Title: Arizona Checklist — Key Record Keeping: Ensuring Efficient Business Management Introduction: The Arizona Checklist — Key Record Keeping serves as a vital tool for individuals and businesses in Arizona to maintain organized and accessible records. This comprehensive checklist ensures compliance with Arizona state regulations, facilitates efficient business management, and helps individuals keep track of their important documentation. From financial records to legal documents, let's explore the various types of Arizona Checklist — Key Record Keeping and their significance. Key Record Keeping Types: 1. Financial Records: Financial records play a central role in the Arizona Checklist — Key Record Keeping. These include— - Bookkeeping ledgers: Maintain a detailed record of financial transactions, income, and expenses. — Bank statements: Keep a record of monthly bank statements, including reconciled account details. — Invoices and receipts: Keep track of all invoices issued and received, along with corresponding receipts. — Tax records: Ensure meticulous documentation of tax returns, income statements, and receipts to comply with state tax regulations. 2. Employment Records: Maintaining accurate employment records is crucial for all Arizona businesses. These records include: — Employee contracts: Keep a copy of each employee's contract, clearly defining terms of employment, wage agreements, and benefits. — Time cards and attendance records: Maintain records of employee work hours, overtime, and vacation/sick leave. — Payroll records: Keep updated records of salaries, deductions, and tax withholding information for every employee. 3. Legal Documents: Incorporating legal document record-keeping is essential for Arizona businesses. These include: — Business licenses and permits: Obtain and maintain current copies of all necessary licenses and permits required for business operations. — Contracts and agreements: Archive all legal contracts, agreements, and leases pertaining to the business. — Intellectual property documents: Ensure safe storage of patents, trademarks, copyrights, and other related documents. — Insurance policies: Maintain accurate records of all insurance policies to ensure adequate coverage for the business. 4. Corporate Governance Records: For corporations, maintaining corporate governance records is vital. These include: — Articles of incorporation and bylaws: Keep updated copies of the company's articles of incorporation and bylaws. — Shareholder records: Maintain a record of shareholders' names, addresses, and shares owned. — Meeting minutes: Document the minutes of board meetings and shareholder meetings. Conclusion: The Arizona Checklist — Key Record Keeping encompasses various crucial types of records that businesses and individuals need to maintain for efficient operations and legal compliance. By diligently adhering to this checklist, one can ensure smooth business management and be prepared for any legal or financial obligations. Remember, accurate record-keeping is not only essential for meeting regulatory requirements but also facilitates better decision-making and potential growth opportunities for businesses operating in Arizona.

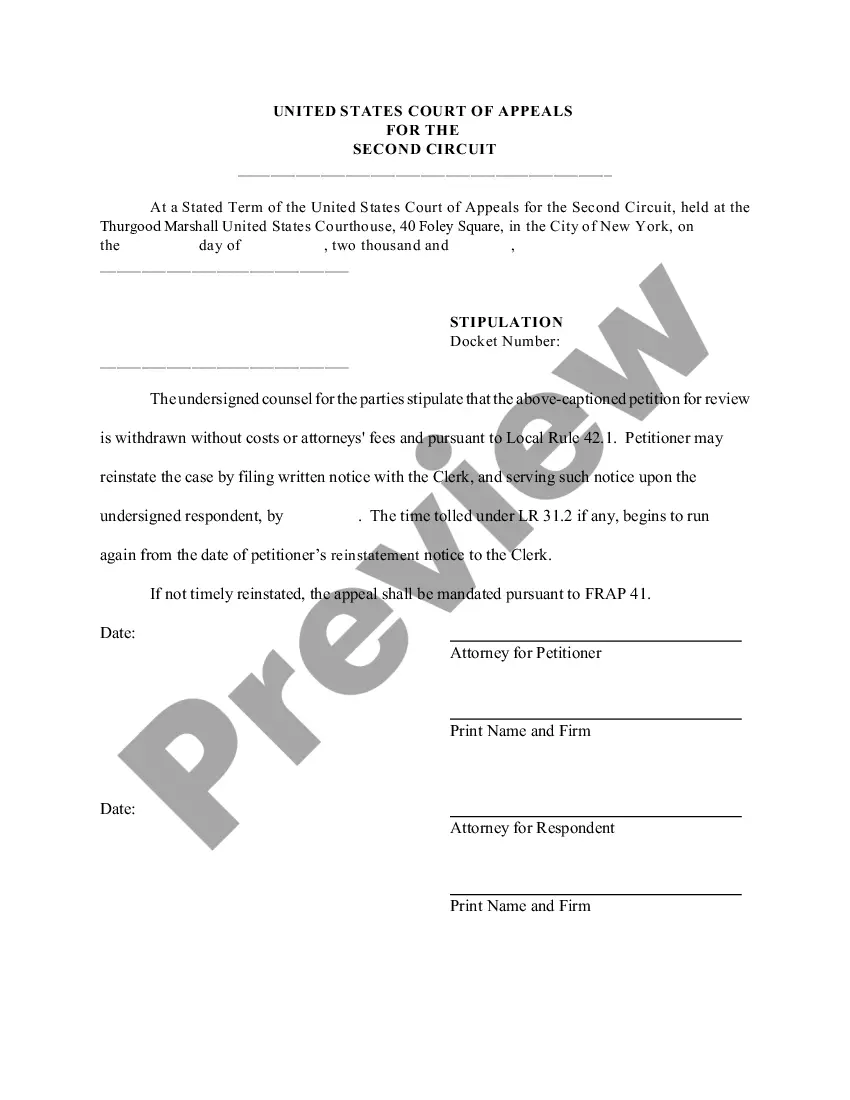

Arizona Checklist - Key Record Keeping

Description

How to fill out Arizona Checklist - Key Record Keeping?

US Legal Forms - one of many biggest libraries of legitimate varieties in the United States - provides a variety of legitimate file templates it is possible to download or printing. Making use of the site, you can get a large number of varieties for enterprise and individual reasons, sorted by groups, says, or keywords and phrases.You can find the most up-to-date versions of varieties just like the Arizona Checklist - Key Record Keeping in seconds.

If you already possess a monthly subscription, log in and download Arizona Checklist - Key Record Keeping from the US Legal Forms local library. The Acquire option will appear on every single form you view. You have accessibility to all previously downloaded varieties from the My Forms tab of your respective bank account.

If you want to use US Legal Forms for the first time, listed here are simple guidelines to obtain started out:

- Be sure to have selected the right form for your personal city/state. Go through the Review option to review the form`s content material. See the form description to ensure that you have selected the right form.

- In the event the form does not match your requirements, take advantage of the Look for field near the top of the monitor to obtain the one which does.

- When you are pleased with the shape, validate your choice by clicking the Buy now option. Then, select the pricing plan you like and give your accreditations to sign up on an bank account.

- Approach the financial transaction. Utilize your bank card or PayPal bank account to finish the financial transaction.

- Choose the file format and download the shape on the device.

- Make adjustments. Load, revise and printing and indication the downloaded Arizona Checklist - Key Record Keeping.

Every template you added to your account lacks an expiry time and is also the one you have for a long time. So, in order to download or printing yet another version, just proceed to the My Forms segment and click on around the form you want.

Gain access to the Arizona Checklist - Key Record Keeping with US Legal Forms, the most substantial local library of legitimate file templates. Use a large number of expert and condition-particular templates that meet up with your organization or individual demands and requirements.