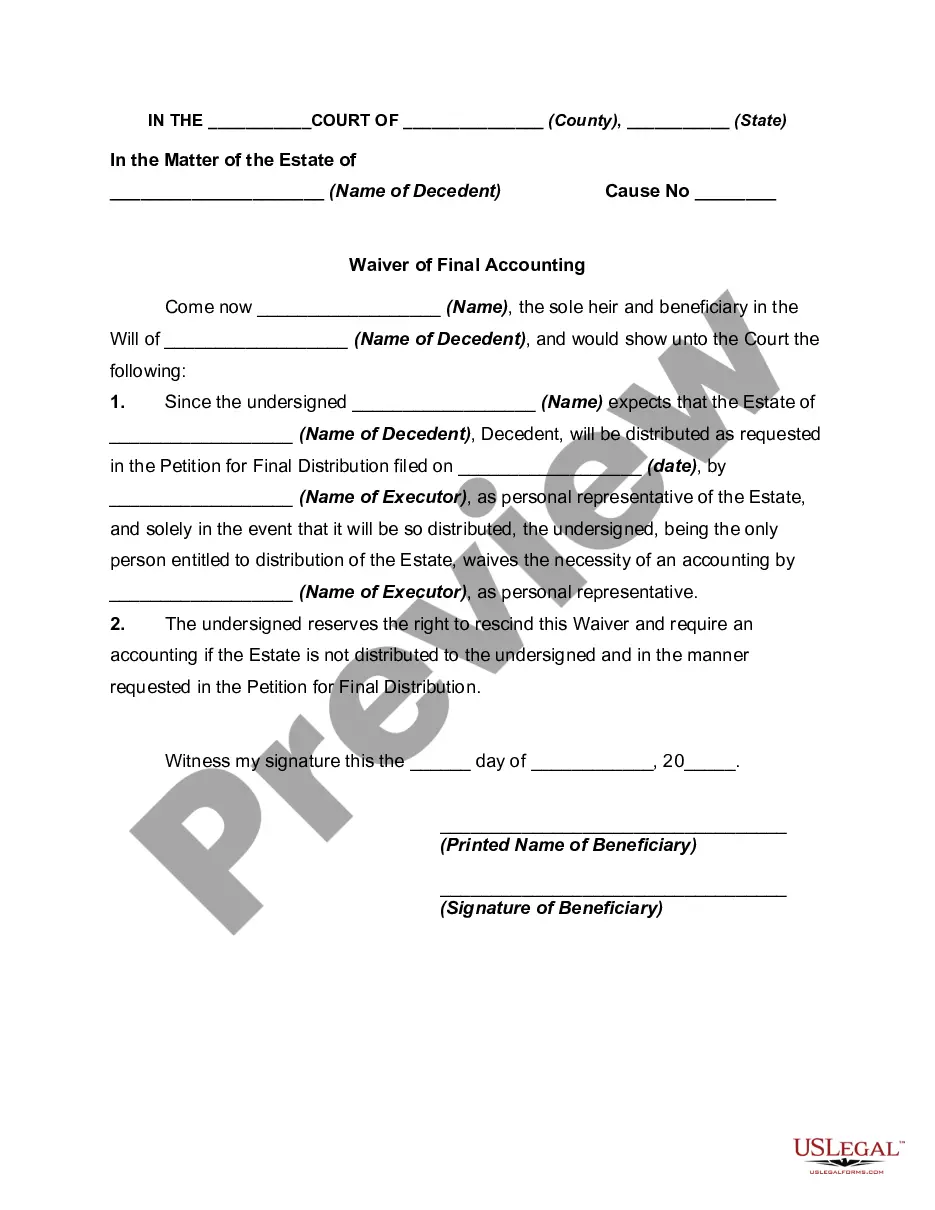

In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

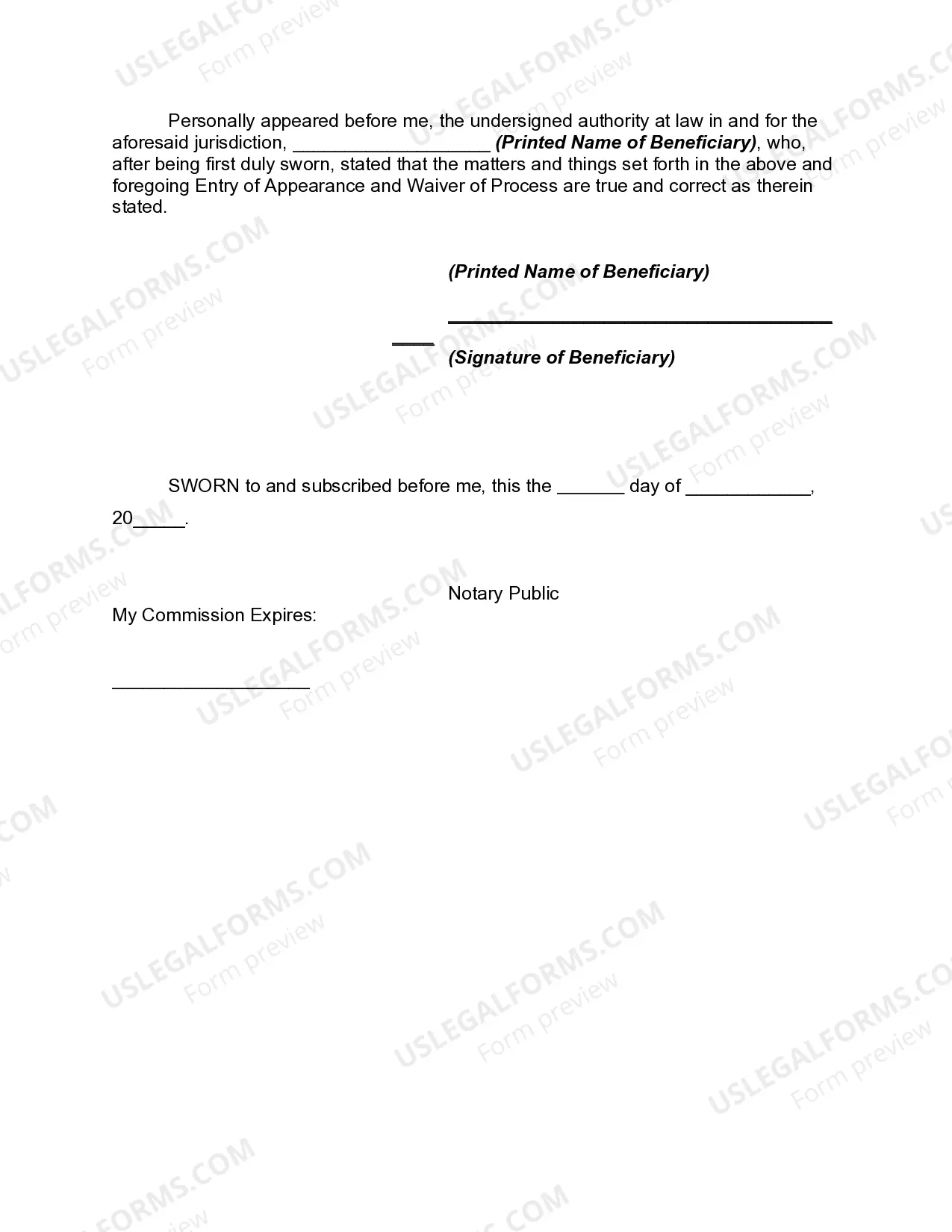

A waiver of final accounting by the sole beneficiary is a legal document that releases the executor or personal representative of an estate from their obligation to provide a detailed accounting of the estate's assets, liabilities, income, and expenses to the beneficiary. In Arizona, a waiver of final accounting by the sole beneficiary can be a valuable tool for simplifying and expediting the probate process. This document is typically executed by the beneficiary, signaling their agreement to forego the receipt of a comprehensive final account. By waiving the final accounting, the beneficiary acknowledges that they are fully informed about the estate's assets and liabilities and trust the executor's management of the estate. This waiver can save time and resources that would otherwise be spent preparing and reviewing a detailed account. Keywords: Arizona, waiver of final accounting, sole beneficiary, estate, executor, personal representative, assets, liabilities, income, expenses, probate process, beneficiary, comprehensive final account, informed, executor's management, save time, save resources. There may not be different types of Arizona Waiver of Final Accounting by Sole Beneficiary, as it typically refers to a single document that releases the executor from the duty to provide a detailed account to the sole beneficiary.