This form is intended for a major commercial office complex. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arizona Detailed Office Space Lease with Lessee to Pay Pro-rata Share of Expenses

Description

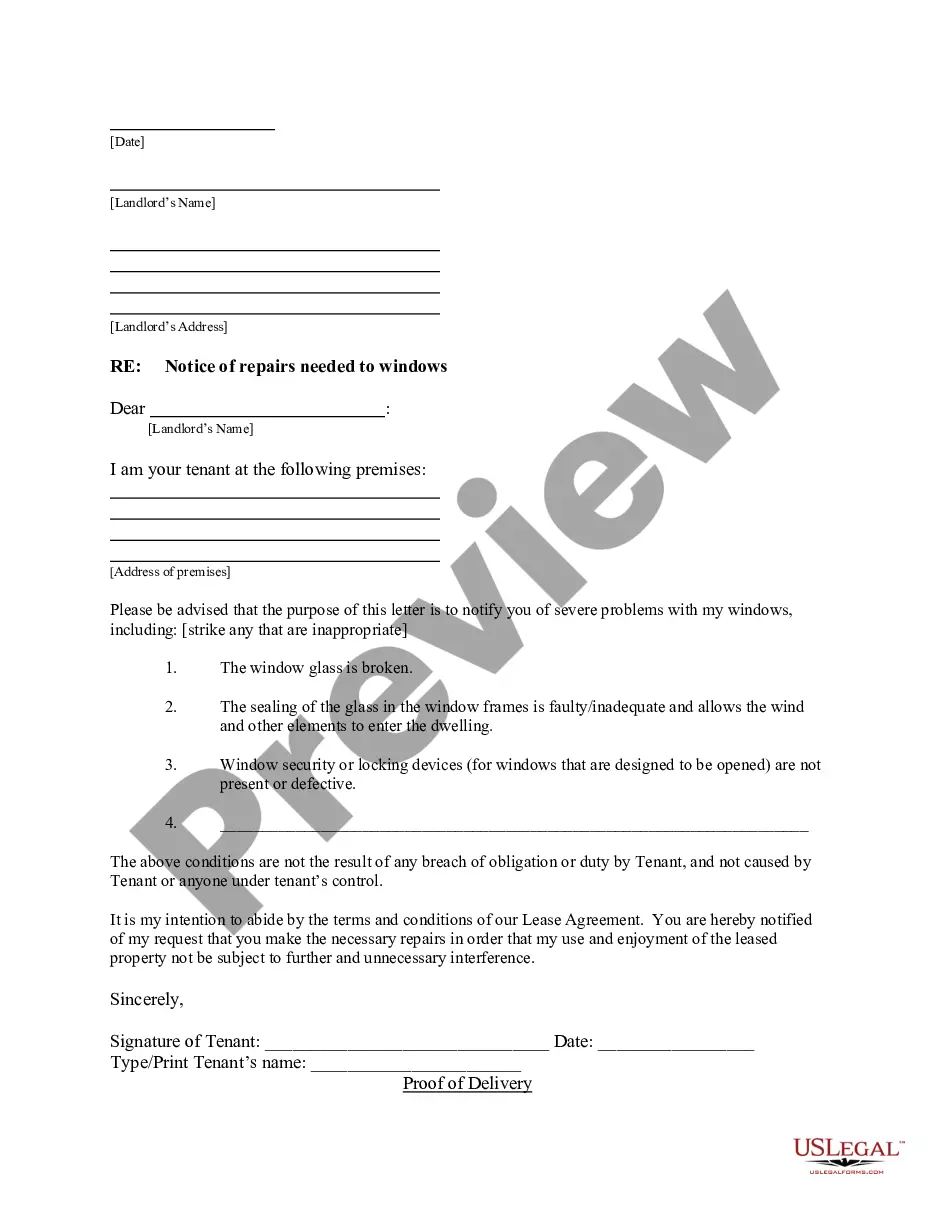

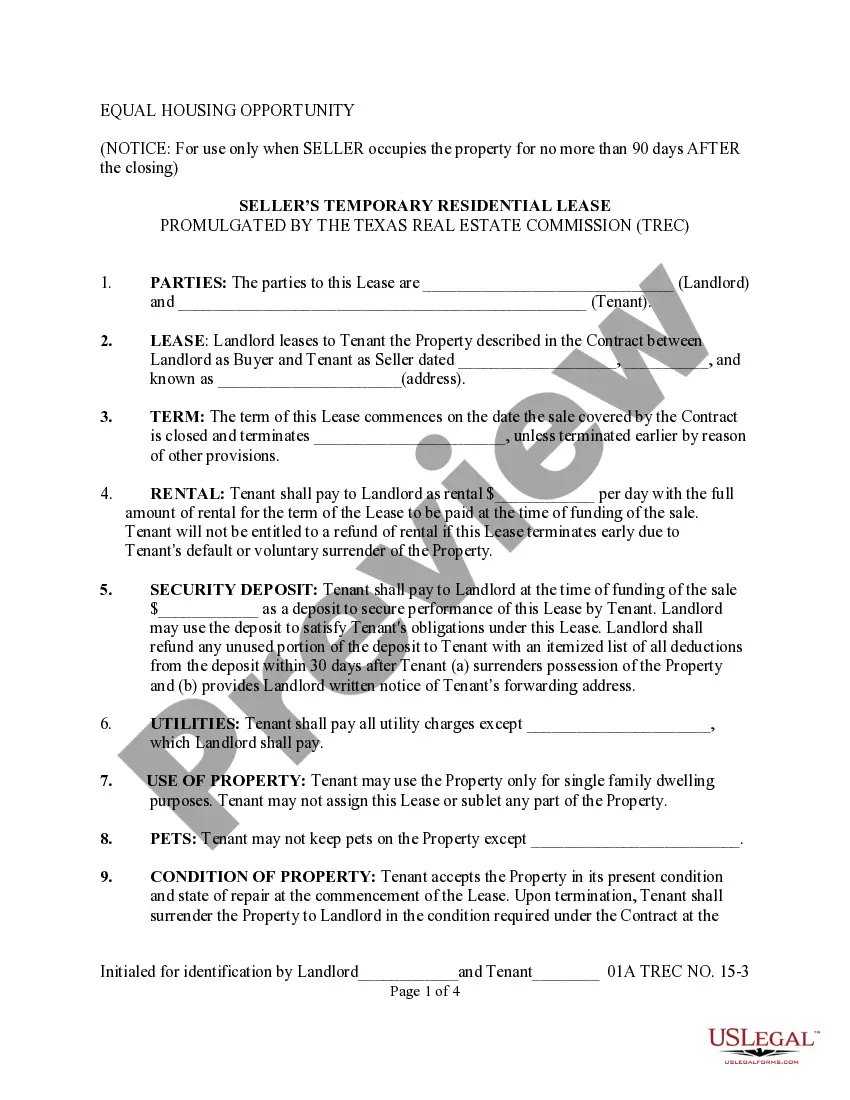

How to fill out Detailed Office Space Lease With Lessee To Pay Pro-rata Share Of Expenses?

You can spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that can be reviewed by experts.

You can easily obtain or print the Arizona Detailed Office Space Lease with Lessee to Pay Pro-rata Share of Expenses from your services.

Review the form description to confirm you have chosen the correct document. If available, utilize the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can sign in and click the Download button.

- Then, you can complete, modify, print, or sign the Arizona Detailed Office Space Lease with Lessee to Pay Pro-rata Share of Expenses.

- Each legal document template you purchase is yours indefinitely.

- To obtain an additional copy of any acquired form, go to the My documents section and click the relevant button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your chosen state/city.

Form popularity

FAQ

For instance, if your leased office space in an Arizona Detailed Office Space Lease occupies 1,000 square feet in a 10,000 square foot building, your pro rata share of shared expenses is 10%. This means if the total monthly expenses are $1,000, you would be responsible for $100. Grasping this concept will empower you to manage your lease obligations better and plan financially.

The formula for pro rata share is fairly straightforward. It involves multiplying the total expenses by the ratio of the leased space to the total space available. For instance, if a tenant occupies 1,000 square feet in a 10,000 square foot property, their pro rata share would be calculated as (1,000/10,000) multiplied by the total expenses of the property.

Tenant's Share may also be referred to as Tenant's Proportionate Share, Pro Rata Share or simply PRS. It represents the percentage of the Defined Area that is occupied by a particular tenant.

How to calculate pro rata salaryDivide the full-time annual salary by 52 (number of weeks)Divide the result by 40 (standard full-time weekly hours) to get the hourly rate.Multiply the hourly rate by the number of actual work hours per week.Multiply this by 52 to get the annual pro rata salary.

In general, the tenant's proportionate share is determined by taking the building's rentable square footage and dividing it by the tenant's rentable square footage. Local industry customs usually provide the landlord with the guiding principles for: Measuring the building.

There are three basic types of net leases: single, double, and triple net leases. With a triple net lease, the tenant promises to pay all the expenses of the property, including real estate taxes, building insurance, and maintenance. These payments are in addition to the fees for rent and utilities.

For example, a pro rata dividend is a dividend that is paid to each shareholder in proportion to the number of shares they own. If a company has 100 shares outstanding and it announces it will pay $1,000 in dividends to its shareholders, the pro rata amount that each share is worth is $10.

The pro-rata share is the percentage of expenses shared by the tenant for the shopping center or office building. In most leases, the pro-rata share is calculated as a fraction of the tenant's demised square footage divided by the total square footage of the shopping center or the building.

Some examples of items that might be included in Operating Expenses are: employee payroll and benefits for property managers, administrative, and other personnel; office supplies; legal fees; costs for repairs and maintenance of exterior and interior common areas, including, for instance, parking lots, lobbies,

In the context of commercial real estate, the term Pro Rata Share is a method of calculating a tenant's share of a building's expenses based upon a calculation defined in a tenant's lease. Pro Rata Share of expenses is generally expressed as a percentage.