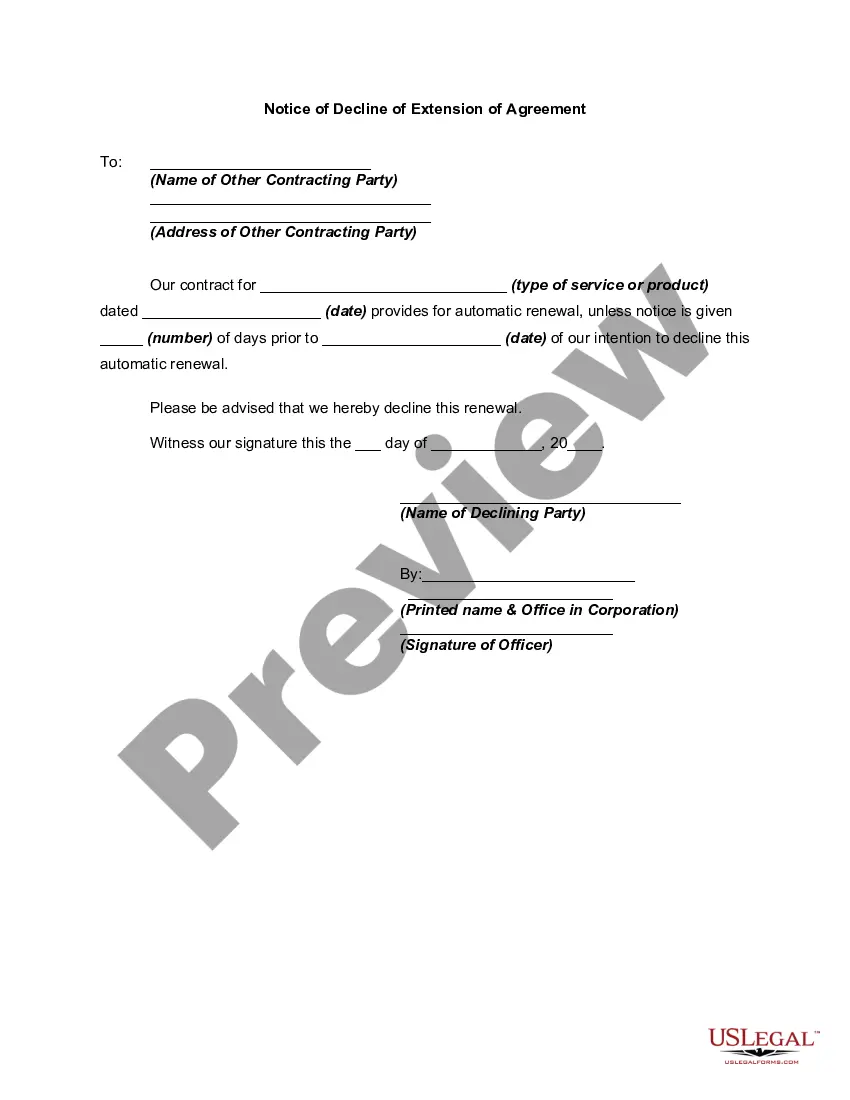

Many different types of contracts provide for automatic extension unless timely notice is given that a party declines such an extension. This is a generic form declining such an extension.

Arizona Notice of Decline of Extension of Agreement

Description

How to fill out Notice Of Decline Of Extension Of Agreement?

Are you presently in a location where you will require documents for either business or personal reasons on a daily basis.

There are many reliable document templates available online, but finding ones you can trust can be challenging.

US Legal Forms offers a vast array of form templates, such as the Arizona Notice of Decline of Extension of Agreement, designed to comply with state and federal regulations.

7. Select a convenient file format and download your copy.

8. Access all the document templates you have acquired in the My documents section. You can obtain another copy of the Arizona Notice of Decline of Extension of Agreement anytime if needed. Just click on the appropriate form to download or print the document template. Utilize US Legal Forms, which offers one of the most extensive collections of legitimate templates, to save time and avoid mistakes. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account at US Legal Forms and start making your life a bit simpler.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arizona Notice of Decline of Extension of Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these guidelines.

- 1. Find the form you need and ensure it is for the correct state/region.

- 2. Use the Review button to look over the form.

- 3. Read the description to confirm you have selected the correct document.

- 4. If the form does not match your requirements, use the Lookup field to find the document that suits your needs.

- 5. Once you locate the correct form, click on Buy now.

- 6. Choose the pricing plan you prefer, fill in the necessary information to create your account, and purchase the order using your PayPal or credit card.

Form popularity

FAQ

Yes, Arizona requires corporations to file a corporate extension if they need additional time to submit their tax returns. Simply filing for a federal extension does not cover your Arizona obligations. The Arizona Notice of Decline of Extension of Agreement highlights the importance of making these requests separately to avoid problems with the state. Make use of resources like uslegalforms to facilitate your filing.

Yes, filing for a state extension is necessary, even if you have filed a federal extension. The Arizona Notice of Decline of Extension of Agreement emphasizes that each extension request must be made according to state tax laws. Failing to do so may lead to penalties and interest. Always verify your state's requirements to ensure compliance.

No, Illinois does not automatically extend your state taxes if you have filed a federal extension. Each state operates under its own set of rules concerning tax filings. Make sure to file the required Illinois extension separately to avoid issues. Understanding distinctions like this can prevent problems similar to those with the Arizona Notice of Decline of Extension of Agreement.

Yes, you can file your federal tax return now and file the Arizona state return later. However, it is important to be aware of the deadlines for both federal and state filings. If you do not file the state extension in a timely manner, you may face penalties. The Arizona Notice of Decline of Extension of Agreement can help clarify your obligations.

You can mail your Arizona extension to the Arizona Department of Revenue. Make sure to check their website for the most current mailing address for extensions. It is essential to properly address your envelope, as incorrect addresses can lead to delays. Don't forget to keep a copy for your records after filing.

No, you cannot file two tax extensions for the same tax year. Once you submit a request for an Arizona extension, that is the only extension you can obtain for that year. Keep in mind that the Arizona Notice of Decline of Extension of Agreement will indicate your options if you missed your deadline. Always file on time to avoid complications.

Yes, you must file a state extension even if you have filed a federal extension. The Arizona Notice of Decline of Extension of Agreement requires separate filings for state taxes. Each state has its rules, and Arizona does not automatically accept the federal extension as a valid state extension. Make sure to file your Arizona extension to avoid penalties.

Arizona does not automatically extend with federal deadlines. If you file for a federal extension, you must still file an Arizona extension separately. Understanding both sets of regulations can help you avoid complications. The Arizona Notice of Decline of Extension of Agreement emphasizes the importance of staying informed on filing requirements.

Arizona does not automatically extend your filing deadline with a federal extension. Taxpayers must submit a specific request for an Arizona extension. Always double-check both federal and state requirements to avoid missing deadlines. The Arizona Notice of Decline of Extension of Agreement can serve as a reminder of this necessity.

Arizona generally aligns its extension policies with federal guidelines, but they require specific actions to validate it. Taxpayers must adhere to state regulations even after federal approval. Make sure to stay updated on any changes that may affect your obligations. Reference the Arizona Notice of Decline of Extension of Agreement when in doubt.