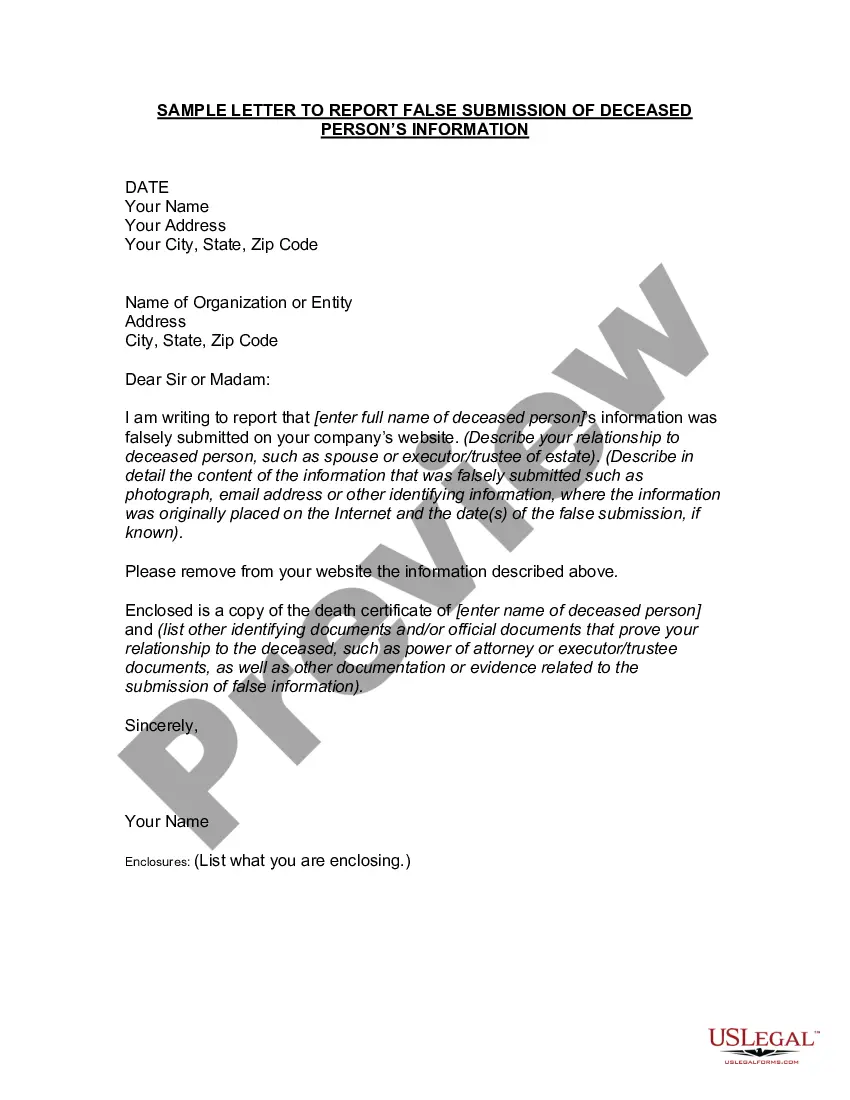

Arizona Letter to Report False Submission of Deceased Person's Information

Description

How to fill out Letter To Report False Submission Of Deceased Person's Information?

If you wish to total, down load, or print lawful document templates, use US Legal Forms, the most important variety of lawful types, which can be found online. Take advantage of the site`s simple and hassle-free look for to discover the files you require. A variety of templates for business and specific reasons are sorted by types and claims, or search phrases. Use US Legal Forms to discover the Arizona Letter to Report False Submission of Deceased Person's Information in just a few clicks.

If you are currently a US Legal Forms buyer, log in in your accounts and then click the Download option to get the Arizona Letter to Report False Submission of Deceased Person's Information. Also you can gain access to types you formerly saved within the My Forms tab of your accounts.

If you work with US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape for your proper town/nation.

- Step 2. Take advantage of the Review choice to look over the form`s content. Do not forget to learn the information.

- Step 3. If you are not satisfied with all the form, use the Research discipline at the top of the screen to get other variations of your lawful form template.

- Step 4. After you have found the shape you require, click the Buy now option. Select the rates plan you choose and put your accreditations to sign up for the accounts.

- Step 5. Method the financial transaction. You can use your credit card or PayPal accounts to complete the financial transaction.

- Step 6. Find the format of your lawful form and down load it on the gadget.

- Step 7. Comprehensive, modify and print or sign the Arizona Letter to Report False Submission of Deceased Person's Information.

Every single lawful document template you get is your own forever. You may have acces to every form you saved within your acccount. Click on the My Forms portion and choose a form to print or down load once again.

Contend and down load, and print the Arizona Letter to Report False Submission of Deceased Person's Information with US Legal Forms. There are millions of specialist and state-distinct types you may use for your business or specific requires.

Form popularity

FAQ

Whether the payment was made in the year of death or after the year of death, the employer also must report the payment to the estate or beneficiary on Form 1099-MISC. The employer should report the payment in box 3, and enter the name and TIN of the payment recipient on Form 1099-MISC.

Form 1099-R is used to report distributions from annuities, profit-sharing plans, retirement plans, IRAs, insurance contracts, or pensions. The form is provided by the plan issuer. Form 1099-R is also used to record death or disability benefits that may be paid out to a beneficiary's estate.

Final wages paid within the same calendar year in which the employee died are not subject to Federal Income Tax Withholdings (FITW), but they are subject to taxes under the Federal Insurance Contributions Act (FICA) and the Federal Unemployment Tax Act (FUTA).

The person who files the return should use the individual income tax form the deceased taxpayer would have used if they were alive. The person who files the return should print the word "deceased" after the decedent's name and enter the date of death after the decedent's name.

If you are preparing the decedent's final return and you have received a Form 1099-INT for the decedent that includes amounts belonging to the decedent and to another recipient (the decedent's estate or another beneficiary), report the total interest shown on Form 1099-INT on Schedule B (Form 1040), Interest and ...

The personal representative of an estate is an executor, administrator, or anyone else in charge of the decedent's property. The personal representative is responsible for filing any final individual income tax return(s) and the estate tax return of the decedent when due.

If you want to be cautious you can put "deceased " on it and send to the IRS with a letter or you can address it later if they contact you over it. If you are on the 1099-C as a joint recipient of the canceled debt, you need to include it on your return.

Typically, you're advised to keep financial statements for three to seven years. This provides an appropriate amount of time necessary to settle a deceased person's estate, address possible legal or financial obligations, resolving disputes, and filing tax returns.