Arizona Sample Letter for Compromise on a Debt

Description

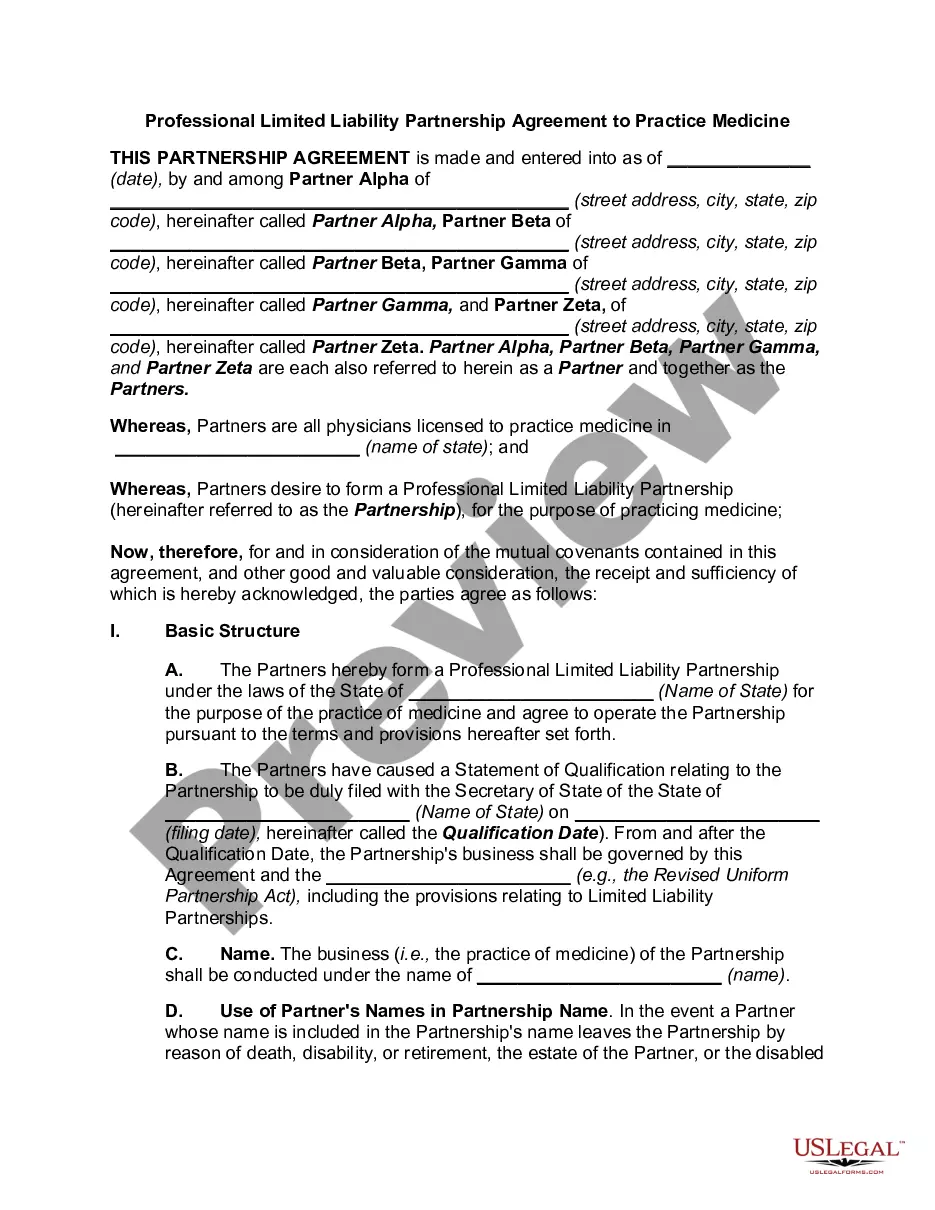

How to fill out Sample Letter For Compromise On A Debt?

It is feasible to spend hours online searching for the official document template that aligns with the federal and state requirements you require.

US Legal Forms offers a multitude of legal forms that are vetted by professionals.

You can actually obtain or create the Arizona Sample Letter for Compromise on a Debt through the service.

If available, utilize the Review option to examine the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Arizona Sample Letter for Compromise on a Debt.

- Every legal document template you acquire is permanently yours.

- To obtain another copy of the acquired form, navigate to the My documents section and select the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city you choose.

- Review the form summary to confirm you have chosen the correct type.

Form popularity

FAQ

When negotiating a debt settlement, start by clearly stating your intention to settle and provide your offer amount. Use language similar to the Arizona Sample Letter for Compromise on a Debt to ensure clarity. Discuss your reasons for the proposed amount, such as financial difficulties, and invite the creditor to respond with a counteroffer. Always maintain a respectful tone and be prepared to negotiate.

A debt settlement letter should clearly state your intention to settle the debt and the amount you propose. Referencing the Arizona Sample Letter for Compromise on a Debt can guide you in creating a compelling letter. Include your financial situation to provide context for your offer and request written confirmation of the agreement. Always be polite and direct in your communication.

A reasonable offer to settle a debt often ranges between 30% to 70% of the total balance, depending on your financial situation and the creditor's willingness to negotiate. When drafting your proposal, consider using the Arizona Sample Letter for Compromise on a Debt to frame your offer professionally. Explain your reasoning for the reduced amount, like financial hardship. This approach can enhance your chances of reaching a favorable agreement.

An example of a debt dispute letter starts with your contact information and a clear statement that you dispute the debt. Use the Arizona Sample Letter for Compromise on a Debt to outline the specifics of the debt you contest. Include why you believe the debt is incorrect, such as discrepancies or lack of supporting documentation. Finish with a request for the creditor to investigate the matter and respond.

A sample letter for a settlement offer typically includes your personal details and the amount you propose to settle the debt for. Reference the Arizona Sample Letter for Compromise on a Debt to help you structure the offer professionally. Specify your reasons for the settlement and mention any financial hardship if applicable. End with a request for a written response to your offer.

To fill out a debt validation letter, start by including your personal information at the top. Next, clearly state that you are requesting validation of the debt in question, referencing the Arizona Sample Letter for Compromise on a Debt as a guide. Provide details about the debt, like the amount and creditor's name, and request any documentation that proves the debt’s legitimacy. Conclude with your signature and a request for a response.

The IRS debt forgiveness program allows eligible taxpayers to settle their tax debt for less than what they owe, often through an offer in compromise. This program seeks to help those facing financial hardships reach manageable debt levels. For crafting effective applications, including the Arizona Sample Letter for Compromise on a Debt can enhance your proposal's chances of success.

When determining your offer in compromise amount, consider your total unpaid tax debt, income, expenses, and what the IRS deems collectable. The offer should be realistic yet aggressive enough to prompt the IRS to consider it seriously. Using tools like the Arizona Sample Letter for Compromise on a Debt can assist you in formulating a strong offer that aligns with IRS expectations.

The IRS generally sets a baseline for their acceptance of offers in compromise, which is often determined by your income and expenses. Your lowest payment will depend on the IRS's assessment of your financial standing. To ensure you present a compelling case, refer to the Arizona Sample Letter for Compromise on a Debt while making your offer.

Typically, the IRS settles for a percentage of what you owe, depending on your financial situation. While there is no fixed amount, it is important to use the Arizona Sample Letter for Compromise on a Debt to propose a figure that reflects your financial capabilities. This way, you present a compelling argument based on your specific circumstances, increasing the chance of settlement.