Arizona Security Agreement Regarding Aircraft and Equipment

Description

Until a conveyance, lease, or instrument executed for security purposes which may be recorded under ??? 44107(a)(1) or (2) has been filed with the FAA, it is valid only against the parties to the instrument and individuals and entities who have actual knowledge of the instrument. Therefore, the interests of the parties to a transaction, including purchasers, lessor, lessees and secured parties, are not perfected until the instruments creating those interests have been filed with the FAA.

How to fill out Security Agreement Regarding Aircraft And Equipment?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

Through the website, you can access thousands of templates for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of documents such as the Arizona Security Agreement Regarding Aircraft and Equipment in just seconds.

If you have a monthly subscription, Log In and download the Arizona Security Agreement Regarding Aircraft and Equipment from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

Choose the format and download the form to your device.

Make modifications. Fill out, edit, print, and sign the acquired Arizona Security Agreement Regarding Aircraft and Equipment. Every template you added to your account has no expiration date and belongs to you indefinitely. Thus, if you wish to download or print another copy, simply go to the My documents section and click on the form you desire.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

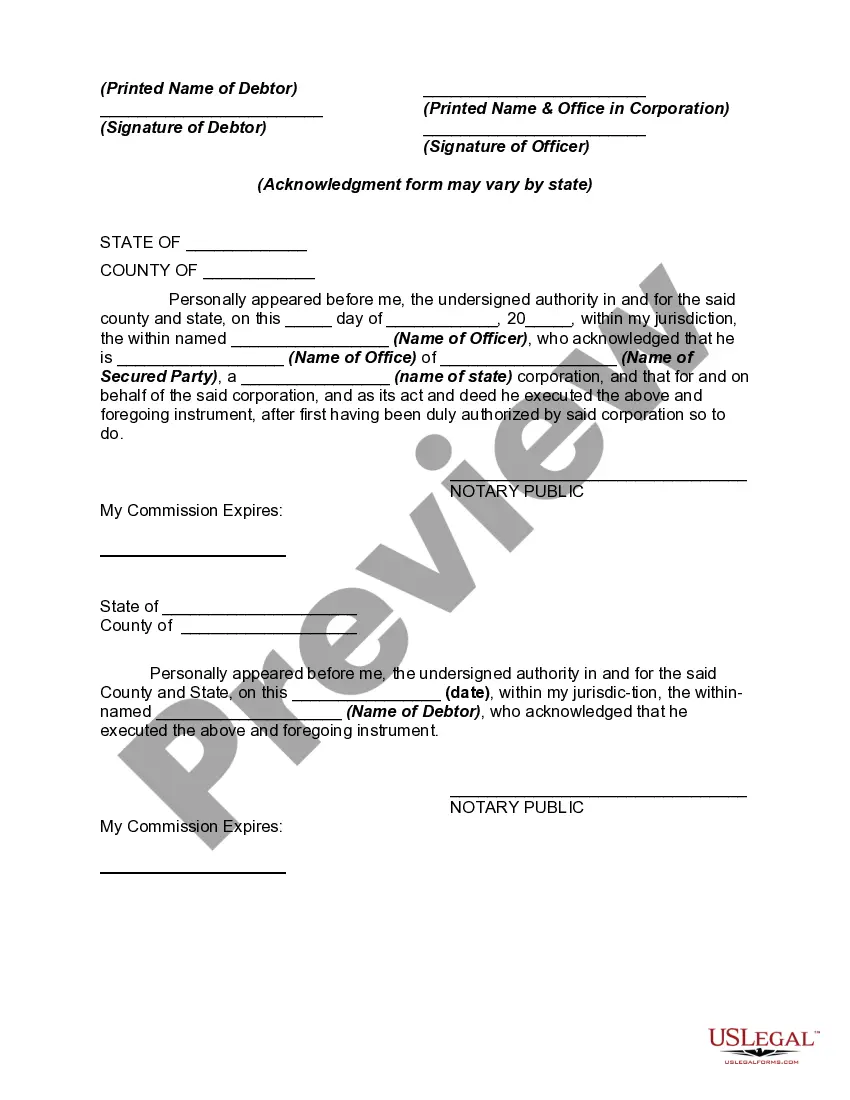

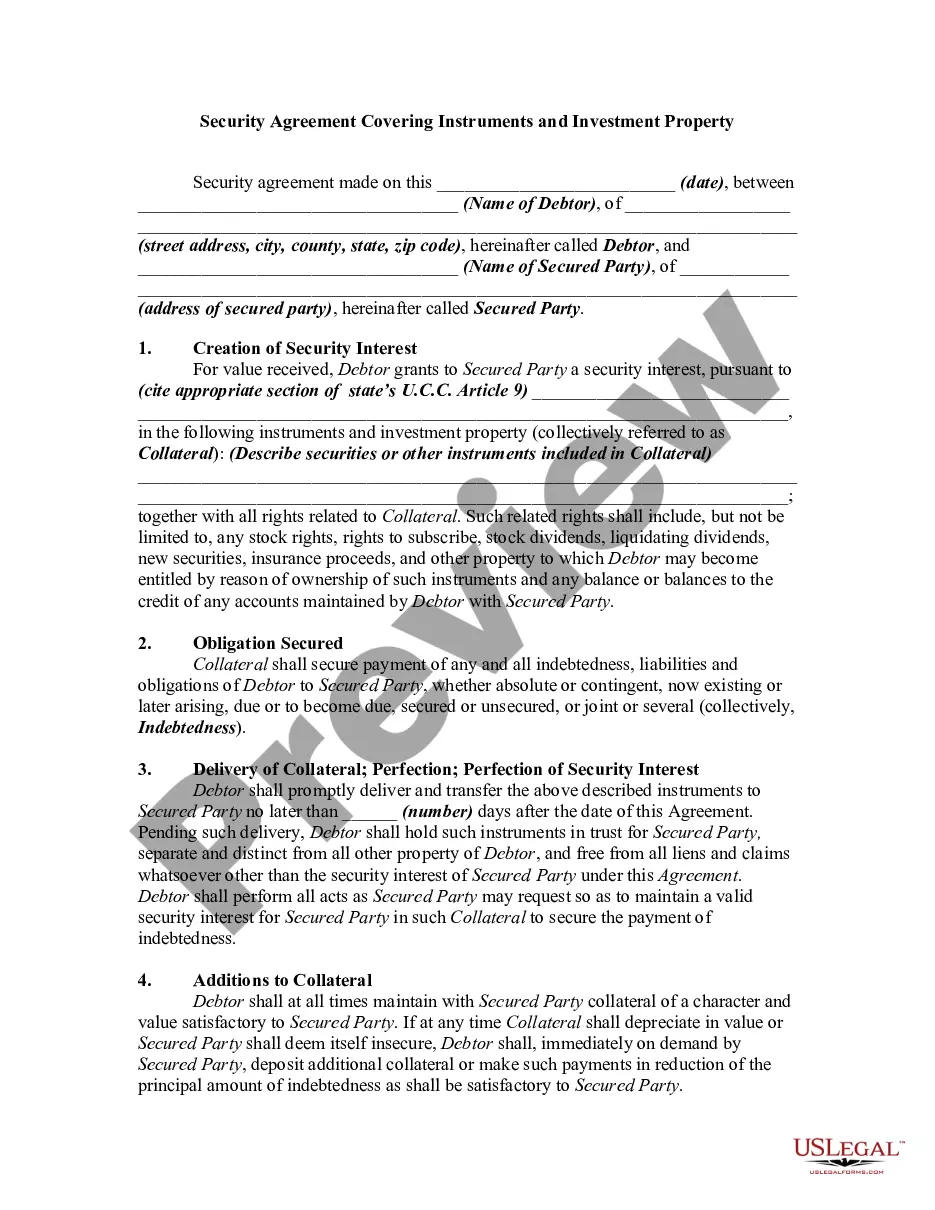

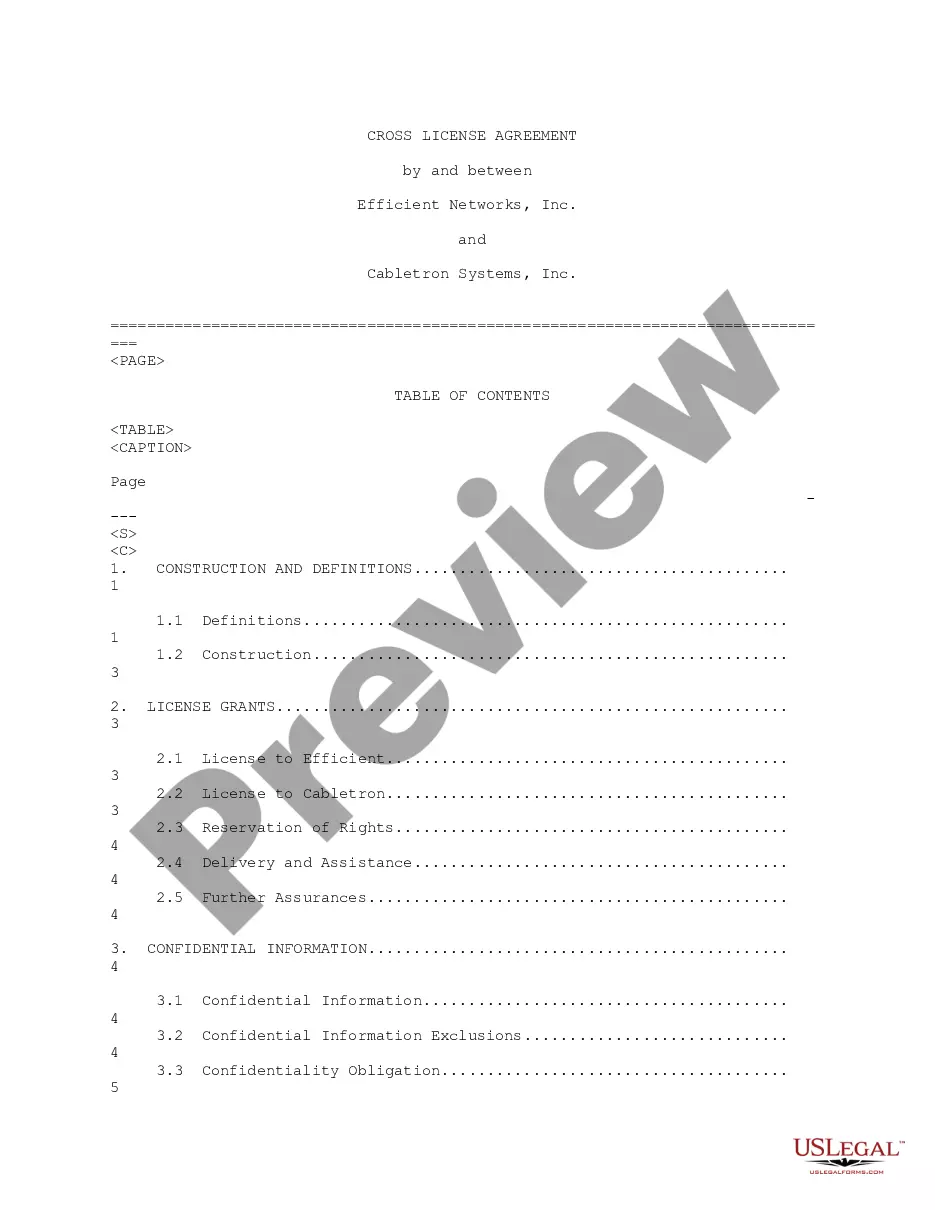

- Ensure you have selected the correct form for your region/county. Click the Preview button to examine the form’s content.

- Review the form description to confirm that you have chosen the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button. Next, choose the payment plan you prefer and provide your credentials to register for an account.

- Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the purchase.

Form popularity

FAQ

A security agreement and a lien are related, but they are not the same thing. A security agreement creates a legal framework defining the collateral and the rights of the parties involved, while a lien represents the legal claim against the collateral. In an Arizona Security Agreement Regarding Aircraft and Equipment, the agreement establishes the terms, while a lien serves as the practical claim that allows the lender to take possession of the aircraft and equipment if the borrower defaults. Understanding this difference is critical for anyone entering into a lending agreement.

The primary purpose of a security agreement is to establish the legal rights of a lender in the collateral provided by a borrower. When dealing with an Arizona Security Agreement Regarding Aircraft and Equipment, the agreement protects the lender's interest if the borrower fails to meet their obligations. This ensures that lenders can recoup losses by claiming the specified aircraft and equipment if necessary.

When purchasing an aircraft, you need to file several documents with the FAA, including the bill of sale and the registration application. It is essential to also prepare the Arizona Security Agreement Regarding Aircraft and Equipment to ensure that your ownership rights are well documented. These filings safeguard your investment and help establish your rightful ownership in case of disputes. US Legal Forms offers resources and templates to assist you in completing these crucial filings effectively.

To transfer ownership of an aircraft, you must complete the necessary documentation, including a bill of sale. Additionally, the new owner should file the Arizona Security Agreement Regarding Aircraft and Equipment with the Federal Aviation Administration (FAA). This agreement provides a clear record of ownership and helps protect your rights. Using a legal platform like US Legal Forms can streamline this process by providing ready-to-use templates and guidance.

Perfecting a security interest in aircraft requires careful adherence to both state and federal regulations. Filing a financing statement and registering with the FAA are essential steps in this process. An Arizona Security Agreement Regarding Aircraft and Equipment serves as a solid foundation for this endeavor, offering the necessary legal backing to enhance your protections.

To perfect a security interest in an airplane, you must file a UCC-1 financing statement and comply with any Federal Aviation Administration regulations. By doing so, you establish your claim against the aircraft. Incorporating an Arizona Security Agreement Regarding Aircraft and Equipment simplifies this process, ensuring you meet all legal obligations.

Yes, security agreements generally need to be recorded to provide notice to other parties. In Arizona, recording your security agreement enhances your legal protection. With an Arizona Security Agreement Regarding Aircraft and Equipment, you can efficiently navigate this recording process to safeguard your rights.

The three main ways of perfecting a security interest include filing a financing statement, taking possession of the collateral, or obtaining control over the collateral. Each method has its own advantages and implications. By leveraging an Arizona Security Agreement Regarding Aircraft and Equipment, you can choose the most suitable approach for your specific situation.

The most common way to perfect a security interest is by filing a financing statement with the appropriate state authority. In Arizona, this process is crucial for establishing your priority over other claims. Utilizing an Arizona Security Agreement Regarding Aircraft and Equipment, you ensure compliance with legal requirements while protecting your investment.

To perfect a security interest in a fixture, you must file a financing statement under the Uniform Commercial Code (UCC) in Arizona. This statement usually includes details about the fixture and the security agreement. An effective Arizona Security Agreement Regarding Aircraft and Equipment will help you clearly outline your rights and claims, ensuring clarity and legal strength.