Arizona Executive Employee Stock Incentive Plan

Description

How to fill out Executive Employee Stock Incentive Plan?

US Legal Forms - among the finest repositories of legal documents in the United States - offers an extensive selection of legal form templates that you can download or print.

Utilizing the website, you can access thousands of forms for commercial and personal uses, organized by categories, states, or keywords. You can quickly find the latest versions of forms such as the Arizona Executive Employee Stock Incentive Plan.

If you possess a membership, Log In and fetch the Arizona Executive Employee Stock Incentive Plan from the US Legal Forms library. The Download button will be visible on every form you review.

Once you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select your preferred pricing plan and provide your details to register for an account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the saved Arizona Executive Employee Stock Incentive Plan.

Every template you added to your account does not expire and is yours indefinitely. Therefore, if you need to download or print another copy, simply visit the My documents section and click on the form you need.

Access the Arizona Executive Employee Stock Incentive Plan with US Legal Forms, one of the most extensive collections of legal document templates. Use thousands of professional and state-specific templates that meet your business or personal requirements.

- Gain entry to all previously saved forms in the My documents section of your account.

- To begin using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the appropriate form for your city/county.

- Click the Preview button to examine the form's content.

- Review the form description to confirm that you have selected the correct form.

- If the form does not meet your requirements, use the Search field at the top of the page to locate the one that suits you.

Form popularity

FAQ

An incentive stock option plan is an employee benefit that allows employees to buy company stock at a discounted rate, typically as part of their compensation package. These plans are designed to encourage employees to invest in the company and share in its success. Implementing an Arizona Executive Employee Stock Incentive Plan can create a motivated workforce, fostering loyalty and productivity while offering tax advantages to both the employer and employee.

The $100,000 rule refers to the limit on the value of stock options that can qualify for special tax treatment under the Arizona Executive Employee Stock Incentive Plan. Specifically, if the total fair market value of the stock options granted exceeds $100,000, any excess options may not receive the same favorable tax treatment. Understanding this limit can help you better plan your exercises and tax liabilities, ensuring you maximize your benefits.

To qualify for the Arizona Executive Employee Stock Incentive Plan, you typically need to be a full-time employee of the company offering the plan. Many companies require participants to work for them for a certain period, demonstrating commitment and performance. Additionally, certain roles or levels within the organization may be prioritized to ensure key employees benefit from the plan. You can explore your eligibility further by consulting your HR department or reviewing your company’s plan details.

One downside of an ESOP is that it can limit your investment diversification, as a significant portion of your retirement savings may be tied up in company stock. This risk is particularly relevant under the Arizona Executive Employee Stock Incentive Plan, where fluctuations in company performance can impact your financial security. It's important to consider balanced investment strategies and consult with financial advisors to mitigate this risk. You can find resources to help navigate this through uslegalforms.

Incentive Stock Options (ISOs) have some disadvantages, including limitations on eligibility and the potential for alternative minimum tax (AMT) implications. Additionally, under the Arizona Executive Employee Stock Incentive Plan, the stock needs to meet specific holding requirements for favorable tax treatment. If you fail to meet these requirements, you may incur unexpected tax liabilities. It's wise to evaluate these factors carefully before participating.

Yes, you generally need to report any distributions or sales from your ESOP on your tax return. The Arizona Executive Employee Stock Incentive Plan can have specific tax implications based on your situation. Ensure you document all transactions accurately to comply with IRS regulations. Consulting with a tax advisor or using resources from uslegalforms can help you understand your reporting obligations.

Filing an ESOP involves submitting the appropriate documentation related to your employee stock ownership plan. This typically includes details about the stock allocation and any distributions you received under the Arizona Executive Employee Stock Incentive Plan. You can file directly with the company or through an external administrator. For detailed instructions and templates, you may find uslegalforms helpful.

To claim your ESOP, start by reviewing your company's employee stock ownership plan documents. These documents outline the procedure for claiming your shares under the Arizona Executive Employee Stock Incentive Plan. You will usually need to fill out specific forms provided by your employer or the plan administrator. If you need assistance, consider using platforms like uslegalforms to access the necessary forms and guidance.

To qualify for incentive stock options under the Arizona Executive Employee Stock Incentive Plan, employees typically must meet specific criteria set by the company. This may include being a full-time employee or holding a particular role within the organization. Your company’s guidelines will clarify the eligibility requirements needed to participate in the program.

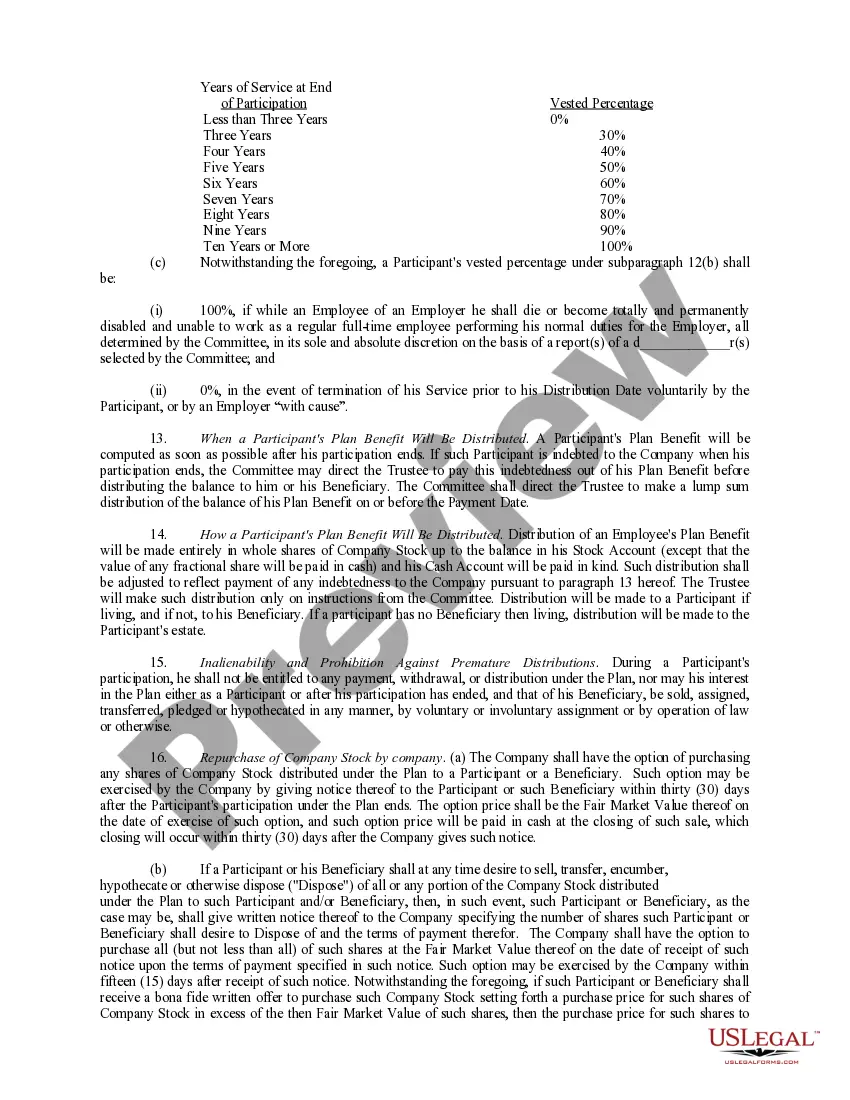

Employees receive ESOP shares as part of the Arizona Executive Employee Stock Incentive Plan by participating in the company’s plan. This process usually involves being granted shares or stock options as a reward for your contributions to the company's success. The shares you receive may become fully vested over time, ensuring your continued investment in the company.