Arizona Participation Agreement in Connection with Secured Loan Agreement

Description

Participations in the loan are sold by the lead bank to other banks. A separate contract called a loan participation agreement is structured and agreed among the banks. Loan participations can either be made with equal risk sharing for all loan participants, or on a senior/subordinated basis, where the senior lender is paid first and the subordinate loan participation paid only if there is sufficient funds left over to make the payments.

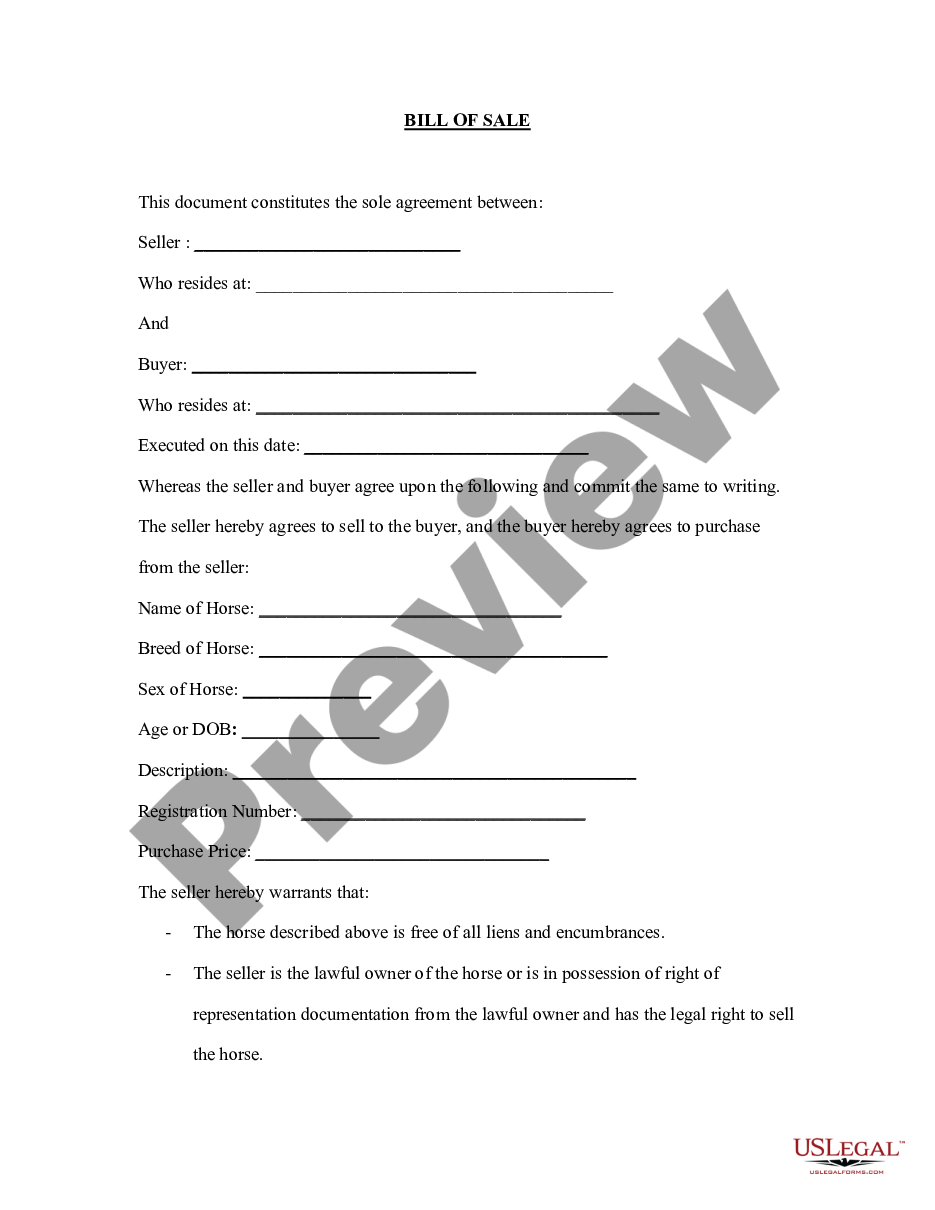

How to fill out Participation Agreement In Connection With Secured Loan Agreement?

You can spend hours online searching for the legal document template that meets the federal and state regulations you need.

US Legal Forms offers thousands of legal forms that can be reviewed by professionals.

You can download or print the Arizona Participation Agreement related to Secured Loan Agreement from this service.

If available, use the Review button to take a look at the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Next, you can complete, modify, print, or sign the Arizona Participation Agreement related to Secured Loan Agreement.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of a purchased form, navigate to the My documents tab and click on the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the form description to confirm you have chosen the proper type.

Form popularity

FAQ

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

Generally, participation agreements involve one or more participants who purchase an interest in the underlying loan, but a single lender, the lead lender, retains control over the loan and manages the relationship with the borrower.

A secured loan is a loan connected to collateral. A collateral is something of value like a car or a house or equity shares. A lender has the right to take possession of the collateral if you fail to repay the loan as agreed. The most common examples of secured loans are car loan and a mortgage loan.

A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

Participation mortgages reduce the risk to participants and allow them to increase their purchasing power. Many of these mortgages, therefore, tend to come with lower interest rates, especially when multiple lenders are also involved.

Participations are a long-established means by which both: Lenders can reduce their exposure to a borrower's credit risk by selling interests in their loans. An investor can acquire an interest in a borrower's loan without becoming a lender under the loan agreement.

Secured loans are loans that are protected by collateral. This means that when you apply for a secured loan, the lender will want to know which of your assets you plan to use to back the loan. The lender will then place a lien on that asset until the loan is repaid in full.

Disadvantages of Secured LoansThe personal property named as security on the loan is at risk. If you encounter financial difficulties and cannot repay the loan, the lender could seize the property. Typically, the amount borrowed can only be used to purchase a specific asset, like a home or a car.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties.

A secured loan is a loan backed by collateralfinancial assets you own, like a home or a carthat can be used as payment to the lender if you don't pay back the loan. The idea behind a secured loan is a basic one. Lenders accept collateral against a secured loan to incentivize borrowers to repay the loan on time.