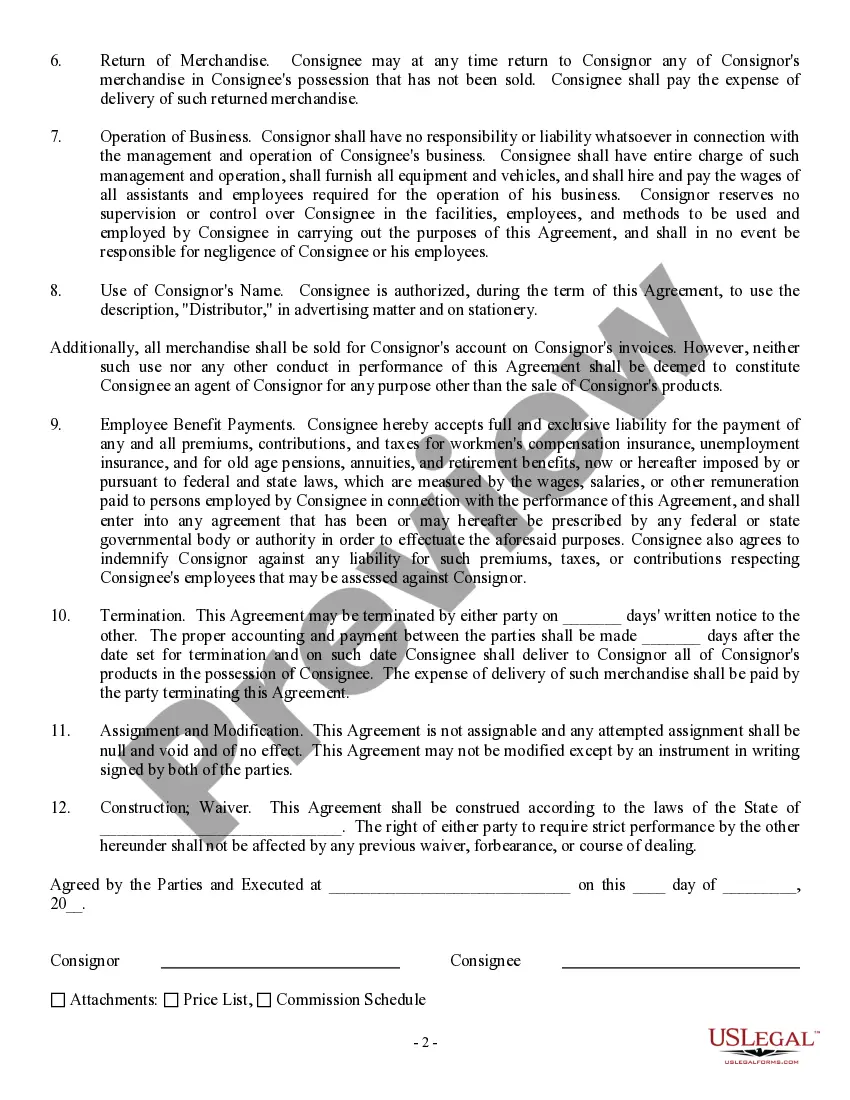

The Arizona Contract for Sale of Goods on Consignment is a legally-binding agreement between a consignor and a consignee, outlining the terms and conditions for the sale of goods on consignment in the state of Arizona. This contract is designed to protect the rights and interests of both parties involved in the consignment transaction. Under this contract, the consignor agrees to deliver their goods to the consignee for the purpose of sale. The consignee, on the other hand, agrees to act as an agent for the consignor and make reasonable efforts to sell the goods. The consignor retains ownership of the goods until they are sold, at which point the consignee will remit the proceeds, minus any agreed-upon fees or commissions, to the consignor. The Arizona Contract for Sale of Goods on Consignment typically includes the following key elements: 1. Identification of the Parties: The contract clearly states the names and contact details of the consignor and the consignee, establishing their respective roles and responsibilities. 2. Description of Goods: A detailed description of the goods being consigned is provided, including their quantity, quality, condition, and any unique characteristics. 3. Delivery and Acceptance: The contract specifies the date and location for the delivery of the goods, and outlines the requirements for their acceptance by the consignee. 4. Sales Efforts: The consignee agrees to use reasonable efforts to promote and sell the consigned goods. This may include marketing, advertising, and displaying the goods appropriately. 5. Pricing and Payment: The contract outlines the agreed-upon pricing for the goods and any applicable fees or commissions that the consignee may deduct from the sales proceeds. It also defines the payment terms, including when and how the consignee will remit the payment to the consignor. 6. Term and Termination: The contract specifies the duration of the consignment arrangement, including any renewal or termination clauses. It also addresses the procedure for returning unsold goods to the consignor. 7. Insurance and Risk of Loss: The contract may determine whether the consignee or the consignor is responsible for insuring the goods against loss, damage, or theft during the consignment period. There are no specific different types of Arizona Contracts for Sale of Goods on Consignment, as the key elements described above generally remain consistent across consignment contracts in the state. However, the terms and conditions of the contract may vary depending on the nature of the goods, the industry involved, and the agreement reached between the consignor and consignee.

Arizona Contract for Sale of Goods on Consignment

Description

How to fill out Arizona Contract For Sale Of Goods On Consignment?

Are you currently in a situation where you need documents for either professional or personal purposes almost every day? There are numerous legal document templates available online, but finding reliable ones isn’t easy.

US Legal Forms offers thousands of form templates, including the Arizona Contract for Sale of Goods on Consignment, which are crafted to meet federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Arizona Contract for Sale of Goods on Consignment template.

Find all the document templates you have purchased in the My documents menu. You can acquire another version of the Arizona Contract for Sale of Goods on Consignment anytime if needed. Click on the required form to download or print the template.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- Obtain the form you need and ensure it is for the correct city/area.

- Use the Review button to evaluate the form.

- Read the description to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, use the Research section to find the form that meets your needs.

- Once you find the right form, click Buy now.

- Select the pricing plan you prefer, fill in the required information to create your account, and place your order using your PayPal or Visa or Mastercard.

- Choose a convenient document format and download your version.

Form popularity

FAQ

Yes, income earned from consignment sales is considered taxable income by the IRS. You should report this income during tax season, as it affects your overall earnings for the year. Proper documentation and utilizing an Arizona Contract for Sale of Goods on Consignment can aid in accurately reporting this income.

To account for consignment sales, clearly track the sales made and the inventory remaining. Recording sales as they occur helps maintain accurate financial records. An Arizona Contract for Sale of Goods on Consignment can also facilitate better accounting practices by providing a structured framework for sales transactions.

The typical consignment split generally favors the seller, with splits ranging from 50-70% for the seller. It's crucial to negotiate this percentage upfront. An Arizona Contract for Sale of Goods on Consignment can serve as a formal agreement to delineate these splits, ensuring both parties understand their share.

Yes, you must report any income earned from sales, including consignment sales, to the IRS. This means keeping track of your sales and income accurately. Using an Arizona Contract for Sale of Goods on Consignment can streamline this process by providing clear records of transactions.

Yes, if you earn above a certain threshold from consignment sales, you may receive a 1099 form from the consignee. This form reports your earnings to the IRS. It's important to document all sales and review the terms in your Arizona Contract for Sale of Goods on Consignment to ensure compliance.

You may need to issue a 1099 for consignment sales if you meet certain thresholds, usually when payments to the consignor exceed $600 in a calendar year. It is essential to track sales accurately and consult with a tax professional to ensure compliance. An Arizona Contract for Sale of Goods on Consignment can help manage these financial records seamlessly.

A contract for sale of goods on consignment is a legal document that outlines the terms between a consignor and consignee for selling goods. This type of agreement specifies how sales will occur, how payments will be made, and the responsibilities of both parties. The Arizona Contract for Sale of Goods on Consignment is tailored to streamline this arrangement, ensuring clarity and legal compliance.

Terminating a consignment agreement generally involves providing written notice to the other party, as specified in your contract. Depending on the agreement terms, there may be a notice period or specific conditions to fulfill before termination. An Arizona Contract for Sale of Goods on Consignment helps define these conditions, making the process straightforward and efficient.

Yes, consignment sales must be reported to the IRS, as they are considered sales income. As a consignee, you must keep accurate records of all transactions, as you are responsible for reporting earnings, even though you do not own the goods sold. Tools like the Arizona Contract for Sale of Goods on Consignment can assist by clarifying reporting obligations within your agreement.

A consignment contract allows one party to sell another party's goods and receive a percentage of the sale revenue. Essentially, the goods remain the property of the consignor until sold. This type of agreement can be efficiently drafted using an Arizona Contract for Sale of Goods on Consignment, which covers essential terms, helping both parties understand their rights and responsibilities.

Interesting Questions

More info

This program is a great way for the public to acquire stocks in limited supply.