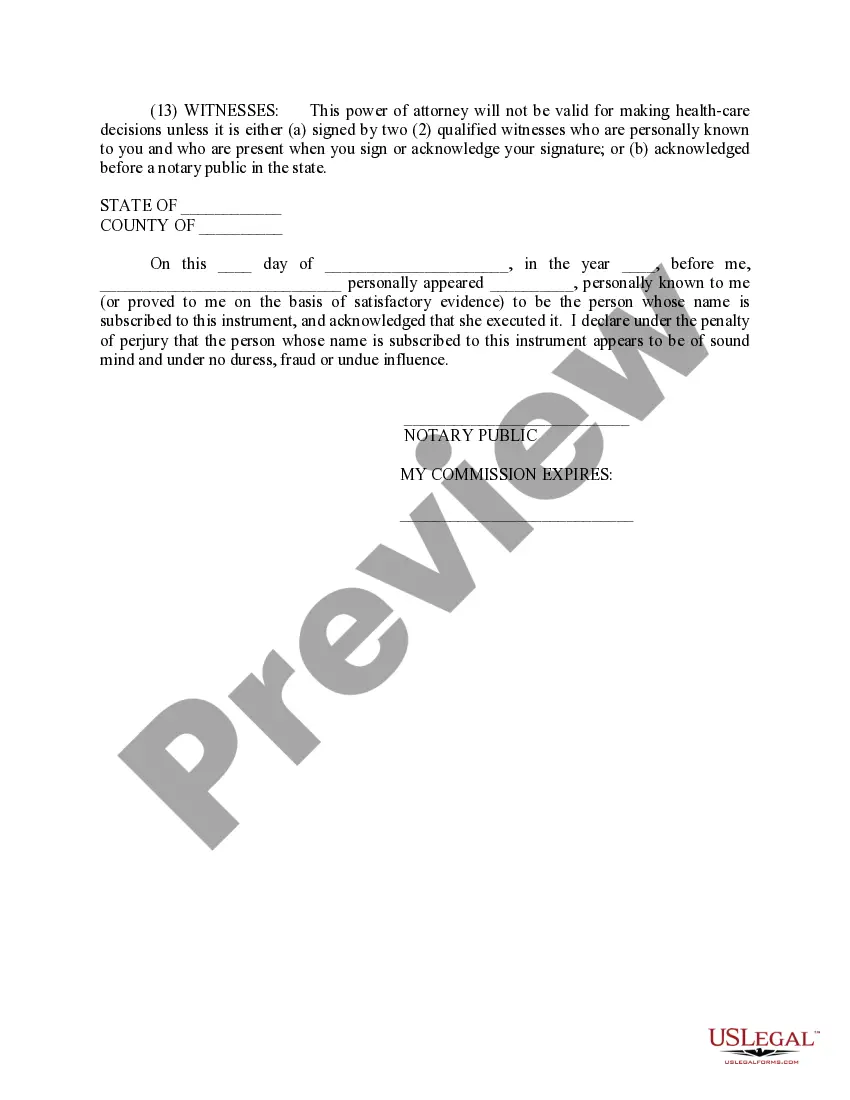

Arizona Uniform Healthcare Act Form

Description

How to fill out Uniform Healthcare Act Form?

You may commit time on the Internet trying to find the legitimate papers template that meets the state and federal specifications you require. US Legal Forms gives a large number of legitimate kinds that happen to be evaluated by pros. You can actually download or printing the Arizona Uniform Healthcare Act Form from my service.

If you already have a US Legal Forms account, you are able to log in and click the Download key. Following that, you are able to total, edit, printing, or indicator the Arizona Uniform Healthcare Act Form. Each legitimate papers template you buy is your own eternally. To get an additional backup associated with a purchased develop, check out the My Forms tab and click the related key.

If you work with the US Legal Forms internet site for the first time, follow the basic instructions beneath:

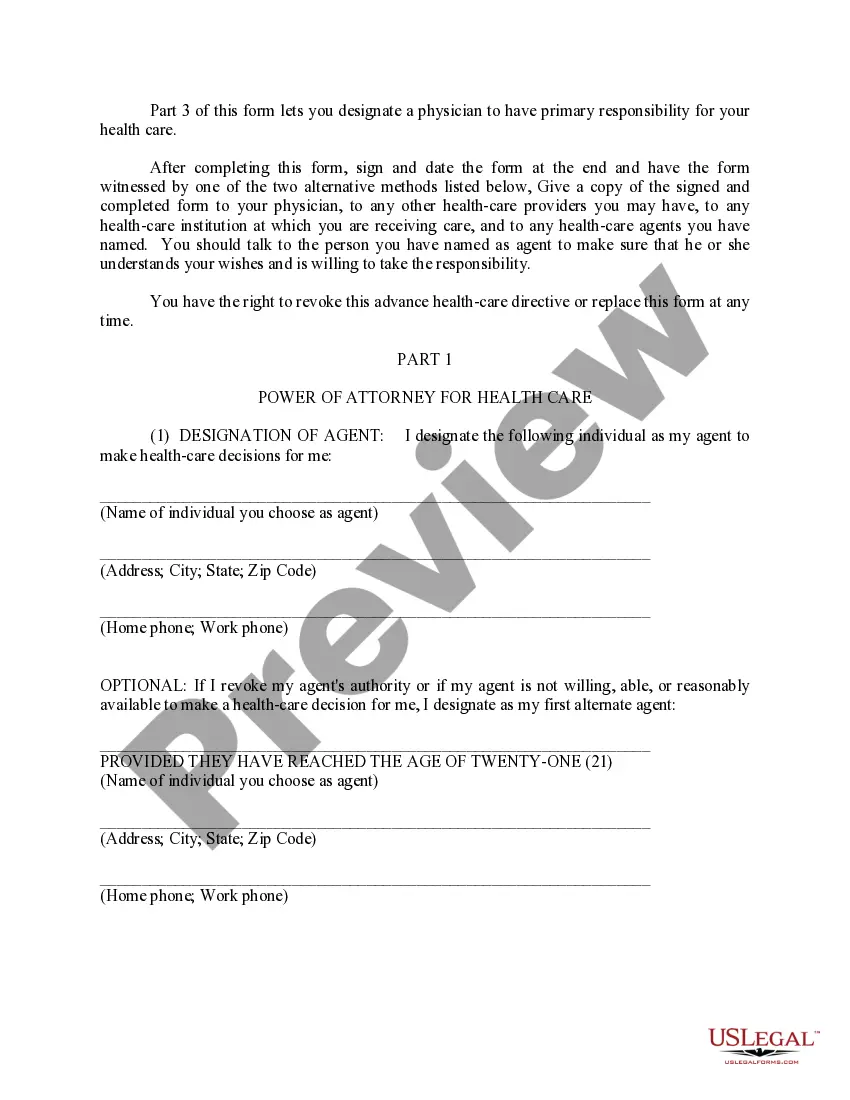

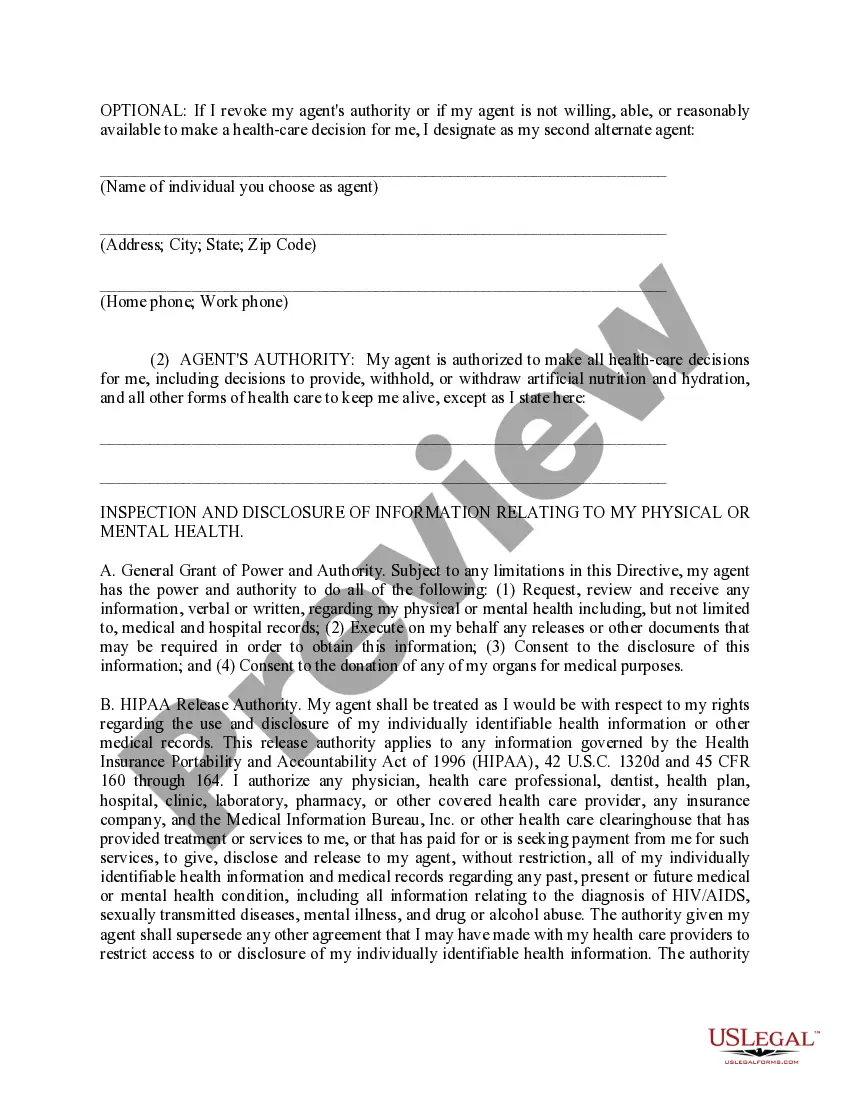

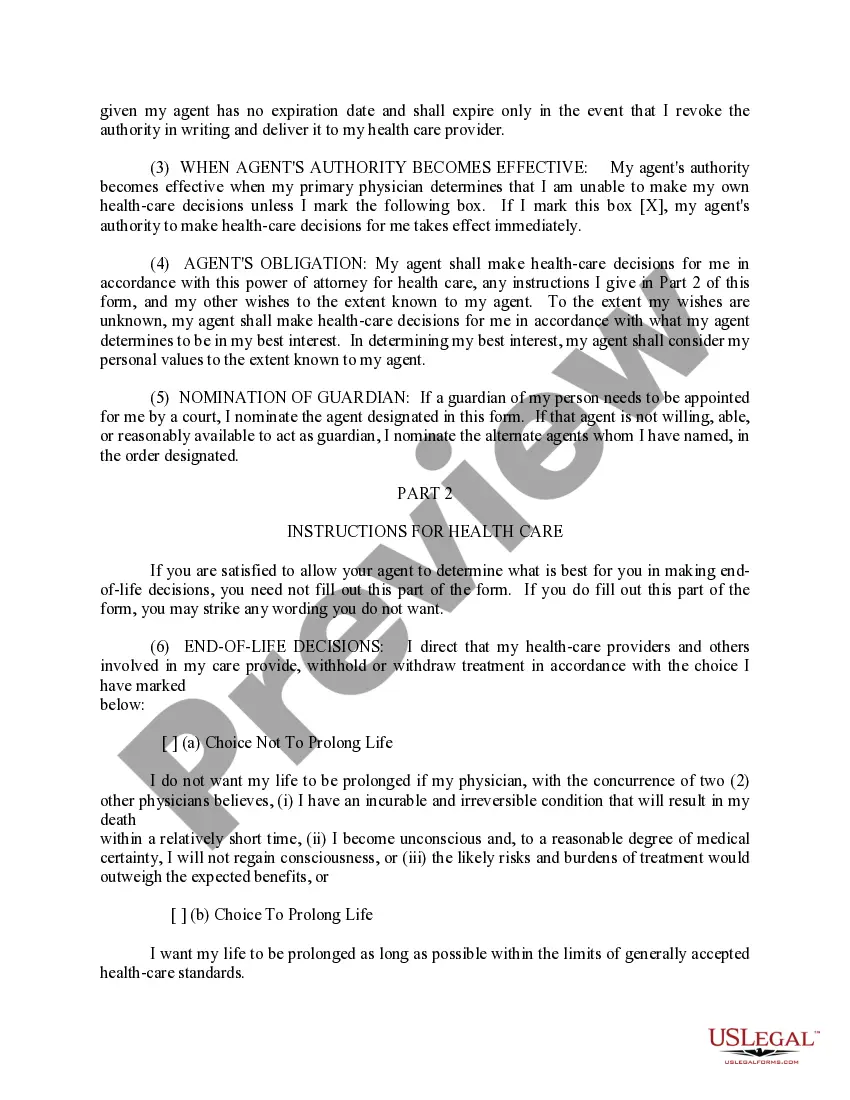

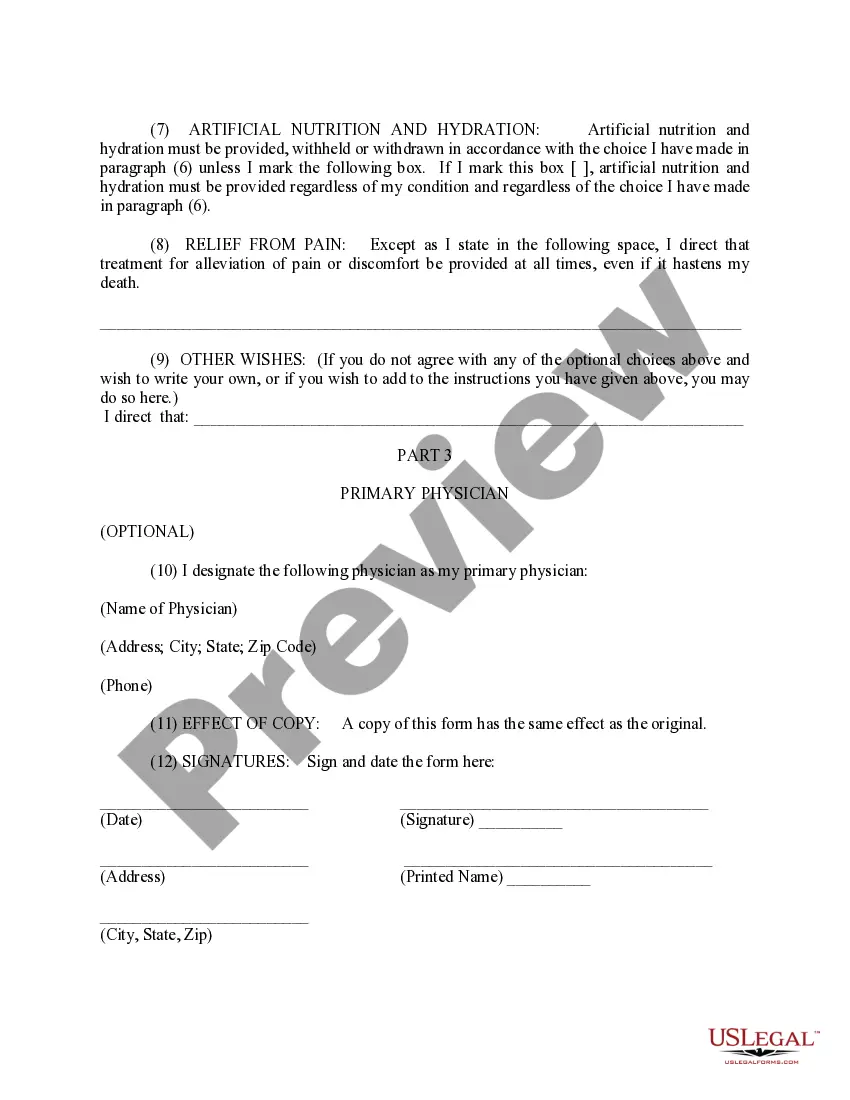

- Very first, ensure that you have chosen the proper papers template for your county/area that you pick. Read the develop explanation to ensure you have chosen the correct develop. If accessible, take advantage of the Preview key to check with the papers template at the same time.

- If you wish to find an additional model from the develop, take advantage of the Research field to discover the template that suits you and specifications.

- Upon having discovered the template you need, click Buy now to continue.

- Pick the pricing prepare you need, type in your references, and register for a free account on US Legal Forms.

- Full the financial transaction. You should use your Visa or Mastercard or PayPal account to purchase the legitimate develop.

- Pick the format from the papers and download it for your gadget.

- Make alterations for your papers if possible. You may total, edit and indicator and printing Arizona Uniform Healthcare Act Form.

Download and printing a large number of papers web templates using the US Legal Forms website, that provides the greatest assortment of legitimate kinds. Use professional and status-particular web templates to handle your organization or person requirements.

Form popularity

FAQ

"Danger to others" means that the judgment of a person who has a mental disorder is so impaired that the person is unable to understand the person's need for treatment and as a result of the person's mental disorder the person's continued behavior can reasonably be expected, on the basis of competent medical opinion, ...

Prior authorization (prior auth, or PA) is a management process used by insurance companies to determine if a prescribed product or service will be covered. This means if the product or service will be paid for in full or in part.

If you are trying to locate, download, or print state of Pennsylvania tax forms, you can do so on the Pennsylvania Department of Revenue. The most common Pennsylvania income tax form is the PA-40. This form is used by Pennsylvania residents who file an individual income tax return.

If you are a PA resident, nonresident or a part-year PA resident, you must file a 2022 PA tax return if: ? You received total PA gross taxable income in excess of $33 during 2022, even if no tax is due with your PA return; and/or ? You incurred a loss from any transaction as an individual, sole proprietor, partner in a ...

The PA-W3 is used to reconcile the employer withholding activities for each quarter to the payments made. The PA-W3 is still due if withholding did not occur.

The easiest way to apply for benefits is online through Health-e-Arizona Plus. You may also begin the application process by phone by calling 1-855-432-7587.

You may fax the Fee For Service Prior Authorization Request Form to the AHCCCS FFS Prior Authorization Unit to request authorization, or you may use AHCCCS Online to enter a pended authorization request online, 24 hours a day/7 days a week.

PURPOSE OF SCHEDULE The entity must report interest it received for the use of its money that it does not include in another income class. Do not report interest from obligations that are statutorily free from Pennsylvania tax.