Arizona Owner Financing Contract for Home

Description

How to fill out Owner Financing Contract For Home?

Locating the appropriate legal template can be a challenge. Of course, there are numerous templates accessible online, but how do you locate the legal document you require.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Arizona Owner Financing Agreement for Home, which you can access for business and personal purposes.

All templates are reviewed by professionals and comply with applicable federal and state regulations.

US Legal Forms is the largest repository of legal documents where you can find various document templates. Utilize this service to download professionally crafted paperwork that adheres to state regulations.

- If you are already a registered user, Log In to your account and click the Download button to retrieve the Arizona Owner Financing Agreement for Home.

- Use your account to view the legal documents you have previously acquired.

- Go to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions that you can follow.

- First, ensure you have selected the correct template for your locality/state.

- You can examine the document using the Review option and inspect the document description to confirm this is the right one for you.

- If the document does not satisfy your requirements, utilize the Search field to find the appropriate template.

- Once you are certain that the document meets your needs, click the Get now button to obtain the document.

- Choose the pricing plan you prefer and enter the required information.

- Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legal document to your device.

- Complete, modify, print, and sign the obtained Arizona Owner Financing Agreement for Home.

Form popularity

FAQ

While owner financing offers benefits, it also comes with potential downsides. Sellers must be prepared to manage the financial risks of holding the mortgage, while buyers may face higher interest rates compared to traditional loans. Additionally, without proper documentation, disputes can arise over payment terms or property condition. Utilizing a service like uslegalforms can help both sellers and buyers create a strong, clear contract to navigate these challenges.

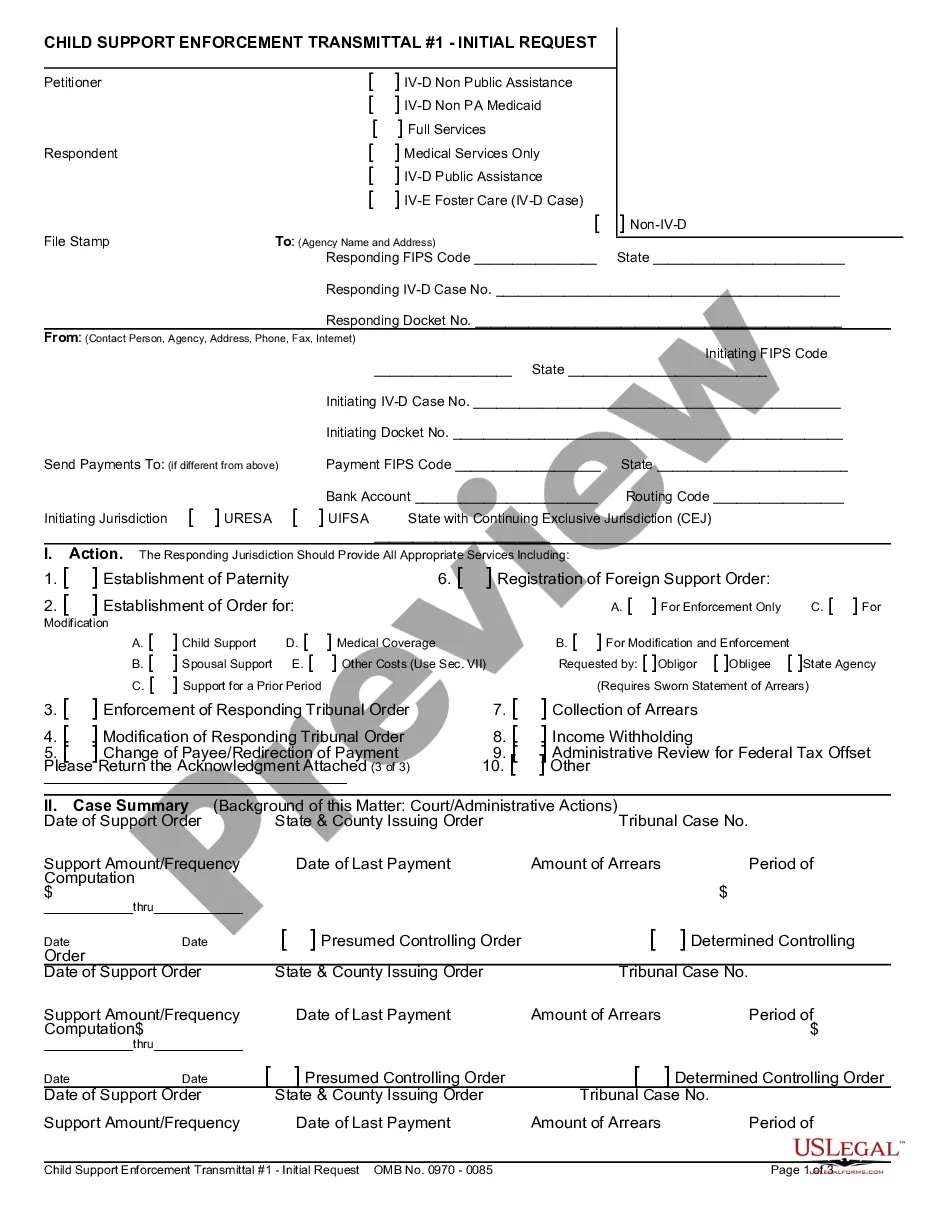

If a buyer defaults under an Arizona Owner Financing Contract for Home, the seller may have specific rights outlined in the contract to recover their investment. Typically, this means the seller can reclaim the property, but the process varies depending on state laws and the terms set in the agreement. Clear communication about default consequences should be part of the financing terms, helping both parties understand their risks. Platforms like uslegalforms can help you draft an effective contract to address these scenarios.

In most cases of owner financing in Arizona, the seller acts as the lender and retains the deed. Unlike traditional financing, where a bank holds the deed, in an Arizona Owner Financing Contract for Home, the seller's retention of the deed secures their investment. This direct relationship can simplify the process and make it easier for buyers who may have trouble securing traditional financing. Both parties should understand the implications this may have on their agreement.

When you engage in owner financing, you need to report the income from the interest on your taxes. The IRS requires you to document this as part of your taxable income. Using an Arizona Owner Financing Contract for Home helps to formally establish the terms, making it easier to keep accurate records for tax purposes.

Typically, the seller sets up the Arizona Owner Financing Contract for Home, as they determine the terms of the financing. However, buyers may negotiate terms with the seller to better suit their financial situation. Both parties should seek legal guidance to ensure the contract meets all legal requirements and protects their interests.

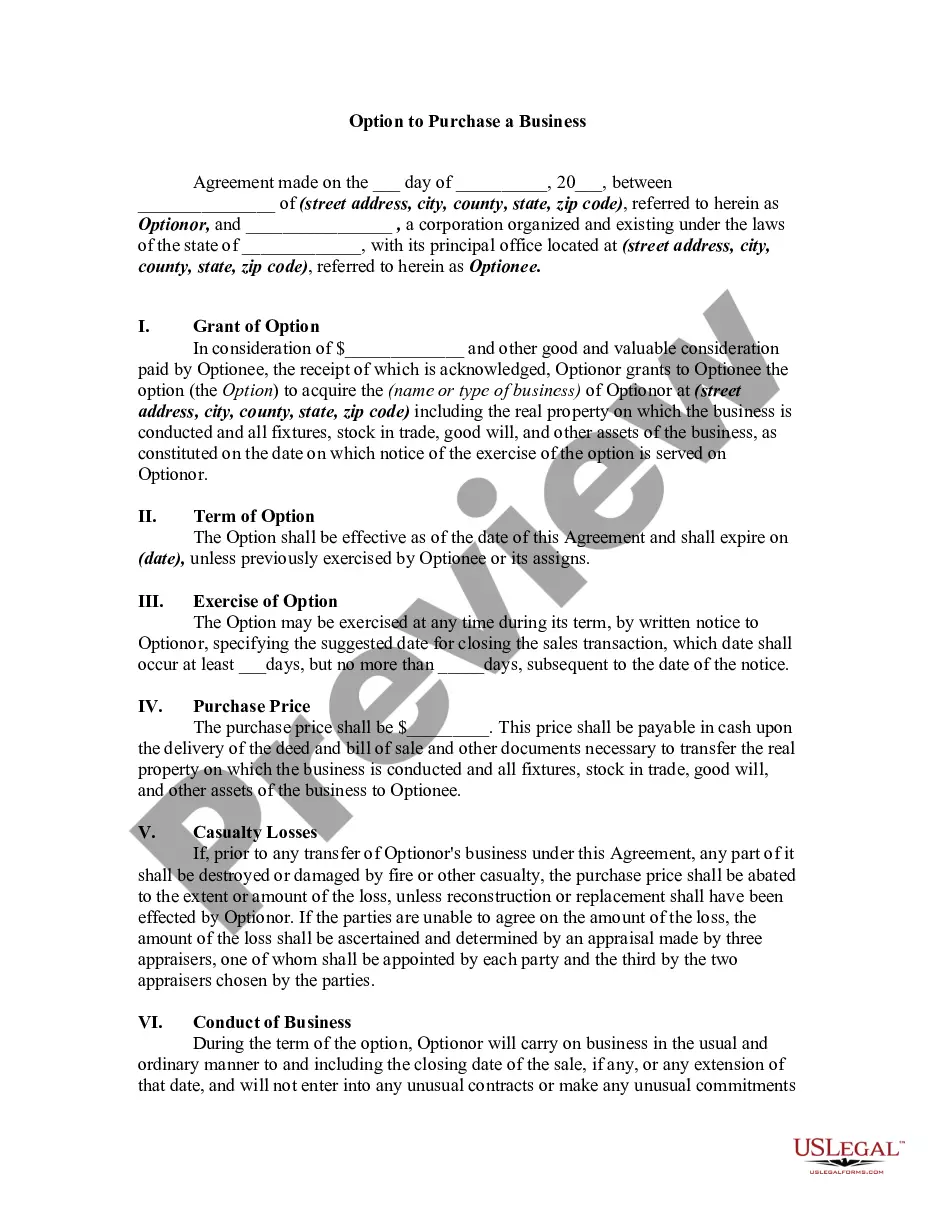

To write an owner finance contract, begin with key details like the buyer and seller’s names, property description, and financing terms. Clearly outline payment schedules, interest rates, and any specific conditions that apply. Using a legal form template can simplify this process, ensuring that all necessary components are included for a valid Arizona Owner Financing Contract for Home.

An example of owner financing could involve a seller listing their home for $300,000 with a $30,000 down payment. The buyer agrees to make monthly payments for the remaining balance, often at a specified interest rate. This arrangement can benefit both parties by providing flexibility and potentially quicker transactions compared to traditional bank financing.

To write an effective finance contract, begin by detailing the parties involved, property description, and the amount to be financed. Make sure to include terms like interest rates, payment schedule, and any penalties for late payments. Utilizing a reliable platform like US Legal Forms can help ensure that your Arizona Owner Financing Contract for Home adheres to legal standards.

An owner financing document outlines the terms between the seller and buyer when the seller provides financing options for purchasing a home. This contract specifies the interest rates, repayment schedule, and any contingencies linked to the sale. Utilizing an Arizona Owner Financing Contract for Home can streamline the buying process and allow buyers who may not qualify for traditional mortgages to secure home ownership. It is essential to understand all aspects of this document to protect both parties' interests.