Arizona Equipment Lease - Detailed

Description

How to fill out Equipment Lease - Detailed?

If you want to finalize, acquire, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Make use of the website's straightforward and user-friendly search function to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the Arizona Equipment Lease - Detailed with just a few clicks.

Every legal document template you obtain is yours permanently. You will have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Be proactive and acquire, and print the Arizona Equipment Lease - Detailed with US Legal Forms. There are countless professional and state-specific templates available for your personal or business needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to get the Arizona Equipment Lease - Detailed.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you're using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

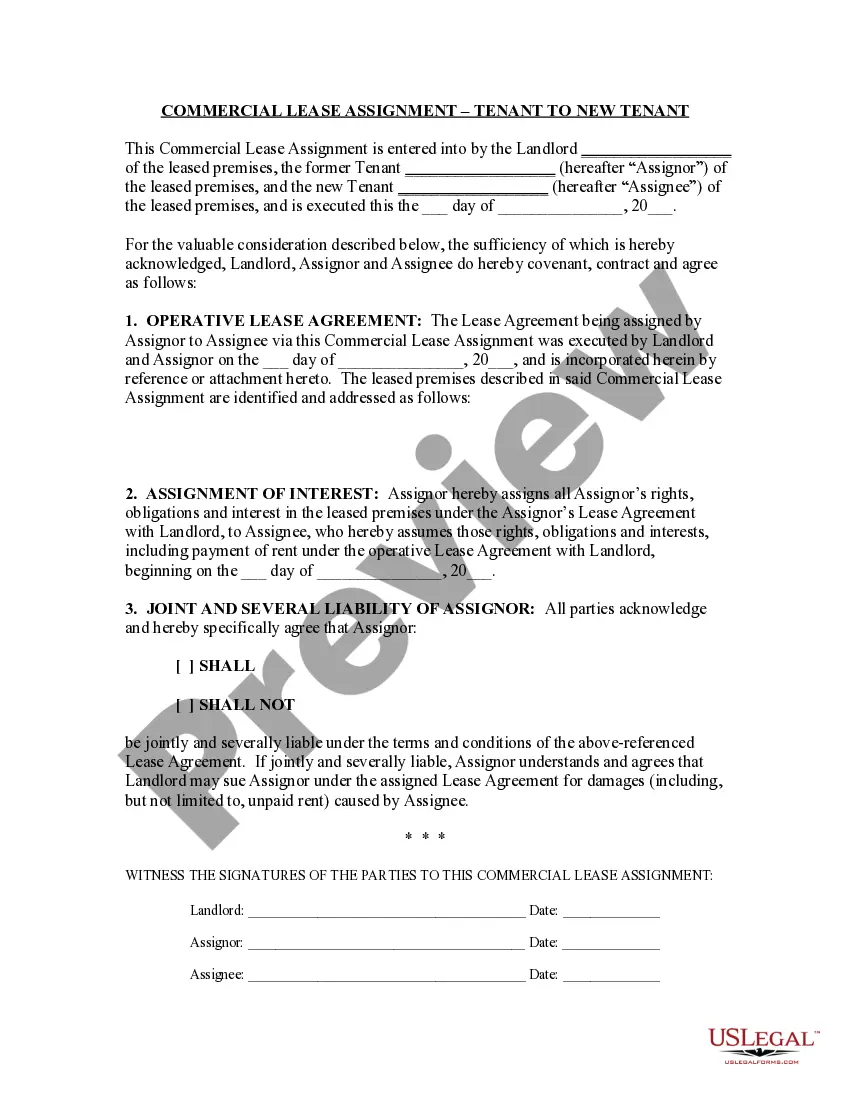

- Step 2. Use the Preview option to review the form's contents. Don't forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and provide your credentials to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Arizona Equipment Lease - Detailed.

Form popularity

FAQ

A good equipment lease rate varies based on factors such as the type of equipment, lease duration, and your creditworthiness. In the context of an Arizona Equipment Lease - Detailed, competitive rates generally range from 5% to 15% of the equipment's value annually. Researching various leasing options and comparing rates will help you secure a favorable deal. Making use of platforms like uslegalforms can help you navigate your leasing needs effectively.

Leased equipment is usually considered an expense under accounting guidelines, especially with an Arizona Equipment Lease - Detailed. Payments made for the lease can be recorded as operating expenses on your profit and loss statement. This classification can affect your financial ratios and tax planning. Understanding how to properly categorize these leases is vital for accurate financial management.

Yes, you can typically write off equipment rentals as business expenses when using an Arizona Equipment Lease - Detailed. This write-off can help lower your taxable income, making it a beneficial option for budget-conscious businesses. However, it is important to confirm that your rental agreements meet tax guidelines. Checking with a tax advisor can ensure you take full advantage of this deduction.

Leases are generally treated favorably for tax purposes, especially with an Arizona Equipment Lease - Detailed. Lease payments you make can usually be deducted as an expense, reducing your taxable income. However, the treatment can involve nuances, such as the type of lease agreement you enter into. Reviewing your options and consulting with a tax professional will provide clarity.

Yes, ASC 842 applies to equipment leases and changes how companies report lease obligations and assets. Under this standard, an Arizona Equipment Lease - Detailed may require companies to recognize lease liabilities on their balance sheets. It's crucial to understand these rules to ensure compliance and accurate financial reporting. Familiarizing yourself with ASC 842 can lead to better decision-making regarding your leasing options.

With an Arizona Equipment Lease - Detailed, you often find that lease payments can be fully tax-deductible as a business expense. However, the exact tax treatment can depend on your specific circumstances and the type of lease. It's essential to consult with a tax professional to ensure you're following the current tax laws. This guidance will help you maximize your tax benefits.

The Arizona Equipment Lease - Detailed has specific forms that outline the terms of the lease agreement, with Form 5000 and 5000A serving different purposes. Form 5000 focuses on the actual lease agreement, detailing the obligations of both parties, while Form 5000A is generally used for the equipment lease's approval or rejection process. Understanding these differences is essential for anyone looking to navigate the equipment leasing landscape effectively. Using platforms like US Legal Forms can help you access accurate forms and ensure compliance with Arizona's legal requirements.

To write off leased equipment, you must record lease payments as an expense on your financial statements. Depending on accounting methods, you may be able to deduct lease payments in the fiscal year they occur. Consult Arizona Equipment Lease - Detailed bookkeeping guidelines for specifics on writing off leased equipment correctly.

Setting up an equipment lease requires initial research on the type of equipment and its market value. Follow this by drafting a lease agreement that details the terms of use, payment schedule, and rights and responsibilities of each party. Guidance through Arizona Equipment Lease - Detailed can provide clarity on proper procedures and legalities.

In Arizona, equipment rentals may be subject to sales tax, depending on the nature of the equipment and the terms of the lease. Often, the rental income is taxed, while the lessor must collect the appropriate tax from the lessee. It's important to consult Arizona Equipment Lease - Detailed resources to understand your specific tax obligations.