The Arizona Credit Agreement refers to a legally binding contract between a borrower and a lender in the state of Arizona. It outlines the terms and conditions under which credit is extended and the obligations of both parties involved. This agreement sets the framework for the borrower to obtain credit and the terms under which repayment must occur. The Arizona Credit Agreement typically includes crucial information such as the names and contact information of the borrower and lender, the amount of credit being extended, the interest rate charged, the duration of the credit, any fees or charges, and the repayment schedule. These terms may vary depending on the type of credit agreement and the lender's policies. Different types of credit agreements available in Arizona include personal loans, credit cards, mortgages, auto loans, student loans, and business loans. Each type of agreement serves a specific purpose and has its own unique terms and conditions. The terms and interest rates of these agreements may differ based on factors such as the borrower's creditworthiness, the loan amount, and the repayment period. One notable type of Arizona Credit Agreement is the Arizona Revolving Credit Agreement, commonly associated with credit cards. In this agreement, the lender provides the borrower with a maximum credit limit, and the borrower can make purchases on a revolving basis. The borrower is charged interest on the outstanding balance, and a minimum payment is typically required each month. Another type is the Arizona Installment Credit Agreement. This agreement is commonly used for personal loans or auto loans, where the borrower receives a lump sum payment and agrees to repay the loan in equal installments over a specified period. The terms of this agreement generally include interest rates, payment amounts, and the duration of the loan. Businesses in Arizona may also enter into Arizona Credit Agreements for commercial purposes. These agreements may encompass lines of credit, equipment financing, or loans for business expansion. The terms and requirements for these agreements are typically tailored to suit the specific needs of the business and may involve additional documentation or collateral. In summary, the Arizona Credit Agreement is a legally binding contract governing the terms and conditions of credit extended to borrowers in the state of Arizona. It serves as a crucial framework outlining the rights and obligations of both parties involved, ensuring transparency and clarity in credit transactions. The various types of credit agreements available in Arizona cater to individual needs, including personal loans, credit cards, mortgages, auto loans, student loans, and business loans.

Arizona Credit Agreement

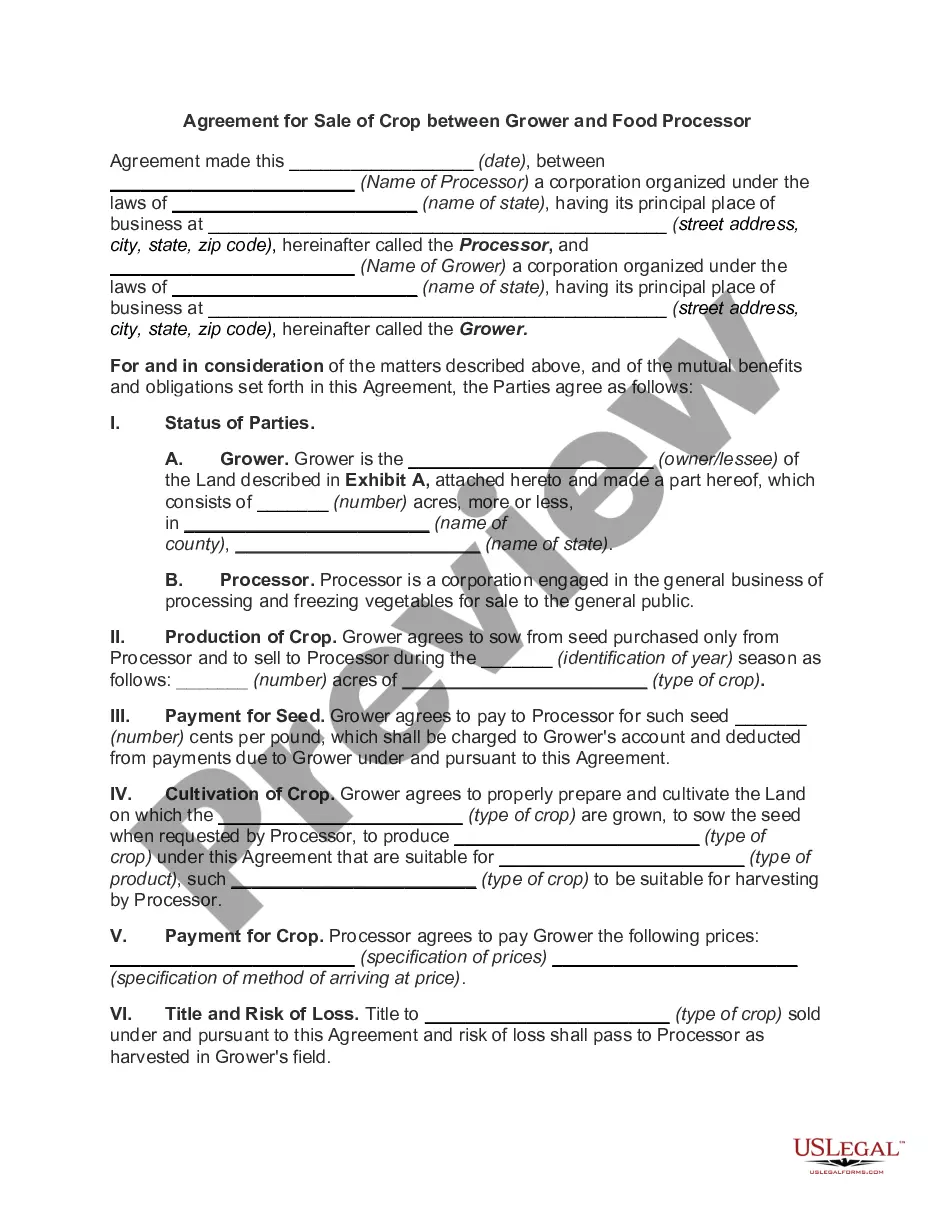

Description

How to fill out Arizona Credit Agreement?

Are you presently within a place where you require files for sometimes enterprise or individual uses just about every working day? There are a lot of legitimate record themes available online, but getting kinds you can rely on isn`t straightforward. US Legal Forms offers thousands of kind themes, just like the Arizona Credit Agreement, which can be published to satisfy federal and state demands.

Should you be previously knowledgeable about US Legal Forms site and get an account, basically log in. Afterward, it is possible to down load the Arizona Credit Agreement web template.

If you do not come with an bank account and want to begin to use US Legal Forms, abide by these steps:

- Get the kind you require and make sure it is for the appropriate town/state.

- Use the Preview option to analyze the form.

- Read the explanation to ensure that you have chosen the right kind.

- In the event the kind isn`t what you`re trying to find, take advantage of the Search field to obtain the kind that fits your needs and demands.

- If you find the appropriate kind, click Acquire now.

- Choose the pricing prepare you desire, fill out the necessary info to generate your bank account, and buy an order with your PayPal or Visa or Mastercard.

- Decide on a handy paper formatting and down load your copy.

Find every one of the record themes you might have bought in the My Forms food selection. You can get a further copy of Arizona Credit Agreement any time, if required. Just select the necessary kind to down load or print out the record web template.

Use US Legal Forms, one of the most comprehensive collection of legitimate varieties, to conserve efforts and steer clear of faults. The service offers expertly manufactured legitimate record themes that you can use for a variety of uses. Make an account on US Legal Forms and commence creating your life a little easier.