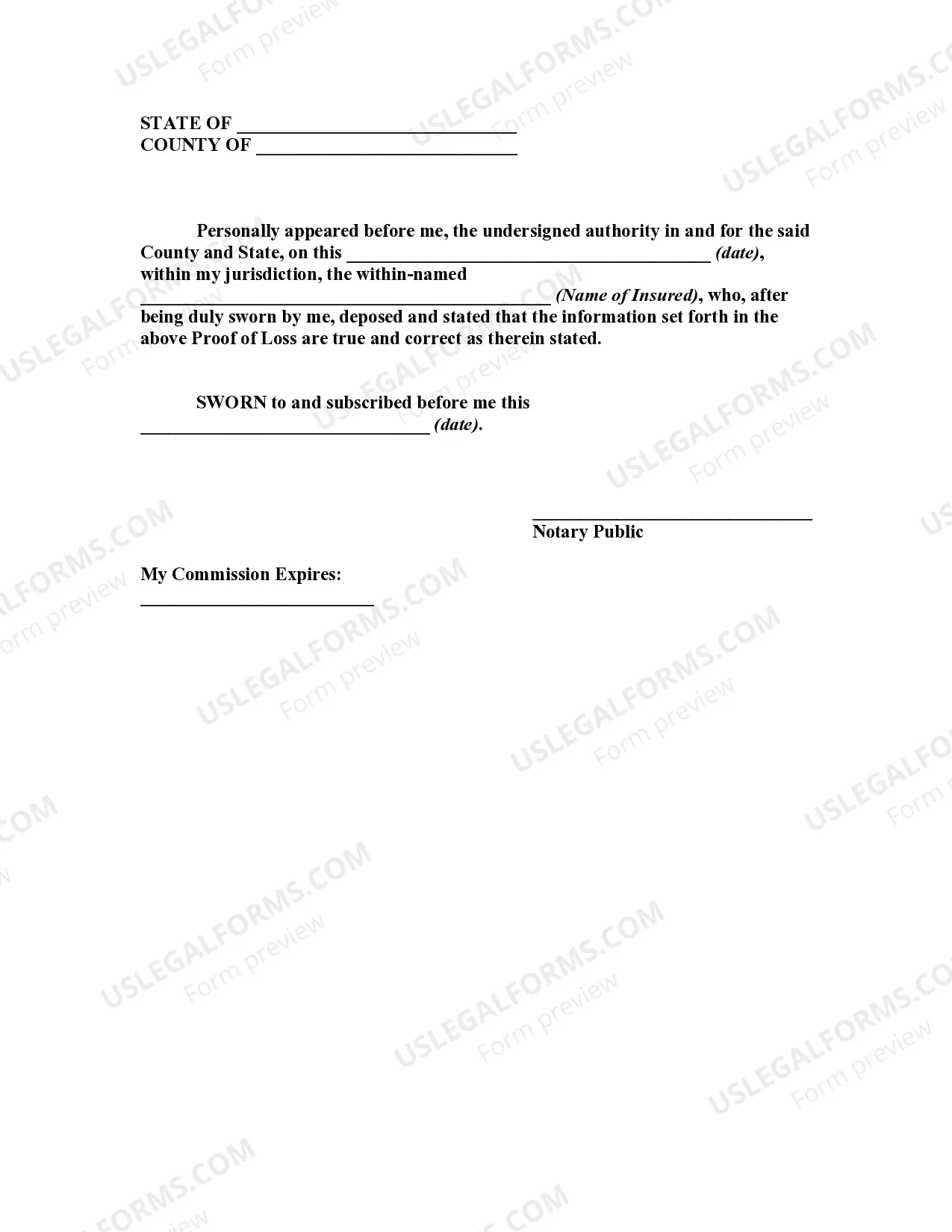

A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

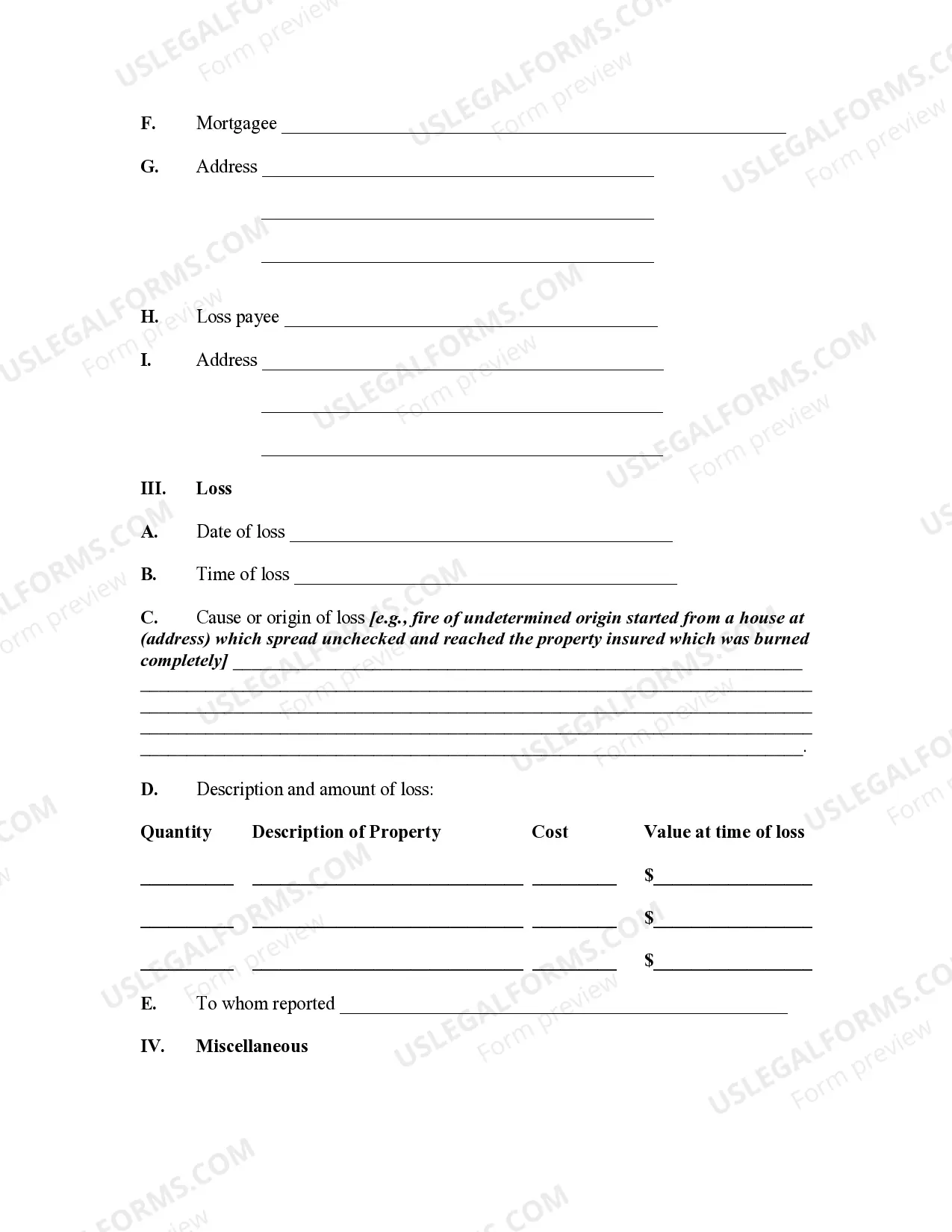

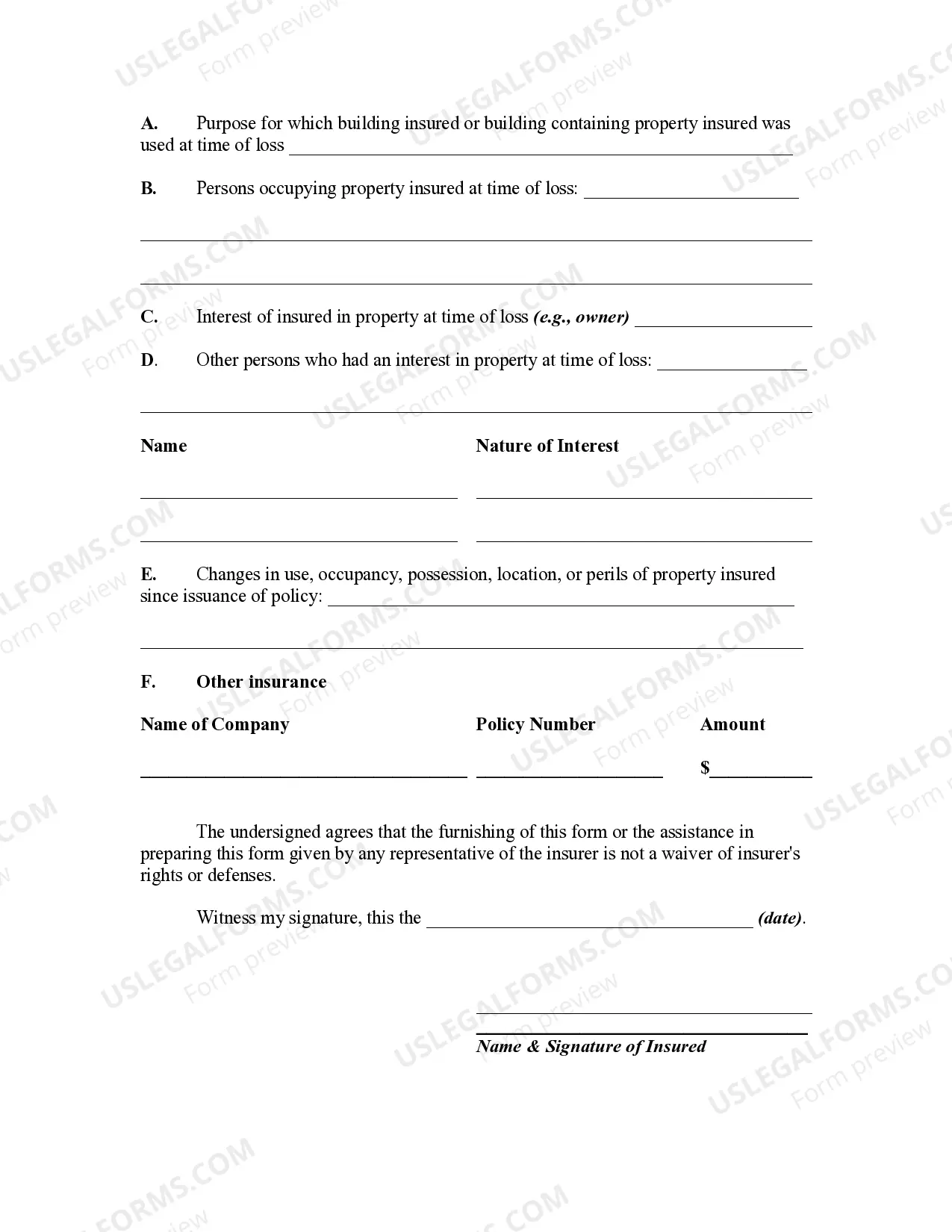

Description: Arizona Proof of Loss for Fire Insurance Claim is a crucial document that plays a significant role in the insurance claim process. It serves as evidence of the damages incurred due to a fire incident and enables policyholders to request compensation from their insurance company. This document contains essential details, including the type and extent of damage, estimated repair costs, and any other relevant information necessary to authenticate the claim. When filing a fire insurance claim in Arizona, policyholders must ensure that the Proof of Loss is accurately completed and submitted within the specified time frame, as outlined in their insurance policy. This document acts as a formal declaration of the damages suffered, providing a transparent record for both the policyholder and the insurance company. The Arizona Proof of Loss for Fire Insurance Claim requires policyholders to provide comprehensive information pertaining to the fire incident. This may include the date and time of the fire, its cause, location, and a detailed description of the damaged property or possessions. The document should also specify the estimated cost of repairs or replacement, taking into account any depreciation or exclusions mentioned in the policy. Policyholders should be aware that there might be variations of the Arizona Proof of Loss for Fire Insurance Claim, depending on the insurance company and the specific policy. Therefore, it is essential to review the insurance policy thoroughly to understand the specific requirements and guidelines for submitting the Proof of Loss. Some common types of Arizona Proof of Loss for Fire Insurance Claim may include: 1. Standard Arizona Proof of Loss: This is the most commonly used document for reporting fire damage to the insurance company. It incorporates all the necessary information required for the claim process. 2. Detailed Property Inventory Proof of Loss: In addition to the standard information, this type of Proof of Loss demands a detailed inventory of all damaged or destroyed items, including their estimated value and age. 3. Business Interruption Proof of Loss: This particular document is necessary for businesses affected by a fire, as it includes information on the financial losses and expenses incurred due to the interruption caused by the fire incident. Submitting an accurate and complete Proof of Loss is crucial for a successful fire insurance claim in Arizona. It is highly recommended consulting with the insurance company or a professional insurance adjuster to ensure all the necessary information is included and submitted within the designated timeframe.