Arizona Escrow Instructions for Residential Sale

Description

How to fill out Escrow Instructions For Residential Sale?

US Legal Forms - one of the most prominent collections of legal forms in the USA - provides a variety of legal document templates that you can download or create.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can acquire the latest versions of forms like the Arizona Escrow Instructions for Residential Sale in moments.

If you hold a membership, Log In to download the Arizona Escrow Instructions for Residential Sale from the US Legal Forms library. The Download option will be available on every form you view. You can access all previously saved forms from the My documents tab in your account.

Select the format and download the form onto your device.

Make edits. Fill out, modify, and print and sign the saved Arizona Escrow Instructions for Residential Sale. All templates you save in your account have no expiration date and belong to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

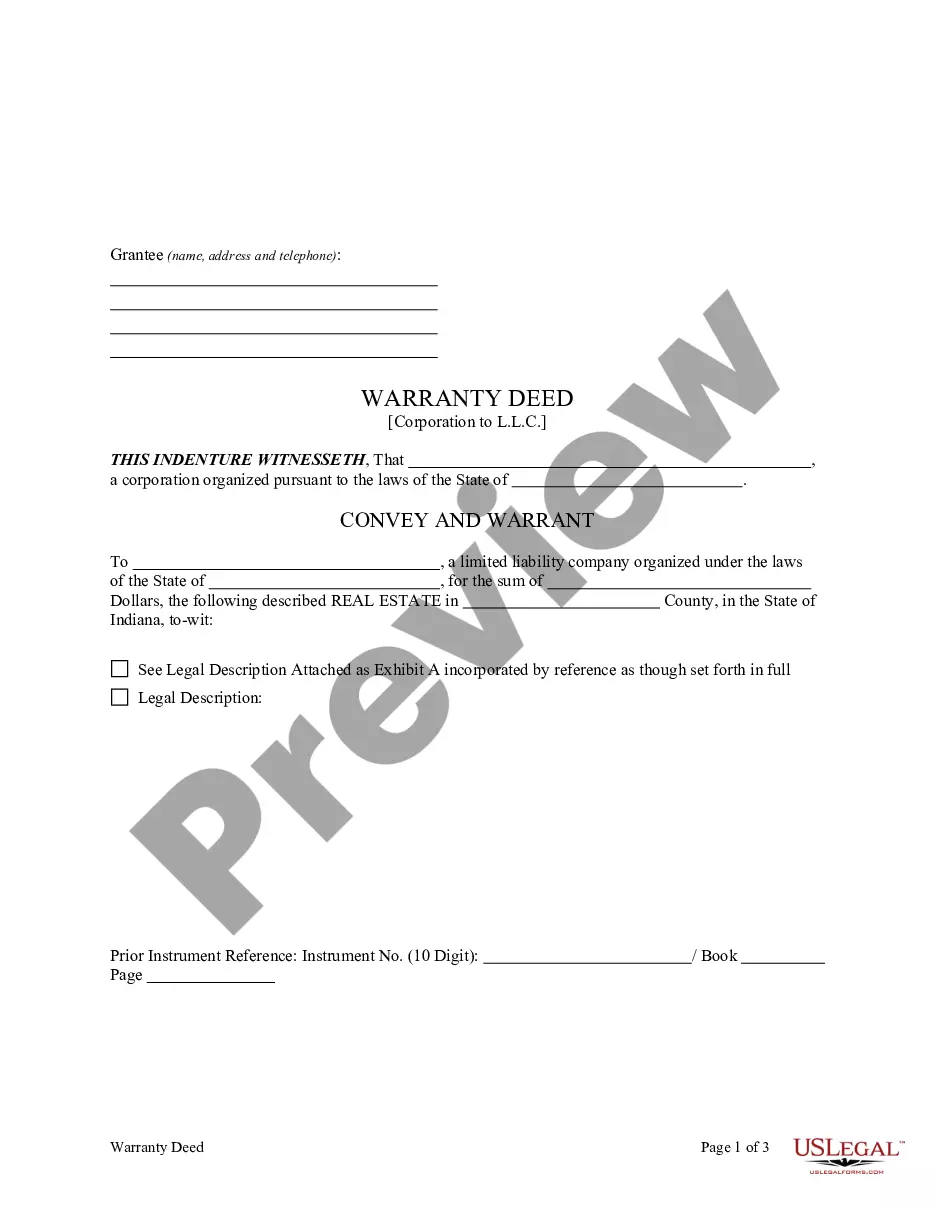

- Ensure you have selected the correct form for your area/region. Choose the Preview option to review the form's content.

- Examine the form information to confirm that you have selected the appropriate form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select your preferred pricing plan and provide your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Form popularity

FAQ

The escrow management process involves the oversight of the transaction from start to finish by a licensed escrow officer. This officer coordinates communication between all parties, ensures compliance with escrow instructions, and manages the distribution of funds and documentation. Having a clear understanding of this process reduces the risk of errors and delays. Utilizing resources from US Legal Forms can streamline your understanding of escrow management in Arizona.

The decision of which escrow company to use in Arizona is typically made during the negotiation process and can be influenced by the agreement between the buyer and seller. Often, the buyer's agent will recommend a trusted escrow company. Whichever company you choose, ensuring that they have a good reputation and experience with Arizona escrow instructions for residential sale is crucial.

In Arizona, escrow usually takes between 30 to 60 days, depending on the complexity of the transaction. Various factors can influence this timeline, including the financing, inspections, and title searches. It’s important for buyers and sellers to stay proactive throughout this period. With the right Arizona escrow instructions for residential sale, you can navigate the timeline more smoothly.

The primary document that serves as escrow instructions is the Escrow Agreement or Escrow Instructions document. This document outlines the transaction details, responsibilities, and the timeline for the escrow process. It's essential for both buyers and sellers to review these instructions carefully, as they govern the entire transaction. US Legal Forms offers templates to simplify this process for you.

In Arizona, the escrow instructions for a residential sale are typically prepared by the escrow company or an attorney involved in the transaction. These instructions define the terms and responsibilities of all parties involved. It's crucial to have clear and accurate instructions to avoid misunderstandings later on. Using a reliable platform like US Legal Forms can help ensure your escrow instructions are correctly drafted.

When you sell your house, the escrow account is used to manage the financial details of the transaction. Your escrow officer will distribute funds according to your Arizona escrow instructions for residential sale, covering outstanding bills and disbursing your share as appropriate. If you need assistance understanding the process, USLegalForms provides resources and templates to help you navigate the complexities of escrow and residential sales. This can ensure a smooth transition and minimize stress during the sale.

Typically, the escrow instructions are prepared by the escrow officer or the title company managing your sale. They gather necessary information from both the buyer and seller to draft these documents accurately. Carefully written Arizona escrow instructions for residential sale ensure that everyone's responsibilities are clear throughout the transaction. If you have questions about these instructions, do not hesitate to ask your escrow officer for clarification.

When you sell your property, your escrow account is generally settled at closing. Any outstanding payments, including property taxes and homeowner’s association fees, are usually cleared from this account. Your Arizona escrow instructions for residential sale will guide these transactions and ensure everything is handled correctly. It's wise to confirm with your escrow officer how funds will be disbursed to avoid surprises.

When you sell your house, the funds in your escrow account may be released to you at closing, but this depends on your specific escrow agreement. Typically, Arizona escrow instructions for residential sale outline how any remaining balance will be handled. If there are costs associated with the sale, such as outstanding fees or repairs, those may be deducted from your escrow balance. Therefore, it’s important to carefully review your escrow instructions before completing the sale.

An escrow agent typically uses the written escrow instructions submitted by both parties involved in the transaction. This document outlines the responsibilities of the agent and provides a roadmap for processing the sale. For Arizona Escrow Instructions for Residential Sale, it is vital that this document is detailed and precise, covering all necessary agreements. Utilizing professional services like USLegalForms can help ensure that the agent has the right documentation to facilitate an efficient and legal closing.