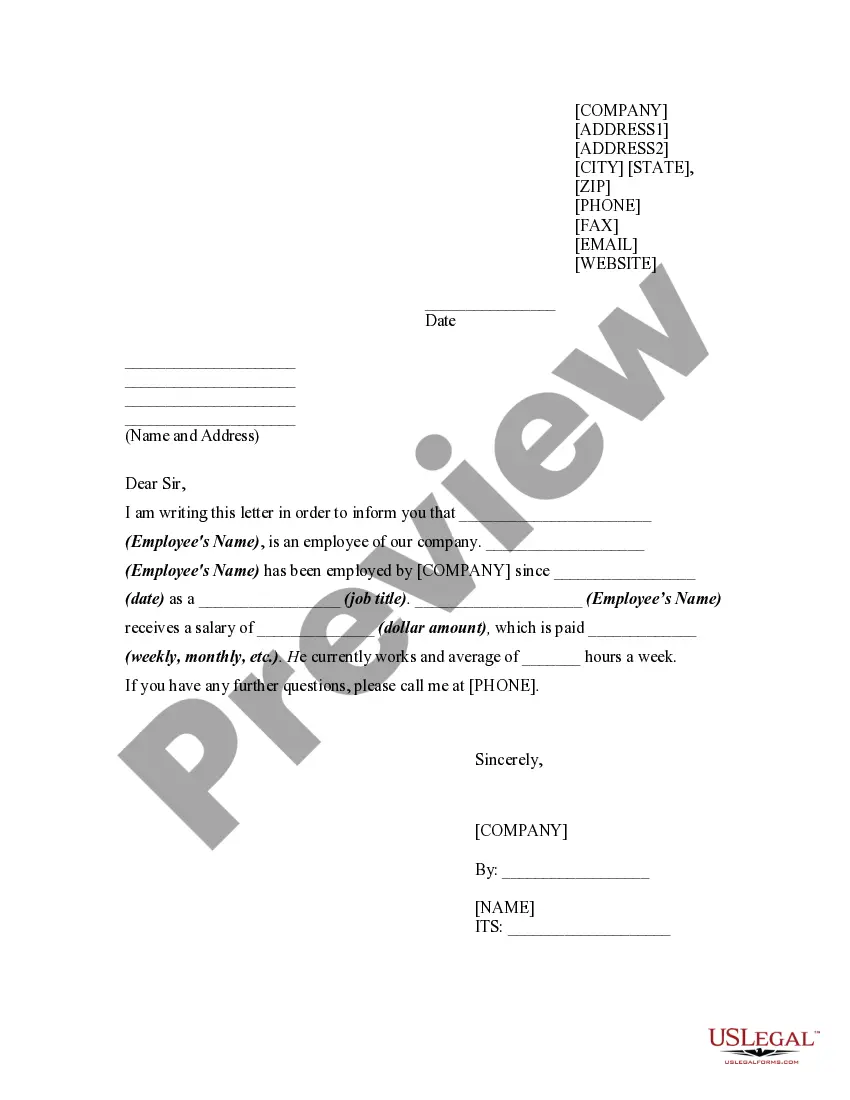

The Arizona Sales Receipt is a legal document issued to customers by businesses operating within the state of Arizona after a sales transaction has taken place. It serves as proof of purchase and records the details of the sale conducted. This document is crucial for both the seller and the buyer for various purposes, such as tracking sales, maintaining accurate financial records, facilitating returns or exchanges, and calculating taxes. The Arizona Sales Receipt typically includes several key components. Firstly, it contains the name and contact information of the seller, including their business name, address, phone number, and sometimes their tax identification number. Similarly, the buyer's information, such as name, address, and contact details, is also mentioned. A unique identification number or receipt number is usually assigned to each sales receipt, allowing for easy tracking and reference. The date and time of the transaction are recorded, providing a chronological order of sales made by the seller. Additionally, the receipt outlines the payment method used in the transaction, whether it be cash, credit card, debit card, check, or electronic payment. The sales receipt also includes a detailed list of the purchased items or services. Each item is typically described individually, mentioning the product or service name, quantity, unit price, and total price. This breakdown allows the buyer to verify the items purchased and facilitates inventory control for the seller. Depending on the nature of the sale, specific details may be included on the Arizona Sales Receipt. For instance, if the sale is subject to sales tax, the receipt includes the tax rate applied and the calculated tax amount. Some receipts also indicate any discounts, promotions, or coupons applied to the sale, providing complete transparency to the buyer. In Arizona, there are no specific types of sales receipts mandated by the state. However, businesses may choose to use custom-designed receipts or opt for electronic receipts (e-receipts) instead of traditional paper-based ones. Electronic receipts are increasingly popular as they offer convenience to both businesses and customers, reducing paper waste and enabling easy record-keeping. In conclusion, the Arizona Sales Receipt is an essential document that serves as evidence of a completed sales transaction within the state. It includes vital information about the seller, buyer, payment method, date, and purchased items. Whether in paper or electronic format, the sales receipt plays a crucial role in maintaining accurate financial records, tracking sales, and complying with taxation regulations.

Arizona Sales Receipt

Description

How to fill out Arizona Sales Receipt?

If you have to full, download, or print legitimate document web templates, use US Legal Forms, the biggest collection of legitimate varieties, which can be found on the Internet. Utilize the site`s simple and handy look for to get the documents you will need. A variety of web templates for business and person functions are sorted by categories and states, or keywords. Use US Legal Forms to get the Arizona Sales Receipt within a few click throughs.

If you are presently a US Legal Forms consumer, log in for your profile and then click the Download key to obtain the Arizona Sales Receipt. You may also entry varieties you in the past delivered electronically inside the My Forms tab of your respective profile.

If you are using US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape for the appropriate city/country.

- Step 2. Utilize the Review method to check out the form`s content material. Don`t overlook to read through the information.

- Step 3. If you are not satisfied using the kind, take advantage of the Research area towards the top of the display to find other models of your legitimate kind template.

- Step 4. Once you have identified the shape you will need, click the Acquire now key. Opt for the prices plan you choose and add your references to sign up for the profile.

- Step 5. Method the deal. You should use your credit card or PayPal profile to complete the deal.

- Step 6. Choose the format of your legitimate kind and download it on your own device.

- Step 7. Total, modify and print or indicator the Arizona Sales Receipt.

Each legitimate document template you get is your own for a long time. You may have acces to every single kind you delivered electronically with your acccount. Go through the My Forms portion and decide on a kind to print or download yet again.

Compete and download, and print the Arizona Sales Receipt with US Legal Forms. There are thousands of professional and state-specific varieties you can use for your business or person needs.

Form popularity

FAQ

To apply for Arizona's Transaction Privilege Tax, you will need to complete the appropriate application form, which can be found on the Arizona Department of Revenue's website. After filling out the form correctly, submit it along with any required documents. Using a service like uslegalforms can simplify this process by providing templates and guidance to help you along the way.

No, TPT and EIN are different. TPT, or Transaction Privilege Tax, is a tax levied on businesses for the privilege of conducting sales, while an EIN (Employer Identification Number) is a unique identifier for businesses for tax purposes. When preparing an Arizona Sales Receipt, ensure the correct identification numbers are used to avoid confusion during tax filings.

Arizona does not generally collect sales tax on out-of-state sales since these transactions occur outside its jurisdiction. However, if a seller has a physical presence or nexus in Arizona, they may be required to collect the tax. For accurate recordkeeping and compliance, it's vital for businesses to issue proper Arizona Sales Receipts that reflect transactions accordingly.

In Arizona, sales tax is based on the destination. This means that tax rates applied to an Arizona Sales Receipt depend on where the buyer takes possession of the goods. As a result, knowing the correct rates for different locations is essential for accurate tax calculations. Businesses should stay informed about local tax rates to avoid any compliance issues.

Arizona's Transaction Privilege Tax (TPT) functions similarly to a sales tax, but there are differences. While sales tax is charged on the sale of goods, TPT is a tax on the privilege of doing business in Arizona. Understanding these distinctions is crucial when preparing an Arizona Sales Receipt. This knowledge helps businesses ensure accurate compliance with state tax laws.

In Arizona, certain entities are exempt from sales tax. For instance, nonprofits engaged in specific activities may qualify for exemptions. Additionally, government agencies and some educational institutions can also be exempt. It’s important to review the Arizona Sales Receipt regulations to ensure compliance and eligibility.

Filling out the title when selling a car in Arizona involves signing in the designated area and providing the buyer's information. Make sure to include the odometer reading and any applicable disclosures. Completing the title correctly is vital for a smooth transfer of ownership, and you can also utilize the Arizona Sales Receipt for added documentation.

In Arizona, a bill of sale is not strictly required for all transactions, but it is highly recommended. This document provides proof of ownership transfer and can protect you in the event of disputes. To create a proper Arizona Sales Receipt, consider using resources from USLegalForms for accuracy and legal protection.

No, a sales receipt and a bill of sale serve different purposes. A sales receipt is typically a proof of payment, while a bill of sale is a legal document that transfers ownership of an item. Both documents can be beneficial, but ensure your Arizona Sales Receipt serves the specific purpose you need.

Yes, you can create a handwritten bill of sale in Arizona. Make sure it includes all essential details such as names, addresses, and a description of the item. While a handwritten document is acceptable, using a template may enhance clarity and professionalism, giving you a solid Arizona Sales Receipt.