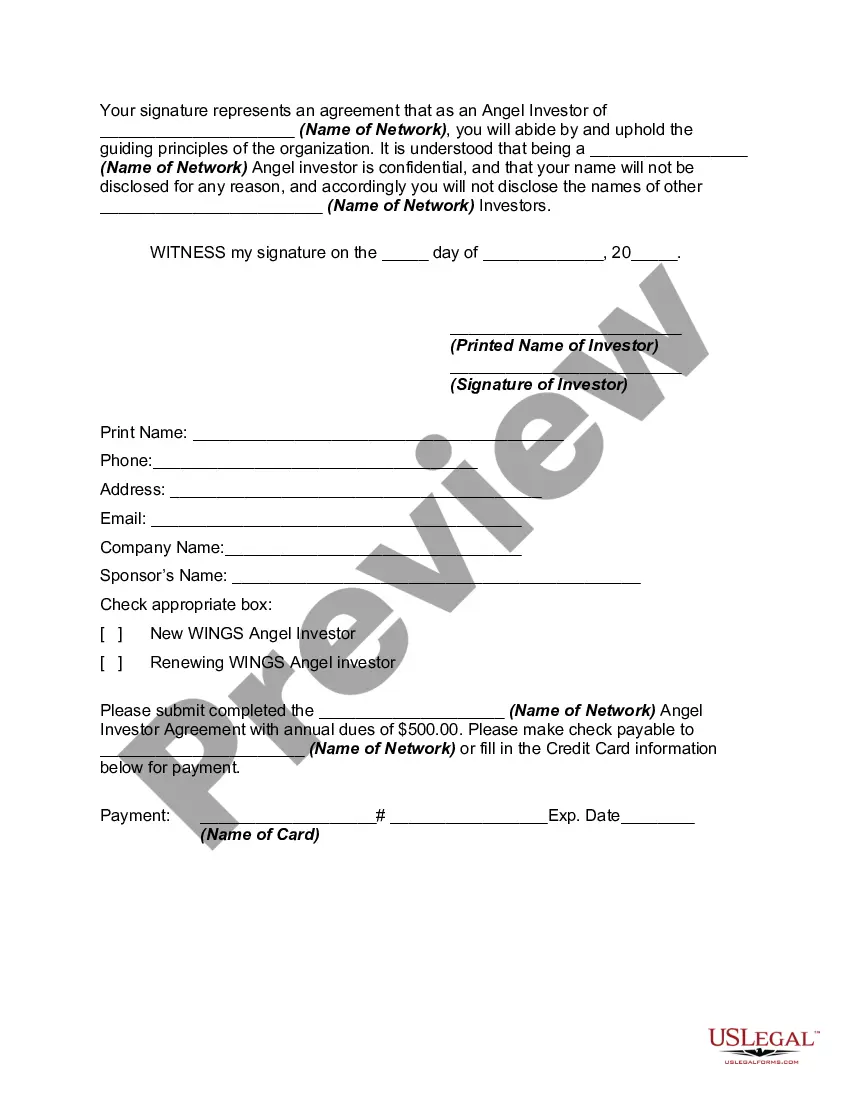

The Arizona Angel Investor Agreement is a legal document designed to facilitate investment between entrepreneurs and angel investors in the state of Arizona, United States. This agreement outlines the terms and conditions under which an angel investor provides funding to a startup or early-stage company. Angel investors are high-net-worth individuals who invest their personal funds into promising businesses, usually in exchange for equity or convertible debt. They often provide crucial financial support to startups that are not yet eligible for traditional bank loans or venture capital funding. The Arizona Angel Investor Agreement protects the interests of both parties involved in the investment. This agreement typically covers various important aspects, such as the amount of investment, the ownership percentage the investor receives in return, the valuation of the company, the rights and responsibilities of the investor, and provisions for governance and decision-making. It also outlines the terms of the exit strategy, including the conditions under which the investor can sell their shares or receive a return on investment. Within the Arizona Angel Investor Agreement, there may be different types or variations of agreements depending on the specific terms negotiated between the angel investor and the entrepreneur. Some common types of agreements include: 1. Equity Financing Agreement: This type of agreement involves the angel investor providing capital in exchange for ownership equity in the company. The investor becomes a shareholder and benefits from the company's success through capital appreciation and potential dividends. 2. Convertible Debt Agreement: In this agreement, the investor provides a loan to the entrepreneur, which can convert into equity at a future date based on predetermined conversion terms. This allows for flexibility and reduces the complexities of valuation at the initial investment stage. 3. SAFE (Simple Agreement for Future Equity): A relatively newer type of agreement, the SAFE instrument is gaining popularity in startup financing. It allows investors to provide capital in exchange for the right to obtain shares in future equity rounds, typically with additional discount or valuation cap provisions. 4. Revenue-Sharing Agreement: Instead of equity ownership, this agreement allows the angel investor to receive a percentage of the company's revenue over a specified period. This agreement may be preferred when the company is generating consistent cash flow but lacks the potential for high growth. It is important for entrepreneurs and angel investors in Arizona to carefully review and negotiate the terms of the Angel Investor Agreement to ensure a fair and mutually beneficial investment arrangement. Seeking legal advice from an experienced attorney can be crucial in drafting and finalizing these agreements while adhering to Arizona's specific regulatory requirements.

Arizona Angel Investor Agreement

Description

How to fill out Arizona Angel Investor Agreement?

It is possible to invest several hours on-line searching for the legitimate record web template that fits the state and federal specifications you will need. US Legal Forms gives a huge number of legitimate kinds that are evaluated by professionals. It is possible to down load or produce the Arizona Angel Investor Agreement from my assistance.

If you currently have a US Legal Forms accounts, you can log in and click the Download switch. Next, you can total, revise, produce, or sign the Arizona Angel Investor Agreement. Every single legitimate record web template you get is the one you have for a long time. To acquire another copy of any acquired develop, proceed to the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms internet site initially, stick to the straightforward recommendations under:

- First, make certain you have chosen the correct record web template for your area/town of your liking. Read the develop explanation to ensure you have selected the appropriate develop. If offered, use the Preview switch to search through the record web template too.

- If you wish to get another edition in the develop, use the Search field to find the web template that suits you and specifications.

- When you have discovered the web template you want, simply click Purchase now to move forward.

- Choose the costs program you want, key in your references, and register for a free account on US Legal Forms.

- Full the deal. You can use your bank card or PayPal accounts to purchase the legitimate develop.

- Choose the formatting in the record and down load it to your system.

- Make modifications to your record if necessary. It is possible to total, revise and sign and produce Arizona Angel Investor Agreement.

Download and produce a huge number of record templates while using US Legal Forms website, that provides the greatest selection of legitimate kinds. Use professional and state-distinct templates to deal with your business or specific requirements.

Form popularity

FAQ

To become an angel investor in Canada, one should start by understanding the investment landscape and the legal requirements. While many aspects are similar to the Arizona Angel Investor Agreement framework, it's essential to review Canadian-specific guidelines. Building a network with fellow investors and startups can provide valuable insights. You might also benefit from consulting legal resources for comprehensive knowledge.

While many people aspire to be angel investors, certain financial criteria often apply. In Arizona, the Arizona Angel Investor Agreement outlines the necessary qualifications and potential restrictions in place for investors. Nevertheless, educating yourself about the investment landscape can help you determine your eligibility. Stay informed about the requirements that govern this exciting role.

Generally, you do not need a special license to become an angel investor. However, following legal guidelines is crucial to ensure compliance, especially regarding the Arizona Angel Investor Agreement. It's advisable to familiarize yourself with local regulations and possibly consult with experts to avoid any pitfalls. Your investment approach should always align with legal standards.

Yes, you can be an angel investor without being accredited, but there are limitations. Each state has different rules, and in Arizona, understanding the legal framework is essential. The Arizona Angel Investor Agreement can provide guidance on what it means to invest without accreditation. It's wise to consult with a legal professional to navigate the complexities.

The agreement between a business owner and an investor typically lays out the expectations, responsibilities, and rights of both parties. This may include investment amounts, ownership stakes, and conditions for profit distribution. By using an Arizona Angel Investor Agreement, both parties can establish a clear understanding that fosters a healthy investment relationship and drives business growth.

Writing an investor agreement involves several steps, starting with defining the parties and outlining the agreement's purpose. Next, you should specify the investment terms, including amounts, payment schedules, and consequences for non-compliance. A structured Arizona Angel Investor Agreement template from uslegalforms can provide clarity and ensure that you include all necessary elements for a successful partnership.

To structure an investor agreement, start with a comprehensive introduction outlining the context of the agreement. Include sections on the investment amount, equity distribution, decision-making processes, and exit strategies for both parties. The Arizona Angel Investor Agreement can help you create a well-organized structure that anticipates future business developments and preserves a positive partnership.

Structuring an investor deal involves clearly defining the roles and contributions of each party. You should outline financial terms, such as investment amounts and profit-sharing arrangements, while considering the long-term relationship between the investor and the company. An Arizona Angel Investor Agreement can serve as a guide to create a balanced deal that fosters growth and cooperation.

To write an investment agreement sample, start by stating the purpose and define the involved parties clearly. Next, include details like the investment amount, the ownership structure, and any obligations or rights of each party. Utilizing resources like the Arizona Angel Investor Agreement template from uslegalforms can streamline this process, providing a solid foundation to customize based on your needs.

An investment agreement is a formal document outlining the terms and conditions of an investment between a business owner and an investor. It details the amount of investment, ownership percentages, and the expectations of both parties. A well-drafted Arizona Angel Investor Agreement protects the interests of both the business and the investor, ensuring clarity and mutual understanding.