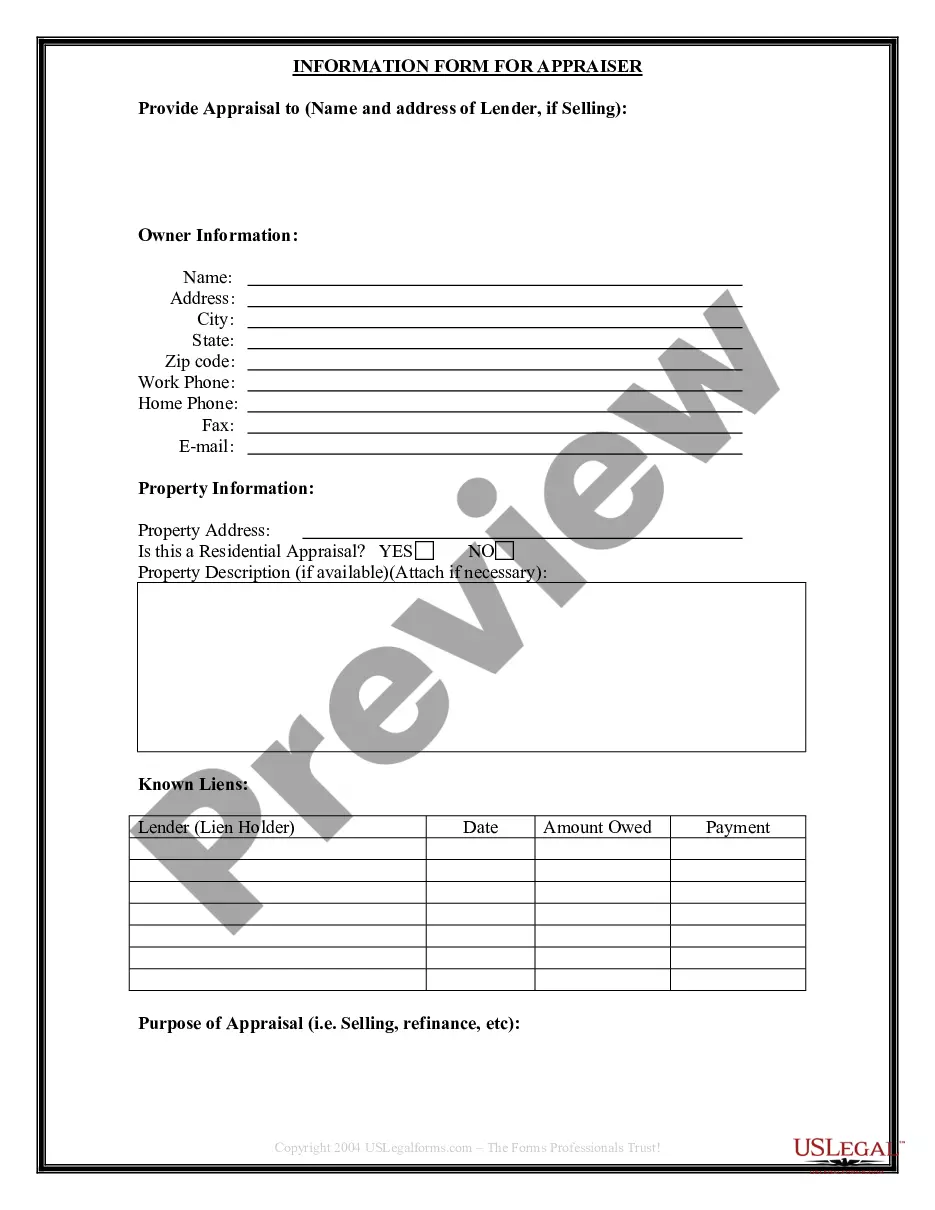

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arizona Gift of Entire Interest in Literary Property

Description

How to fill out Gift Of Entire Interest In Literary Property?

Are you currently in a location for which you require documentation for possibly organization or specific activities almost every business day.

There are numerous legal template documents available online, but finding ones you can count on is challenging.

US Legal Forms offers countless document templates, such as the Arizona Gift of Entire Interest in Literary Property, that are designed to comply with both federal and state requirements.

Once you locate the correct form, click Get now.

Choose your desired pricing plan, fill in the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you may download the Arizona Gift of Entire Interest in Literary Property template.

- If you do not have an account and wish to start utilizing US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct jurisdiction/state.

- Utilize the Review button to examine the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search area to find the form that meets your requirements.

Form popularity

FAQ

Present interest gifts allow the recipient to enjoy and utilize the gift immediately, while future interest gifts restrict access until a later date or event occurs. This distinction is particularly relevant in estate planning and financial decisions involving assets like the Arizona Gift of Entire Interest in Literary Property. Knowing which type of gift to use can significantly impact your estate and financial strategies.

The key difference between present and future interest lies in the timing of rights to the property or benefit. Present interest means you can use the property right away, while future interest means you must wait for a specified time or event to access those rights. Understanding this difference is essential when considering gifts, such as the Arizona Gift of Entire Interest in Literary Property, as it influences both control and benefit.

A present interest gift provides the recipient with immediate rights to the property or benefit, whereas a future interest gift grants rights to the property or benefit at a later date. This distinction is important in financial planning, especially if you are looking to navigate terms like the Arizona Gift of Entire Interest in Literary Property, which may affect timing and usage.

A gift of present interest trust allows a beneficiary to immediately access the benefit of gifts made into the trust. This means that the gifts are available for use right now, instead of waiting until a future date. Understanding this concept can be crucial when exploring avenues like the Arizona Gift of Entire Interest in Literary Property, where immediate use may be a priority.

The most common type of deed used in Arizona is the warranty deed. This type of deed provides a guarantee that the seller holds clear title to the property and has the right to transfer it. In the context of gifting, it can be important to understand how such deeds influence the transfer of literary property and other assets, particularly when considering the Arizona Gift of Entire Interest in Literary Property.

To gift a house without incurring taxes, you can utilize the annual gift tax exclusion, which allows you to give up to a certain amount per recipient each year without tax consequences. Additionally, consider filing the appropriate forms with the IRS to report the gift, while ensuring it does not exceed the lifetime gift tax exemption limits. If you're looking to understand the implications of gifting literary property, such as a book or script, the Arizona Gift of Entire Interest in Literary Property might be beneficial.

Generally, the recipient of a gift does not have to report it to the IRS, especially if the gift falls below the annual exclusion limit. However, if you receive an Arizona Gift of Entire Interest in Literary Property and the value surpasses certain thresholds, the IRS may require you to report it as income. Always consult with a tax professional to ensure you're complying with applicable tax laws.

Documenting a gift for tax purposes means creating a formal record that shows the transfer of value. For the Arizona Gift of Entire Interest in Literary Property, include key information such as the donor's and recipient's names, the gift's value, and the date it was made. This documentation will serve as a reliable reference for any tax forms you file.

Reporting a gift of equity on your taxes requires you to assess the fair market value of the gifted property. If the Arizona Gift of Entire Interest in Literary Property holds significant value, file IRS Form 709 as necessary to report the gift. Keep detailed records, as this will help clarify the transaction if any questions arise from the IRS.

To declare a gift on your taxes, you must file IRS Form 709, which is specifically designed for reporting gifts. Include information about the Arizona Gift of Entire Interest in Literary Property, ensuring that all necessary details are accurately recorded. This form provides the IRS with clear documentation about your gifting activities and helps you stay compliant.