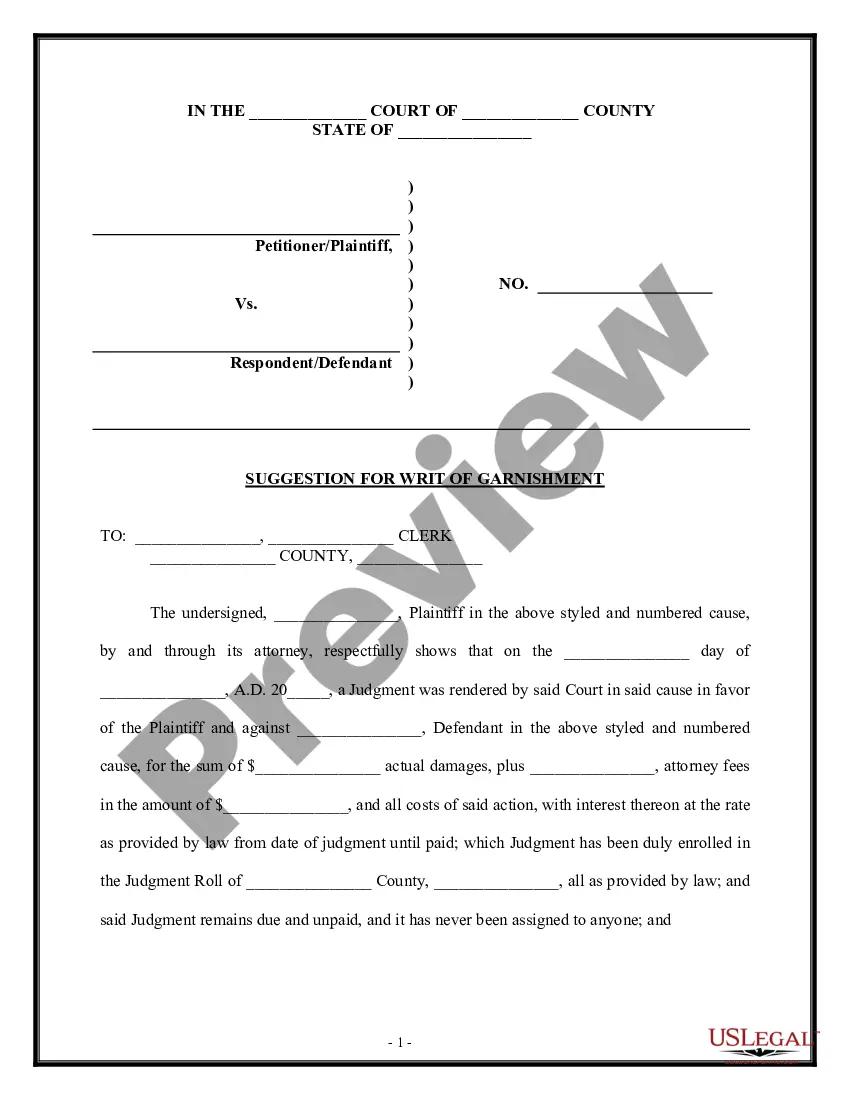

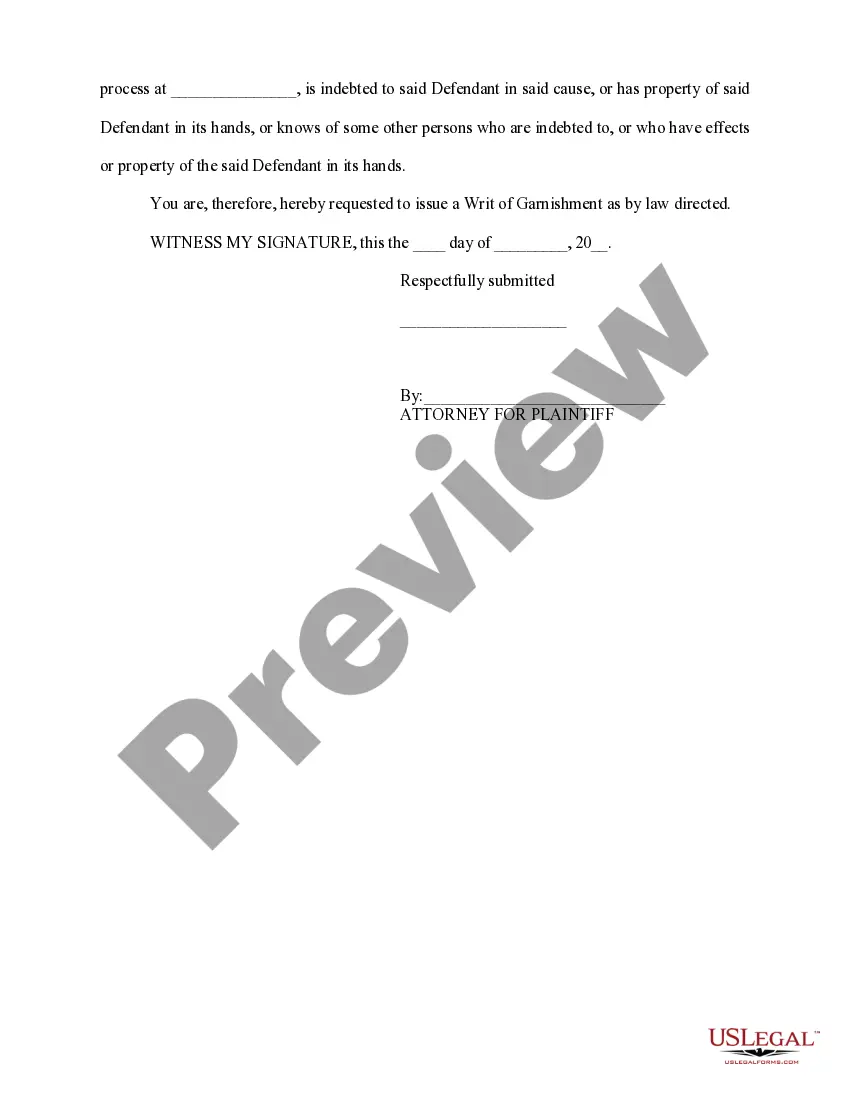

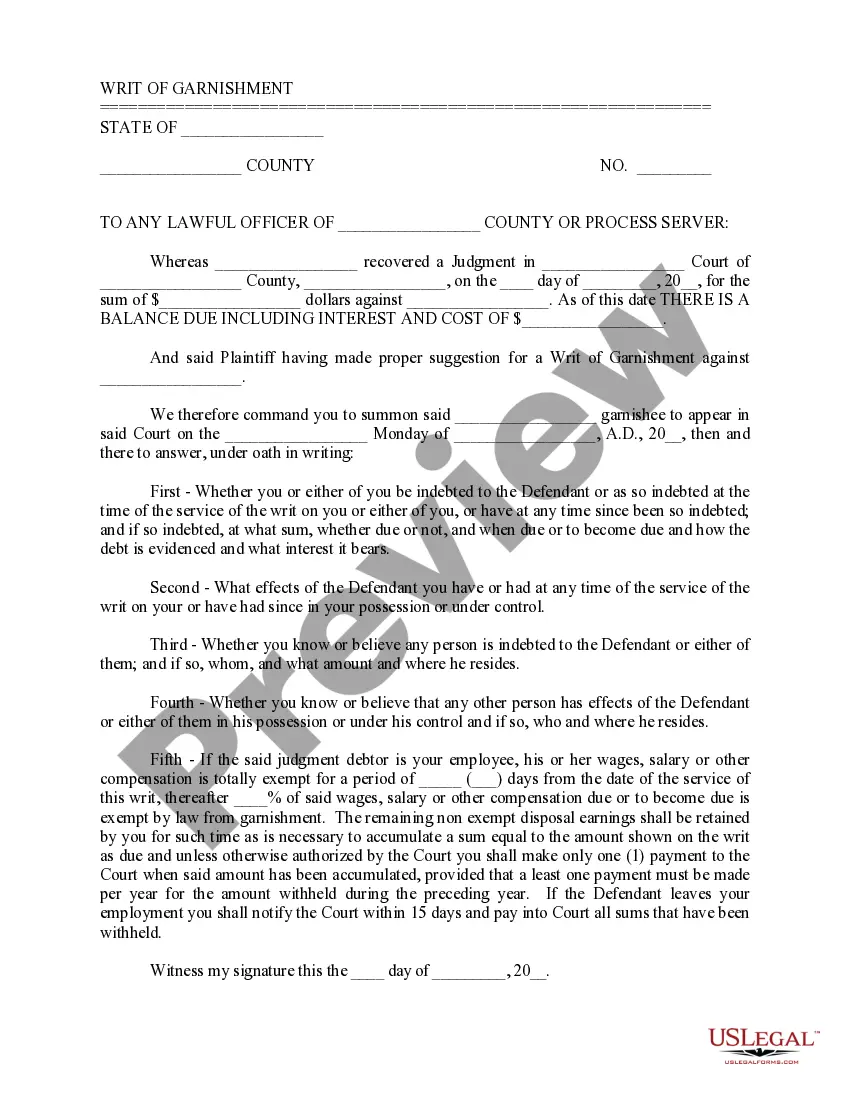

Title: Understanding Arizona's Suggestion for Writ of Garnishment: A Comprehensive Guide Introduction: In Arizona, a Suggestion for Writ of Garnishment is a legal process that allows creditors to collect debts from debtors by involving a third party, typically their employer or a financial institution. This comprehensive guide will provide an in-depth understanding of Arizona's Suggestion for Writ of Garnishment, its purpose, process, and different types. 1. What is Arizona Suggestion for Writ of Garnishment? — Definition: The Suggestion for Writ of Garnishment refers to a legal document filed by a creditor to seek a court order that permits the garnishment of a debtor's wages, bank accounts, or other assets in order to satisfy an outstanding debt. — Purpose: This legal mechanism is employed to enforce judgments and recover owed money by intercepting funds due to the debtor. 2. Process of Filing a Suggestion for Writ of Garnishment in Arizona: — Initiating the Process: The creditor must acquire a court judgment against the debtor for the outstanding debt. — Filing the Suggestion: The creditor files a Suggestion for Writ of Garnishment with the appropriate court, detailing the debtor's information, the amount owed, and the basis for the garnishment request. — Serving the Debtor: Once approved, the garnishment order is served to the debtor, notifying them of the garnishment proceedings and their rights to respond. — Employer or Financial Institution's Role: The creditor directs the garnishment order to the debtor's employer or financial institution, which is obliged to withhold the specified amount from the debtor's wages or bank accounts. 3. Types of Arizona Suggestion for Writ of Garnishment: — Earnings Garnishment: In this type, the creditor targets the debtor's wages or salary, with a percentage allowed to be garnished based on Arizona laws. — Bank Account Garnishment: Here, the debtor's financial institution holds funds on behalf of the debtor, allowing the creditor to intercept and collect the obligated amount directly from the debtor's bank account. — Other Forms of Income Garnishment: This includes garnishing other sources of income such as rent payments, insurance claims, or payments from third parties owed to the debtor. 4. Legal Protections and Exemptions: — Maximum Amounts: Arizona sets limits on the percentage of wages that can be garnished to ensure debtors can maintain a minimum level of income. — Exemptions: Certain types of income, such as Social Security benefits, disability payments, or retirement funds, may be exempt from garnishment. — Financial Hardship: Debtors facing substantial financial hardship may request a reduction in the garnishment amount or even a complete release, which is determined by the court based on their circumstances. Conclusion: With this detailed description of Arizona's Suggestion for Writ of Garnishment, readers can gain a comprehensive understanding of this legal process. It is essential for both creditors and debtors to be familiar with the laws and regulations surrounding garnishment to exercise their rights and obligations in debt collection matters effectively. Seeking professional legal advice is advisable when navigating through the complexities of garnishment proceedings.

Arizona Suggestion for Writ of Garnishment

Description

How to fill out Arizona Suggestion For Writ Of Garnishment?

If you want to complete, obtain, or produce authorized file layouts, use US Legal Forms, the most important selection of authorized varieties, which can be found on-line. Use the site`s simple and handy search to obtain the paperwork you will need. Various layouts for enterprise and personal functions are categorized by types and states, or key phrases. Use US Legal Forms to obtain the Arizona Suggestion for Writ of Garnishment with a handful of click throughs.

When you are already a US Legal Forms customer, log in to your bank account and click on the Acquire switch to find the Arizona Suggestion for Writ of Garnishment. You can even access varieties you in the past delivered electronically within the My Forms tab of your bank account.

If you work with US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the form for your correct town/land.

- Step 2. Take advantage of the Preview choice to check out the form`s content material. Never overlook to read through the description.

- Step 3. When you are unsatisfied together with the form, take advantage of the Research industry at the top of the display screen to find other versions from the authorized form template.

- Step 4. After you have identified the form you will need, click the Acquire now switch. Choose the prices strategy you choose and put your credentials to register for an bank account.

- Step 5. Procedure the financial transaction. You can use your Мisa or Ьastercard or PayPal bank account to finish the financial transaction.

- Step 6. Pick the format from the authorized form and obtain it on your own product.

- Step 7. Full, revise and produce or signal the Arizona Suggestion for Writ of Garnishment.

Every single authorized file template you buy is your own property for a long time. You may have acces to each form you delivered electronically inside your acccount. Click the My Forms portion and select a form to produce or obtain yet again.

Contend and obtain, and produce the Arizona Suggestion for Writ of Garnishment with US Legal Forms. There are thousands of expert and express-particular varieties you can utilize to your enterprise or personal needs.