Arizona Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause

Description

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Limitation Of Liability Clause?

If you require extensive, acquire, or generating sanctioned document formats, utilize US Legal Forms, the largest collection of legal documents available online.

Use the website's straightforward and user-friendly search to find the forms you need.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you want, click the Purchase now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to acquire the Arizona Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to get the Arizona Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

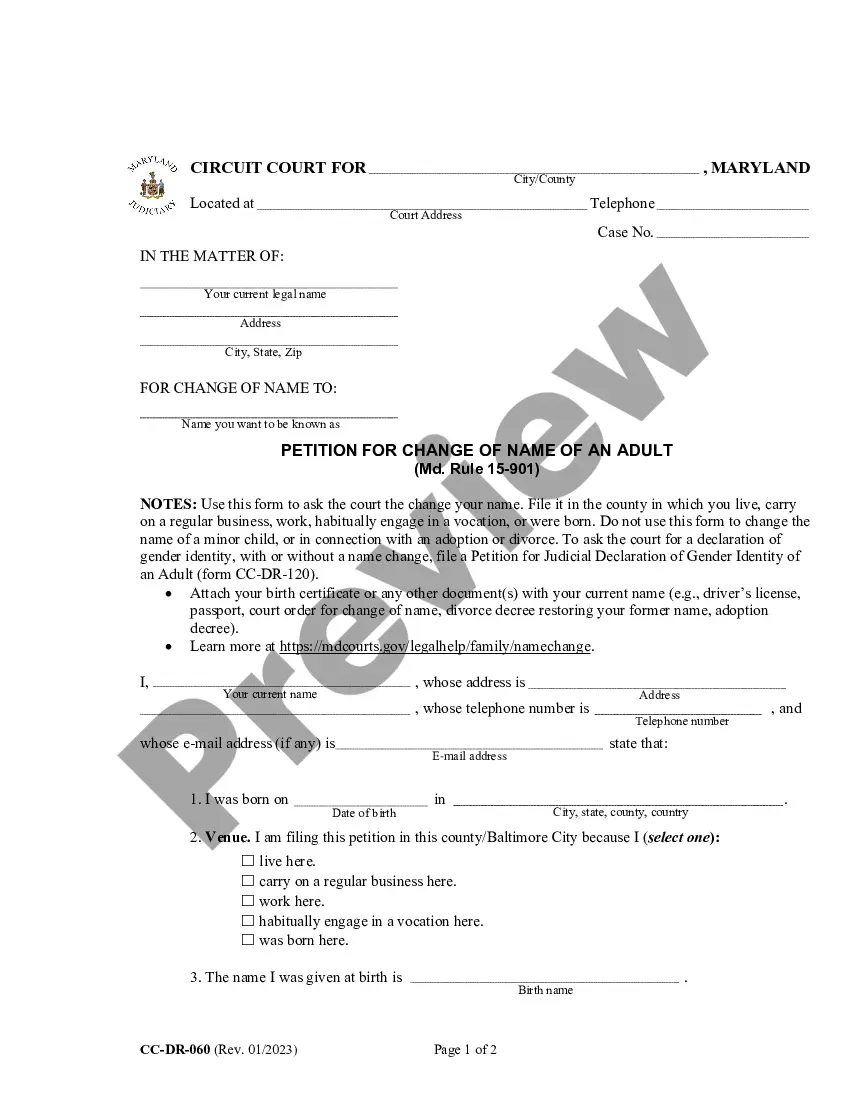

- Step 1. Ensure you have selected the form for the correct region/state.

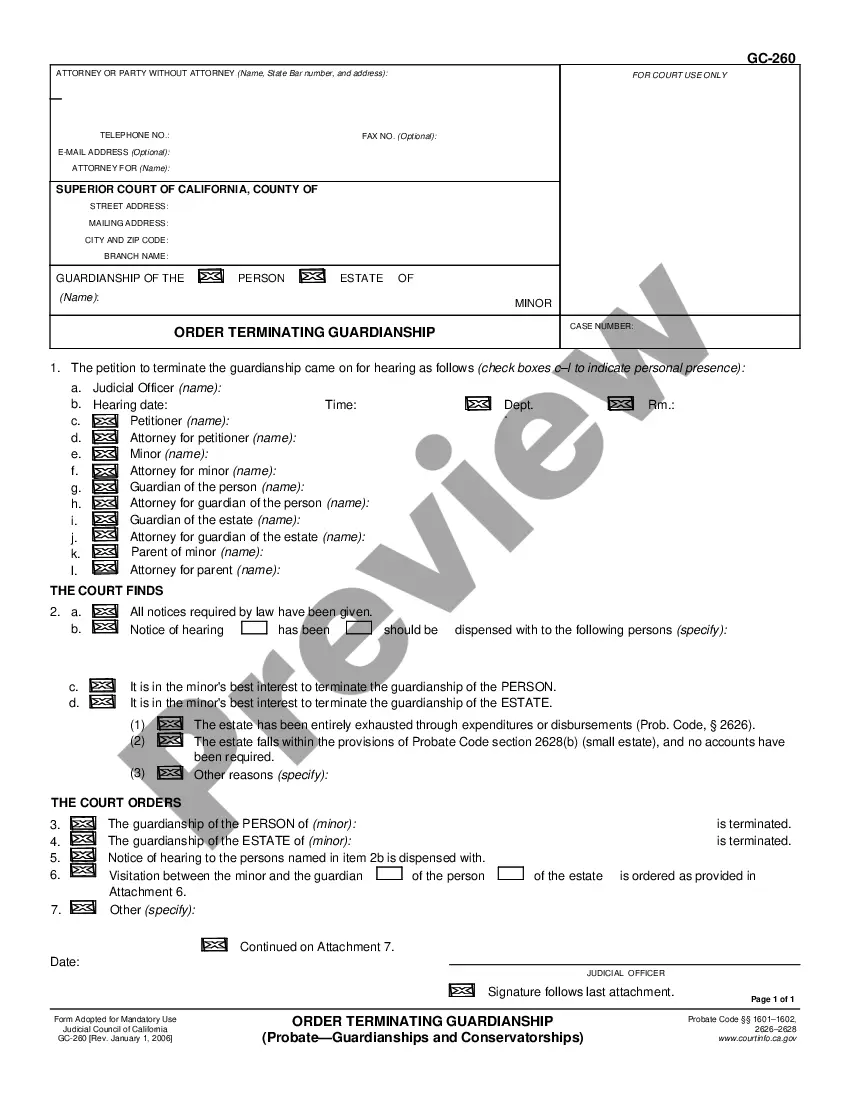

- Step 2. Use the Preview function to review the form's details. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find other versions of the legal document template.

Form popularity

FAQ

Limitations of liability in consulting contracts, such as an Arizona Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, serve to protect both parties from unforeseen legal issues. These limitations typically cap the amount of damages one party can claim against the other, which creates a clearer boundary for liability. This is particularly beneficial for independent contractors, as it helps to minimize financial risks while allowing them to focus on delivering quality services. Utilizing platforms like uslegalforms can help you draft a clear and enforceable contract that outlines these limitations effectively.

Writing a contract for a contractor involves several key steps. Start by defining the parties and specifying the project details, including deliverables, deadlines, and payment arrangements. Always include a limitation of liability clause to safeguard both parties against potential liabilities. For added convenience and professionalism, explore the uslegalforms platform, which offers templates designed for creating an Arizona Contract with Consultant as Self-Employed Independent Contractor.

The best contract for contractors often includes a clear scope of work, payment details, and a limitation of liability clause that protects against unforeseen circumstances. An Arizona Contract with Consultant as Self-Employed Independent Contractor is highly recommended, as it aligns with local legal requirements. This type of contract helps establish a professional relationship and sets expectations upfront, reducing potential conflicts. Consider using the uslegalforms platform to generate reliable contracts tailored for contractors.

To write a simple contract agreement, start by identifying the parties involved and clearly state the purpose of the agreement. Include key details such as project scope, payment terms, and deadlines. You should also add a limitation of liability clause to minimize risk. Utilizing resources like the uslegalforms platform can streamline this process, ensuring you cover all crucial aspects to create an effective Arizona Contract with Consultant as Self-Employed Independent Contractor.

An Arizona Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause outlines the expectations and responsibilities between a company and a contractor. This agreement typically specifies project details, timelines, and payment terms. It also often includes a limitation of liability clause to protect the contractor from undue risk. Understanding this agreement is essential for both parties to maintain clear communication and avoid disputes.

A limitation of liability clause for a consultant is a contractual provision that restricts the amount one party can claim against another in case of a dispute. This clause often protects consultants from excessively large claims that could arise from their work. Including such a clause in your Arizona Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause is essential for safeguarding your interests while delivering your services.

Working as an unlicensed contractor in Arizona is generally not advisable, as it can lead to legal issues and financial penalties. For significant construction projects, a valid contractor’s license is mandatory. To protect your rights and liabilities, consider using the Arizona Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, ensuring all terms are clearly defined.

An independent contractor in Arizona often needs a business license, depending on the nature of the work and local regulations. This requirement safeguards both the contractor and the clients. Moreover, an Arizona Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can aid in defining the scope of work, addressing liability concerns, and establishing a professional relationship.

Yes, you do need a license to work as a contractor in Arizona, especially for projects that exceed a certain monetary threshold. Obtaining a license helps protect consumers and ensure quality workmanship. When drafting an Arizona Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, incorporating licensing details might also reassure your clients about your qualifications.

In Arizona, various business types, including sole proprietorships, partnerships, and corporations, can apply for a contractor license. However, they must demonstrate compliance with state laws and regulations. Having an Arizona Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause ensures clarity in your agreements, which can also be beneficial during the licensing process.