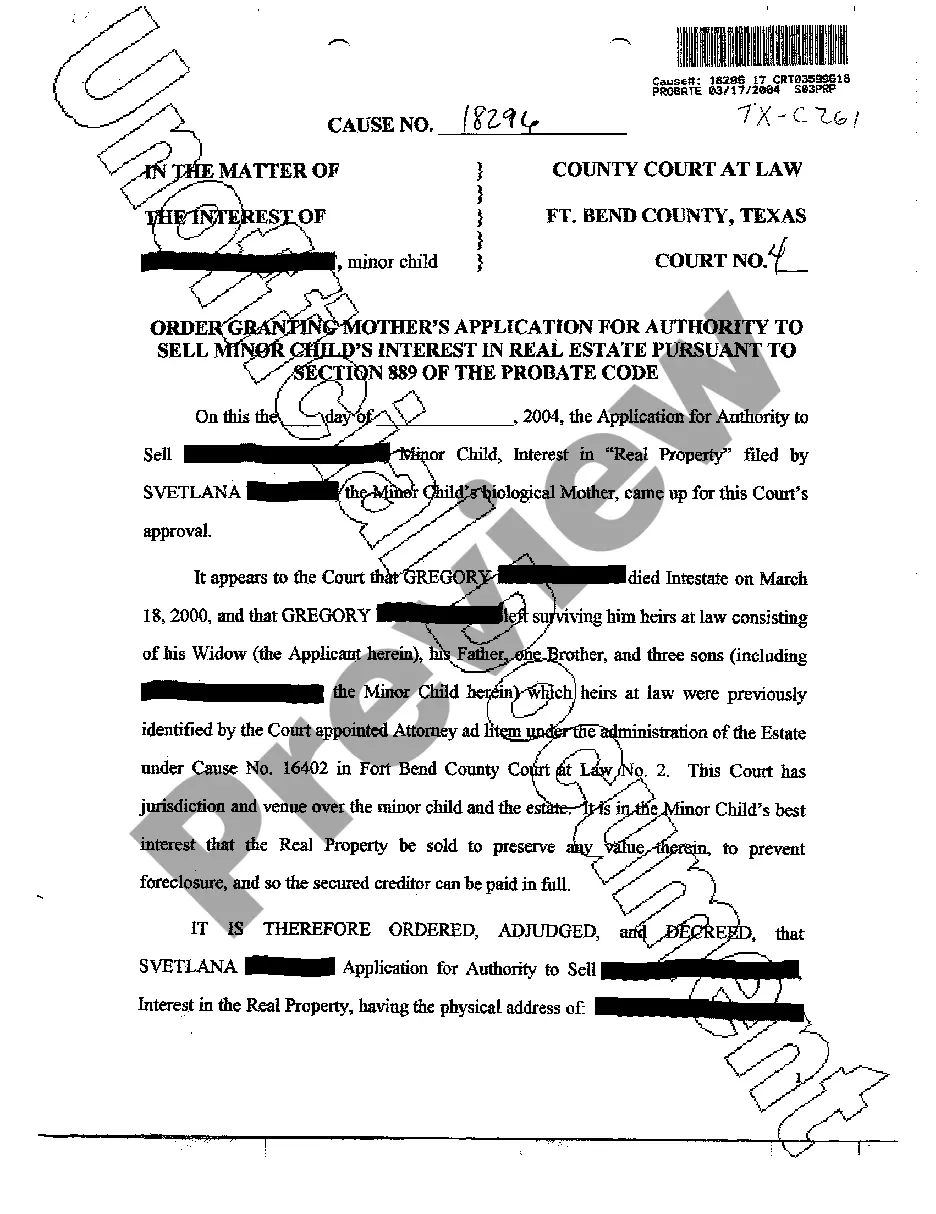

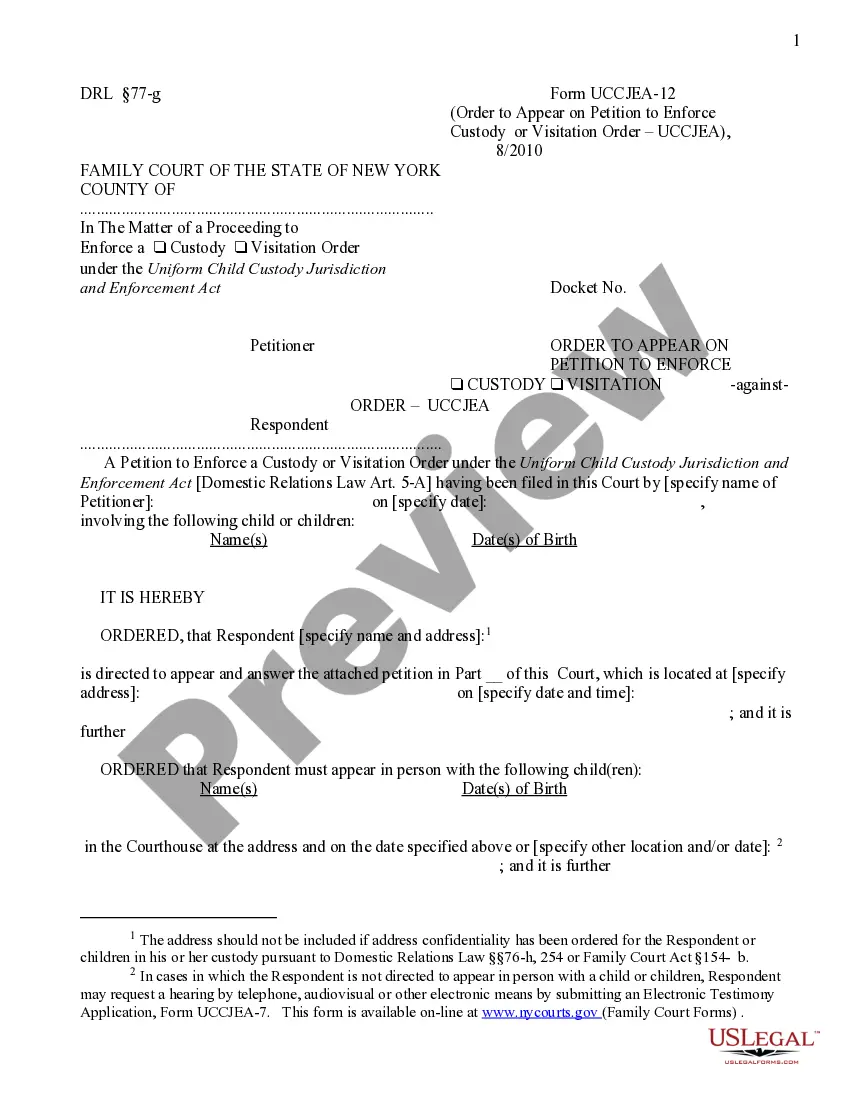

Arizona Invoice Template for Chef: A Comprehensive Guide An Arizona Invoice Template for Chef is a professionally designed document that enables chefs and culinary professionals to effectively manage their finances and streamline their invoicing processes. This template is specifically tailored to meet the needs of chefs operating within the state of Arizona, ensuring compliance with applicable tax laws and necessary details unique to this region. The Arizona Invoice Template for Chef includes various relevant keywords to provide a comprehensive solution specifically designed for this niche. Some of these keywords include: 1. Arizona-Specific: This template takes into account the specific requirements and regulations in Arizona, ensuring that chefs adhere to local tax laws and accurately track sales tax information. 2. Customizable: The template offers a high degree of customization, allowing chefs to tailor their invoice to suit their specific business needs. They can add their own logo, branding elements, and personalize the template with their contact information. 3. Itemized Billing: Chefs can easily itemize and list all the services and products provided to their clients, ensuring transparency and accountability. The template allows for detailed descriptions, quantities, rates, and amounts for each item, resulting in clear and accurate invoices. 4. Sales Tax Calculation: As per Arizona tax laws, the template includes an automated sales tax calculation feature. It enables chefs to calculate and include the applicable sales tax rate for each item or service, simplifying the overall invoicing process. 5. Payment Terms and Methods: The template incorporates sections to outline payment terms, due dates, and accepted payment methods. Chefs can specify whether they accept cash, checks, credit cards, or other forms of electronic payment. Additionally, they can include late payment penalties or discounts for early payment. Different Types of Arizona Invoice Templates for Chef: 1. Basic Invoice Template: A simple and straightforward template that includes essential sections such as invoice number, invoice date, client details, itemized billing, and payment information. Ideal for chefs who prefer a minimalist approach. 2. Hourly Rate Invoice Template: Specifically designed for chefs who charge clients on an hourly basis. This template includes sections to specify hourly rates, the number of hours worked, and total billing amount, ensuring accurate time-based invoicing. 3. Menu-Based Invoice Template: A specialized template for chefs who provide prefixed menus or catered events. This template allows chefs to list menu items, quantities, pricing per person, along with any additional charges for special requests or dietary needs. 4. Retainer-Based Invoice Template: Suitable for chefs who work with clients on a retainer basis, this template includes sections to specify retainer terms, billing frequency, and any additional services provided beyond the retainer agreement. Overall, an Arizona Invoice Template for Chef simplifies the billing process for culinary professionals operating within the state and ensures compliance with local tax regulations. By utilizing the right template, chefs can enhance their professionalism, improve financial management, and maintain a streamlined invoicing system.

Arizona Invoice Template for Chef

Description

How to fill out Arizona Invoice Template For Chef?

It is possible to spend time online attempting to find the legal file web template that fits the federal and state requirements you require. US Legal Forms gives a huge number of legal forms that happen to be examined by experts. It is possible to download or produce the Arizona Invoice Template for Chef from your service.

If you currently have a US Legal Forms accounts, you can log in and then click the Obtain switch. After that, you can complete, edit, produce, or indicator the Arizona Invoice Template for Chef. Each and every legal file web template you purchase is yours permanently. To get one more copy associated with a acquired kind, go to the My Forms tab and then click the related switch.

If you work with the US Legal Forms website initially, adhere to the basic recommendations under:

- Initial, make sure that you have selected the proper file web template to the county/town of your choosing. Read the kind explanation to make sure you have selected the appropriate kind. If offered, make use of the Preview switch to appear through the file web template also.

- In order to get one more variation in the kind, make use of the Search area to get the web template that fits your needs and requirements.

- After you have discovered the web template you want, click on Buy now to continue.

- Pick the rates strategy you want, type your qualifications, and sign up for a free account on US Legal Forms.

- Total the financial transaction. You may use your charge card or PayPal accounts to fund the legal kind.

- Pick the formatting in the file and download it to the gadget.

- Make modifications to the file if possible. It is possible to complete, edit and indicator and produce Arizona Invoice Template for Chef.

Obtain and produce a huge number of file layouts utilizing the US Legal Forms web site, which offers the greatest variety of legal forms. Use expert and condition-certain layouts to deal with your small business or personal needs.

Form popularity

FAQ

Microsoft Word also offers a few free templates. You can find them from File > New and then searching/selecting from the available invoice templates.

How to Create a Business InvoiceDownload the free Business Invoice Template from FreshBooks.Add any business branding, such as the logo, colors and font of your own company.Include your name, your business name (if have one) and contact details.Outline each service and/or product provided, as well as the cost.More items...

Check out these free invoice creators:Simple Invoicing.Zoho Online Free Invoice Generator.FreshBooks Invoice Generator.Invoiced Free Invoice Generator.PayPal Online Invoicing.Free Invoice Maker.Invoice Ninja.Invoice-o-matic. This free invoice generator has a beautiful user interface.More items...?

Here's a detailed step-by-step guide to making an invoice from a Word template:Open a New Word Document.Choose Your Invoice Template.Download the Invoice Template.Customize Your Invoice Template.Save Your Invoice.Send Your Invoice.Open a New Blank Document.Create an Invoice Header.More items...?

To create an invoice in Word from scratch, businesses can follow these invoicing steps:Open a New Blank Document.Create an Invoice Header.Add the Invoice Date.Include a Unique Invoice Number.Include Your Client's Contact Details.Create an Itemized List of Services.Display the Total Amount Due.More items...?

How to create an invoice: step-by-stepMake your invoice look professional. The first step is to put your invoice together.Clearly mark your invoice.Add company name and information.Write a description of the goods or services you're charging for.Don't forget the dates.Add up the money owed.Mention payment terms.

You work hard for your clients, so make sure your Google Docs invoice works just as hard to get you paid! Download the invoice template. It's fast and easy to do and best of all it's absolutely free!

How to Create a Simple InvoiceDownload the basic Simple Invoice Template in PDF, Word or Excel format.Open the new invoice doc in Word or Excel.Add your business information and branding, including your business name and logo.Customize the fields in the template to create your invoice.Name your invoice.Save

One of the easiest ways to deal with this is by using an invoice generator, which simplifies the billing process. These invoice generators were designed to assist you with your invoicing needs and are also freeideal for any budget.