Arizona Miller Trust Forms for Assisted Living provide a crucial financial solution for individuals seeking assistance with long-term care costs while still qualifying for government benefits such as Medicaid. These forms are specifically designed to satisfy Arizona's Miller Trust requirements and enable individuals with excess income to become eligible for Medicaid coverage for assisted living services. Also known as Qualified Income Trusts (Its), Miller Trusts serve as a legal mechanism to divert excess income from an individual into a trust account, which is then used to pay for their assisted living expenses. By creating a Miller Trust and depositing the excess income into it, individuals can bring their income level below the Medicaid eligibility threshold, ensuring they can receive financial assistance for assisted living services. Various types of Arizona Miller Trust Forms cater to specific circumstances and individual income situations. Some commonly used forms include: 1. Arizona Miller Trust Application Form: This form initiates the process of setting up a Miller Trust for assisted living coverage in Arizona. It requires to be detailed personal and financial information, such as the individual's name, address, monthly income, and specific details regarding the source and amount of income. 2. Arizona Miller Trust Agreement Form: This legal document outlines the terms and conditions of the Miller Trust. It includes provisions regarding the trustee, beneficiaries, income deposits, authorized disbursements, and the ultimate purpose of using the trust funds for assisted living expenses. 3. Arizona Miller Trust Beneficiary Designation Form: This form allows individuals to designate beneficiaries who will inherit any remaining funds in the Miller Trust after the beneficiary's passing. It requires the full legal names and contact information of the designated beneficiaries. 4. Arizona Miller Trust Disbursement Authorization Form: Once the Miller Trust is established, this form permits the trustee to withdraw funds from the trust account and disburse them directly to the assisted living facility to cover the individual's monthly care expenses. It is important to consult with an elder law attorney or a knowledgeable professional when dealing with Arizona Miller Trust Forms for Assisted Living. They can guide individuals through the process, ensuring compliance with Arizona state requirements and maximizing eligibility for Medicaid coverage.

Arizona Miller Trust Forms for Assisted Living

Description

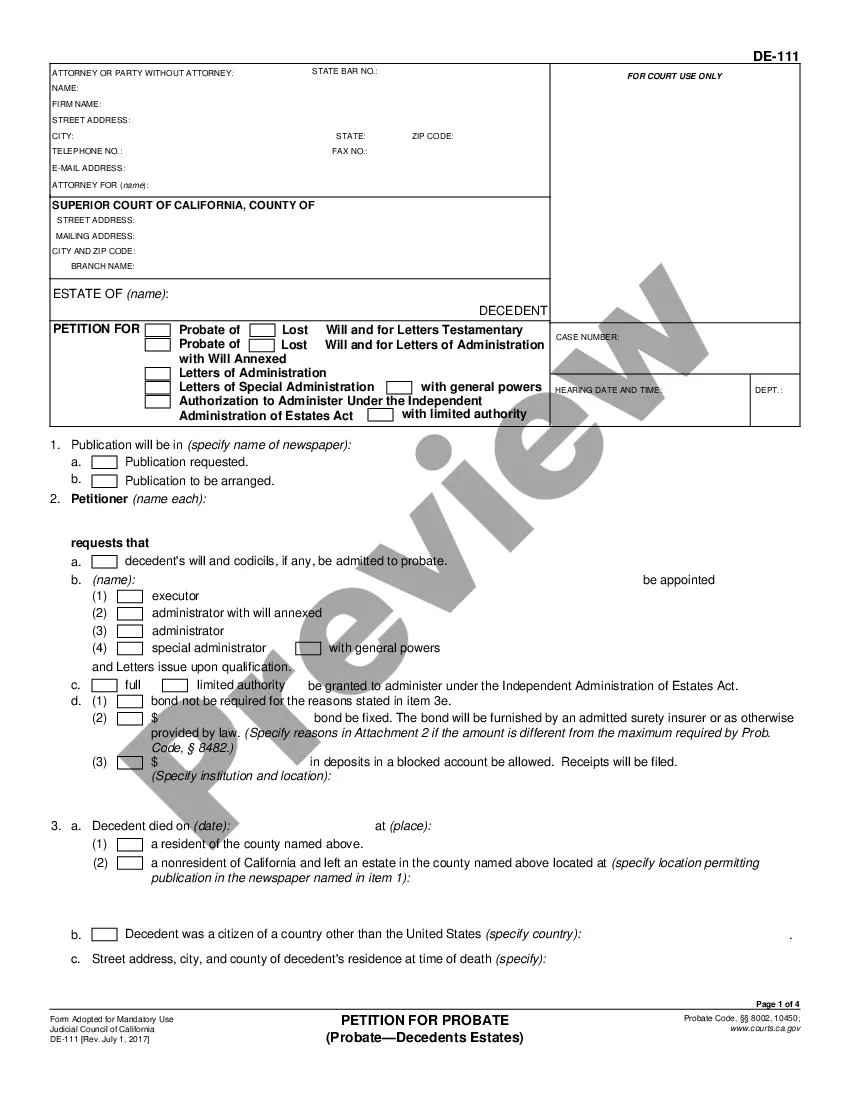

How to fill out Arizona Miller Trust Forms For Assisted Living?

Are you presently in a situation that you need documents for either business or personal reasons almost every workday.

There are numerous authentic document templates accessible online, but finding ones you can trust isn't easy.

US Legal Forms offers thousands of template forms, like the Arizona Miller Trust Forms for Assisted Living, that are designed to meet federal and state regulations.

Once you locate the right form, click on Buy now.

Select the pricing plan you prefer, fill in the necessary details to create your account, and complete the payment with your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Arizona Miller Trust Forms for Assisted Living template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/county.

- Utilize the Preview button to review the form.

- Examine the summary to confirm that you have chosen the correct form.

- If the form isn't what you were looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

While you do not need a lawyer to set up a Miller trust, professional guidance can be beneficial. By leveraging Arizona Miller Trust Forms for Assisted Living, you can create a trust without legal expertise, yet it is wise to consult with a professional to ensure compliance with state laws. This approach maximizes your peace of mind and the effectiveness of your trust.

Recording a living trust in Arizona typically doesn’t require formal registration, as it is not a public document. However, you must keep the trust documents in a safe place and provide copies to relevant beneficiaries or financial institutions. Using Arizona Miller Trust Forms for Assisted Living can ensure your trust is properly organized and easily accessible when needed.

A Miller trust in Texas serves a similar purpose as in other states, allowing individuals with excess income to qualify for Medicaid benefits. The trust holds income over a certain limit, enabling individuals to access necessary assisted living services. Understanding how Arizona Miller Trust Forms for Assisted Living can be tailored to suit Texas regulations can make this process easier.

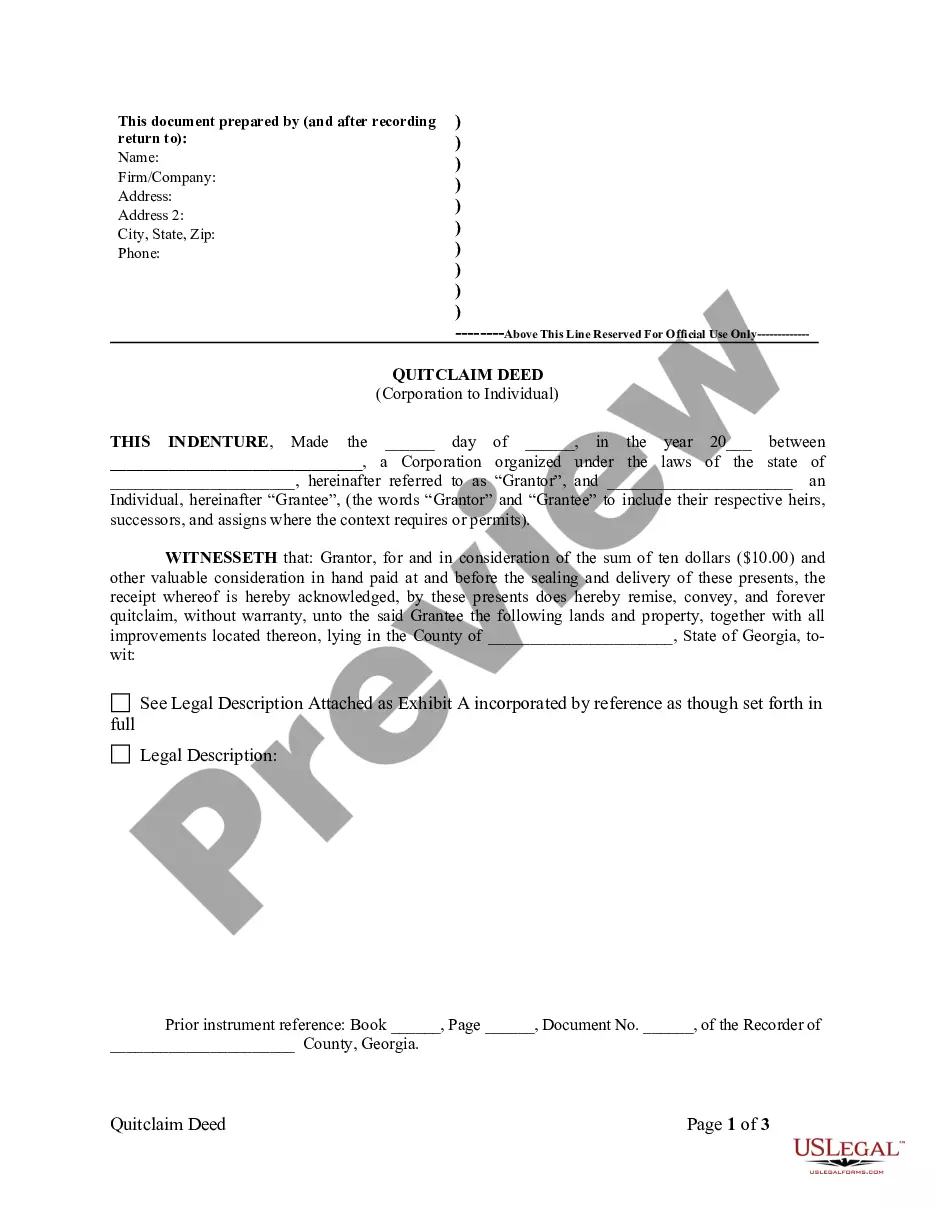

Establishing a Miller trust involves a few straightforward steps. First, gather essential information about your assets and income. Next, utilize Arizona Miller Trust Forms for Assisted Living to draft your trust documents, clearly specifying how assets will be managed. Finally, ensure all documentation is signed and properly witnessed to make your trust legally binding.

Yes, you can create a trust without a lawyer, but it comes with risks. Using Arizona Miller Trust Forms for Assisted Living can simplify the process, ensuring that your trust meets legal requirements without needing professional assistance. However, it is prudent to understand the laws and complexities involved to avoid potential pitfalls.

To set up a Miller trust in Arizona, you need to complete the Arizona Miller Trust Forms for Assisted Living. First, gather the necessary financial documents and determine your eligibility based on income limits. Then, fill out the trust forms precisely, ensuring you include all required information. After that, you can submit the forms to the appropriate authorities to get started on protecting your assets and accessing the benefits needed for assisted living.

The Miller trust can pay the Medicaid recipient a small personal needs allowance, and the trust can also be used to pay the recipient's spouse a monthly allowance. Any additional money is used to pay the recipient's share of his or her cost of care.

Understanding Personal Income TrustsAn income trust will hold income-producing assets. It is typically managed by a trustee on behalf of a trustor who seeks to pass on the assets to a beneficiary. The terms of the trust fund are designated by the trustor and managed by the trustee.

Upon Death, Assets in a QIT Will be Given to the State Any funds that remain after the state has been reimbursed will be paid to other trust beneficiaries. Normally, all deposited income is spent each month, so most QITs are usually empty at the time of the applicant's death.