucial to follow the protocols outlined in your corporation's bylaws to ensure legality. If you encounter challenges or need assistance, platforms like uslegalforms can simplify the process, ensuring smooth handling of the Arizona Corporation - Transfer of Stock.