Compiled financial statements represent the most basic level of service that certified public accountants provide with respect to financial statements. In a compilation, the CPA must comply with certain basic requirements of professional standards, such as having a knowledge of the client's industry and applicable accounting principles, having a clear understanding with the client as to the services to be provided, and reading the financial statements to determine whether there are any obvious departures from generally accepted accounting principles (or, in some cases, another comprehensive basis of accounting used by the entity). It may be necessary for the CPA to perform "other accounting services" (such as creating a general ledger for the client, or assisting the client with adjusting entries for the books of the client (before the financial statements can be prepared). Upon completion, a report on the financial statements is issued that states a compilation was performed in accordance with AICPA professional standards, but no assurance is expressed that the statements are in conformity with generally accepted accounting principles. This is known as the expression of "no assurance." Compiled financial statements are often prepared for privately-held entities that do not need a higher level of assurance expressed by the CPA.

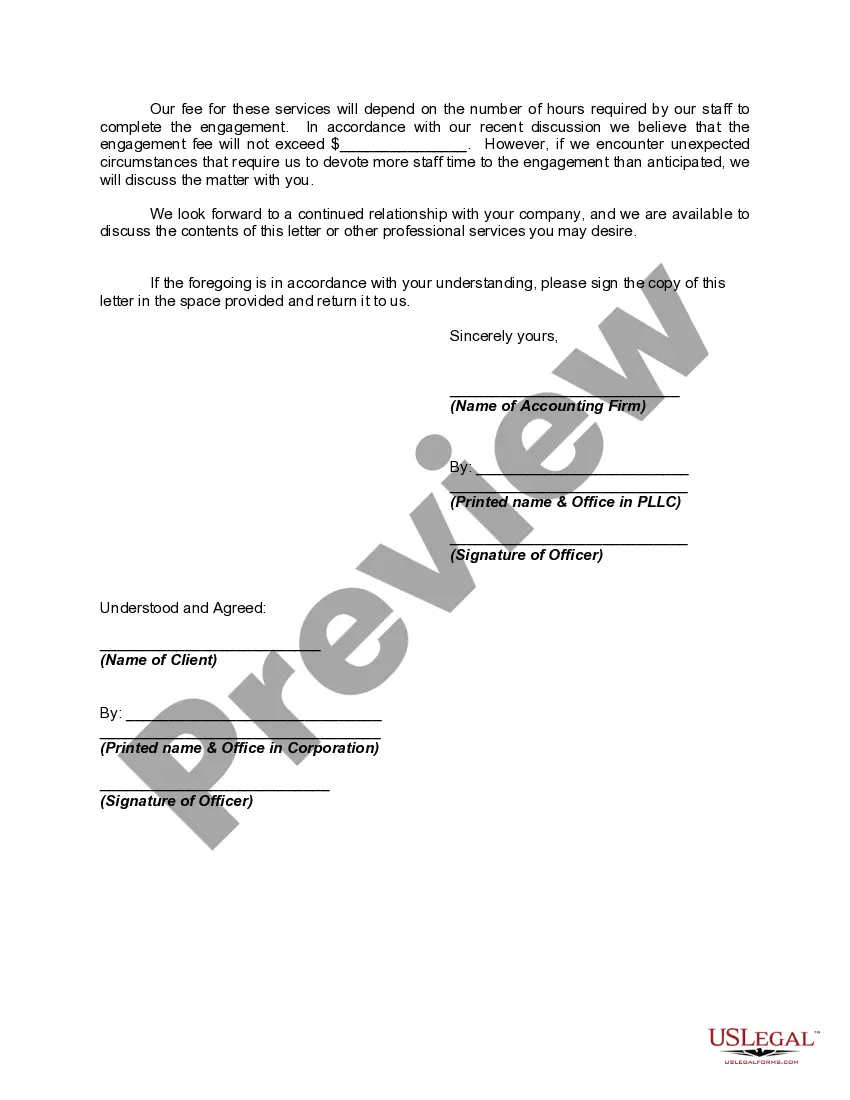

An Arizona Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm is a formal agreement between the accounting firm and the client, outlining the scope of work, responsibilities, and expectations for reviewing or compiling financial statements. This engagement letter serves as a blueprint for the entire engagement and helps establish a clear understanding of the accountant's role in the process. Keywords: Arizona, Engagement Letter, Review of Financial Statements, Compilation, Accounting Firm Types of Arizona Engagement Letter for Review of Financial Statements and Compilation by Accounting Firm: 1. Review Engagement Letter: The Review Engagement Letter is used when an accounting firm is engaged to perform a review of the client's financial statements. It outlines the procedures the accountant will follow to assess the reasonableness of the financial statements, identify any material misstatements, and provide a limited level of assurance. 2. Compilation Engagement Letter: The Compilation Engagement Letter is utilized when an accounting firm is engaged to compile the client's financial statements. This type of engagement does not involve any assessment of the reasonableness of the financial information or providing assurance; the accountant simply organizes the data provided by the client into a properly formatted financial statement. 3. Combined Review and Compilation Engagement Letter: In some cases, an engagement may require a combination of review and compilation work. The Combined Review and Compilation Engagement Letter addresses this situation and outlines the specific tasks to be performed for both review and compilation aspects of the engagement. 4. Agreed-Upon Procedures Engagement Letter: Sometimes, a client may require the accounting firm to perform specific agreed-upon procedures on selected financial statement elements or accounts. The Agreed-Upon Procedures Engagement Letter is used to establish the scope and limitations of these agreed-upon procedures engagements. Each type of engagement letter will have its specific content, including engagement objectives, responsibilities of the accountant and the client, scope of work, reporting requirements, and fee arrangements. It is crucial for both parties to thoroughly review and understand the engagement letter before proceeding with the engagement to ensure effective communication and a successful outcome.