Arizona Revocable Living Trust for Married Couple

Description

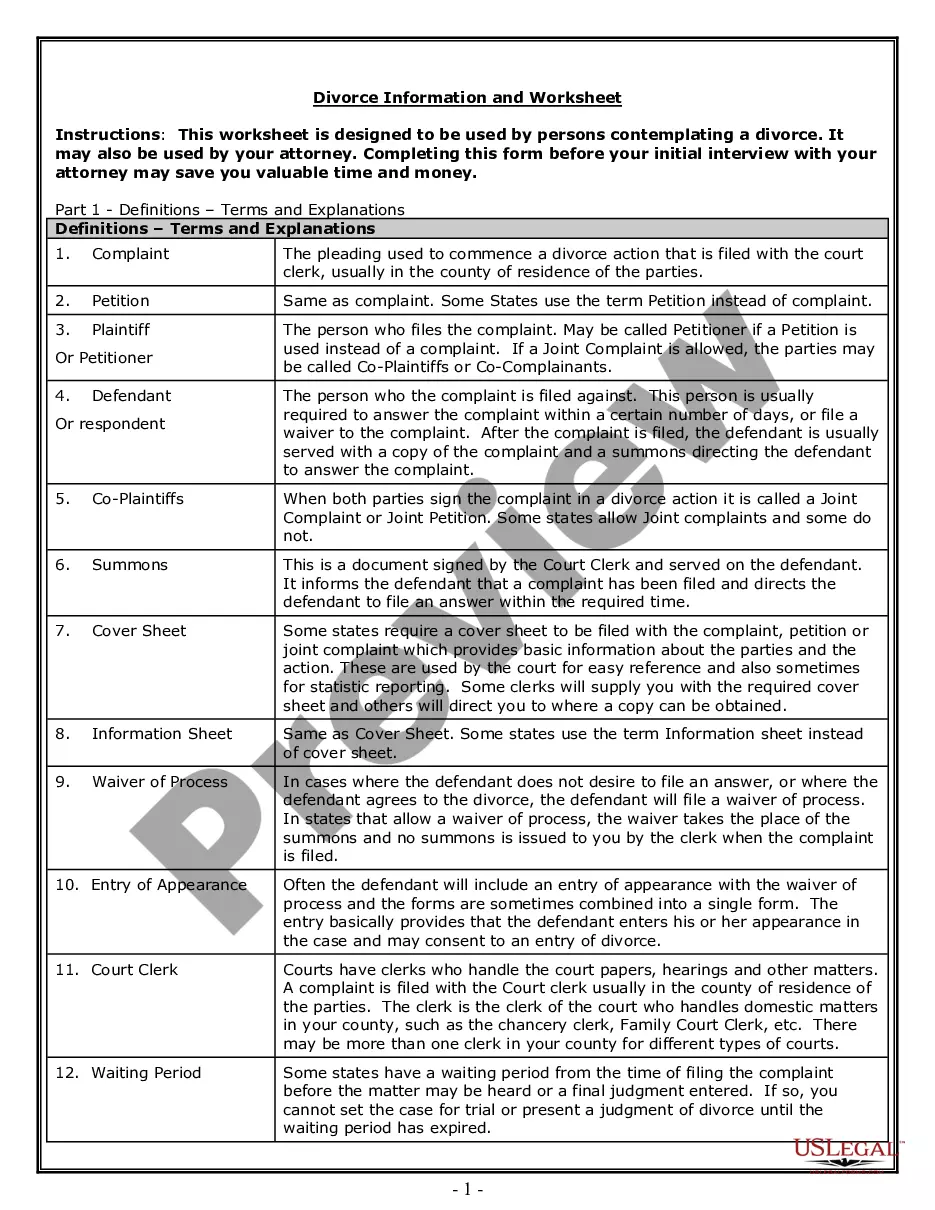

How to fill out Revocable Living Trust For Married Couple?

If you need to finalize, obtain, or print official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly search feature to find the documents you need.

Various templates for business and personal purposes are categorized by type and state or keywords.

Step 4. After locating the form you need, click the Get now button. Choose the pricing plan you prefer and provide your information to create an account.

Step 5. Complete the payment process. You can use your Visa or Mastercard or PayPal account to finalize the transaction.Step 6. Choose the format of your legal document and download it to your device.Step 7. Complete, edit, and print or sign the Arizona Revocable Living Trust for Married Couple.

Every legal document template you obtain is yours permanently. You will have access to every document you downloaded in your account. Click on the My documents section and select a form to print or download again.

Compete and download, and print the Arizona Revocable Living Trust for Married Couple with US Legal Forms. There are millions of professional and state-specific forms available for your personal or business needs.

- Use US Legal Forms to locate the Arizona Revocable Living Trust for Married Couple in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Arizona Revocable Living Trust for Married Couple.

- You can also access forms you previously downloaded from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Always remember to read the description.

- Step 3. If you are not satisfied with the document, utilize the Search bar at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Joint revocable trusts can pose challenges, especially if one spouse passes away or if there is a change in circumstances. These trusts may complicate the distribution of assets, particularly if there are children from previous marriages or different beneficiary wishes. Further, managing a joint trust requires ongoing cooperation and clear communication between spouses. An Arizona Revocable Living Trust for Married Couple can address these concerns by allowing couples to maintain individual trusts that can work in harmony while protecting their unique needs.

Yes, a married couple can establish a joint revocable trust. This option enables both spouses to combine their assets into a single trust, streamlining administration and distribution. An Arizona Revocable Living Trust for Married Couple can facilitate shared decision-making and simplify estate planning. This arrangement often reduces costs and helps ensure that both partners' intentions are honored.

While it is not mandatory for married couples to have separate revocable trusts, it might be beneficial in certain situations. Each spouse can maintain control over their individual assets, ensuring a clear separation of personal property for estate planning. An Arizona Revocable Living Trust for Married Couple allows for tailored strategies to address individual needs. Additionally, this approach can simplify asset distribution while accommodating both partners' wishes.

Marital property in Arizona includes assets acquired during the marriage, regardless of whose name is on the title. This may include real estate, bank accounts, and investments, as well as any assets held in trusts, such as an Arizona Revocable Living Trust for Married Couples. It’s essential to clearly define these assets in your estate planning to avoid disputes in the future.

In Arizona, the characterization of assets in an Arizona Revocable Living Trust for Married Couples can be quite complex. Generally, assets placed in a trust during marriage are considered marital property, but this can depend on how the trust is structured. Understanding these nuances is crucial, as they can impact property division during a divorce.

The best option for a married couple often includes establishing an Arizona Revocable Living Trust for Married Couples. This trust allows both partners to maintain control over their shared assets while providing flexibility for changes in circumstances. It's advisable to consult with an attorney who can help tailor the trust to meet your unique situation and ensure all legal requirements are satisfied.

Arizona has specific laws governing the creation and management of trusts, including an Arizona Revocable Living Trust for Married Couples. A trust must have a clear purpose, identifiable assets, and named beneficiaries. Additionally, the laws require that the trust document be properly executed in accordance with local regulations to ensure its validity.

In the context of an Arizona Revocable Living Trust for Married Couples, the trust assets typically remain under the control of the trust creator during their lifetime. If you and your wife are co-trustees, both of you have equal rights to manage the trust. However, it's important to note that in the event of divorce, your wife's access to the trust may be contingent upon the specific terms laid out in the trust.

In Arizona, you do not need to officially record a living trust. The Arizona Revocable Living Trust for Married Couple becomes valid once drafted and signed. However, if the trust holds real estate, you will need to file a deed to transfer ownership to the trust, ensuring that your property is properly aligned with your estate planning goals.

You can set up a trust without an attorney in Arizona, especially with the help of user-friendly platforms like uslegalforms. However, doing this requires careful attention to detail to meet all legal criteria. Making sure your trust is valid is crucial, so consider your comfort and knowledge of legal terms.