Arizona Revocable Trust for Lottery Winnings

Description

How to fill out Revocable Trust For Lottery Winnings?

Are you in a position where you need documents for potential business or personal reasons almost every day.

There are numerous legitimate document templates available online, but finding reliable ones is challenging.

US Legal Forms offers thousands of document templates, including the Arizona Revocable Trust for Lottery Winnings, designed to meet state and federal requirements.

Once you find the appropriate form, click Purchase now.

Choose the pricing plan you want, complete the required information to create your account, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Arizona Revocable Trust for Lottery Winnings template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Select the form you need and ensure it is for the correct state/region.

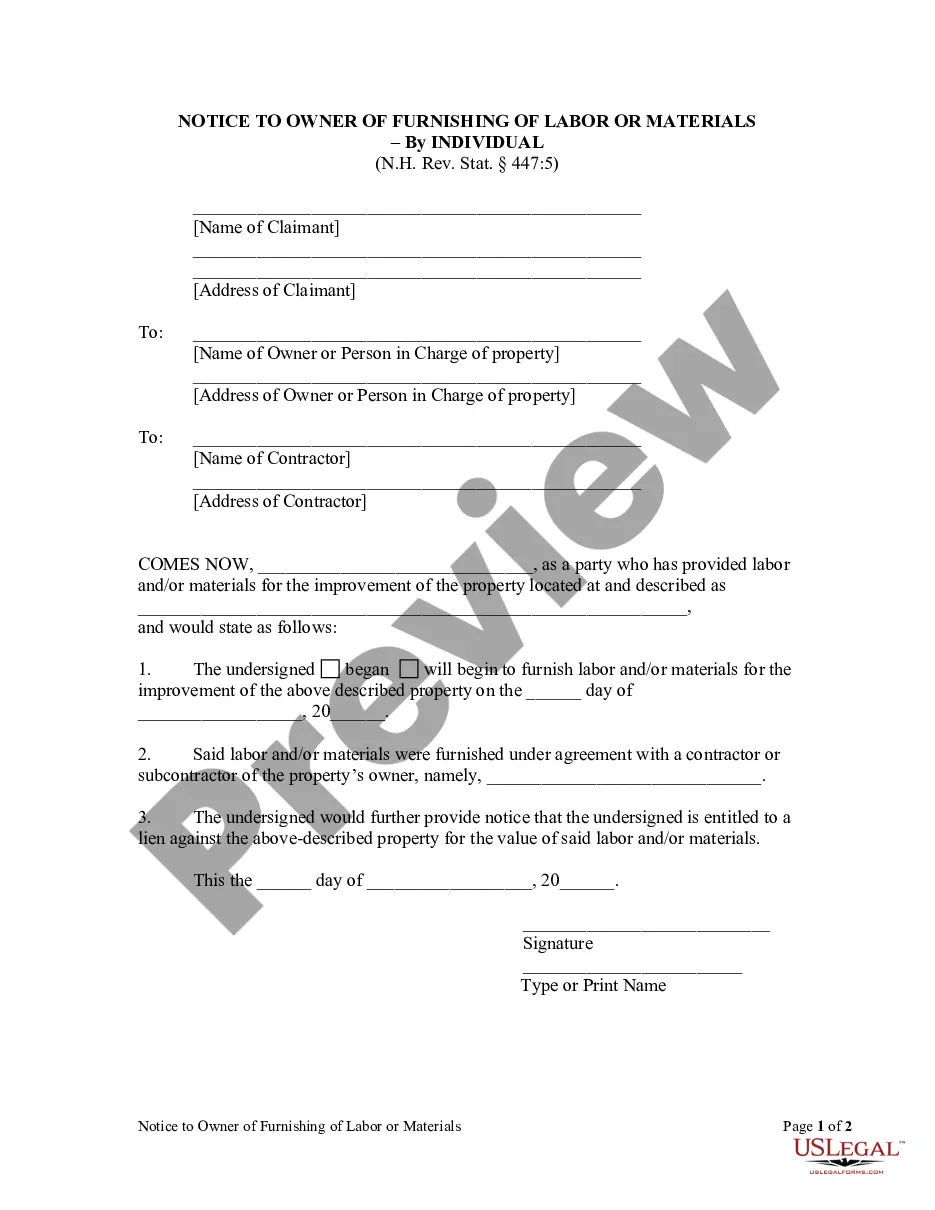

- Use the Preview feature to review the document.

- Check the description to confirm you have selected the correct form.

- If the document is not what you are looking for, utilize the Search bar to find the form that suits your needs and specifications.

Form popularity

FAQ

In Arizona, the option to remain anonymous after winning the lottery is limited. However, claiming your winnings through an Arizona Revocable Trust for Lottery Winnings can enhance your privacy. By establishing a trust, you can avoid public disclosure of your name, as the trust itself becomes the claimant. This strategy allows you to enjoy your prize without the spotlight and still manage your financial future effectively.

Yes, a trust can indeed claim a lottery prize in Arizona. This legal structure provides a distinct advantage, as it can help maintain anonymity and protect the winnings from hefty tax implications. Additionally, an Arizona Revocable Trust for Lottery Winnings allows you to dictate the terms for distribution, and it can safeguard your winnings from creditors. Therefore, establishing a trust is a practical step for anyone fortunate enough to win the lottery.

The best account for managing lottery winnings is often a high-yield savings account or a trust account linked to your Arizona Revocable Trust for Lottery Winnings. These types of accounts typically offer better interest rates compared to traditional checking accounts, maximizing your returns on the wealth you have just gained. Additionally, they provide a safe place to store your funds while you make long-term financial plans. It's wise to consult with a financial advisor to determine the best account strategy tailored to your needs.

An Arizona Revocable Trust for Lottery Winnings is typically considered the best option for lottery winners. This type of trust allows you to maintain control over your assets while providing flexibility for changes if your circumstances evolve. By setting up a revocable trust, you ensure that your winnings are managed according to your preferences, minimizing probate and simplifying taxation. Additionally, this trust can offer peace of mind knowing your assets are securely handled.

Yes, a trust can claim lottery winnings in Arizona. In fact, establishing a trust to claim your lottery winnings can offer numerous benefits, such as preserving privacy and simplifying the distribution of funds. An Arizona Revocable Trust for Lottery Winnings allows you to outline how and when your winnings should be distributed, aligning with your long-term financial goals. This approach not only makes financial sense but also ensures that your family’s needs are met.

The loophole for gift tax often involves properly structuring your gifts through an Arizona Revocable Trust for Lottery Winnings. For instance, you can gift amounts below the annual exclusion limit without facing taxes. Understanding these limits and utilizing a trust structure can provide a practical way to transfer your lottery winnings efficiently.

While you cannot entirely avoid taxes on lottery winnings, using an Arizona Revocable Trust for Lottery Winnings can significantly reduce your tax burden. This approach allows for strategic asset management and may defer tax liabilities. Consulting with a financial advisor specialized in tax strategies is highly recommended to maximize your benefits.

Avoiding gift tax on lottery winnings can be accomplished by establishing an Arizona Revocable Trust for Lottery Winnings. By transferring your winnings to this trust, you can distribute benefits to heirs without triggering gift tax implications. Ensure that you consult with a tax advisor or legal expert to navigate the specific requirements.

To share your lottery winnings without incurring gift tax, consider using an Arizona Revocable Trust for Lottery Winnings. This strategy allows you to distribute funds to beneficiaries while taking advantage of certain exclusions and deductions. Proper planning through a trust can help you safeguard your assets and minimize tax liabilities.

Yes, you can maintain your anonymity in Arizona if you win the lottery. To achieve this, many winners choose to create an Arizona Revocable Trust for Lottery Winnings. By claiming your prize through a trust, you can keep your name and details confidential, reducing unwanted attention and potential solicitations.