Title: Arizona Lease of Business Premises — Real Estate Rental: Exploring Types and Detailed Description Introduction: The Arizona Lease of Business Premises — Real Estate Rental encompasses legal agreements that outline the terms, conditions, and obligations between a landlord and tenant when leasing commercial properties in Arizona. This comprehensive description aims to provide a thorough overview of what this lease entails, including its different types and relevant keywords associated with it. Detailed Description: 1. Standard Arizona Lease of Business Premises: The standard lease agreement outlines essential aspects, including lease duration, rental payment terms, security deposits, maintenance responsibilities, and any specific provisions related to the leased premises. It maintains the legal framework for leasing commercial spaces in Arizona. 2. Gross Lease: In a gross lease, the tenant pays a fixed monthly rent amount, while the landlord covers all operating expenses, such as property insurance, utilities, property taxes, and maintenance fees. This type of lease simplifies the tenant's financial obligations, providing predictability and ease of budgeting. 3. Net Lease: Under a net lease, the tenant pays a base rent amount, along with additional charges for property-related expenses. These additional expenses can include property insurance, property taxes, maintenance costs, and common area fees. Different variations of net leases include single net leases, double net leases, and triple net leases, shifting varying levels of expenses from the landlord to the tenant. 4. Percentage Lease: Typically used for retail properties, a percentage lease allows the landlord to receive a percentage of the tenant's revenue, in addition to a base rent amount. This arrangement is common in shopping centers, where the landlord benefits directly from the tenant's success. 5. Ground Lease: A ground lease separates the ownership of the land and any structures built upon it. In this type of lease, the tenant leases only the land, while they construct and own any buildings or improvements. Ground leases are often long-term and can last for several decades. 6. Short-Term Lease: Short-term leases provide flexibility for businesses seeking temporary commercial space. These leases can range anywhere from a few days to a few months, accommodating temporary retail operations, pop-up stores, or seasonal businesses. 7. Renewal and Option to Terminate: Many Arizona leases of Business Premises agreements include provisions for lease renewal or an option to terminate. Renewal clauses allow the tenant to extend the lease beyond the initial term, subject to negotiation. Termination clauses outline the conditions for early lease termination, protecting both parties' interests. Keywords: — Arizona commercial leas— - Business premises lease agreement — Real estate rentaArizonanon— - Lease duration and payment terms — Security deposits and maintenance responsibilities — Gross leasArizonanon— - Net lease variations — Percentage lease for retail properties — Ground lease anlandownershiphi— - Short-term lease flexibility — Renewal and termination options in leases Conclusion: The Arizona Lease of Business Premises — Real Estate Rental encompasses various lease types, each catering to specific commercial needs. From gross and net leases to percentage leases, businesses can find the right agreement to suit their requirements. Understanding the details and keywords associated with these lease types ensures a well-informed approach to leasing business premises in Arizona.

Arizona Lease of Business Premises - Real Estate Rental

Description

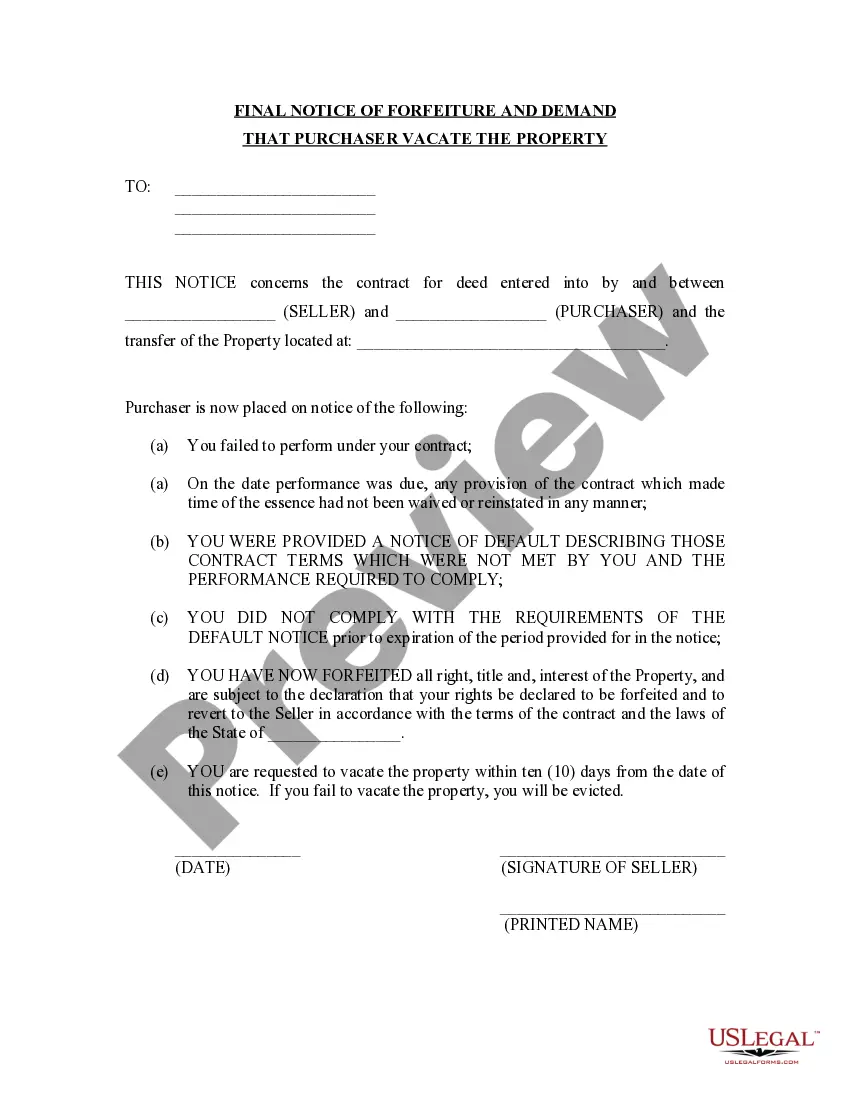

How to fill out Arizona Lease Of Business Premises - Real Estate Rental?

If you want to complete, obtain, or print legal record themes, use US Legal Forms, the biggest variety of legal varieties, which can be found online. Utilize the site`s simple and hassle-free lookup to obtain the paperwork you want. A variety of themes for business and specific functions are sorted by groups and claims, or key phrases. Use US Legal Forms to obtain the Arizona Lease of Business Premises - Real Estate Rental with a couple of click throughs.

In case you are previously a US Legal Forms buyer, log in in your profile and click on the Down load switch to obtain the Arizona Lease of Business Premises - Real Estate Rental. You can even accessibility varieties you formerly downloaded in the My Forms tab of your respective profile.

If you are using US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for your right city/country.

- Step 2. Make use of the Review option to look over the form`s content. Never neglect to read through the description.

- Step 3. In case you are not satisfied using the develop, utilize the Lookup area near the top of the display screen to find other models in the legal develop design.

- Step 4. After you have located the shape you want, click the Purchase now switch. Pick the pricing strategy you like and add your accreditations to register to have an profile.

- Step 5. Procedure the deal. You can use your Мisa or Ьastercard or PayPal profile to perform the deal.

- Step 6. Pick the structure in the legal develop and obtain it on the gadget.

- Step 7. Total, change and print or indicator the Arizona Lease of Business Premises - Real Estate Rental.

Every legal record design you buy is the one you have eternally. You may have acces to every develop you downloaded in your acccount. Go through the My Forms area and select a develop to print or obtain once more.

Remain competitive and obtain, and print the Arizona Lease of Business Premises - Real Estate Rental with US Legal Forms. There are thousands of specialist and status-certain varieties you can utilize for your business or specific requirements.