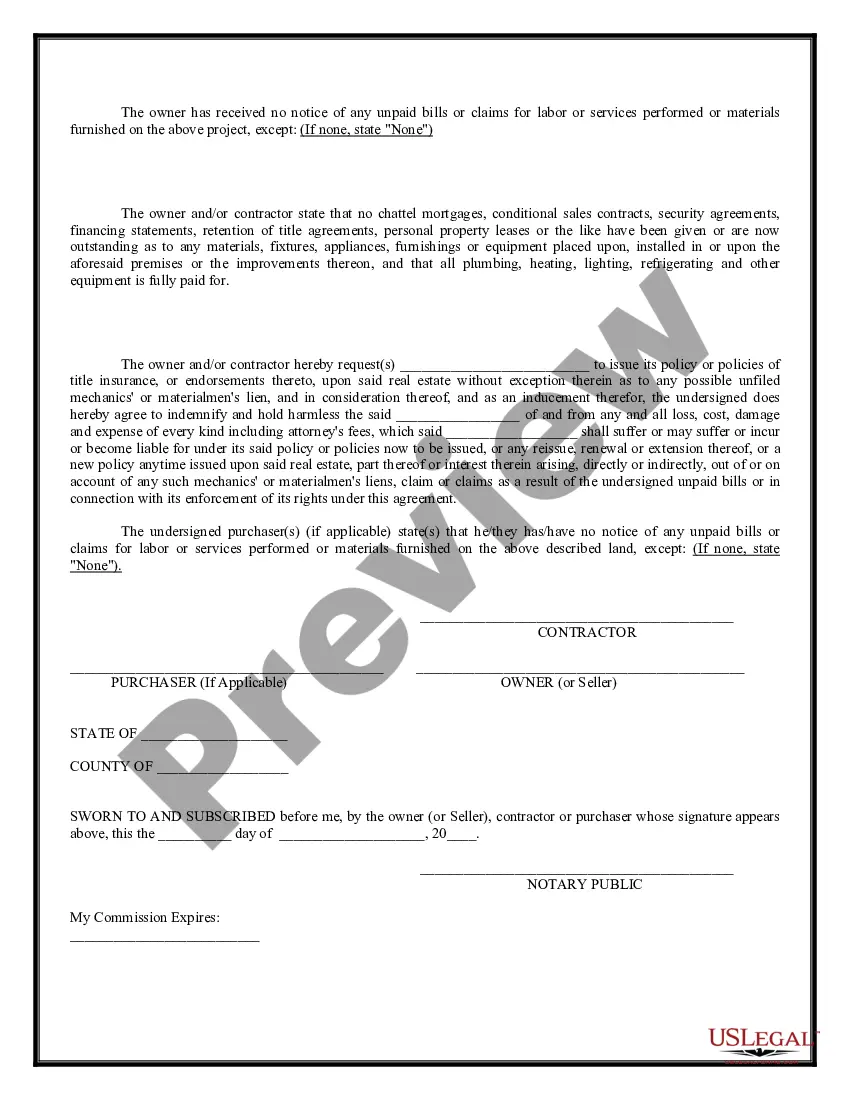

Arizona Owner's and Contractor Affidavit of Completion and Payment to Subcontractors

Description

How to fill out Owner's And Contractor Affidavit Of Completion And Payment To Subcontractors?

You have the ability to devote time online searching for the legal document template that satisfies the state and federal standards you will require.

US Legal Forms offers thousands of legal templates that can be evaluated by experts.

You can easily acquire or create the Arizona Owner's and Contractor Affidavit of Completion and Payment to Subcontractors from the service.

To find another version of your form, utilize the Search field to locate the template that suits your requirements and specifications.

- If you already possess a US Legal Forms account, you can Log In and select the Download option.

- Subsequently, you can fill out, amend, create, or sign the Arizona Owner's and Contractor Affidavit of Completion and Payment to Subcontractors.

- Every legal document template you purchase is yours permanently.

- To acquire an additional copy of any obtained form, navigate to the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, adhere to the straightforward guidelines below.

- First, ensure that you have chosen the correct document template for the county/city that you select.

- Review the form description to make certain you have chosen the correct template.

Form popularity

FAQ

Subcontractors in Arizona generally need to be licensed if the work they perform requires a specific trade license. Licensing ensures that subcontractors meet industry standards for safety and quality. The Arizona Owner's and Contractor Affidavit of Completion and Payment to Subcontractors is a great way to manage the documentation needed for licensed work.

The AZ 5005 form is a notification form used in Arizona for contractors and subcontractors to inform their clients of a project's completion. This form serves to document the working relationship and the payment terms. Including the Arizona Owner's and Contractor Affidavit of Completion and Payment to Subcontractors helps formalize these agreements and improve transparency.

Hiring an unlicensed subcontractor in Arizona is possible, but it is risky. Contractors may face penalties and liability issues if the unlicensed work does not meet legal requirements. It is advisable to use the Arizona Owner's and Contractor Affidavit of Completion and Payment to Subcontractors to ensure all parties are compliant and protect your interests.

Yes, independent contractors in Arizona may need a license depending on their specific trade. If their work involves construction or other specialized services, obtaining the proper license is essential. The Arizona Owner's and Contractor Affidavit of Completion and Payment to Subcontractors can be a useful tool when documenting your work and compliance.

Yes, subcontractors in Arizona typically need a Transaction Privilege Tax (TPT) license. This license allows them to collect and remit sales tax on their services. Utilizing the Arizona Owner's and Contractor Affidavit of Completion and Payment to Subcontractors can simplify documentation and ensure proper tax compliance.

In Arizona, you can perform up to $1,000 worth of work without a contractor license. However, if your project exceeds this amount, you must obtain the appropriate license. Completing the Arizona Owner's and Contractor Affidavit of Completion and Payment to Subcontractors can help streamline your process and ensure compliance.

Yes, contractors must obtain a TPT license in Arizona if they engage in activities that involve selling or providing services related to construction. This license is crucial as it ensures compliance with taxation requirements specific to the construction industry. Using the Arizona Owner's and Contractor Affidavit of Completion and Payment to Subcontractors helps reinforce your legal standing, demonstrating that you follow state regulations and respect the rights of all involved parties.

Yes, in Arizona, subcontractors typically need to be licensed, especially if they perform work valued over a specific monetary threshold. Licensing ensures that subcontractors meet the state's standards for skill and safety. Thus, the Arizona Owner's and Contractor Affidavit of Completion and Payment to Subcontractors becomes more relevant, as it confirms that licensed individuals have handled the work in accordance with regulations.

In Arizona, any business that sells tangible personal property or provides certain services must obtain a Transaction Privilege Tax (TPT) license. This includes contractors who engage in construction services, as they are subject to TPT regulations. Having a TPT license helps ensure compliance with state tax laws, which is crucial for contractors looking to operate legally and responsibly in the state.