Under the Equal Credit Opportunity Act, a creditor may design its own application forms, use forms prepared by another person, or use the appropriate model application forms contained in 12 C.F.R. Part 202, Appendix B. If a creditor chooses to use an Appendix B form, it may change the form by: (1) asking for additional information not prohibited by 12 C.F.R. § 202.5; (2) by deleting any information request; or (3) by rearranging the format without modifying the substance of the inquiries; provided that in each of these three instances the appropriate notices regarding the optional nature of courtesy titles, the option to disclose alimony, child support, or separate maintenance, and the limitation concerning marital status inquiries are included in the appropriate places if the items to which they relate appear on the creditor's form.

Arizona Application for Open End Unsecured Credit - Signature Loan

Description

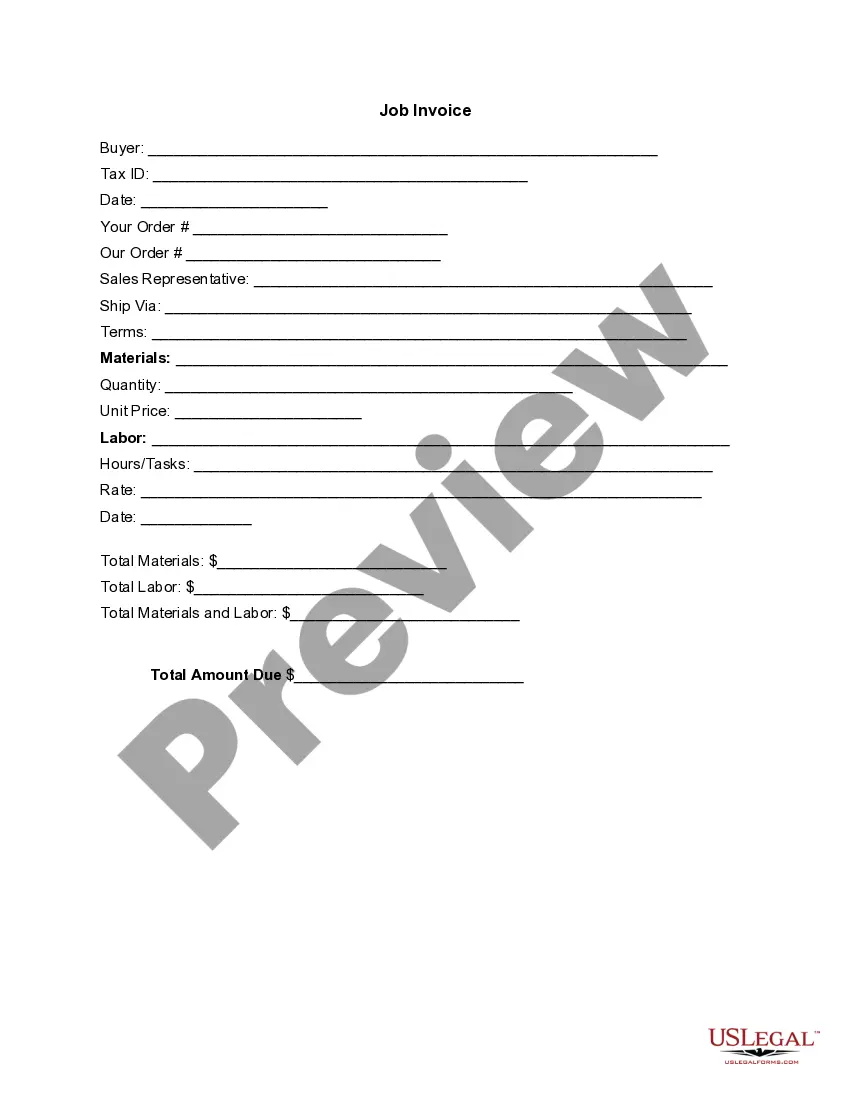

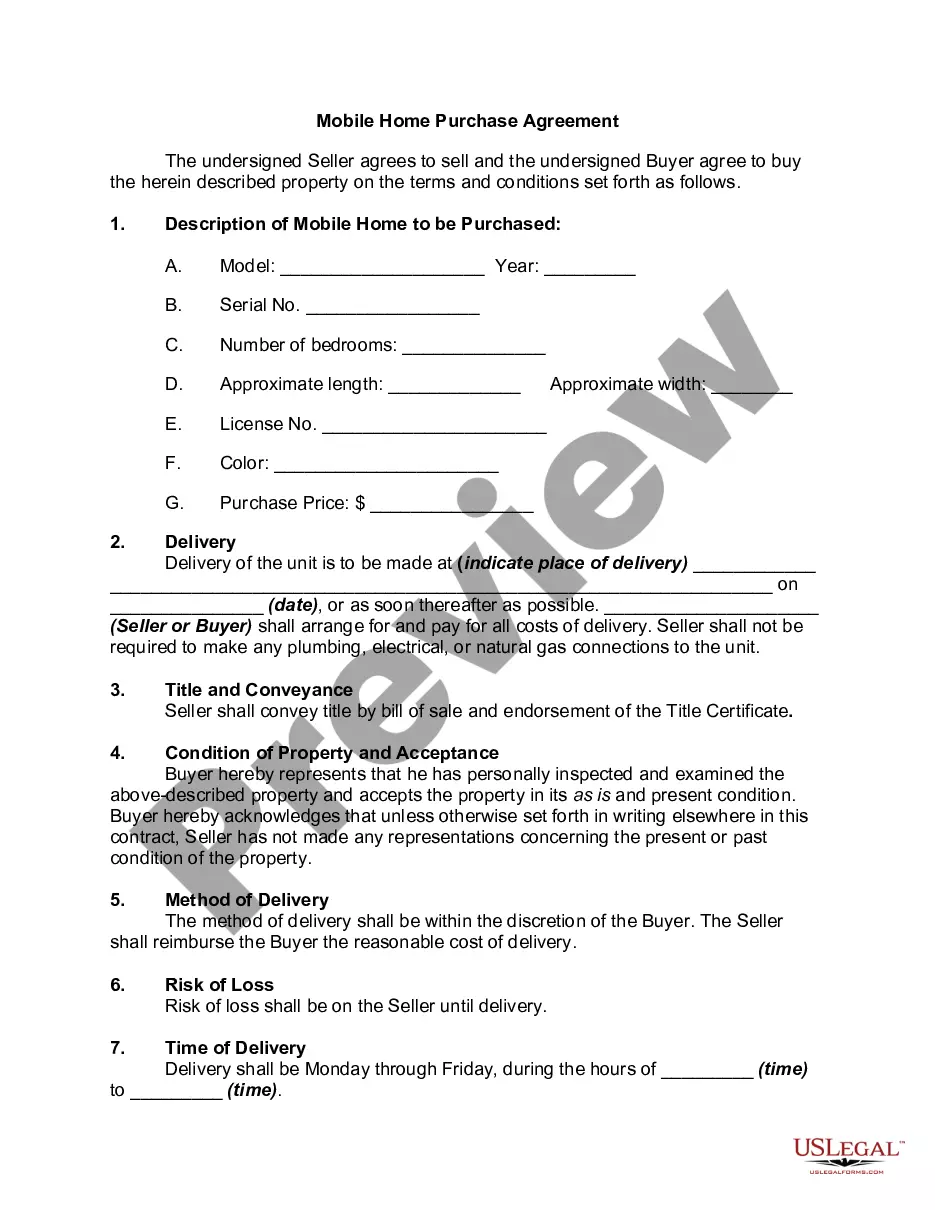

How to fill out Application For Open End Unsecured Credit - Signature Loan?

If you need to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site's simple and user-friendly search to find the documents you require. Various templates for businesses and particular purposes are categorized by types and states, or by keywords.

Use US Legal Forms to acquire the Arizona Application for Open End Unsecured Credit - Signature Loan with just a few clicks.

Each legal document format you purchase is yours permanently. You have access to every form you acquired within your account. Click on the My documents section and select a form to print or download again.

Complete and obtain, and print the Arizona Application for Open End Unsecured Credit - Signature Loan with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Arizona Application for Open End Unsecured Credit - Signature Loan.

- You can also access forms you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for your appropriate city/state.

- Step 2. Use the Preview feature to review the form’s details. Don’t forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal document.

- Step 4. Once you have found the form you need, click the Buy now button. Select the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Retrieve the format of your legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Arizona Application for Open End Unsecured Credit - Signature Loan.

Form popularity

FAQ

A signature loan, which does not require collateral, is simply an unsecured personal loan.

Because unsecured loans are riskier for lenders, they have stricter eligibility requirements than secured loans. Size of the loan: Smaller loans may be easier to qualify for because you'll likely have a smaller monthly payment that may be manageable with your income and expenses.

Many give preference to borrowers with good or excellent credit scores (690 and above), but some lenders accept borrowers with bad credit (a score below 630). The typical minimum credit score to qualify for a personal loan is 560 to 660, ing to lenders surveyed by NerdWallet.

Eligibility: To qualify, applicants must have a minimum personal credit score of 660. Their businesses must also have been in operation for at least one year. Generally, TD Bank is more difficult to qualify for compared to nonbank online lenders on this list.

An unsecured loan is a loan that doesn't require collateral, like a house or car, for approval. Instead, lenders issue this type of personal loan based on information about you, like your credit history, income and outstanding debts.

Open-end credit is a loan from a bank or other financial institution that the borrower can draw on repeatedly, up to a certain pre-approved amount, and that has no fixed end date for full repayment. Open-end credit is also referred to as revolving credit.

Loan Requirements Two valid picture National Identification* (Valid Passport or National Identification Card) Job Letter ? Not older than 3-months old. Payslip ? Most Recent. Proof of Address ? Bank Statement, Credit Card Statement, Utility Bill, Rental Agreement etc.

Key Takeaways. An unsecured loan is supported only by the borrower's creditworthiness, rather than by any collateral, such as property or other assets. Unsecured loans are riskier than secured loans for lenders, so they require higher credit scores for approval.