Arizona Sale of Business Noncom petitionon Agreement - Asset Purchase Transaction is a legally binding contract that outlines the terms and conditions for the sale of a business and includes provisions related to noncom petition. This agreement is commonly used in Arizona to ensure the smooth transfer of business assets and to protect the buyer's interests. In an Arizona Sale of Business Noncom petitionon Agreement - Asset Purchase Transaction, there are several types or variations that may exist, depending on the specific nature of the transaction. Some common types include: 1. Full Asset Purchase Agreement: This type of agreement encompasses the complete sale and transfer of all business assets, including tangible assets like equipment, inventory, intellectual property, licenses, and goodwill. 2. Partial Asset Purchase Agreement: Unlike a full asset purchase agreement, a partial asset purchase agreement covers the sale and transfer of only specific assets instead of the entire business. This type of agreement allows the buyer to acquire selected assets, such as certain product lines, patents, or customer contracts. 3. Noncom petition Agreement: A noncom petition agreement is an essential component of the overall transaction. It imposes certain restrictions on the seller, preventing them from engaging in similar business activities within a specified geographic area and period after the transaction's completion. In an Arizona Sale of Business Noncom petitionon Agreement - Asset Purchase Transaction, key elements that are typically included are: 1. Identification of Parties: The agreement begins by clearly identifying the buyer, seller, and the business being sold. It also outlines their addresses and contact information for future correspondence. 2. Sale Price and Payment Terms: This section specifies the total purchase price of the business and the agreed-upon payment terms, including any down payment, installment payments, or financing arrangements. 3. Asset Description: It outlines the assets being sold, whether it is the entire business or certain selected assets. This description may include tangible assets, inventory, intellectual property, licenses, and more. 4. Liabilities and Indemnification: The agreement may address the assumption of certain liabilities by the buyer and how any potential claims or disputes will be handled after the transaction. This often includes provisions for indemnification by the seller to protect the buyer from any undisclosed or unknown liabilities. 5. Noncom petition Agreement: This section includes provisions to restrict the seller from competing with the buyer's business within a defined geographic area and for a specific period. It outlines the scope of the noncom petition agreement, exceptions, and potential penalties for violation. 6. Confidentiality and Nondisclosure: The agreement may include provisions to protect sensitive information and trade secrets of the business being sold, ensuring that the seller does not disclose such information to third parties. 7. Governing Law and Dispute Resolution: This section states the jurisdiction's laws that govern the agreement and outlines the process for resolving any disputes or disagreements that may arise between the parties. It is important to note that these elements may vary depending on the specific circumstances and negotiations involved in the Arizona Sale of Business Noncom petitionon Agreement - Asset Purchase Transaction. It is always recommended consulting with legal professionals familiar with the specific laws and regulations in Arizona before finalizing such an agreement.

Arizona Sale of Business - Noncompetition Agreement - Asset Purchase Transaction

Description

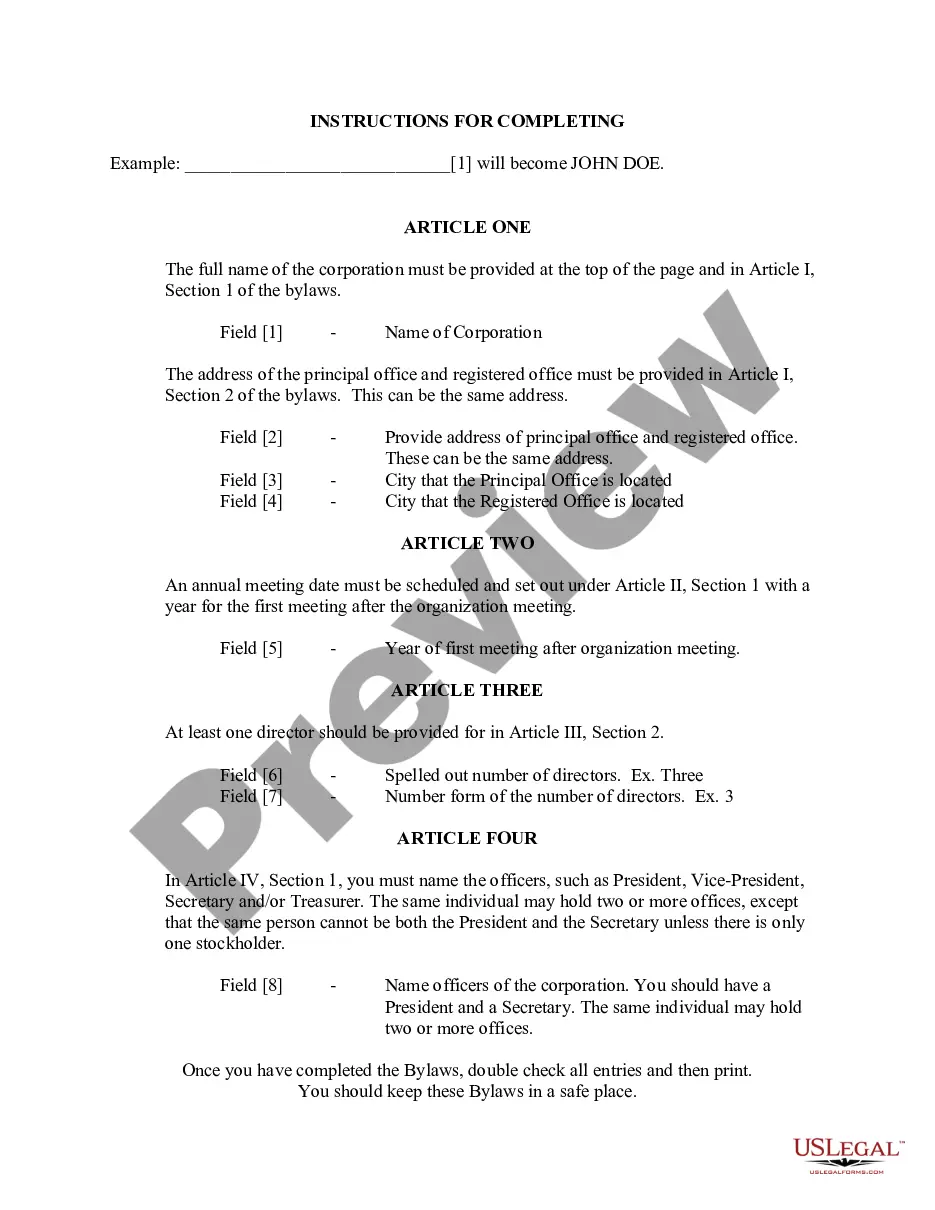

How to fill out Sale Of Business - Noncompetition Agreement - Asset Purchase Transaction?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can download or print.

While navigating the site, you will encounter a vast selection of forms for both business and personal use, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Arizona Sale of Business - Noncompetition Agreement - Asset Purchase Transaction in a matter of minutes.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by selecting the Purchase now button. Next, choose your preferred pricing plan and provide your information to register for an account.

- If you have an existing monthly subscription, Log In to access and download the Arizona Sale of Business - Noncompetition Agreement - Asset Purchase Transaction from the US Legal Forms library.

- The Get button will appear on every form you view.

- You have access to all previously downloaded forms from the My documents section of your account.

- To use US Legal Forms for the first time, here are a few simple steps to help you start.

- Ensure you have selected the correct form for your city/region.

- Click the Preview button to review the form's details.

Form popularity

FAQ

An asset acquisition strategy is when one company buys another company through the process of buying its assets, as opposed to a traditional acquisition strategy, which involves the purchase of stock.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

What Is an Equity Contribution Agreement? An equity contribution agreement occurs between two parties that are agreeing to pool together cash, capital, and other assets into a company to conduct business. The capital is provided in exchange for a portion of the equity in the company venture.

An asset sale is the purchase of individual assets and liabilities, whereas a stock sale is the purchase of the owner's shares of a corporation. While there are many considerations when negotiating the type of transaction, tax implications and potential liabilities are the primary concerns.

Generally, stock purchases are more straightforward than asset purchases. The parties sign the Stock Purchase Agreement and related documents that outline the terms of the deal, and the seller(s) transfer the target company's stock to the purchaser. With this the purchaser assumes all the target company's liabilities.

An asset acquisition is the purchase of a company by buying its assets instead of its stock. An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company's residual assets and earnings (should the company ever be dissolved).

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

Interesting Questions

More info

Tags.