Arizona Loan Assumption Agreement

Description

How to fill out Loan Assumption Agreement?

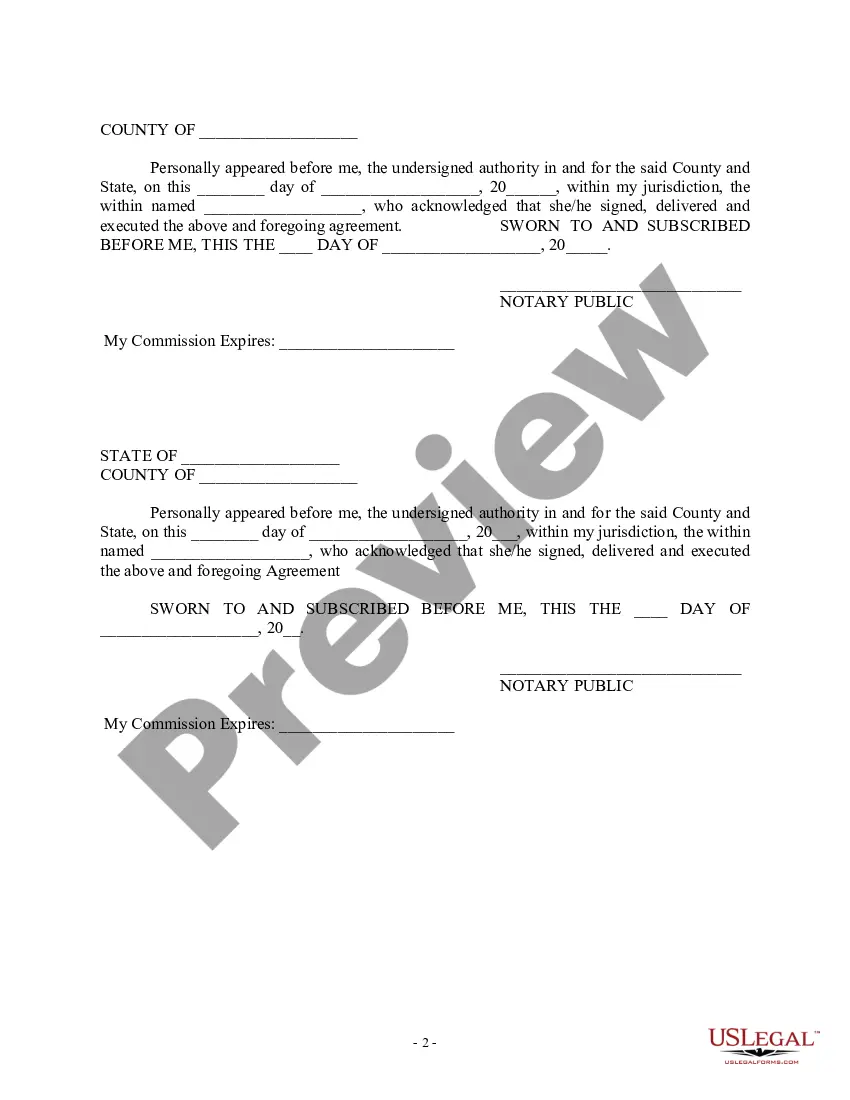

Are you presently in a role that requires paperwork for possible business or specific tasks every day? There are numerous legitimate document templates accessible online, but finding reliable ones can be challenging. US Legal Forms offers thousands of form templates, including the Arizona Loan Assumption Agreement, which is designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Then, you can download the Arizona Loan Assumption Agreement template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Obtain the form you need and ensure it is for the correct state/region. Utilize the Preview option to review the form. Read the description to confirm you have selected the right form. If the form does not meet your requirements, use the Lookup field to find the form that suits your needs and preferences. Once you have the correct form, click Acquire now. Choose the pricing plan you prefer, provide the necessary information to set up your account, and pay for the order using your PayPal or credit card. Select a convenient document format and download your copy.

Avoid altering or deleting any HTML tags. Only replace plain text outside of the HTML tags.

- Access all the document templates you have purchased in the My documents section.

- You can download another copy of the Arizona Loan Assumption Agreement anytime if necessary.

- Simply select the desired form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

- The service provides properly crafted legal document templates that you can use for various purposes.

- Create an account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

A loan assumption agreement is an agreement between a lender, original borrower, and a new borrower, where the new borrower agrees to assume responsibility for the debt owed by original borrower. These agreements are commonly seen in mortgages and real estate.

An assumable mortgage is a type of financing arrangement whereby an outstanding mortgage and its terms are transferred from the current owner to a buyer. By assuming the previous owner's remaining debt, the buyer can avoid obtaining their own mortgage.

Get help from housing counselors and programs The Making Home Affordable (MHA) program offers free counseling if you are struggling to pay your mortgage. Call 1-888-995-HOPE (1-888-995-4673). Find a HUD-approved housing counseling agency in your area for free, local foreclosure prevention services.

Cons On An Assumable Mortgage If you don't have that much cash, you'll have to take a second mortgage at current rate to cover the shortfall. You'll have to assume mortgage insurance payments: Most FHA and all USDA loans will include a monthly mortgage insurance payment in addition to the mortgage payment itself.

Loan assumption presents an alternative way for a seller to sell a property to a buyer. This option could prevent a seller from facing a short sale or pending foreclosure. With an assumption, the buyer takes title to the property and assumes the payments due on the mortgage without having to obtain new financing.

How does the loan assumption process work? Getting approved to assume a loan is similar to getting approved for a new mortgage. You will need to complete an application, provide documents, and meet the lender's credit, income, and financial requirements to get the loan assumption approved.

(Buyers) You're limited to the current lender ? If you'd like to assume a mortgage, you must still apply for the loan and meet all of the lender's requirements. Without the lender's consent, the assumption cannot happen. That restriction limits your choice of a lender.

Your mortgage servicer might offer the following options as an alternative to foreclosure: Forbearance. This option temporarily suspends payments, allowing you time to make up the shortfall. ... Repayment Plan. ... Loan Modification. ... Refinance. ... Partial Claim. ... Forgiving a Payment.